Senior Citizen Health issue is of utmost important these days. Because of raising medical expenses, higher life expectancy and high probability of health issues will ruin the financial life. Hence it is very much important to have senior citizen health insurance.

How to choose the right plan?

Below are the few points you need to consider before proceeding for buy. Choosing the right product and understanding the policy wordings is must. Otherwise sometime even though having health insurance will not be of use for you.

Maximum Sum Insured Covered-In few plans you have restrictions of maximum limit of SI. So it is always better to opt a plan which will not have such restriction or offers to cover highest that others. . Otherwise what will happen is, after some time if you try to increase your SI then it will not be possible with existing insurance.

Premium Charged-Never buy health insurance only considering the cheapest plan. Such plans may not have other additional features which are very much important for senior citizens. Hence decide on plan feature and your requirement rather than premium.

Renewal Age-This is the age after which you can’t renew the plan and you will be no choice but to live without any insurance coverage. Some plans cease renewal age after certain period like 70-75 yrs. But it is always preferable to go for plan which offers lifetime renewal.

Co-Payment-This is the amount you need to pay from your own pocket during the time of claim. Hence always choose the plan which offers lesser co-payment.

Pre-existing disease covered-Opt a plan which claim to be lower waiting period. Because of this clause in your policy, you may not get claim for your existing diseases. Hence choosing the lowest waiting period is always a best option.

Limit and Sub-Limits-This is the limit which insurance company will fix the maximum amount payable if one got diseases like cancer or any other major illness. Even though you have overall high Sum Assured, but by restricting the limits for a particular disease may ruin your financial life.

Quality of service– Verify the company history related to service and how fast are they in settlement of claim. Because this matters more while emergencies. Hence verify how they are competent in handling your emergencies so fastly. Check for TPA (who are like middlemen between you and insurance company in settling insurance claims).

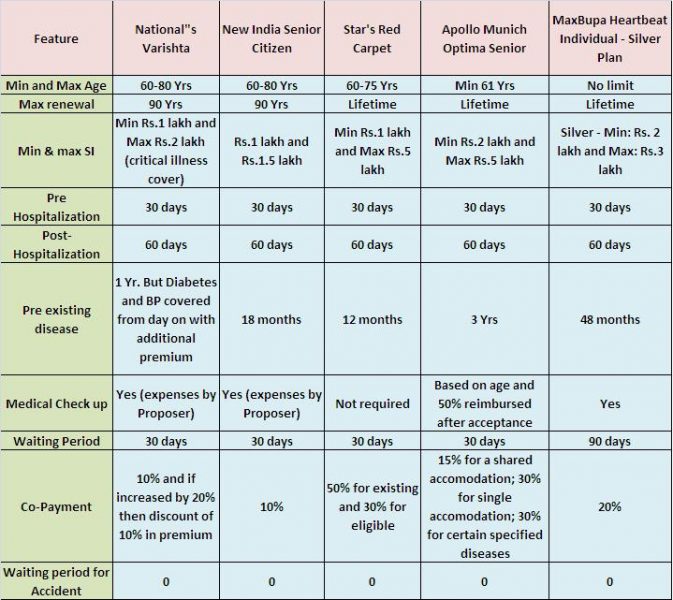

Below I did some comparison from top health insurance providers. I tried to simplify the points as much as possible. But for detailed product feature, you must contact respective health insurance company. Also I excluded the premium, as due to health complication senior citizen premiums may vary.

From above list you noticed that there is no such plan which we can say as best and will be suitable to all senior citizens. Hence based on the requirement one must opt the suitable plan. Hope my post will help you in choosing the right senior citizen health insurance plan.

112 Responses

sir my mother aged 64 and she is suffering from both sugar and BP from past 7 yrs. can u pls suggest me which one is better health insurance company and hassele free claim settlement to her

Dear Nagabhushana,

It is hard to say which is better. But try to knock the Public Sector Companies.

Sir – I am looking for a policy for my father. He is 60 years old and has lung ailments and asthma. Cataract is also due for one of his eye.

One of my friend suggested HDFC Ergo policy of 3L for 10499 and Bajaj Super top up of 10L for 8544.

Pre existing disease covered by HDFC after 3 years and Bajaj after 1 year.

There is no expenses due at this point of time but i want insurance for future for unforeseen events.

Do you know how is the claim ratio of HDFC and Bajaj?

Which policy due to suggest for him?

