Many of us invest in the name of our spouse or kids and feel that we can easily avoid taxes. But it is not true in many cases. Because even though the earning is in your spouse or kids name, Clubbing of Income provisions apply and you have to pay the tax. Let us see the applicable rules in this regard.

In this regard, let me separate in two ways. One is let us first consider the clubbing of income provisions applicable to spouse and another to the child.

Clubbing of Income of Spouse

Let us discuss the major provisions of Clubbing Of Income rules in case of a spouse. There are two IT Sections which we have to keep it in mind for clubbing of income provisions in case of a spouse.

1) As per IT Sec.64(1)(IV), there are certain conditions which have to be satisfied.

-The taxpayer is an individual.

-He/She has transferred an asset (other than a house property).

-The asset must be transferred to his/her spouse.

-The transfer may be direct or indirect.

-The transfer must not be in connection with an agreement of divorce settlement or with adequate consideration.

2) IT Sec.27 (which deals with deemed ownership of house property)

Rule 1-

If you transfer an asset to your spouse name without any consideration (directly or indirectly), then income from such asset will be clubbed in your income.

Let us assume Mr.X transfer Rs.1,00,000 to Mrs.X name. In return Mrs.X invest this Rs.1,00,000 into FD. Assume this FD earned Rs.8,000 after a year. This FD is not the income of Mrs.X but it is the income of Mr.X (even though the FD and TDS are in the name of Mrs.X).

I used the word CONSIDERATION in above definition. For that, let me give you an example.

Let us assume Mr.X transfer Rs.1,00,000 worth of an asset to Mrs.X name with the consideration of Rs.25,000 (Mrs.X pay Rs.25,000 to Mr.X for buying an asset). Then, Mrs.X will turn to be the owner of Rs.25,000 of that asset ONLY. Income generated from this Rs.25,000 will be the income of Mrs.X and taxed to her. Rest of Rs.75,000 worth of asset income will be clubbed with Mr.X income.

Rule 2-

Let us assume Mr.X transfer Rs.1,00,000 to Mrs.X. Then Mrs.X invested this in FD which fetch her 8% return per year. So the year end income of Rs.8,000 is the income of Mr.X (as I explained above).

However, assume Mrs.X invested this Rs.8,000 again in some FD which fetch her 8% return per year. So whatever the earning from this Rs.8,000 (i.e Rs.640) is the income of Mrs.X but not the Mr.X.

Rule 3-

The above-said rules are applicable under IT Sec.64(1)(IV) which not deals with house property. But for house property, IT Sec.27 will come into the picture.

Assume Mr.x transferred his house property to his wife Mrs.X without adequate consideration, then in such a case, even the property belongs to Mrs.X, the deemed ownership of property is Mr.X. In future, if Mrs.X sell the property, then the capital gain from such property sale is the income of Mr.X but NOT the Mrs.x

This would, however, not cover cases where the property is transferred to a spouse in connection with an agreement to live apart.

Now let us assume that instead of transferring the house property, Mr.X transferred Rs.50 Lakh to Mrs.X. In return, Mrs.X purchased a flat. The ownership, in this case, is with Mrs.X. However, any rental income or capital gains from this property is the income of Mr.X (even though here the ownership is with Mrs.X and Sec.27 rules not applies).

Clubbing of Income of Child

Here, the child may be minor or major. But rules changes based on the age of a child. Hence, I separate this section into minor and major child.

Clubbing of Income of minor child (less than 18 years old)

The income of minor child will be included in the income of that of a parent whose total income is greater. Hence, it does not mean that anyone like father or mother can club their minor child income as per their wish.

Let us say Mr.X created an FD of Rs.10,00,000 in his minor child name. If such FD earned the interest income of say Rs.80,000 a year. Then such income is Mr.X income.

Also, assume child earning is Rs.1,00,000 and wife earning Rs.5,00,000 and husband earning Rs.4,00,000. In this case, child earning should be clubbed with wife’s income but not with husband’s income. Hence, in total wife’s income changes to Rs.6,00,000 (Rs.5,00,000 self income+Rs.1,00,000 of child income).

However, clubbing provision will not come into the picture in below cases.

- Income of minor child suffering from any disability of the nature specified under SEc.80U.

- If the income of such minor child is due to manual work of a child.

- If the income of such minor child is due to any activity involving the application of his skill, talent or specialized knowledge and experience.

If you included an income of your minor child, then you are entitled to an exemption of Rs.1,500 in respect of each minor child. However, if such minor income is less than Rs.1,500, then such amount is applicable for exemption but not more than Rs.1,500.

If child attains majority during the previous year part of the income earned by the child during his minor stage shall be clubbed in the hands of the Parent.

