Which are the Best Tax Saving Options for 2018-19? What are the Best Tax Saving Options for Salaried for 2018-19?Financial Year 2018-19 already started. However, many of us sadly get up at the end to look for best tax saving options. Instead, it is always best to start tax planning for the first day of financial year. Hence, let us look at the options available.

Tax Planning or Tax Saving is not a bad concept. But the bad concept is to invest JUST FOR SAVING TAX. Instead, you have to first identify your financial goals. Based on the time horizon of the goal, do the asset allocation between debt and equity. Within debt or equity, while finally investing, you may choose the product which also gives you an option to save tax.

However, many of doing the reverse. We all in the asleep mode for the whole financial year. We get up during the financial year-end. In a hurry to save tax, we invest in bad products which in no way may help us to reach our financial goals.

Tax Planning or Tax Saving must start from the first day of financial year. This will give you the advantage to plan well and save tax.

What is the difference between Exemption and deduction?

If an income is exempt from tax, then it is not included in the computation of income. However, the deduction is given from income chargeable to tax. Exempt income will never exceed the amount of income. However, the deduct may be less than or equal to or more than the amount of income.

Allowances available to save tax for 2018-19

# Standard Deduction of Rs.40,000

Actually, I have to put this under Deductions. However, this standard deduction replaced the existing allowances. Hence, I placed it here for better understanding.

Earlier you used to claim Rs.15,000 under Medical Allowance and Travel Allowance. However, with effect from FY 2018-19, you can claim the direct Rs.40,000 deduction instead of these two allowances.

This deduction obviously for salaried and pensioners. This is irrespective of the amount of taxable salary you will be receiving to get a deduction of Rs.40,000 or taxable salary, whichever is less.

Hence, let us assume for FY 2018-19, you worked only for few days. Your salary is taxable salary is Rs.50,000. In such scenario, you can directly claim the deduction of Rs.40,000. However, if your salary is less than Rs.40,000 (say Rs.20,000), then you have to claim only Rs.20,000 but not Rs.40,000.

# Mobile/Telephone Reimbursement

If your employer offering you the mobile/telephone connection or internet connection which requires for work, then you can claim 100% of such cost. However, you have to produce the bill. Only the postpaid connections are allowed for reimbursement.

# Leave Travel Allowance

The bills for your travel against LTA can be claimed for exemption. It is allowed to be claimed twice in a block of four years. The current block is 2014 to 2017. You can carry forward your unclaimed LTA to the next year. You can request your employer to not deduct tax on it and allow you to claim it next year.

# Entertainment Allowances

You may be getting this allowance. However, the exemption is available only for Government employees. The amount of exemption is least of the following.

a) Rs 5,000

b) 1/5th of salary (excluding any allowance, benefits or other perquisites)

c) Actual entertainment allowance received

# House Rent Allowance (HRA)

This is the famous exemption which is used by many salaried individuals. However, the wrong belief is that whatever the rent they pay is actually exempted from their income. The reality is different. The amount of exemption is least of the following.

a) Actual HRA Received

b) 40% of Salary (50%, if house situated in Mumbai, Calcutta, Delhi or Madras)

c) Rent paid minus 10% of salary

(Salary= Basic + DA (if part of retirement benefit) + Turnover based Commission)

# Children Education Allowance

If your employer providing this allowance, then you can take exemption up to Rs.100 per month per child (maximum of up to 2 children). Therefore, monthly you can save Rs.200 from this allowance. The exemption may seems so low. But why to pay the tax?

# Hostel Expenditure Allowance-If your employer providing this allowance, then you can take exemption Up to Rs. 300 per month per child up to a maximum of 2 children is exempt. Therefore, you can save around maximum of Rs.600 from this allowance.

# Conveyance Allowance

This is the different allowance than transport allowance. It is the expenditure granted to an employee to meet the expenses on conveyance in performing of his office duties. There is no limit for this. If such conveyance allowance is Rs.5,000 a month, then whole allowance is exempt. Hence, you may this may be exempt to the extent of expenditure incurred for official purposes.

# Any Allowance to meet the cost of travel on tour or on transfer

Here also no limit. The employee can claim exempt to the extent of expenditure incurred for official purposes.

