HDFC Life recently revised it’s existing term life insurance plan and launched a new plan HDFC Life Click 2 Protect 3D Plus. Let us see it’s review and benefits.

What is Term Life Insurance?

Term Life Insurance is a type of life insurance, which provides coverage during a policy period. If the insured dies during the policy tenure, then his nominee will be eligible to receive the death benefit (or sum assured). If insured survives up to the period of maturity, then he will not receive anything.

Simple right?? But hold on! Now the definition seems simple. Also, such simple products were available few years back. Now the game changed. There is a huge demand for such term life insurance.

Hence, life insurance companies looking for innovative ideas to lure the customers and garner the business. One of such an idea is the birth of HDFC Life Click 2 Protect 3D Plus.

I am not sure why so many unwanted features clubbed and made a simple term life insurance into the complicated product.

The idea of HDFC Life is to offer a single product which has all features in its kitty. But sadly such things makes buyers more complicated and they easily run away.

Earlier they have a term plan called HDFC Click2Protect Plus, which itself complicated many new buyers. But HDFC Life Click 2 Protect 3D Plus product crossing that limit now.

HDFC Life Click 2 Protect 3D Plus Eligibility

I have explained the same from below image. Do remember that the maximum maturity age is 75 years. So bit cheerful news to those who desperately looking for a term life insurance beyond their retirement 🙂

Features of HDFC Life Click 2 Protect 3D Plus

# In HDFC Life Click 2 Protect 3D Plus plan 3D refers to a feature of the plan which it provides cover for 3Ds – Death, Disease, and Disability. Hence, it is nothing but the Term Insurance clubbed with accidental and critical illness disability riders.

# HDFC Life Click 2 Protect 3D Plus plan offers 9 different plan options. You can choose based on your requirement.

# All future premiums are waived on Accidental Total Permanent Disability( available under all options ) and on a diagnosis of Critical Illness (Available with 3D Life and 3D Life-Long Protection options). This means, let us say if you met with an accident and resulted in Total Permanent Disability, then your all future premiums are waived off.

Total Permanent Disability means when the life assured is totally, continuously and permanently disabled and meets either of the two definitions below.

- Unable to Work: Disability as a result of injury or accident and is thereby rendered totally incapable of being engaged in any work or any occupation or employment for any compensation, remuneration or profit and he/she is unlikely to ever be able to do so.

- Physical Impairments: The life assured suffers an injury/accident due to which there is a total and irrecoverable loss of-The use of two limbs, The sight of both eyes, The use of one limb and the sight of one eye, Loss by severance of two or more limbs at or above wrists or ankles, The total and irrecoverable loss of sight of one eye and loss by severance of one limb at or above wrist or ankle.

Same way, if you are diagnosed with Critical Illness, then your all future premiums are waived off ONLY in case of 3D Life and 3D Life-Long Protection options.

Critical Illness coverage is restricted. Hence, you must know what is critical illness and what the illnesses covered under this plan. This list is as below.

# You can protect your life for whole life by opting the features like Life-Long Protection Option and 3D Life-Long Protection Option.

# Life Stage Protection feature offers to increase insurance cover on certain key milestones without medicals. Under this feature, you have the option to increase the basic Sum Assured without fresh The three stages are as below.

- Life Assured 1stMarriage: 50% of Sum Assured subject to a maximum of Rs. 50 lakh.

- Birth of 1st child: 25% of Sum Assured subject to a maximum of Rs. 25 lakh.

- Birth of 2nd child: 25% of Sum Assured subject to a maximum of Rs. 25 lakh.

Hence, without any further medical examination and all other under underwriting exercise, you can enhance your sum assured in the same existing term life insurance.

# Flexibility to increase your cover every year through top-up option. You may opt for a systematic increase of your cover from 1st policy anniversary onwards. This option will be available subject to all of the following conditions being met

- This option can be exercised only at the policy inception.

- The Life Assured is underwritten as a standard life at policy inception. This means there will not be any loading in premium due to health or other issues. Then only you can exercise this option.

- The increments in Sum Assured shall stop applying in the event of any claim (including rider claim) under the policy.

- An additional premium will be charged for the increase in the Sum Assured. Therefore, you must remember that for such incremental top-up option, the premium will not be same throughout the policy period.

