During a lecture at National Council of Applied Economic Research (NCAER) in New Delhi, Mr. Raghuram Rajan explained the inflation effect with an example of Dosa Economics. I thought this was a simple way to explain you about the inflation.

Before proceeding further, let us understand the meaning of nominal interest rate and the real rate of return.

# Nominal Interest Rate–

It is the interest rate generated by your investment before adjusting the tax effect, inflation rate or investment expenses. Let us say you invested Rs.1,00,000 in a one year FD for the interest rate of 9%. This is nothing but 9% nominal interest rate.

You are not bothering about the taxation or inflation attached to this income.

# Real Rate of Return–

It is the interest rate generated by your investment after adjusting for inflation. In simple term, let us say you invested Rs.1,00,000 in a one year FD for the interest rate of 9%. Assume for that same period, the inflation rate as 7%. Then your real rate of return is just 2% (9%-7%).

Falling FD rates and falling inflation rate

Now the biggest concern for all of us mainly the retirees who depend on such fixed instrument is, falling FD rates. FD rates, postal savings schemes rates fell so drastically that we all searching for the options where we get risk-free best returns.

But whether we observed why there is a fall in an interest rate? It is because of falling inflation rate. RBI lowers the interest rate and banks following the same. Whether it is on your FD rates or on your loans, an effect is definitely a falling trend.

What is Dosa Economics?

It is nothing but an example given by Mr.Raghuram Ranjan about explaining of how lower inflation is good even though fall in your FD rates. Hence, no need to worry. For that, he took the example of dosas as a purchasing item.

Let us take the same example to understand this concept. Mr.X a retiree want to buy Dosas of Rs.1,00,000. The cost of dosa is Rs.50. Therefore, he can buy 2,000 dosas in total.

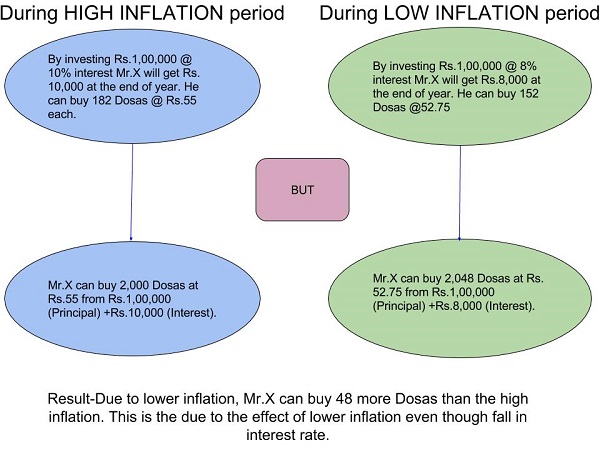

However, Mr.X wants his principal intact and wants to buy dosas from the amount he will get by depositing the money in bank FD. Let us say he deposited this Rs.1,00,000 in an FD which fetches him an interest rate of 10%. So at the year end, he will earn Rs.10,000 from this investment and also get back his principal amount.

But assume due to high inflation the rate of dosas also raised to 10% means from earlier Rs.50 to Rs.55. Therefore, he can buy 182 dosas and also he will get back the Rs.1,00,000 deposited amount.

Next year, he will invest the same Rs.1,00,000 in a bank FD where the interest rate falls to 8% due to fall in an inflation rate. This time, the inflation rate also falls to 5.5%. So dosas rate now is at Rs.52.75. After a year, he will get Rs.8,000 as an interest and Rs.1,00,000 principal amount. From this Rs.8,000 interest amount now he can buy only 152 dosas.

Definitely due to the fall in interest rate, his buying capacity dropped from 182 dosas to 152. Therefore, even though the inflation dropped, he doesn’t get benefitted as return on his investment also dropped.

Considering this aspect, we all believe that falling interest on our FD rates a dangerous sign. However, wait…

At the time of high inflation rate after a year of deposit, he will get back Rs.1,10,000 in total (Rs.1,00,000 principal and Rs.10,000 interest). At the rate of Rs.55 of each dosa he can buy 2,000 dosas in total.

However, after the fall of inflation and interest rate, he will get Rs.1,08,0000 from his investment (Rs.1,00,000 principal and Rs.8,000 interest). At the rate of Rs.52.75 (dosas price also fallen as inflation came down), he can buy 2047 dosas.

In reality, during the falling inflation rate period, he can buy 47 more dosas from his principal and interest rate than the rise in inflation and FD rates.

I tried to explain the same from below image.

Now it is clear that if we just consider the nominal rate of return, then definitely it hurts all of us. However, we forget that fall in interest rate is due to fall in an inflation rate. This leads to same real return. The problem is the way we all look at returns on our investments.

Therefore, the best way to judge your return is always considering the inflation rate or in terms of real return. Hope this concept cleared the doubts of many.

24 Responses

Where do new taxes and increasing rates of utilities , like seer tax swatch Bharat tax etc , property tax etc figure in inflation stats

Vinay-Here the concept is to find REAL return not the taxes.

Tax slab never changes with inflation. Government should link the tax slabs with inflation.