The minor’s income, in the case of both the parents not alive, can not be assessed in the hands of the grandparents or any other relatives or even in the hands of a minor. A guardian should file a return on behalf of the minor child. Clubbing provision can’t be applicable to guardian also.

Clubbing of Income of major child (equal or more than 18 years)

Clubbing of income provision will not apply to a major child (whether he is earning or not). Hence, assume that you transferred Rs.1,00,000 to your major child. He invested that into an FD and earned Rs.8,000 as an interest income. Such interest income is not your income but it is your major child income.

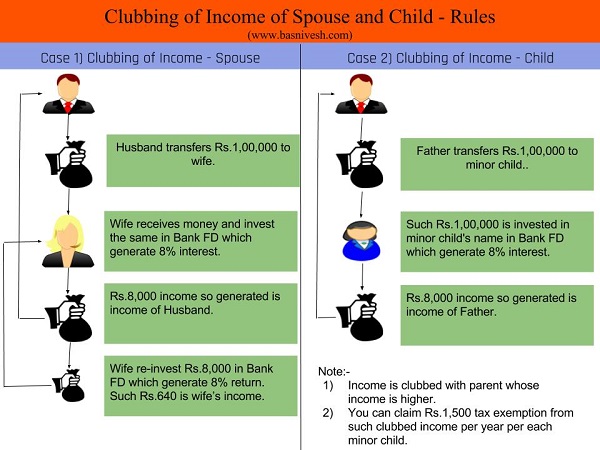

I tried to show the all rules in simplified format in below image. This will give you an example of how clubbing of income works in case of wife and child.

Few important points for clubbing of income provision-

# You can club negative income also-Suppose you transferred Rs.1,00,000 to your wife. She in return did some investment where she lost around Rs.20,000. Such loss can be clubbed into your income for taxation purpose.

# Clubbing should be under the same income heads-The income will be clubbed in the same head from which it is earned. If income is earned from investing in FD it will come in the category of the “Income from Other Sources”, if income is earned from the sale of a house it will come under the “Head of Income from Capital Gains”. Then clubbing is considered under the same head of income.

Clubbing of Income of spouse and child -Tips to save tax

Now you understood the basics of Clubbing of Income rules when it comes to spouse and child. Let us now go further and understand how we can save tax.

# Invest in non-working wife name-Suppose you have Rs.1,00,000 and if you invested this in an FD which fetch you 8% per annum, then this interest income of Rs.8,000 is your income. Same way even if you booked the FD in your wife name, then this Rs.8,000 will be your income.

However, if your wife booked that Rs.8,000 FD, then any income arising from that Rs.8,000 will be her income but not your income. As she is not working, then her tax liability turn to be ZERO. If the same is in your name, you might have to pay the tax on such income.

# Give Loan than Gifting-Instead of gifting which again clubbed into your head, you can give a loan to your wife with the nominal interest rate (there is no such rule that to specify the interest rate). Then all such income should be your wife’s income. It will not be clubbed with your income.

The only caution here is that she has to repay the loan and interest to you (OFFICIALLY). But you must have a documentary proof of Loan. A simple letter of Loan with Signatures of both the parties will be enough as a proof.

# Gift to wife or daughter-in-law before your marriage or before your major son marriage-If you transfer money to your wife or daughter-in-law, then the clubbing provisions will apply. However, if you transfer the money before your marriage or before your major son marriage, then there is no such clubbing provision.

You can gift them during the marriage and avoid clubbing of income and they also can save tax if any gift received during the marriage (as per gift rule Refer-Income Tax on Gift in India – Rules and tips to save tax ).

# Gift to your child who is major-As I stated above, if you gift to your child who is 18 years of age or above, then clubbing provisions will not apply. Hence, whatever the income your child earn is purely his/her.

# Gifting in the name of HUF-Clubbing provision applies when you gift to your own HUF. However, clubbing provision not apply when someone gifts to HUF. Hence, if someone trying to gift to you, then better to tell them that to gift to HUF. Then such income is not you own but the HUF members.

# Investing in products like PPF-By investing in products like PPF (which is EEE product) in your spouse or minor child name, then as the maturity proceeds of PPF is tax-free, you will enjoy the tax-free income. Same applies to equity products. (Refer-PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks)

Hope this much information is enough to udnerstand how the clubbing of income works for taxation purpose.

1) can GIFT DEED ( may be with notary or written in plain paper with doner and donee signature with two witness ) avoiding clubbing provision in between husband and wife, regardless transferring money ( spouse non working )?

2) Money transfer towards major child and after that transfer to my spouse, is it eligible for clubbing?