- The incremental cover as well as the incremental premium, both, will apply prospectively.

- The premium rate applicable, for the additional Sum Assured shall be as per the premium table “Incremental”.

- This premium rate shall be based on the age attained and outstanding policy term at the time of the exercise of option.

- This shall be subject to the minimum policy term available under the product at the time of exercising this option.

- This option is available subject to the premium rates being available at the time of exercise of the option.

- The policyholder has the option to exit this option at any time during the remaining policy term.

# Special premium rates for female lives.

HDFC Life Click 2 Protect 3D Plus Plan Options

As I mentioned above in plan features, HDFC Life Click 2 Protect 3D Plus offers you 9 different plan options. You can choose anyone based on your requirement. Let us move on and discuss one by one.

1) HDFC Click 2 Protect 3D Plus -Life Option

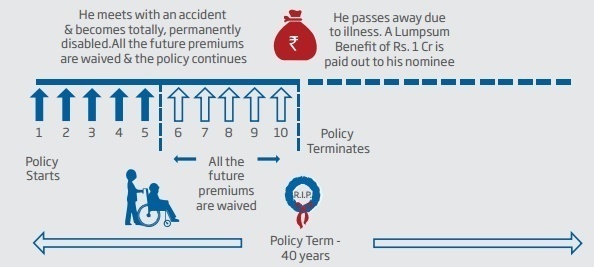

This is the simplest form of plan feature. The only additional feature than the typical term life insurance is premium waiver benefit in case of you met with an Accidental Total Permanent Disability. The same is illustrated from below image.

Let us say Mr.X is a 25-year-old. He buys this plan for Sum Assured of Rs.1 Cr, Term-40 Yrs and Premium Paying Term also 40 Yrs. There may be 3 possibilities and those are explained as below.

- Assume that during the 5th Policy Year, he meets with an accident which renders him totally, permanently disabled. Hence, from that moment, his premiums are waived off. He no needs to pay an additional premium. However, the life risk continues as usual up to the policy period.During the 10th Policy Year, he passes away due to illness.

- Assume during the 10th Policy Year, he passes away due to illness. Then his nominee will get Rs.1 Cr and policy ceases there itself.

- If he survives till the policy period, this he will not receive anything.

2) HDFC Click 2 Protect 3D Plus -3D Life Option

The plan feature of this option is exactly same like “Life Option”, which is explained above. The only exceptional is that critical illness rider is also added. If you are diagnosed with a critical illness, then the future premiums are waived off. Rest of all benefits are same.

Hence, if you met with an accident and resulted in Accidental Total Permanent Disability or diagnosed with Critical Illness during the policy period, then your future premiums are waived off.

3) HDFC Click 2 Protect 3D Plus – Extra Life Option

The plan feature of this option is exactly same like “Life Option”. The only exceptional is that “Accident Death Benefit” is added in this plan.

Hence, this “Extra Life Option” will come into the picture if the life assured died due to the accident. The Sum Assured opted in “Extra Life” (which is additional and above the basic sum assured), will be payable to nominee along with basic sum assured.

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

4) HDFC Click 2 Protect 3D Plus – Income Option

In all above features, the sum assured payable to the nominee in a case of life assured will be as a lump sum. This lump sum payout in case of death of life assured is common.

However, HDFC Life went one step ahead and planning to offer the “Income Option”. Under this plan, if policy holder’s death occurs during the policy period, then his nominee will get two benefits.

a) Nominee of the insured will get basic sum assured chosen by insured immediately after the death.

b) For the next 10 years from the death of life assured, his nominee will receive monthly income starting from Rs.1 Lakh. Increasing every year at 10% p.a. simple rate.

This is the only additional feature of this plan. Rest of all features are like “HDFC Click 2 Protect 3D Plus -Life Option”.

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

5) HDFC Click 2 Protect 3D Plus -Extra Life Income Option

In this option, the plan features are exactly like “Income Option”. The only additional benefit is that adding an accidental rider. Hence, the benefits can be explained as below.

a) If life assured died (except accidental death), then nominee of the insured will get basic sum assured chosen by insured immediately after the death. Along with this, his nominee will be eligible to receive the benefit of-For the next 10 years from the death of life assured, his nominee will receive monthly income starting from Rs.1 Lakh. Increasing every year at 10% p.a. simple rate.

b) If death occurs due to an accident, then nominee of the insured will get basic sum assured chosen by insured immediately after the death and the extra life sum assured. Along with this, his nominee will be eligible to receive the benefit of monthly Income for Income Period paid to the nominee and the policy terminates.