Mukul-Tax is different thing which NONE can link with inflation.

Basu,

I dont understand how the DOSA price decreased here. Inflation in first year is 10% which brought the cost to 55 rs. Second year the inflation is 5.5. So it is 5.5% of 55 rs. which should be 58 rs.

Here the inflation in second year is not negative. it can go down to 52.5 only when the inflation is -5.5%

Considering +5.5% it cannot go to 52.5 rs. And in India I doubt if there can be a way of negative inflation.

Phani-Please read once again.

Basavaraj, I did go through the article. But still I couldn’t make out the logic on how the price of Dosa arrived to 52.5 unless its negative inflation. Low inflation is different from negative inflation. Could you pls point out to me what is the mistake in my analysis.

Also, on another note, all your articles are really superb. They are written in such a simple style for everyone to understand.

Phani-Me and YOU know that the price of DOSA never came down whether the inflation is at 4% or 8%. Rs.52.75 is price drop due to fall in inflation rate from 10% to 8% an assumption to make sure that how the inflation fluctuate.

Too many economists fool the economy:-

The essence of article is on right track however reality is biting some of my peer group friends.

Falling interest rate is an idealistic situation for any economy which tends to low cost of capital to finance existing & upcoming ventures. Of course, someone would suffer in gain of others & that is person interested in fixed income bearing securities.

However, if the same customer routes the money in Bond Market, that would have gained due to falling interest rate as it works contrary to interest rate trend. No bank can advance all it’s available funds as advances for commercial loans hence ideally, government wants to see public as investors rather than an interest earner.

Term deposits with Schedule/Non Schedule banks are liabilities for an economy. Higher the deposits means finding more venues of investment which is quite a concern & banks officials have constant pressure to make the balance sheet fairer which force them to go for adverse funding that creates NPAs.

A good businessman always want to retain quality customers who have least lead time to return the debt with hope of leverage to selected group & denying to sell the vendor with low creditworthiness. Ironically, government is not a businessman hence caters to retailers as well as large groups.

Neeraj-The problem here is, we feel FDs and Bonds as an investment, but never feel we are lenders to bank or corporate world.

In real world dosa price (OR any other price) will always go UP ???, on what basis is inflation rate calculated? it’s a joke,

my monthly expenses every month is going UP ??? thanks to the various tax,VAT, cess etc.

One more thing… less interest rate leads to more growth which in turn leads to higher inflation.

The only good, stable and constant thing is bank FD’s, that also now is being taken away by capital cronies.

dosa price nomics in practice is completely flawed in India, in Western Countries i can understand it will apply there as the inflation rate will be constant.

Vinay-Few myths in your understanding.

Here I am not arguing about dosa price. But my intention is to understand the real return. Is if your monthly expenses going up due to tax means what is the connection to INFLATION? Bank FDs taken away by capital cronies? Capitalist need money and they get it from your FD. Inflation constant in western countries? Check your facts.

Sir have taken kotak midcap regular g sip of 2 k is this right selection for me or any better option

Moin-Please raise this question in our Blog Forum.

Nice Article. Good to understand. But the RBI governor name mentioned here is wrong 🙂 His name is Raghuram Rajan

Shanky-Oh………….typo. Corrected and thanks 🙂

Dear Basu,

Dosa economy nicely illustrated in simple way, it is true once the price go up it never comes down(Literally -Dosa or any eatables in Hotels)When inflation down they make more money as the price of common commodities may have softened.

In one of your blog I had asked your advice to name a fund to invest, but you kept on giving me hint but never mentioned the fund name. May be b’coz it was direct question??!!. You gave me a lot of home work like good teacher to a dull student. During my search I came across few blog sites which are really good. But more fascinating thing is these bloggers also read your articles and appreciate your work by posting in comment section.

Way to go Basu …………………cheers! keep it up!

By the way the funds which I was looking for, found in your blog site only !!! in an answer to some one’s query!!!,

Thanks again for spreading awareness.

Ravinder-My intentions to ask you so many questions and not answering direct product are as below.

1) It gives you opportunity to think of why you are investing and gives me an opportunity to know more about your goal

2) I hesitate to name products. Because some may feel I am biased or some financial gains by recommending a product. Hence, I usually stay away.

Hope you understood my problem 🙂

When in real life has the Dosa price decreased due to fall in inflation? Never in India.

The rates were lowered for a reason i.e to lower the cost of Govt borrowing.

Raj-Here the idea is to identify the REAL RETURN than the ABSOLUTE RETURN.

Agree with Raj.. With fall in inflation we expect the prices to go down aswell but it has never happened.. For that economist will be having someother reason

Raghu-That is different story to question these economist 🙂

HELLO,

DOSA RATE FIRST YEAR 50 SECOND YEAR 55 AND THIRD YEAR IT WILL BE 55 + 5.5% OR WE HAVE TO TAKE 50 ALWAYS FOR CALCULATING INFLATION??

Sanjay-Check it. At high inflation, I considered at Rs.55 and during lower inflation I considered at Rs.52.75. It must either go high or low as per the movement of inflation.