# Allowance to meet the cost of travel on tour or on transfer

Here also no limit. The employee can claim exempt to the extent of expenditure incurred for official purposes.

# Daily Allowance

If you are not placed in normal duty place, then your employer may provide you such allowance. The employee can claim exempt to the extent of expenditure incurred for official purposes.

These are the major allowances, which can be utilized to save tax on salary income. There are few other allowances also to claim the exemption. But many of such allowances are not so famous. Hence, I left them to list.

Best Tax Saving Options for 2018-19

Now let us discuss the deductions available for 2018-19. Using these deductions you can save the tax.

# Section 80C

This is the famous section which often used by all of salaried. The maximum limit for the current year is Rs.1,50,000. Therefore, up to Rs.1,50,000, you can save tax on salary income from this section alone. The different investments you do and can also be claimed under Sec.80C are listed below.

- Life Insurance premium (Paid by an individual, spouse, and child. In the case of HUF, on the life of any member of HUF).

- EPF-Employee contribution can be claimed for deduction.

- Public Provident Fund (Paid by an individual, spouse, and child. In the case of HUF, on the life of any member of HUF).

- National Savings Certificate (NSC).

- Sukanya Samriddhi Account

- ELSS or Tax Saving Mutual Funds.

- Senior Citizen Savings Scheme.

- 5-Years Post Office or Bank Deposits.

- Tuition fee of kids.

- Principal payment towards home loan.

- Stamp duty and registration cost of the house.

# Sec.80CCC

Deduction under Sec.80CCC is available only for individuals. Contribution to an annuity plan of the LIC of India or any other insurer for receiving the pension. Do remember that the amount should be paid or deposited out of income chargeable to tax.

The maximum amount deductible under Sec.80CCC is Rs.1.5 lakh. Do remember that this is also the part of the combined limit of Rs.1.5 lakh available under Sec.80C, Sec.80CCC, and Sec.80CCD(1).

# Sec.80CCD1

- The maximum benefit available is Rs.1.5 lakh (including Sec.80C limit).

- An individual’s maximum 20% of annual income (Earlier it was 10% but after Budget 2017, it increased to 20%) or an employees (10% of Basic+DA) contribution will be eligible for deduction.

- As I said above, this section will form the part of Sec.80C limit.

# Sec.80CCD2

- There is a misconception among many that there is no upper limit for this section. However, the limit is least of 3 conditions. 1) Amount contributed by an employer, 2) 10% of Basic+DA and 3) Gross Total Income.

- This is additional deduction which will not form the part of Sec.80C limit.

- The deduction under this section will not be eligible for self-employed.

NPS Tax Benefits under Sec.80CCD (1B)

- This is the additional tax benefit of up to Rs.50,000 eligible for income tax deduction and was introduced in the Budget 2015

- Introduced in Budget 2015. One can avail the benefit of this Sect.80CCD (1B) from FY 2015-16.

- Both self-employed and employees are eligible for availing this deduction.

- This is over and above Sec.80CCD (1).

I explained all three sections of NPS (Sec.80CCD1, Sec.80CCD2 and Sec.80CCD(1B) in below image for your reference.

NOTE:- PLEASE NOTE THAT THE COMBINED LIMIT OF DEDUCTION UNDER SEC.80C, SEC.80CCC AND SEC.80CCD(1) TOGETHER CAN NOT EXCEED RS.1,50,000 FOR FY 2018-19.

Best Tax Saving Options other than Sec.80C for 2018-19

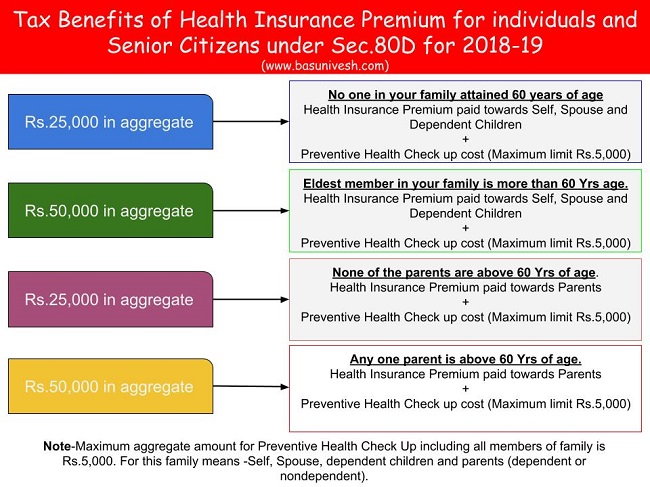

#Sec.80D

Deduction under this section is available if you satisfy the following conditions.