Nirav-If plan features of HDFC and Bajaj suitable to your requirement, then go ahead.

dear sir,

at first thanks for writing such informaitonal blog for the good of the community.

please can you post an update to this article as this is dated around 3/4 years back, it would be really good and helpful.

thanks again

Krala-Surely I will.

Dear Sir,

My father Age is 66 Years and Mothers age is 62 Years.

both are insured for 1,00,000/- individual from oriental Insurance from past 30 – 40 years.

now he wants to increase sum insured but oriential people said at age of 65 they don’t.

i have been approched by our regular insurance agent he says :

STAR HEALTH RED CARPET IS BEST AND GO FOR IT. PREMIUM APPROX : 15000/- EACH AND TOTAL 30000 FOR 3 LAKHS POLICY.

THE I CONTACTED POLICY BAZAAR, THAT GUY SUGGESTED ME : HDFC MEDISURE CLASSIC : 3,00,000/- FAMILY FLOATER : 27,280/- PREMIUM.

ALSO CIGNA PROTECT PRO HEALTH : ASKED ME TO ADD NIL CO-PAY RIDER : PREMIUM : FOR 3.5 LAKHS EACH INDVIDUAL :

FOR FATHER : 15252/- + NIL CO PAY RIDER ( 2792/-) TOTAL : 18044/-

For Mother : 12,072/-

is CIGNA GOOD CO. OR STAR HEALTH IS BETTER AS IN STAR PREMIUM IS FIXED FOR LIFE TIME.

PLEASE SUGGEST.

DINESH K MURJANI.

+91 9879006412.

Dinesh-Never compare products just with premium but look for features also (as I explained above). If you have still doubt, then we discuss.

Sir can you suggest best health insurance policy for my mother age 62 suffering from diabetes but no medication required sum insured of Rs 10 lac

Sneha-You try with above products. If insurers avoid or load the premium, then better to go for this “Health Insurance by Banks – Should you buy?“.

Thank you for your kind advice.

Sneha-Pleasure 🙂

Sir my mother is 62 year old..in which health insurance policy I should go? I want a coverage 5 lacs

Srijita-They are listed above. Please check it.

My Mom hv Diabetes (Tablets only, No Insulin) age 61 & Dad have high BP (Tablets only, No Insulin) Age 66. Which Policy i should prefer for both ??

Paresh-Check with public sector insurers.

Sir my mother age 63 years and she have cholesterol and hypertension only. which is the best plan for her. i am from Cochin

Jose-Check with public sector companies.

Sir my dad age 63 years and he have cholesterol and hypertension only. I selected national insurance varishtha plan will I go for this or anything else you would suggest? My mother age 53 years she have heart disease. I select raligare care plan will I stick to that or anything else would be best. I need cashless as many as possible hospitals and need to cover pre-existing disease with low premium. and I want to insure only 2lacs for each.

Abhijit-But the issue with National is lower sum assured. Instead, I suggest to opt for better public sector companies. You can go for Religare for your mother.

Hi

Please advise . National Insurance has a maximum coverage of Rs 1.5 lakhs. Now , since medical expense in very costly , is it worthwhile to buy more than 1 policy ? Say , for example , can I buy 1 National Insurance policy of 1.5 lakhs + 1 New India Assurance policy of 1 lakh + 1 or 2 other policies ?

If that is allowed , then please advise how I should use my policies in case of a hospitalization to cover for the total expense?

Secondly , do PSU Insurance companies provide Cashless facilities?

Thanks.

Rajarshi-You can buy so. When claim arises, the amount will be shared among insurers.

Hi,

My mother is 60 years old and she is diabetic with rheumatic heart disease. Please suggest me which company health policy will be issued with these preexisting illness.

Regards,

Rajeev

Rajeev-No company will offer the insurance with pre-existing illness.

sir

my grandmother age is 66 and my ageis 30 advise me best health insurance policy

Karthik-Check the public sector companies for your grandmother.

Hi,

My father (dob: 17/01/1942) has a 2 year old policy from National Varistha… After two years can I change to another for higher coverage under portability.. if not what super top ups are available?

BR

Ravi

Ravi-You can do the portability. However, there may some restrictions from new insurer. Hence, first opt the insurance company and based on their restrictions take a call.

Hello Sir,

My father in law is 65 years old, is diabetic (blood sugar) and mother in law is 59 years old, no health issues.

Please suggest me a suitable health insurance plan for around 5 to 10 lacs coverage?

Please tell me if I should go for Individual or family floater?

My total premium budget is around 30,000 per annum?