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

6) HDFC Click 2 Protect 3D Plus -Income Replacement Option

This is one more complicated option. In earlier option, a nominee will receive the basic sum assured and yearly Rs.1 lakh for the next 10 years at the increasing rate of 10% per year. However, in this case, if the policyholder dies during the policy period, then his nominee will receive the 12 times the then “Increased Monthly Income” paid as Lumpsum Benefit + Level/ Increasing Income for Residual Policy Term paid to the nominee and the policy terminates.

Let us assume that Mr.X is a 40 year 40-year-old. He buys this plan option. He announced that his annual income is Rs.6 lakh and premium payment term is 15 years. Also, he must announce the level of increase in his income and he mentioned that it is at 10%.

Do remember that in this option you have to specify below points without fail.

a) Annual Income

b) Income Increasing Rate

c) Term of the Policy.

Let us assume he dies on the 4th year. Hence, his nominee will receive (immediately on death) 12 times the increased monthly income.

Here, earlier while buying this plan he mentioned that his monthly income was Rs.50,000 per month (annually Rs.6 lakh). Also, he mentioned that the income increasing rate is at 10%. Hence, as per this, on the 4th year, his income will be Rs.65,000 per month or Rs.7,80,000. Hence, his nominee will receive Rs.7,80,000 as lump sum payment immediately.

Along with this lump sum payment, his nominee will also receive Increasing Monthly Income paid to nominee until the end of Policy Term.

If your nominee is not interested in receiving increasing monthly income, which is payable till the end of the policy period, then he can surrender such all future payment and get back a lump sum. This lump sum shall be the discounted value of the future income payments at the prevailing revival interest rate. The current rate of interest is 9% p.a and shall be reviewed half-yearly which shall be effective from 25th February and 25th August each year

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

7) HDFC Click 2 Protect 3D Plus -Return of Premium Option

This option exactly works like the 1st one (Life Option), except if life assured survive till the policy period, then he will receive all the premiums he paid during the policy period.

Do you feel the return of premium the BEST option? No…Because such feature is discounted in premium. Hence, life insurance companies not at all doing any social work. Hence, better to avoid such options.

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

8) HDFC Click 2 Protect 3D Plus – Life-Long Protection Option

This feature also works exactly like the first one (Life Option). The only difference is that your life risk continues throughout your life (even after the premium paying term). Hence, in this plan it is sure that your nominee will receive the death benefit whether you die today, tomorrow or after 90 years of age.

Do remember that if you met with an accident and resulted in Accidental Total Permanent Disability, then, as usual, your future premiums are waived off. However, this plan not provides you any benefits if you are diagnosed with Critical Illness during the policy period.

9) HDFC Click 2 Protect 3D Plus – 3D Life-Long Protection Option

This is the additional featured of “HDFC Click 2 Protect 3D Plus – Life-Long Protection Option”. Here, you will be allowed to opt for accidental rider and also the critical illness rider. Rest of all features remain same. Hence, if you met with an accident and resulted in Accidental Total Permanent Disability or diagnosed with Critical Illness during the policy period, then your future premiums are waived off.

HDFC Life Click 2 Protect 3D Plus Review

1) Complexity–

Is it easy for a common man to understand? In my view, HDFC Life thought to launch a product which OFFERS everything in a single plan. But the result is horrible. Except few, none can understand what the features are. I am not sure how an individual will choose the options. Hence, by creating more features, HDFC Life made it like a COMPLEX product.

2) Limitation in Accidental Rider-

Even though for all plans they added the “Accidental Total Permanent Disability”, which if happens then you no need to pay the future premium, but there will not be any benefit like what you get as a lump sum in cases of standalone Accidental Insurance Products.

Even though in the option 3 “Extra Life Option” and Option 5 “Extra Life Income Option”, you will receive the lump sum benefits as accidental death benefits. But what about the person who met with an accident and survives with a permanent disability? ONLY future premiums are waived off but no other benefits.