- The taxpayer should be an individual (resident, NRI or Foreign Citizen) or HUF.

- Payment should be made out of income chargeable to tax.

- Payment should be in NON-CASH mode (for preventive health check up, you can pay either through cash or non-cash mode).

Changes from Budget 2018-

- In Budget 2018, the maximum tax deduction limit for senior citizens under Sec.80D is raised to Rs.50,000. The earlier limit was Rs.30,000.

- In case of single premium health insurance policies having a cover of more than one year, it is proposed that the deduction shall be allowed on a proportionate basis for the number of years for which health insurance cover is provided, subject to the specified monetary limit.

I will try to summarize the whole benefit from below image.

# Sec.80DD

A resident individual or HUF is allowed to claim the deduction under Sec.80DD. You can claim the deduction if you incurred an expenditure for medical treatment, training, and rehabilitation of dependent relative (being a person with a disability).

A deduction can also be claimed if an individual or HUF deposited or paid for any approved scheme of LIC (or any other insurance) or UTI for the maintenance of such dependent relative.

Here, dependent means spouse, children, parents, brothers, and sisters, who is wholly and mainly dependent upon the individual.

You can claim a fixed duction of Rs.75,000 under this section. A higher deduction of Rs.1,25,000 is available if such dependent relative is suffering from severe disability.

# Sec.80DDB

An Individual’s of HUFs expenses actually paid for medical treatment of specified diseases and ailments subject to certain conditions can be claimed under this section.

The maximum deduction is Rs. 40,000. This can also be claimed on behalf of the dependents. The tax deduction limit under this section for Senior Citizens and very Senior Citizens (above 80 years) is now revised to to Rs 1,00,000.

With effect from the assessment year 2016-17, the taxpayer shall be required to obtain a prescription from a specialist doctor (not necessarily from a doctor working in a Government hospital) for availing this deduction.

You can claim the deduction for the medical treatment of self, spouse, children, parents brothers, and sisters of the individual.

The ailments covered under this section are as below.

# Neurological Diseases where the disability level has been certified to be of 40% and above;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

# Malignant Cancers

# Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

# Chronic Renal Failure

# Hematological disorders

a) Hemophilia

b) Thalassaemia

# Sec.80E

An individual can claim deduction under Sec.80E. If the loan is taken by an individual for any study in India or outside India, then they can claim the deduction. The interest part of the loan on such education loan can be claimed for deduction for pursuing individual’s own education or for the education of his relatives (Spouse, children or any student for whom the individual is legal guardian).

The entire interest is deductible in the year in which the individual starts to pay interest on the loan and subsequent 7 years or until interest is paid in full (i.e for total 8 years). But do remember that interest should be paid out of the income of chargeable to tax.

# Sec.80EE

First time Home Buyers can claim an additional Tax deduction of up to Rs.50,000 on home loan interest payments under this section. Below are the few conditions for this.

- He must be an individual (Resident or Non-Resident).

- Loan must be taken for the acquisition of the property.

- Loan should be sanctioned after 2016-17.

- Loan amount should not exceed Rs. 35 Lakh.

- The value of the house should not be more than Rs 50 Lakh.

- The home buyer should not have any other existing residential house during the sanction of loan.

Do remember that if you claimed the interest under this section, then the same can’t be claimed under other sections for deductions.

# Sec.80G

Donations to certain approved funds, trusts, charitable institutions/donations for renovation or repairs of notified temples, etc can be claimed as a deduction under this section. This deduction can only be claimed when the contribution made by cheque or draft or in cash. In-kind contributions like food material, clothes, medicines etc. do not qualify for deduction under this section.

The donations made to any Political party can be claimed under section 80GGC.

