Whether Debt Funds are alternative to Fixed Deposits (FDs)? Recently Reliance Mutual Fund launched one NFO Reliance Nivesh Lakshya Fund. One of my blog reader unluckily brought to my notice after the NFO was over.

However, this is the classic example of how debt funds are sold by few as an alternative to Fixed Deposits. Hence, thought to write on this subject.

Before jumping into selecting any debt funds, you have to understand the basics of below few definitions for your better understanding.

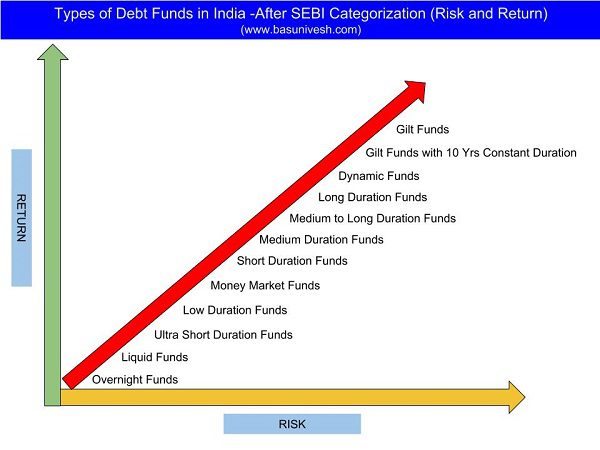

I have already discussed these topics in my earlier post “Types of Debt Funds in India -After SEBI Categorization“. However, I will repeat the same again here.

Macaulay Duration

Macaulay Duration means the time an investor would take to get back all his invested money in the bonds by way of periodic interest (coupon) as well as principal repayments (at maturity). It is named after Frederick Macaulay who developed this concept analyzing the risk of the bonds.

It is confusing for you (and of course me also!!) if you try to dig deep to understand how it is calculated. Hence, for simplicity purpose, I just provided you the meaning of it.

You just keep one thing in mind that higher the Macaulay Duration means higher the risk. Because of longer the tenure of the bond, the more sensitive the Macaulay duration to changes in yield.

You may be aware that bond prices are inversely proportional to interest rates. Suppose there is a fall in the interest rate, then the price of the bonds will rise and vice versa.

You must stay with funds or bonds with longer maturity when interest rates are expected to go down and move to bonds or funds with short maturity when interest rates are either likely to stay stable or go up. This makes it important for you to know the Macaulay Duration of a fund before buying it. It is the clear indication of the risk involved in any bond fund.

However, you noticed that SEBI’s Debt Fund Categorization will not mention the Macaulay Duration for all types of Debt Funds. Macaulay Duration is applicable only to 8 categories of funds. In such situation, the other factors to analyze the risks will play a major role. Hence, along with this Macaulay Duration, you must also look for below criteria before jumping into any debt fund categories.

Credit Risk-

Debt Mutual Funds invest in treasury bills, government securities, Certificate of Deposits (CDs), Commercial Papers (CPs), bonds, money market instruments and many more. The credit quality of these underlying instruments are measured in terms of ratings.

Usually higher the ratings lead to lower the return or risk. It is a misconception among many that credit risk refers to the risk of default by the bond issuing entity. However, the truth is something different.

There is a possibility that the credit rating of a bond or instrument the fund is holding may change at any point of time. Let us say ABC Debt Fund holding the bond of XYZ which is rated as AAA by credit rating agencies (highest rating).

It does not mean that this rating is permanent. It may change at any point of time if the company XYZ’s finance changes.

Hence, never be in a misconception that credit rating refers to default risk and also credit rating of bond will NEVER CHANGE.

Modified Duration-

It is a measurement of a bond’s sensitivity to movements in interest rates. It is usually measured in years. For example, if debt mutual fund with the modified duration of 3.1% means if there is a 1% interest rate movement then the fund will undergo the movement of 3.1%.

Hence, the higher the modified duration means higher the interest rate risk.

Average Maturity-

A debt fund portfolio usually consists of a number of bonds where each could have a different maturity date. Maturity is the time period remaining before which a bond comes up for repayment by the issuer. Average maturity is simply the weighted average time left up to the maturity of the various bonds in a portfolio.

Higher the average maturity greater the interest rate risk of a debt fund.

Exit Load-

Some category of funds will charge you exit load. Hence, you have to be careful while selecting the funds and the conditions apply regarding the load structure.