Or Should I go for group insurance cover provided by my company?

Regards,

Ashok

Ashok-Getting claim with such health issues will be difficult if you go for individual or floater. Instead, I suggest you to include them in your company provided insurance. Because claims will be easily settled and there will no such waiting period. Once you have that, then think of separate own policy for both of them. Better to go for family floater.

Hello Sir,

My father is 65 years old. He does not have any major health issue. He went for his eye check up and the doctor suggested minor surgery. I want to buy a plan where the waiting period is minimum and where this surgery can also be covered. Can you suggest any good one.

Regards,

Anjali

Anjali-Sadly NONE. Because no insurance company is here to run their business on social platform.

Dear Basu,

I came across your post regarding health insurance for senior citizens.I am a 29 year old female.I have a 10 lacs group insurance cover provided by my company which covers my parents as well. My dad suffered from Kidney failure last year and is on dialysis now.I feel the 10 lacs cover is just bare minimum enough to take care of my dad’s expenses only so i am looking for buying health insurance outside.I have few queries.Will be great if you can help me.

1.I would take seperate plocies for my mom (60) and dad (62).My mom has no pre-existing illness.So what would be best plan for her.

2.For my dad, the only plan which has lowest waiting period is Star red carpet*(1 year) but the co-payment is pretty high-50%.So should i go for a plan where waiting period is 3 years but copayment is less.In the meantime my office cover might just be enough?

3.Also should i specifically look for health insurance designed for senior citizens or do i take normal regular individual health plans which also allow individuals to purchase at 60-62 years of age.

If i have to zero down a particular plan considering my situation,which one would you suggest.Will be really great if you can help.

Regards,

Ambuja

Ambuj-1) Considering your father’s health issues, I suggest to go for separate health insurance.

2) In my view, he already covered under your corporate insurance. Hence, to enhance coverage go with plan which has lower co-payment and regular waiting period.

3) Usually considering the age of your father, he will be eligible for senior citizen health insurance only.

Sir, I am 68 years old and want to buy health insurance. which Company I should approach where I can feel safe n secured.Can you guide me?

Sushil-Sir, check first with public sector companies.

I have a family with 2 senior citizen parents (mum is 75 yrs and dad is 77 yrs) along with a brother who is in his mid 40s and a sister who is in her early 40s and myself in late 30s. Siblings are all single. I would like to make a family medical policy. What policy/ company /premium should I be looking at and what fine print should I be paying attention to. I would like a rather large coverage of about Rs 10 lakh each member. thanks in advance

Topaz-In my view, better to separate your parents from you siblings. I already explained about senior citizen health insurance. Regarding you all three siblings, check with National Insurance, New India, Apollo, MaxBupa or Religare.

Age of My Father (Having BP) – 60 yrs and Mother – 56 yrs

Having health insurance of Star.

I plan to shift their policy to public sector companies, due to higher premiums for star.

Which policy would you suggest?

Francis-Please check the premium of public sector companies. I think they charge more than Star.

Hi Sir

Need you help again. 🙂

After reading the above article and comments, i have decided to buy separate health insurance policies for my parents (Age 61 and 59). Since the table in the blog is not an updated one, i am trying to collect the same information from their respective websites. I wanted to understand from you regarding the Sum Insured that i should choose. I do understand that inflation factor should be taken into account. But since my dad has no previous illness and mother has cataract operation done recently, i am not sure if i should go for 2,3,5 or 10 lakhs SI? Please guide.

Regards

Ankur

Ankur-Apart from inflation, you also need to consider the city in which you live and the cost of medical expenses for a day’s stay. Based on this you have to buy. Buying Term Insurance or Health Insurance and forget for life is not a wide idea. Instead, we have to review it once in 5 years at least and increase the cover accordingly.

Thanks Sir. What are your views about CIGNA heath insurance for senior citizens? I am finding it good as compared with other policies. But wanted an expert view.

Also, since we need to review the policy cover every 5 year, then should i consider SI keeping in mind next 5 years only?

Just a note that PolicyBazaar guys have been stressing on CIGNA. Major reason i saw is that Co-payment is zero for my parents.

Ankur-If policy features matches your requirement, then go ahead. But not because of policybazaar recommending it.

Hi Basavaraj,

I am a salaried person and my company has come up with health insurance plan for dependent parents which costs 13000/Annum for 2lakhs SA (includes self+spouse+2 kids+ parents). The premium may increase every year depending upon claim ratio. my company also has regular health insurance which covers self+spouse+2 kids upto 1lakh SA.