From FY 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

# Sec.80GG

I have written a complete post on this section. Refer “Section 80GG Deduction-Get Tax Benefit on rent paid if not getting HRA !!!“. I will give you the brief about this section as below.

This section only applies to those who have not availed HRA in their salary or not claiming the deduction on their rent in any of the other sections of income tax. Below are a few conditions to avail the deduction under this section.

- This section is only applicable to Individual or HUF.

- Tax Payer may be either salaried or a self-employed. However, must not be getting HRA.

- Tax Payer himself or spouse/Minor Child/HUF of which he is a member should not own any accommodation at a place where he is doing a job or business.

- If Tax Payer owns a house at a place other than the place noted above, then the concession in respect of self-occupied property is not claimed by him [Under Section 23 (2) (a) or 23 (4) (a)].

- Tax Payer has to file a declaration in Form No.10BA regarding the expenditure incurred by him towards the payment of rent.

How much amount of deduction one can avail under Sec. 80GG?

If the above five conditions are satisfied, the amount deductible under Section 80GG is LEAST OF THE FOLLOWING.

- Rs.5, 000 per month;

- 25% of total income of taxpayer for the year; or

- Rent Paid less 10% of total income (Rent Paid-10% of Total Income).

# Sec.80TTA

A deduction of up to Rs.10,000 can be claimed by an individual or HUB in respect of any income by the way of interest on deposits (not on FDs) in a savings account with a bank, co-operative society or post office.

# Sec.80TTB

This section is for Senior Citizens. The interest income earned from Bank FDs, RDs (including Post Office), will be exempt up to Rs.50,000.

This deduction can be claimed under new Section 80TTB. However, if the taxpayer claimed deducted under Sec.80TTB, then he can not claim the deductions under existing 80TTA.

# Sec.80U

To claim tax benefits under Sec.80U, the taxpayer should be an individual and resident of India. If he is suffering from 40% or more than 40% of any disability, then he can claim a tax deduction.

You can claim the fixed deduction of Rs.75,000. a higher deduction of Rs.1,25,000 is allowed in respect of a person with a severe disability (i.e. having a disability of 80% or above).

# Sec.24 (B)

The interest part of your home loan EMI will be claimed under this section. The maximum limit for the self-occupied property is Rs.2,00,000 per year (even if you have multiple houses). For let-out property, earlier the entire interest payment of home loan (Loss from House Property) can be allowed to set off against any other income source without any limit. However, effective from FY 2017-18, this set-off now limited to Rs.2 lakh per individual (irrespective of the number of properties you are holding).

The unclaimed loss if any will be carried forward to be set off against house property income of subsequent 8 years. In most of the cases, this can be treated as DEAD LOSS.

# Rebate under Sec.87A

The tax rebate of Rs.2,500 for individuals with income of up to Rs 3.5 Lakh has been proposed in Budget 2017-18.

To avail this benefit, there are certain conditions and they are as below.

- The taxpayer must be a resident individual.

- Your Total Income (Less Deductions from 80C to 80U) is equal to or less than Rs.3,50,000.

- The rebate is the 100% of income tax on such income or Rs.2,500 (whichever is less).

Conclusion:-I have listed all the major tax saving options available. Hence, choosing the Best Tax Saving Options for 2018-19 is now in your hand.

Hello sir

In the recent budget, it is indicated as standard deduction Rs.50,000 for Salaried individuals. My question is –> I feel it is applicable to pensioners as well…for that matter, applies to ALL. Am I correct sir ?

Dear Ravindra,

It only applies to salaried and pensioners.

Thanks sir, one more question..

I was working for Philips India Pvt ltd and retired at the age of 58 (now I am 60 yrs – senior citizen). There is no such thing like pension in private IT companies. However, we had LIC annuity scheme where company used to credit the premium. After retirement at 58 yrs, I am getting a pension of Rs.17700 per month (life time) from LIC.

Also From EPS, I am getting a pension of Rs. 2495/- per month (life time).

Am I to be considered as a “pensioner” (in the context of availing 50k standard deduction). Thanks

Dear Ravindra,

YES.