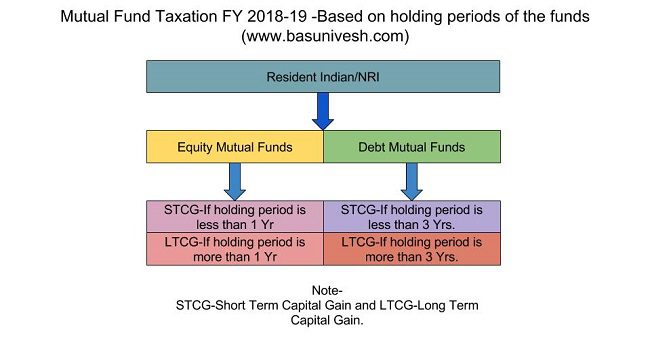

Taxation-

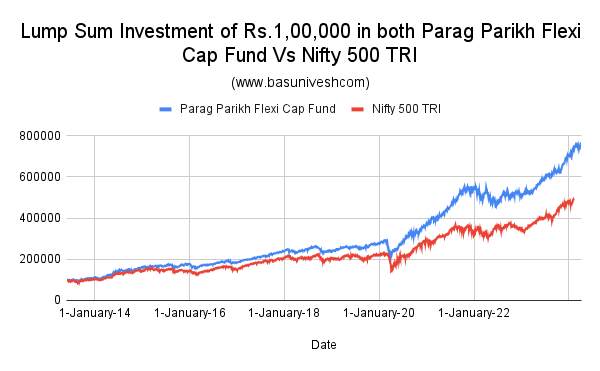

Remember that Equity Funds and Debt funds are taxed differently. Hence, you must understand the taxation part as well before jumping into investment. I tried to explain the same in below image.

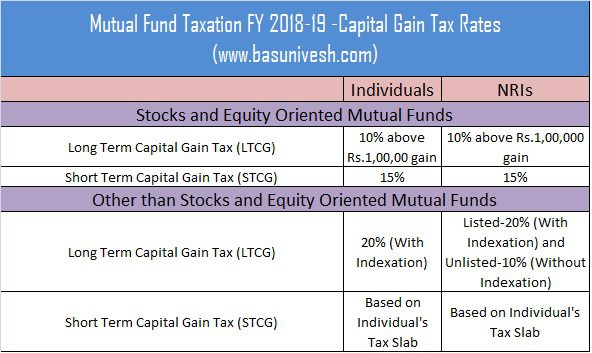

The rate of taxation is as below for the current FY.

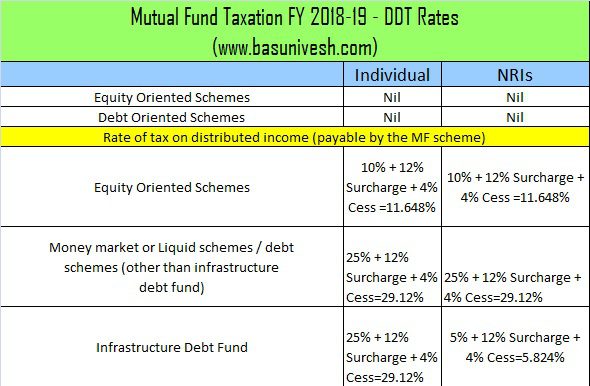

Also, the current DDT rates for Mutual Funds is explained in below chart.

Now there are a few positives also towards debt funds when we compare with Bank FDs. These are the positives, which are highlighted by SELLERS to force you to think of debt funds as the best alternatives to Bank FDs. However, they are true and hence I too accept them. If I do not accept these positives, then they may point at me as BIASED.

Advantages of Debt Funds over Bank Fixed Deposits

# Liquidity

In the case of Bank FDs, you lock in for a few years. If you try to withdraw before maturity, then Banks always charge some penalty as premature closure charges.

However, in case of Debt Funds, there are no such premature closure charges. You can exit at any point of time (subject to the exit load and taxation).

# Re-Investment Risk

In the case of Bank FDs, you can hold them to the maximum period of 10 years (as many banks offer to the maximum of 10 years FDs only). More than this period, you can’t hold it.

Hence, after the maturity of 10 years, there is always a re-investment interest rate risk. If the interest after 10 years is conducive for us, then not an issue. If interest rate has fallen, then we may end up with booking our FDs at that time’s low-interest rate Bank FDs.

This risk is not here in case of debt funds.

# Taxation

You may refer above details which I already shared regarding taxation part of debt funds. In case of FDs, there is a TDS and also the interest earned is taxed as per your tax slab.