Please let me know whether to opt for company’s insurance or individual plan for my father of age 65 years. He has sugar and BP.

If separate please suggest few plans.

Thank you,

Naveen

Joshi-In my view Rs.2 lakh coverage is not sufficient. However, I suggest you to go for company plan and along with that buy a standalone insurance for your father. The list of plans are already discussed above.

Dear Sir,

We came across your article while researching on a suitable health insurance for myself and my wife. Please guide me further on our requirement.

We are resident of T. Nagar . Chennai 600 017

We want to buy a health insurance product for self and wife.I am 67 and my wife 63 years.

We two are type 2 diabetic and under control on medication. and fluctuate between plus minus 10 of normal

admissible level.

I have mild pressure.Wife does not have any other ailment other than orthopedic problems in her knee.

We are mobile and agile.

Could you suggest the appropriate health insurance company which is hassle free and settle claims promptly.

We can not run from pillar to post to get our claims.

Please enlighten on pre existing diseases clause.

We appreciate your professional (unbiased) in puts.

Best wishes,

Rukmani,Krishnamoorthy

Krishnamoorthy-Sir, you can check with National Insurance, Apollo, New India or Star.

Thank you for your prompt response.I appreciate your valuable input.

Hi, I am having ICICI Lombard Health insurance. Am married. My mother is dependent on me. She is 64 Years. Please advise, if i can add her in my insurance. Or do i need to opt for a new one. And which one is the best.

She is diabetic, BP. I want some coverage which will cover from day 1. If so, what would be the premium. (And is cataract surgeries also covered).

Please advise

Sobha-Better you can have a single policy for her. There is no such plan which covers the existing diseases from day one.

Hi ,

Very nice and informative artical. Few quick questions.

1. How are L&T Health Insurance policies? (As they are a renowned brand but new in insurance sector , information like

claim settlement ratio etc is not available)

2. I am planning to extend health cover for my Mother as medical costs are skyrocketing.Is it benefecial to get new policy

from a different company or extend existing policy to provide higher cover.

3. Bit confused between Star and L&T. L&T is new but atleast on paper offfering some amazing benefits. But Star is reputed and in this field for long.

Thanks,

Dev

Devadatta-L&T may be new, but they are aggressive and I have not heard any negativity about this. You may consider it if plan features and premiums are within budget. Better to extend the health cover from the existing insurer. Because if you try to opt for new insurer then again they put bar about waiting period or they may reject proposal considering her age or health complications. In between Star and L&T, I prefer L&T. Star may be cheapest but you have to look for other features also.

Thanks for prompt reply

Hi

Thanks for this wonderful post. Currently I am looking for health insurance for my parents (Father 71 and Mother 64), both healthy over all. (Father diabetic Mother has high BP nothing major). I am inclined to Max Bupa plan as it covers life long renewal, but I have few queries.

1) Some one told me Max Bupa claims are not settled quickly is it true?

2) Max Bupa people said they will provide cash less card, so after that also for any hospitalization 20% cost will be ours?

3) During renewal every year do we need medical test? Is it taken care of by the insurance company or individual need to that?

4) Total family floater coverage is said to be 15 Lakh, for the policy I am inclined to, but in the table above you mentioned something like 3 Lakh maximu. Please elaborate a bit on that.

Somanath-Claim process some time get delayed due to a complication. Hence, check why it was delayed to those who said this company settles claim late. Co-payment exists in almost all products of health insurance. It only varies. Hence, providing a cashless benefit does not mean purely cashless. You have to pay the rest of co-payment agreement. Usually, no insurance companies request for a medical test every year. They may ask during initial buying only. The list updated above may be an older one and they might have changed the maximum limit. Hence, if they are offering Rs.15 lakh then go ahead.

Dear Sir,

I am planning to take a policy to my mother-in-law, She is a diabetic, aged 62yrs old.

No Pre existing diseases so far,

Plan to go with Star Health Insurance Senior Citizen red carpet plan.

Yearly premium will increase or not.

Kindly advice.

Satish-Diabetic is considered as an existing disease. Premium loading depends on insurance company. I can’t say on this.

Dear Sir

I want to buy a health insurance product for my parents. The age of my father is 60 and mother is aged 55. My mother has suffered from cervical cancer 8 years ago and now she has recovered completely from it.

Both of them have high bp issues for which they take regular medicines.

My mother is also suffering currently from slipped disk problem.