3) Critical Illness-

Here also if you diagnosed with a critical illness, and opted for the options like 3D Life Option or 3D Life-Long Protection Option, then your future premiums are waived off.

This I feel the biggest disadvantage of this plan. They waive off future premiums. But what about the cost of hospitalization and treatment of such critical illness?

If you opted for standalone critical illness cover, then you might have received some lump sum. However, in this plan no such benefits.

4) Each feature comes with cost–

Even though the income options provided by this plan looks attractive, all such features will come with COST. If you compare with “Life Option”, then you see that there is a huge difference of premium. Hence, I don’t think it is worth to go for such options.

5) Top-Up Option

Even though you have the option to top up the sum assured. But the premium will increase accordingly. However, in case of other insurers who offer such plans (SBI Life eShield), the premium will remain same throughout the policy period.

Also, such option will come with certain conditions.

6) Whole Life–

The worst part of HDFC Life Click 2 Protect 3D Plus plan is offering term life insurance as a whole life. Do we need life insurance during our retirement? In my view NO…bt as per HDFC Life the answer is YES! Hence, this option 🙂

This is the worst feature and I am not sure why they added this feature in term life insurance.

7) Income Replacement Option–

This I think is the unique in many terms of HDFC Life Click 2 Protect 3D Plus. However, those who don’t understand the meaning of “Income Replacement” as a tool of life insurance, will never opt this option.

Overall, to me, it looks like HDFC Life made a simple product called Term Life Insurance into a complicated product. If I am a buyer of this product, then I might have opted the “Life Option”. I will dump all other options and not touch.

Conclusion-

Even though with many features, HDFC Life Click 2 Protect 3D Plus looks good. But each feature comes with a cost. Also, as I said above, many features are unwanted. Stay away from such features. If you still want to go with HDFC Life Term Life Insurance, then in HDFC Life Click 2 Protect 3D Plus, chose the “Life Option” only and dump all other options.

what about the following exclusion in this policy:

“We will not pay Accidental Death Benefit if the death occurs after 180 days from the date of the Accident.”

If it is true then what is the purpose of taking this policy ? can you please provide any thoughts?

Also please mentioned other exclusions which may lead to not paying the Sum Assured.

Dear Sachin,

This applies to accidental death benefit but not for death benefit under the term life insurance.

I choose hdfc click 2 protect 3d plus ( return premium amount ) with critical illness 10 laks and rider 10 laks. Monthly premium is rs 8171.00

Now it’s 20 days over, now I learnt that the premium is very high compares with other.

Please suggest, either continue or cancel in free look period

Dear Ramana,

If you feel the premium is high and not suitable for you, then you can approach and cancel it.

Hi Sir,

I took an HDFC LIFE CLICK 2 PROTECT 3D PLUS POLICY .

in that policy ,it has been mentioned death benefit as follows.

Highest of:

• 10 times of the Annualised Premium

• 105% of Total Premiums Paid

• “Guaranteed Sum Assured on Maturity”

• “Absolute amount assured” to be paid on death

can you please clear my doubt.What is the amount they are going to pay to the nominee.

Sum assured is 50 Lakhs.

Dear Ratheesh,

In above which is HIGHEST now for you? That you will get i.e sum Assured.

Dear Basavaraj sir,

Is it better to pay a lowerPremium throughout the Policy Term or is it better to pay a higher premium for a limited Term(5yrs or 10yrs).

The Insurance agents show a calculation that paying a higher premium for a limited term is better as we can save significantly.

Dear Arjun,

Your agent is a BIG LIER.

HI Sir, below are the details:

Age: 31yrs

Cover – 2crs

Term – 39yrs(Till 70 yrs)

Annual prenium – 23,961

The guy from the portal says that if I choose to pay for full term that is 39 yrs i will be aying 9.3 lakhs premium.

But if i choose a limited payment term say 5yrs i will be paying 62k per year which will come close to 3.1 lakhs which amounts to 58% savings.

Please suggest if Limited term premium payment can be choosen or is there any missing conditions in this.

Dear Arjun,

The guy who is selling you not doing any extra social service. Premium will increase and hence the total amount is reduced because of time value of money. Don’t be in such a trap.

Why do you suggest not buying rider ? Critical illness one will be helpful no?

Dear Rima,

I am not saying you must NOT buy critical illness. But I am saying not buy CRITICAL ILLNESS RIDER. Buy a standalone product.