3) is joint investment ( including share and securities)and joint bank account save us from clubbing?

Thanks and regards

Dear Alok,

1) Without transferring the money how it can be possible?

2) No as source matters.

3) No.

Sir, while in service I invested partly in my ppf and my wife ppf .Both combined is within 80 C limit.Declared both ppf int as exempt income. My ppf is matured..reinvested in her SCSS .Now ,whether the interest on her SCSS taxable in my hands or her hands. Her total interest is about one lakh only.she is homemaker only no other income. Pl clarify

Dear Sharma,

It is taxable under her income.

I have read many articles about clubbing the income. But one thing is not clear to me is regarding the last trick – “Investing in products like PPF” where it is mentioned it applies to equity products as well.

In case of PPF the interest is tax free, so there is no clubbing that is understandable. But, how it benefits in equity products say ELSS. Since, there is 10% ltcg above 1L per year, doesn’t it get clubbed with his/her income? If the gifter has alredy availed his own exception of 1L from the self equity investments income, does the other exception from his spouse ELSS still applies?

Dear Saunak,

In case of ELSS, it is clubbed with the income of the source fo the person who invested (not in whose name).

Thank you for your response.

Sorry, forgot to mention, will the same be applicable for FDs interest also that no need to file ITR if TDS is deducted is marginal from their account and income is less than 2.5 lacs for housewife.

Thanks

Dear Viswanath,

Yes.

Thank you for your quick response.

Also, Can you please clarify that filing ITR will not be required if the TDS not required to get back as it will be marginal amount and income also is less than 2.5 lakhs in this case ?.

Thanks.

Dear Viswanath,

Yes.

Sir,

Please clarify the below query.

If a house wife gets savings account interest more than Rs. 40000 in her account, bank deducts some TDS. In that case, will there be a need to file IT returns for house wife who is not working and income is less than 2.5 lakhs(but some TDS deducted through savings account interest by a bank).

Thanks

Dear Viswanath,

Yes, to get back that TDS.

I am working in psu. I want to do share trading in my wife’s name by taking a gold loan in her name. Will clubbing apply here? Because, income source(gold loan) is of my wife.

Dear Jey,

First thing to CAUTION you that -STAY AWAY FROM STOCK TRADING AND ESPECIALLY FROM THE BORROWED MONEY.

Hello Basu,

Appreciate your efforts in penning this excellent article. My wife has taken a loan of worth 5,00,000 from me at an interest rate of 0.5%. This is properly documented. She invested that in FD under her name and gets the interest into her account. Now she’s not repaying the me the principal and interest amount. In this case, should I pay the tax for the interest amount accrued into her account from FD?

Dear PM,

It is not treated under your head for taxation. However, for avoiding future issues, it is better to consider the lending rate of at least Bank FDs.

Hi,

while examining clubbing of income case studies, one issue needs clarification.

Mr A gifts 5 lc to mrs A IN 2020.

How would tax on 5 lac FD be accounted in first AY and the subsequent years?

Your study has correctly indicated clubbing rule for fist year.But how does calculation work in the second,third year etc.

Thanks

Dear Ashok,

Earning on earnings is the income of Mrs.A. In such a situation rather than yearly ITR declaration, better to declare it at maturity for simplicity.

Hello Sir,

1. a) If I transfer any amount of money to my mother’s account or vice versa does it attract any tax?

b) Is there any upper limit?

2. a) If money is transferred from one person’s a/c to another person’s a/c. Does this attract any tax?

b) Is there any upper limit?

Regards

Dear Susmita,

Along with clubbing provision, you have to check the Gift rules in India to make sure that the receiver must not fall under tax bracket. Refer my post “Income Tax on Gift in India – Rules and tips to save tax“.

Vide your article you have stated that when a Father transfer any money to major child and then if major child invest that money on some investment, say FD, the interest earned from such investment will not be clubbed and will be taxable in hand of Major child. In connection to this could you guide me from which section of income tax act you came to such conclusion.

Dear Hemant,

Please refer IT Dept Portal.

It is really a good article about the clubbing of income. However, I have a question. If my wife is also a working woman and she has an IT file, then also this provision will be applicable? if yes, then there will be another question may arise. Suppose my wife’s income is more than my income. Then there is any difference in the answer?

Dear Avishek,

It is the source of income that matters than who is working and who not.

Did you mean whether my wife is working or not working does not matter in this case? Therefore, if there is any situation related to clubbing of income arisen, the tax liability will be imposed on the husband.

Dear Avishek,

What I am trying to say is that whether your wife is working or not, the source of the money (whether it is from your income or your wife’s income) that matters the most for taxation purpose.