Excellent,Mr.Basavaraj Tonagatti. Highly useful.Keep it up.

Dear Stalin,

Pleasure 🙂

I am currently in deputation for 1 yr to other location .Hence company providing me daily & lodging allowance.But that allowance is included as taxable income for the employee in Form16.Whether this daily allowance is taxable or not?

Dear Krishna,

It is tax free only to the extent of the amount of actual expenses.

is tution earners can also take the benefits of the standerd 40000 rs deduction benifit against medical and transport?

Dear Amber,

Tuition income is not salary income right?

Dear Sir

Total deductions from a retired senior citizen having only earning from interests from bank deposits are ..

1. Standard deduction : 40,000

2. SCSS (max 15 lakhs) : 1,30,500 (sec 80C)

3. FD exemption : 50,000 (Sec 80 TTB)

4. Medical insurance : 30,000 (example)

Total deductions = Rs. 2,50,500/-

Taxable income = Gross – total deductions

If the “taxable income” is less than Rs. 3,50,000, then deduct Rs.2500 from total tax to get net tax.

Is the above summary correct sir ?

Dear Ravindra,

What is Rs.25,000 here?

Dear sir

You mean 2,500/- in my last sentence. It is as follows

Rebate under sec 87a (Rs. 2500 rebate for income up to 3.5 lakhs)

The existing rebate of INR 5,000 available for individuals with an income between INR 2,50,000 to INR 5,00,000 is reduced to INR 2,500. Also, the rebate will now be available only for individuals with an Income less than INR 3,50,000. This means, your Total Income (Less Deductions from 80C to 80U) is equal to or less than Rs.3,50,000 (Basically the “taxable income” should be less than INR 3,50,000, if so deduct Rs.2500 from total tax to get net tax to be paid)

Dear Ravindra,

In that case, your calculation is correct.

Is that right? OP says “earning from interests from bank deposits”, so Standard deduction is not applicable?

Dear Nandan,

Standard deduction is applicable only for Salaried and Pension income. Hence, if you have such income from other sources, standard deduction can’t be claimed.

sir, how many applicants are allowed in a SBI SB account ? Can we have 4 or 5 persons in either or survivor mode.

Dear Ravindra,

In E&O Survivor, as per me only two are allowed. Why you want to complicate the account?

Sir, currently in SBI, I have a joint account (total 3 persons including first applicant)….my wife (50 yrs) is the first applicant (other 2 are senior citizens – opened SCSS).

She also has 15 lakhs FD with 6.5% interest …she wants to add her father to the SB account and shift that 15 lakhs to her father name (SCSS) so that we earn more interest..this is the background.

Can she open SCSS in SBI in her father’s name (without adding his name to SB a/c) and transfer interest to SB a/c ?

Dear Ravindra,

She can open SCSS account in her father’s name but the interest will not be credited to her account.

How about 80CCF option?

Dear Nag,

This section is not available now.

Sir, I am a senior citizen (>60yrs) and I have invested in SCSS 15 lakhs. As per your explanation, I can avail tax benefit under sec 80C. I don’t have any other savings other than SCSS under 80C.

If I am getting an interest from all my savings around 5 lakhs — that is my income per annum. So, my gross income is 5 lakhs.

I will subtract 1.5 lakhs (SCSS) and 40000 (std deduction) and 30000 (80D).

so, total deduction from gross income = 2.2 lakhs

Taxable income = 5 lakhs – 2.2 lakhs = 2.8 lakhs.

I don’t have to pay tax ; My calculation above is it correct sir ?

Dear Ravindra,

Yes, your calculation is correct and whatever the tax liability, it is on Rs.2.8 lakh.

Dear sir,

One small doubt…Can I even subtract 50,000 (exemption on FDs etc.. it was 10k previously) from 5 lakhs in this chat.

So, deductions from my gross income 5 lakhs (only interests)

–> 1.5 lakhs (SCSS), 40000 (std deduction), 30000 (80D) and 50,000 (interest exemption)

It that correct, especially the last deduction.

Dear Ravindra,

Under which section?

Sec 80 TTB

No income tax for the interest earned in the Term Deposit up to Rs.50000/- for the senior citizens under Sec 80 TTB

Dear Ravindra,

Yes, you can.