Can u pls suggest me the appropriate amount of risk cover in this case.

Also can u pls throw some light on pre existing disease clause. It comes in every policy.. Thanks

Vikas-The list is available above. However, it is hard to include the health complications immediately. They usually not include such diseases or they may include it after waiting period (usually it is for 4 years).

Hi Basu,

If you check this link then it seems Religare CARE policy is good if compared for senior citizens. My dad is 63 yrs healthy individual and I want to take health insurance for him but confused with so many products and different conditions. Can you suggest which is best for senior citizen, Star the co-pay is very high.

Manish-If you are comfortable with company, feature and premium then go ahead with Religare.

Dear Basavaraj,

I came across your article while researching on a suitable health insurance for my parents. Please guide me further on my requirement;

Father 62yr – No ailments

Mother 62yr – No ailments

Existing Health Insurance – Bank of India National Insurance (Family health insurance for 5 L)

Please guide if our existing insurance can be ported and which health insurance should we opt for.

Varun

Varun-The existing health insurance is group insurance and it can’t be ported.

Dear Sir…my father is 62 years and suffered cerebral brain hammerage on 2014 july and had to go for brain operation…now he is taking high bp medicine but completely fine…plz suggest can my father can avail health insurance and if yes which company…

Amar-It is hard for me to suggest. Better you share the situation with insurer.

Respected Sir,

My mother is 67 years old with diabetes and blood pressure. Which insurance policy I should opt for?

Aparna-I already replied to your mail.

Please consider writing a detailed article on health insurance offered by banks.The premiums are unbelievably low.

Prince-They restrict you when it comes to sum assured. Hence, better to have direct buying from general insuers than opting for health insurance which banks offer.

Hi. I want to apply for health insurance for my parents (Dad – 69yrs and Mom – 65yrs). With so many companies and comparisons, I had narrowed down to Apollo Munich, Bajaj Allianz and Oriental.

Both parents have only BP issue currently. Kindly advise which insurance from above is most suitable in terms of coverage and more importantly cashless mediclaim. Since me and my siblings stay outside India, we want a plan that would take care of them without payment hassles.

Thanks

N-Suggest you to go with Apollo or Bajaj.

HI,

Can one take medical insurance policy for an aunt? Most of the policies i have gone through mention parents and in-laws only.

My aunt is 58 years old, widow, no pre-existing illness.

Thanks,

Tejaswi.

Tejaswi-I don’t think so.

Hi,

Thanks for the reply. In that case, can you suggest a way out? She doesn’t have any income source also. How can we get a health insurance for her?

Tejaswi-Let her be proposer for herself.

Dear Basav,

I’m a big fan of your blog posts. Thanks for sharing your knowledge with us. Recently i’m looking for a health insurance policy for my mother (64 years of age). She takes medicine for high BP and had a surgery for her hip joint fracture more than one year ago (walks with the help of a stick).

After looking many insurance options for senior citizens, i zeroed on 2 policies. Optima senior by Apollo Munich and Heartbeat by Max Bupa.

My questions are

1. Which one among above two (or any other policy in your view) is the best suited in this case ?

2. If in future any heart related complication occurs, would that be considered as pre-existing disease due to her high BP ?

3. If in future any complication related to her hip joint occurs, would that be considered as pre-existing disease as well ?

Jeet-1) Both are best but first let them issue policy considering the high BP. 2) If currently she don’t have any heart deseases then it will not be considered as existing desease and can get claim. 4) Hip joint may be considered as existing one. But disclose it properly and let they know the health condition of your mother.

Mr. Basavaraj,

Thanks for posting this article. It brings down to a lot of sharing about important artifacts, a step by step guide to approach and choose the right cover. Indeed appreciate your efforts and patiently answer all the queries.

I got a query for you which is partially covered in the post but because it is beyond scope of this article so I had to ask you. Here you go-

Mother is 59 (will complete 60 early next year-2016) and Father is 67.9 (68 years in coming June-2015). Father is normal but still bit high BP and had open heart surgery 1.5 years ago. (which means pre-existing disease).

Base on this data/facts- What would be your opinion/suggestion in choosing a right policy or what best you think from your expertise?

Secondly- From industry experience- what major (or minor) difference you see in opting Government health insurance compare to Private. Being a customer (or patient) when you are standing in a hospital asking your TPA to cover your illness/surgery (whatever), who is prompt and faster without much hassle?

Your response would be really appreciable.