However, in the case of debt funds, if your holding period is more than 3 years, then they are more tax efficient than Bank FDs.

I covered these major advantages of Debt Funds over Bank Fixed Deposits.

Whether Debt Funds are alternative to Fixed Deposits?

Now let us go back to our basic question of writing this post. Whether Debt Funds are alternative to Fixed Deposits? The answer is YES and NO. It is YES, if you know the risks involved and NO if you don’t know the risks of debt funds.

To understand this, let us take an example of recent NFO of Reliance Mutual Fund Reliance Nivesh Lakshya Fund. The Macaulay duration of the fund is more than 7 years. This means that the fund is not investing in short-term debt papers. But it is a pure Long Term Debt Fund.

As I said above, the higher the Macaulay duration means higher the risk. Because of longer the tenure of the bond, the more sensitive the Macaulay duration to changes in yield.

But it was told that the fund will hold the bonds till maturity and hence even if there is a volatility you end up with a fixed amount of coupon and principal pay back at maturity. However, check the SID wordings of this fund “Given the nature of the Scheme, the portfolio turnover ratio may be very high and AMC may change the portfolio from debt to money market and vice versa according to Asset Allocation, commensurate with the investment objectives of the Scheme. The effect of higher portfolio turnover could be higher brokerage and transaction costs.”

It is nowhere written in SID of this fund that they invest ONLY in Long-Term GILTS up to the maturity and hence no credit risk. But few advisers spread this fund as an alternative to Fixed Deposits.

Let us believe this strategy and invest. Assume that I am investing in this fund for 10 years of the period. However, the fund manager is holding the bonds with Macaulay Duration of 7 years. How the fund manager has the protection to my money exactly when I need the money for the 10 years? I have to be satisfied with the prevailing risk and NAV and book either profit or loss from the fund. This is also called mark to market risk, which in no way help me in reducing the risk which fund manager claims to be HOLD TILL MATUIRTY.

Hence, even if the fund manager claims that they do not trade or sell the bonds before maturity, for investors it is in no way connected. The NAV will move as per the interest rate movement and with other associated risks.

Yes, I completely agree that there is no credit risk in case the fund manager is holding the Gilt Bonds. However, it does not mean that the are RISK-FREE or VOLATILE FREE.

Also, if you closely look at the SID of this fund, the benchmark the fund following is “CRISIL Long Term

Debt Index”. The “CRISIL Long Term Debt Index” has three sub-index like Long Term Gilt, Long-Term Bond (AAA) and Long-Term Bond (AA). Hence, it is hard for me to digest that this fund will invest only in GILT.

In the advertisement of this fund, it was mentioned that LOCK the current interest rates by investing in this fund. This makes the investors fancy and feels that the returns are FIXED. However, this fund is also not completely RISK-FREE, which many fail to understand.

I took this NFO as an example of how few may missell you the funds. I am not blaming the fund or fund manager. However, I completely blame to few middlemen who sell such risky funds as if an alternative to Bank FDs.

The conclusions of my above writings are as below.

# Fixed Deposits are not so bad like few Mutual Fund Advisers makes you to believe it.

# However, holding FDs for your long-term goal is bad and yes there are some risks like liquidity, reinvestment risk and taxation.

# Never jump into Debt Funds thinking that they are RISK-FREE. If the fund manager takes few credit risks, then even a liquid fund may crash (Is Liquid Fund Safe and alternative to Savings Account?).

# The average maturity of the fund must be 2-3 times lesser than your holding period. Never try to match the average maturity with your goal time horizon. For example, if your holding period is 3 years, the average maturity should be less 1 years or so (preferably liquid funds). Same way if your time horizon is more than 10 years or so, then use Ultra Short Term Debt Funds.

# Never hesitate to use conservative products like Fixed Deposits, when you are unable to understand the risks associated with Debt Funds.

23 Responses

Dear Basavraj, Please suggest few hybrid FMPs to invest with 3 year horizon. thanks. Naresh

Dear Naresh,

Why FMP ONLY?

Hello,

In your writings it is mentioned that AAA is highest rating, but I have seen in some fund documents credit ratings are as per CRISIL according to which AAA is of 3rd or 4th grade. It is bit confusing to understand the risks. I hardly see any funds with all A1 grade bonds.

Dear Rajat,

Check the portfolio by visiting the respective AMC portal.