Dear Sir

Total deductions from a retired senior citizen having only earning from interests from bank deposits are ..

1. Standard deduction : 40,000

2. SCSS (max 15 lakhs) : 1,30,500 (sec 80C)

3. FD exemption : 50,000 (Sec 80 TTB)

4. Medical insurance : 30,000 (example)

Total deductions = Rs. 2,50,500/-

Taxable income = Gross – total deductions

If the “taxable income” is less than Rs. 3,50,000, then deduct Rs.2500 from total tax to get net tax.

Is the above summary correct sir ?

If you are senior citizen , then you will have no tax upto 3L

From FY 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

In the blog above, can you mention that one has to provide cheque if amount greater than 2000 to claim benefit.

Dear Partha,

Yes, in that case you have donate through cheque or DD.

Dear Basu,

Can I put my entire saving of Rs. 2 lakhs in NPS only ?

Dear Mahendra,

You can do so. But do you feel it is worth?

What alternative do you suggest for best return cum tax saving mechanism please ? I already have ICICIPRU life pension for which the required installments have already been paid. I have ICICI Elite wealth that covers my insurance till the age of 80. I do not have any policy in my wife’s name. Also, I do not have PPF account. I am already 50 years old and my wife 55 year old. Please advice accordingly.

Dear Mahendra,

Your priority should be to reach your financial goals rather than investing BLINDLY FOR THE SAKE OF TAX SAVING.

avid reader of finance articles (investment& tax saving), you are really a charm with consistency, usually ppl/writer get carried away … (which is not bad, but losses innocence/unbiased real info.)

kudos for your painstaking job– keep posting in simple & illustrative lucid style

Dear Gaurav,

Pleasure 🙂

Now my age is 60 years, I have worked L&T for 2 years then I resigned and went to Kazakhstan, again I joined in a company in India on Aug 2015. My new company is also opened an EPF account, I am still working in this company.

I have UAN Number of both the EPF accounts.

I want to withdraw my L&T EPF account, is it possible?

Kindly reply.

Thanks,

Dear kamal,

Considering your age, I suggest you to transfer to new EPF.

My employer doesn’t accept APY (Atal Pension Yojana) scheme under 80CCD (1B). Is there any official/Gazette notification available to prove APY (Atal Pension Yojana) scheme is covering benefit of 80CCD (1B)

Sathish-If employer not ready to accept, then you file your IT return on your own. Employer acceptance or rejection is not final.

APY contribution was never considered for tax savings!! dear Basu pls correct me

also your stake abt APY- its ever changing clauses –ALSO CAN A PERSON HAVE 2 PRANS (NPS&APY)

Dear Gaurav,

Refer my post for the detailed taxation on APY “Atal Pension Yojana Tax Benefits -Sec. 80CCD(1) and Sec.80CCD(1B)“. One must have only one APY account.

pls your comment on PRAN i.e i have one under NPS & 1 with APY.

they say it is not clear in documents so you can have 2 PRAN. is it true?

Dear Gaurav,

As per me and PFRDA, one must hold only one PRAN.

just wanted to share, customer care assured (verbally) one can have different PRAN!!! as NPS & APY both are different schemes. i am waiting a written reply from them

Dear Gaurav,

It is strange!!

Hi,

I am employed in private company and in 30 % slab. I invest the max limit of 1.5 Lac under 80C ( LIC, PPF )

Last year I also started APY for which annual premium comes to 15k.

I am still left with 35k in 80CCD (1B)

I intend to put this 35 k in NPS for tax saving.

Should i go for it… is it worth it ?

Saket-Invest to reach your financial goal rather than with SOLE INTENTION OF SAVING TAX.

My father is 61

He gets interest 70000 per annual from post Mis.

Can he take benefit of 80TTB and save (50000) from income tax?

Nirav-No. Because MIS interest is not considered as pension income.

Thanks a lot Basavaraj, that was very helpful.

Vijay-Pleasure 🙂

Sir, Self/spouse/Parents was hospitalized for a week due to normal illness, is that expense claimed in 80DD?

Any clause or difference if that expense got reimbursed through health insurance?