Sir,

Myself 33 yr old salaried of 6.5lac. Looking for better term insurance. As policy bazaar executive suggested for 1cr hdfc +3d policy with limited option of 27 yr with a premium of 1610per month.. What’s your comment sir.. Please suggest any other…

Dear Chandu,

Whether you are comfortable with their suggestion? what doubted you on their recommendation?

Hi Basavaraj….There are comments from the year 2017 & 2018. Are you still providing service to people who are interested in taking insurance? If yes, can you please reach out to me. I have shared my email ID

Dear Kishore,

I am now registered myself as a SEBI Registered Investment Advisor, where I was not obliged to cell anything to clients. Hence, if you are really looking at my service, then refer my page “Fee-Only Financial Planning Service“.

Sir,

Really confused between

1.HDFC life protect 3d plus life option with WoP for CI and Accident at 8900(vanilla product no riders added)

Or

2.Max life term plan with only one WoP for CI or disability “rider”at 7486.

Dear Maunish,

Choose the product without rider.

my age is 43 Yrs. with income of 10 lakhs/annum. my advisor suggested me to purchase HDFC Life 3D plan with annual premium of Rs. 25456/- for SA of 1.5 CR.

I have already invested in ICICI Elite plus with premium of Rs. 2 lakhs/year for SA of 20 lakhs & I have a pension plan of LIC with premium of Rs. 64776 for SA of 14 lakhs.

Please suggest whether I should purchase HDFC Life 3D plan or not?

or shall i invest in SIP mutual funds?

Dear Prakash,

My only suggestion is that NEVER COMBINE INSURANCE WITH INVESTMENT.

Hello Sir,

Thanks you so much for your valuable information.

As per my family need, I think 50 lakhs SA is enough( even If i got married and in case birth of child). Along with insurance If I started to focus on investment then I think 30 years term is enough. Also I find ICICI premium is less as compared to HDFC.

My current Age is 25.

Please let me know your thoughts

Dear Chandrakant,

if your feel ICICI is good compare to HDFC, then go ahead and no harm in that.

I am a Govt. employee, which one is better to take 1cr term policy for 80y HDFC or 85y ICICI? for only life. and is it better to pay premium period only 30y or through out policy period!!

Dear Subba,

Do you need LIFE INSURANCE during your retirement life?

Sir,

Really nice article and thanks for sharing the same. I applied for LIC e term insurance (31 age, 1 CR Sum Assured for 29 years). Initially the premium was Rs 16500, after Medical test they enhanced the same to Rs 20000(No reason was given). Do you feel its justified or should I look for HDFC or any other private players. Would appreciate your response and suggestions.

Thanks

Dear Satish,

It is wrong that they can enhance without showing valid reasons. You can raise an issue with them. However, if you can’t afford such steep hike, then look for some other insurers.

I insisted them and their response was because of BP which I saw it was normal at the time of measurement. I am little curious whether it is worth to take HDFC considering the premium rates of LIC. Can private players deny Term insurance claims after 3 years(I saw your earlier article) due to any reason? And what can be the reason if any?

Dear Satish,

They increase the premium drastically even if there are small issues. Hence, no need to worry with players and go ahead. At the end, including LIC, all are regulated by IRDA. They can’t deny the claim as per their wish.

What is Rate up in Insurance ?

I have applied for HDFC Life Click to protect 3D plus. One of the main feature of your policy was lump sum + Monthly income with Top Up option. This was the main feature which I found unique and decided to opt for this option.

According I have applied for Sum Assured Rs 2 crore with top up 10% p.a option and monthly income of Rs 50,000 with top up option 5%.

But to my surprise, They have reduced sum assured from Rs 2.00 crore to Rs 69 lak and monthly income from Rs 50,000 to Rs 17 K without any TOP Up (10% for SA and 5% for monthly Income).

I can understand if they have decreased Sum Assured ( as I am holding current Term plan of Rs 1 crore) and monthly income on basis of income proof but there is no logic not giving top up option.

Should I go for HDFC click to protect as Rs 17,475 monthly will be very meager amount if you consider after 20 to 25 years?

Dear Harshal,

Do you need such FANCY addons?