Hi, I want to buy “ICICI Pru Heart / Cancer Protect” to protect me and my spouse. Can you please help me in terms of if I can go ahead. This is specifically for cancer cover.

I already have term and critical illness insurance and this is just another step to protect my family.

Appreciate if you can help or suggest any other cancer plan. Thanks.

Dear Rajeev,

You can go ahead if you or your family have such health issues.

Hi Basavaraj,

I want to understand on thing related to Debt fund which is quite fundamental. For Ultra Short Term Debt Fund, it is mentioned that they invest for more than 91 days (usually 3 to 6 months). So if I make a Lumpsum on one of the Ultra Short Term Fund, do i need to withdraw within 6 months as per my goal of 6 months?

As you mentioned above time horizon as “The average maturity of the fund must be 2-3 times lesser than your holding period. Same way if your time horizon is more than 10 years or so, then use Ultra Short Term Debt Funds.”

I didnt understand it Ultra Short Term Debt Fund have average maturity of 3 to 6 months, and 2 to 3 times means nearly 1 year i should have my holding. but you mentioned it is 10 Years.

I am really confused, I have my goals of 1 year, 3 years and 5 Years and 10 Years. Kindly explain the concept on my holding versus the maturity.

Thanks,

Rohit

Dear Rohit,

Lower the average maturity means lower the volatility. Hence, if you are looking for low volatility debt fund, then you can invest in such funds for 1 year to 10 years also. We look debt portfolio mainly to diversify and to reduce the volatility which is already there in equity.

Hence, I always look for Liquid and Ultra Short Term Debt Funds to park my debt portfolio (irrespective of the time horizon of the goal).

Hi,

I was to invest in the below two funds. I can invest 5,000 in each fund. So total 10,000/month. My goal is to generate 10 Lakh corpus in next 7 years. I am a new investor. Please help with the question.

1. HDFC Short Term Debt Fund

2. Franklin India Ultra Short Bond Fund

Dear Lavanya,

Why you did not include equity funds and how you shortlisted these funds?

Sir, I do not want to take risk as my risk appetite is very low. Do not want the equity exposure. But need something better than FD. I have read about these two funds online and tv shows. Online most of the websites are giving 4 or 5 stars.

Is my choice not correct? Any suggestions or comments about these two funds? thank you very much.

Dear Lavanya,

In that case, stick to liquid funds or ultra short term debt funds.

Sure Sir. Thank you for the advice. Really thank you. Just one last question, just a small advice what do you think about these two funds, can I start investing in –

1. HDFC Short Term Debt Fund

2. Franklin India Ultra Short Bond Fund

Please suggest. again thank you.

Dear Lavanya,

As I said already, stick to Ultra Short Term Debt Funds. Hence, I suggest to go with Franklin Fund but not HDFC.

Dear Basu,

UTI Corporate Bond Fund – NFO is marked with Benchmark Index CRISIL Corporate Bond Composite Index.

Where this will fit in your classification? My investment horizon is 10 years . Is this suits me? do you suggest NFOs in debt area?

Dear Hariprasanth,

Check the modified duration, macular duration and average maturity. You notice the risk involved and based on that you can take a call. For me, I am very much happy with Liquid and Ultra Short Term Debt Funds.

Hi sir

nice article . I follow you regularly.

Dear Arup,

Pleasure.

I meant Kotak balanced advantage fund

Regards

Gautam Rajinder

Dear Basu,

1. Can u comment on Kotak advantage find NFO opening 13-27/7/18

Should one invest for 2-5 year horizon in it around 50000 initially

2. What are your views on FMP of any fund 1124 days or so . Should one invest in them for safety and around 8%plus return in stead of FDR . I recently did it in hdfc fmp and thinking for Kotak fmp opening 10-11 July a meagre sum of 25000 each time

Dear Rajinder,

1) Do you really need NFO? NFOs are meant for Mutual Fund companies and advisers.

2) Regarding FMP, you can expect around 7% to 8%. But look for liquidity issue.

Hi Basu sir,

Really nice article. I had bought axis liquid fund with lump sum investment and for 6 months i see only 3.3 % returns.

As small question, for a non commerce people like us if we invest in liquid funds or ultra short term debt funds how can we know/understand now its time to take out because this is the max returns which it can give and its done. something like this. Do we need to refer to average maturity time?

Dear Sat,

TIME TO TAKE OUT depends on your financial goal. I think you are trying to TIME it. Don’t do that. Instead, first understand your requirement, time horizon of the goal and then invest accordingly.