Nazeer-I think you not read the above post properly. It is for a dependent who is disabled.

Hi Basu,

Today I was discussing with my friend about investing money in bank(FD), since I have already invested through SIP monthly, so I was planning to invest around 1 lakh in bank FD.

He suggested me to invest in Mutual fund and he told every month I will get around 10.5% of interest for the amount and its tax exempted, when I checked with him in detail he told his financial advisor is providing 10.5% from last 1 year and this they are generating it from investing it in various mutual fund and what ever dividend they will get they will provide this amount, I am not aware about this type of investment, this seems to be some loop hole in the plan, can you please guide here so that people should not invest with these kind of rosy number interest rate and also tax exempted

Regards

Anand

Anand-No product on this earth will give you currently 10.5% GUARANTEED return. It is something fishy scheme. Stay away from such products or advisers.

Under section 80G it is mentioned that “This deduction can only be claimed when the contribution made by cheque or draft or in cash”.

So question is if payment done through NEFT is eligible for exemption or not?

Atul-As per rule, then not eligible for exemption.

Hi Basu,

Thank you so much for creating an awareness among Society. I am a regular reader of your blog and each stuff is explained in layman terms. I need some clarifications. Like whether LIC premiums paid for parents can be claimed under 80C ? I have seen on websites that Premiums for LIC and Term insurance paid for parents cant be claimed under 80C for parents . Only health insurance could be claimed under 80D.

Can you please confirm on this ? Thanks! Shan!

Shanmugam-Life Insurance premium paid for parents can’t be claimed under Sec.80C. Please refer above post properly. I clearly mentioned about this.

Thank you so much!

Dear Sir,

Just one question do we still need to provide medical invoice of 40000 to get the deduction and what about if a person doesn’t have invoice of that amount.

Further, if there is any amount paid for availing medical policy by the company but deducted from your salary…would this amount still comes under the purview of above 40000 limit..?

Thanks in advance for explaining…

Super-You no need to submit any medical invoice to claim Rs.40,000 as it is a standard deduction but not medical allowance claim. Regarding you paid the premium to avail health insurance, then it can be claimed under Sec.80D. Refer above post properly.

Dear Mr. Bashu,

I have given a token amount in October 2017 to purchase flat under new GST {12%} and now GST reduced 8% for first time buyers from 26th January 2018 . I have completed my agreement of purchase this under construction flat with builder on 30th January 2018 and there is mentioned clearly tax as per applicable as govt rules. But now builder is asking 12 percent ?

Is GST paid during the completion and registration time at last?

Or it will be paid with instalments with which rates?

Project is registered in ReRa and Credit link scheem plan.

Please breif. Thanks

My loan approved in PMAY scheem in MIG and till date no disbursement has done. It will start from next month.

Thanks Sir.

Yadav-GST has to be payable as and when you do the payment in instalment to the builder. The applicable GST rate for you is 8% but not 12%.

Informative article. Keep it up.

Atul-Thanks.

Hello sir

I would like to know the deductions that for non salaried employees like professionals ( docters).

Raj-Let me write a different post on that.

Excellent article on tax savings sir

Ram-Pleasure 🙂

Dear Basu

Is only Rs 10,000/- of the interest earned on deposit in a Savings Bank, deductible for tax?

Shiva-Yes, under Sec.80TTA.

Dear Basu,

I am a bit confused. Please clarify below case for me

Last FY (16-17), I earned approx 17K interest on fixed FD/RD in one of my banks. Now bank rightfully deducted 10% as TDS which reflected on my Form 26AS. However during filing of income tax, I had to shell out more to IT dept for the interest as I come under 30% slab.

Would Sec. 80TTA have been of any help to me in above case?

Regards

Koustav-As I mentioned in above post, Sec.80TTA is applicable to interest earned on savings account but not on RDs and FDs. Hence, no benefit for you under this section.

great efforts !

Yadav-Thanks.

Very informative

Sunil-Pleasure Sir. Felt happy to see your comment 🙂

very nice a good basic information very helpful i think it covers all basic things

Thanks for your help and guidance

once again thanks

Mangilal-Thanks for kind words.

Very good and really nice informative blog

Sat-Thanks.