Thank you very much, Sir. It is really helpful article.

My daughter got married about 3 months back.She is 24 years. I want to gift about Rs 15 lakhs to her. Is there any Income tax or gift tax liability for me? or for her?

Dear Srimathi,

NO.

With your rule 2 scenario ( clubbing of income) if the dependent wife renews her FD for ?108000( ?1 lakh principal + ?8000 interest income taxed in husband’s name), does the husband still own tax liability for the income in the next year? In other words, should the interest income be split for ?1 lakh in husband’s name and ? 640 (?8000) income in the wife’s name.

Dear LN,

It has to be split.

The TDS will happen in the wife’s PAN and the interest income in her account if the FD is single ownership. So from the second year, do the couple have to manually split the income based on rate % and share %? I will be happy if you could explain with a better example. Every CA related site explains the clubbing of income only for the first year. I want to know if the husband will have to still pay forever if the wife keeps opening new FD annually with the the amount and interest income. ITR verifies 26AS TDS for tax from other sources. If the TDS happens on the wife’s name, how will the husband be under radar for clubbing of income rule?

Dear LN,

Your doubt is valid. Yes, you have to split manually and show it.

Thank you for the detailed explanation in your article and your quick response.

Hi, as the long term equity is now not tax free to save tax on gift given to spouse. So to avoid clubbing if any documented loan given to spouse for share trading & short or long term investment should not attract tax to donor, isnt? Also if the income generated from loan amount is below 2.5 lakhs so IT return may also not be mandatory to file for receiver spouse, isn’t? So how this loan transaction will be intimated or known to IT?

Dear Satya,

1) Yes.

2) Yes.

3) You no need to intimate. But if they ask for then you be ready to prove with proper documentation.

Thanks for your guidance, however i got bit doubts here as below-

A) Intimation to IT by whom donor or receiver? & where in IT Form?

B) Also if the loan returned with interest (or only interest) in any given FY by receiver to donor, will the only interest or( interest + basic loan) be treated as other source income to donor?

C) Also is it mandatory to receive interest on loan from receiver each Fy till closure or it can continue?

D) Each Fy loan can be given to spouse without settlement of previous loan?

Sorry for lengthy queries, appreciate your expert thoughts on these.

Satya

Dear Satya,

1) Better both has to mention.

2) Yes, only the interest part is treated as income to donor but not the principal.

3) It can continue.

4) No such obligations.

Very good blog.

I want to ask that i want to transfer Rs 1 lakh to my major son bank account. My son will invest that in PPF. PPF interest is non taxable.

What will be clubbing provisions?

And what will happen if the proceeds of PPF after maturity is invested in FD by my son?

Dear Mithilesh,

Just transfer or GIFT? Please clarify.

I want to make mutual fund investments in my sons name who is 20years and still studying.Is it allowed as he has no income source ,and I will be issuing cheque from my account to the AMC. Or will it be better to transfer the amount first in my sons account and then issue the cheque from his account to the AMC. Will this be treated as gift and what shall be the tax scenerio for both of us at present and /or in future when the redemption is made into my sons account.

Dear Apurva,

May I know the reasons for investing in your son’s name?

If you convert your individual taxpayer to HUF then clubbing of income of wife will be there or not. How to convert individual account to HUF

Dear Raghavan,

You have to create HUF.

I read the article on clubbing of income at your web blog. It is fantastic. I have also visited the threads, its deep informative. My salute to your knowledge in taxation.

Dear Shakti,

Pleasure.

Hi Basavaraj,

We were not aware of the clubbing issue. So we have goofed up the IT return – My husband had transferred a part of his salary to my account, which I had put as FD’s (previous as well as this FY). So only tds at 10% was taken from my FD’s. My husband is on the 30% slab. My husband had already filed his return. It was a genuine mistake. Is there anything that can be done? Would be much obliged if you could reply.

PS-Try to revise the IT Returns and file once again.

Thank you so much. Will revise the return. Could you please tell me how this is to be included. Would it be Income from other sources? (Wondering how to fill the TDS2 Section.) Sorry to bother you again.

(I suppose we should transfer all the FD’s back to my husband’s account to avoid this confusion from next year on.)

PS-If there is an interest income, then that should be filled under the head of “Income from Other Sources”.

Hi Vasu,

I am retired army person. I am availing my pension as well as my wife’s pension. My wife has expired. Please guide me for the calculation of my income for paying the income tax

Prem-It is hard for me to guide through comment. I suggest you take a help of tax expert of your area.