Thanks and Cheers

Regards

Lucky

Lucky-Go either with Star or Apollo. Because the maximum sum assured offered by public sector companies not at all suffice. I don’t see any difference among private or public. All have either their own in house team or TPA to take care of emergencies. Hence no need to worry. Also rejection of claim may happens on many ground, which you or me can’t predict. But it is always advisable to have buffer cash, instead of solely depending on health insurance.

Dear Basavaraj,

I am 67 yrs & my Wife 64 Yrs. I am planning to take National’s Varishta Policy. But Officials of National Ins. Co. told me they cannot consider my request to cover me for Critical Illness since I am over 65 years age., but they can give coverage only for my wife since she is below 64 yrs. I want to know whether their statement is correct or really I am eligible to get coverage for critical illness also though I am 67 years old. Expecting an arly reply………..Balachandran V Alappuzha

Balachandran-I am not sure about the age. Because such restriction not mentioned in their prospectus too.

Dear Sir, I want to purchase health/medic lam policy for my family(4 members), me-34 , my wife-29 & mother-62, father-68.

Please suggest , which one is the best for us.

Pankaj-After going through above post and below comments, do you still feel doubt?

My father is 66 years old he had star red carpet policy for 2 lakhs and he had not claimed any thing from inception of four years, now e need to switch to National Insurance Mediclaim plus .. Is it eligible for him to go for porting and what is the procedure.. and is it suggested to move to National Insurance company.. any other good polices in same segment

Raju-Why you want to move?

I want health plan for my diabetic father of 64 year. star is good one but have high Co pay. is it good to go with government insurer? if you can pl. suggest plan with difference

regards

Rakesh-Why can’t you consider Varishta Mediclaim of National Insurance?

Sir My father age61.He is cover with max bupa heartbeat family first plan 5+5+5+15 from last year.but prieame too much.now i want to port in raligare.is this write step

Jagmohan-Please check the features properly then go ahead.

What about religare senior citizen health insurance policy with no co payment clause till Rs. 4 Lacs ? Is it the right policy to go for ?

Rajinder-But age limit for entry is 61 years and also check for premium with other plans.

Hello sir.i would like to get health insurance for my parents aged 68 and 56 years.should i get them separate policies or buy one that covers both.

Syed-Better to have it separately.

Thank you

Hello sir.i would like to get health insurance for my parents aged 68 and 56 years.should i get them separate policies or buy one that covers both.

Syed-Better to opt for separately.

I want health plan for my diabetic father of 64 year. star is good one but have high Co pay. if you can pl. suggest plan with difference

Naveen-The list is available above.

I want to purchase a medical insurence for my mother have age of 64. I feel star, max bupa, appolo are the best companies, but I confused to select from this three for 64 age person, bcz some policy entry up to 65. So need to take normal policy or sinior citizen policy?. if normal policy, which company better and if senior citizen policy, which company better ?

Shafi-Better to go normal plan which covers lifetime. Once they issue the policy then your mother will be covered for life long. Check with Apollo or MaxBupa.

Dear Basav

Do any of these health insurance products cover travel abroad for over 3 months to USA or rest of the world?

Regards

Dinesh

Dinesh-These are health insurance, no cover of travel. Instead I suggest you to buy travel insurance separately.

hii dinesh,

I would like to suggest you to go with bajaj allianz or icici lombard for the travel inurance. both are really good in terms of service & in claim settlement as they have their own in house claim settlement department.

for any help call Mr. anand – 9029600256

the guy help me for the same & provide the full details which we never been thought & good service also.

In the above chart what is meant by waiting period

Rahul-Suppose your policy issued today and there is a clause of 30 days waiting period then any illness within that period (except accidental in nature) will not be covered.

would be great if you include a indicative premium for 2 lakh ( as it is a common amount applicable to most of them)

Pradeep-Will try it.

My wife opened PPF account on 21st March 2000. So in that case 15 years will complete on 1st April 2015 or 15 financial years are over? Is there any rule that account should be opened before 5th March for eligibility for same financial year?

Thanks

Vivek-Your wife account matures on 1st April 2015, because it completes 15 FYs. Suppose if your account opened on 1st April 1999 (FY 1999-00), still it used to mature on 1st April 2015. So account closing will be next immediate first day of FY from 15 years completion.

Greetings Sir,

I have a query hence would request you to please give me your email ID since discussing in public forum would not be right. Thanks for the wonderful post.

Best Regards,

Nelson

Nelson-You can reach me by mail id [email protected]