I was impressed with their top plan for SA and Monthly Income. No need to do fresh procedure of application, medical, time saving. Since now they have reduced monthly income I have requested them to provide pure term plan but they refused stating they can’t change the options . I have to make fresh application. As I have purchased just one day before my birthday the premium amount will also increased

Dear Harshal,

If you are so much impressed with their service and product, then go ahead. But do remember that in case of Life Insurance, the age is calculated based on NEAREST DATE OF BIRTH.

Dear Sir,

Nice article explaining the features, pros / cons.

One question about “Even though for all plans they added the “Accidental Total Permanent Disability”, which if happens then you no need to pay the future premium, but there will not be any benefit like what you get as a lump sum in cases of standalone Accidental Insurance Products.”

Does above statement means anyone suffer ATPD and opts for waiver of premium, the nominee will not get any lump sum benefit if insurer dies within term period post ATPD ?

Kindly clarify.

Thanks

Raj

Raj-What I am trying to say is that in case of an accident, totally or permanently disabled, then the future premiums are waived off. You will not get benefits other than this. However, if you have standalone accidental insurance, you may get a benefit based on the severity of the accident.

Hello Sir,

I understood your explanation that it will not offer any accidental benefit only premium waiver benefit is given. But clarification required is “It will still payout death benefit subsequently when event (death) happens say after 5-10yrs after accident” or there is no further claims on policy so in that case one would prefer pure term & no waiver (as I had read policy offering waiver of premium included in policy without additional cost)

Yes agree all riders should be bought separate is better option instead in this policy, but whatever is in-built at no extra cost can be considered is what my question ?

Thanks

Raj

Raj-After premium waiver, if a person dies due to the accident, then his nominee will receive the death benefit.

hi

I am 31 & planning for a term insurance for 1 Cr. and I’ve 3 dependents. Could you plz recommend a best term insurance plan.

Is this articles HDFC basic life term insurance would suffice my needs.

Karthikeyan-Refer my post “Top 5 Best Online Term Insurance Plans in India in 2017“.

Dear Basav,

I already have HDFC Click to Life SA: 75 Lac,

Going for an increase – additional quantum 75L / 100L (TBD)

Need you expertise on below points –

1) I am also considering the option of increasing by SA by 25% due to increase in family. Should I go for it?

2) For new term plan which is a better option – Increasing SA term life insurance vs Regular Term Insurance (Level SA)

Can you please review the pros and cons of below plans –

– SBI eShield – Increasing SA

– HDFC Click to Life 3D – Life Only – Increasing SA

– Canara HSBC iSelect – Increasing SA

– Exide

Thanks,

Debdoot

Debdoot-1) You can if you feel it is necessary and premium is affordable.

2) I usually prefer regular one and review it once in 5 years or whenever my liability or financial responsibilities increases.

Refer each product separately and based on your affordability go ahead.

Sir,

you said “The worst part of HDFC Life Click 2 Protect 3D Plus plan is offering term life insurance as a whole life. Do we need life insurance during our retirement? In my view NO…bt as per HDFC Life the answer is YES! Hence, this option ?”. I just want to know why doesn’t a person need life insurance during retirement?

.

.

I am 25 years old just got into a central govt job..confused about which life insurance to take. Recently I got icici lombar personal protect which protects me against all the accidents for the cover of 50L upto age of 80 and renewable after every 3 years at the single premium of 17784. So please guide me wether to continue with this accidental lan or not and which life insurance shall i purchase at this age keeping in mind the critical illnesses which may happen at later stage of life.

Jewel-“I just want to know why doesn’t a person need life insurance during retirement?”-Life Insurance is required when you have any financial dependents. You retire from working life when you are financially independent right?

You need basically three types of insurance-Life, Health and Accidental.

You correctly said: “Life Insurance is required when you have any financial dependents. You retire from working life when you are financially independent right?

You need basically three types of insurance-Life, Health and Accidental.”

So, Option #9 in this Plan provides all three. If you choose the 30-year payment option It gives…

1. Premium Waiver after both, Critical Illness as well as Accident Disability.

2. One-time payout of chosen amount after diagnosis of Critical Illness, but after 30 days of survival, not immediately after diagnosis. So, some Mediclaim option needs to be there to cover immediate hospitalization or cashless hospitalization (in my case, this is provided by my employer).