“# Give Loan than Gifting-Instead of gifting which again clubbed into your head, you can give a loan to your wife with the nominal interest rate (there is no such rule that to specify the interest rate). Then all such income should be your wife’s income. It will not be clubbed with your income.”

Can I give a loan to my non-working wife at “nominal” interest rate of 0.5% for (say) 30 years? I am a senior citizen. I will not be alive on loan maturity of 30 yrs! Thereby she can purchase SCSS on becoming senior citizen or acquire 7.75% Govt of India Savings Bonds earlier.

Gurmeet-She can but with proper documentation.

if i gift small amounts in thousands(1000 to 5000/10000) to my major or minor child for their personal use .

how same will be treated?

Jitendra-Whatever may the amount, the rules apply to such amounts as I explained above.

but these gifted or transferred amounts are not generating any income or minor saving bank interest maximum.

Jitendra-If there is no income, then no question of clubbing in case of minor and if income, then clubbed with parent.

thanks a lot.

Hi Basu,

I have transferred 10 lakhs to my wife’s account.My wife is not under income tax bracket. So, If she invests the amount in equity mutual fund for more than 1 year, the interest from mutual fund will not be taxable to either of us, right? Or, does she need to invest in ELSS/Tax saving mutual fund?

Regards,

Deb

Deb-Your understanding is right only if she invests in any equity funds (including ELSS) and hold them for more than a year.

Dear sir

Very informative blog. My query is where will I show the loan to my wife in it return. She also file it return as Amway agent. But her income is very less.

Gopal-You mean to say you are lending to her or she is lending to you?

I want to lent. After reading your blog my query is where will I show the gift in my Income tax return

Gopal-It is not income for you and hence no need to show this in your IT return as you are donor.

Sir,

If my rented expenses less than 1 lac it is necessary for landlord pan card details while filling return? If no then what documents I have to submit for HRA exemption in return?

Abhijeet-If your yearly rent payment is less than Rs.1 lakh, then landlord PAN card details not required.

Sir,

My father wants to transfer some money to me as he is sharing his hard earn money with family members, now my wife is not working and he is about to send money very shortly.

I am fazed with the taxation question……….

Pl enlighten us………

Nirmal-If he is sending money to your wife, then the income is clubbed with your father. However, if he transfers the money to you, then there is no such clubbing provision.

Sir,

Sorry , if I am mistaken, but if my father put money into my account then no tax liability will be there for me???

Again, as my father is a retired person, and wife being non working home maker, what is the best way to transfer money, means to transfer total amount to my account or my wife account.

Money is 3L, and he don’t want to hold money with him.

Nirmal-What I said is clubbing provision will not apply to your father as you are the major child. Regarding income tax in your hand, it will not be taxable income for you. However, if your father gifts it to your wife, then the clubbing provisions apply and it may be income for him rather than your wife. In my view, if his intention is to stay away from clubbing provisions after transferring the money, then better to transfer to YOU rather than your wife.

Thanks for good note,

I wanted to know about gift to HUF by third person. Say, if third person transferred Rs 1 Lac to my HUF account as a Gift, in this case i do have evidence saying that its a gift not loan.

Do i need to take registered Gift deed or writing of simple paper with sigh of both will be enough?

Or I do not take any paper work, just a bank transfer is enough.

Dixit-Writing in a simple latter is enough.

Thanks for providing such a useful info with simple graphics.

You are putting lots of hardwork ..

gopal

Gopal-Pleasure 🙂

Sir

I’m a central government employe and my query is in my salary income HRA is a taxable income what is given by employer? While I’m filling IT returns can I deduct total HRA amounts what I get same financial year?

Abhijeet-HRA is taxable income if you not claim your HRA. Please read the rules pertaining to HRA calculation.

Hi Basu,

Very Good Article, i would like to know if the property is in wife’s name and husband is paying the EMI as wife is not working due to personal reasons. Can husband avail the tax benefit.

Sri-NO. Because the property is in wife’s name.

Thanks for the information.

However can Husband (Working) and Wife (Non working) jointly have house property in their name and husband pays the home loan to avail tax benefits.

If Yes, is there any catch in that where husband has to declare that he will be solely responsible for paying the home loan.

Koustav-When it comes to taxation, the tax benefit totally depends on the % of the ownership the husband having in that property. If he is the owner of 50%, then he can claim the 50% tax benefit.

Basu,

Thanks for you reply.

If the taxation depends on % of Ownership husband has, then can that % be anything ?

For example, can Husband has 90% share and Wife has 10% share to avail max tax benefit.

Or it is only predefined by Govt on some fixed ratios options to choose from.

Koustav-It may be any % and for your reference as proof, that ownership % must be mentioned in sale deed (In a case in future IT AO question).