3. 1% of chosen amount per month for 10 years in case of Accidental Disability

4. Also includes Life-long Cover

It this is good. Why is this a bad plan?

Kalpak

Kalpak-Life long cover required? Accidental and Critical Illness insurance are available with more exhaustive feature then why to stick to limited features?

Hi

I am 30 years old and wanted to invest in HDFC Click 2 Protect 3D plus – 3D Life long protection option where I pay till 65 years. I checked with one of the consultant and he told me premium would be 72000 INR approx

And whenever I die they will provide my nominee 1 Cr … Do you really think it is wise to invest in this option as in 35 years in total I will be investing not more than 25 lacs but my nominee will be getting 1Cr for sure whenever I die.

Please reply as soon as possible

Thanks in advance

Prateek-Buy a simple term life insurance without any addon benefits or riders.

Dear Sir,

I am 38 years old and carrying a HDFC Life to protect term plan till 65 years of from last 3 years. This is an online plan and I am paying 1700/month against the premium.

One of HDFClife advisor was suggesting me to switch to other plan in HDFC only as better plan is available at lower premium.

Is it advisable and if yes what are the advantages I will get. Pls let me know the plan too.

Regards,

Praveen Kumar

Praveen-Stick to the old one.

Can i opt for hdfc click 2 protect 3 D life for limited payment option for ten years curently i am 42 years old. What is the merit and demerit of limited payment option : pls explain. Thanks

Arumugam-There is no hard in opting for limit payment option if you can afford it.

Dear Sir

Please share Yours veiw on Click 2 Protect Health

Rajk-Soon I will share.

Awaiting for your valuable adivce

Dear Basavaraj,

Very good article. Helped to identify mis-selling the agent was doing.

I am looking for some option to have insurance coverage for two scenarios.

1. I am alive but suffer Permanent disability and not in a position to work. How do I get some lump sum payment or monthly payment in such situation? I am looking at at least 25 Lacs in lump sump or 50000 per month…

Will the premium paid be

2. I am diagnosed with some critical illness. How do I get some lump sum payment or monthly payment in such situation? I am looking at at least 15 Lacs in lump sump to cover the cost of treatment…

I have enough coverage for basic life insurance (term insurance) and basic medical insurance and already exhausted need Sec 80C benefits. Age 38. Non-smoker.

Can you pls help suggest which options and insurers/plan I should check?

Many thanks in advance for your help.

Regards,

Arijit

Arijit-1) Buy accidental insurance separately.

2) Buy Critical Illness insurance.

Hello Sir,

“6) Whole Life–

The worst part of HDFC Life Click 2 Protect 3D Plus plan is offering term life insurance as a whole life. Do we need life insurance during our retirement? In my view NO…bt as per HDFC Life the answer is YES! Hence, this option ?

This is the worst feature and I am not sure why they added this feature in term life insurance.”

I disagree that its a worst feature the same feature comes with Jevan anand and every one while calculating is not think the benefit of it ,

Suppose suddenly at the old age person his only son is died and only husband and wife left then in that case if person died then atleast his life partner gain some financial benefit or

Take the example of Raymond last owner who son throw him out , may be if he have insurance of 1 Cr son may keep it

Real truth : In India now kids are very money minded , if they know that after death they will at-least get some $$$ then they will take care of parents else old age home is the option.

So please consider all the situation before saying any bad for any policy.

Thanks

Pankaj-Just you have given me the great industrialist example, I want to remind you one thing. Do you know what was the minimum sum assured LIC used to offer around 15-20 years back? It is Rs.5,000 or Rs.10,000 SUM ASSURED NOT PREMIUM. Now, do you think today’s Rs.1 Cr will have same value after 30-40 years? Relying on KIDS during retirement is the BIGGEST MISTAKE. He is paying the penalty for that. Don’t combine insurance with the financial mistakes he did.

Sir,

I am confused between Aegon Life term plan vs HDFC click to protect life term plan. I am a govt salaried employee per anuum income 3-3.5 lac. I am 26 years old. Dob- 22-12-90. Which plan will be better for me. For Aegon the premium is 4500 approx for 50 year term and sum assured of 50 lac. For HDFC sum assured 50 lac annual premium is 6000.

Rajib Chowdhury

Rajib-Both are best. You can choose anyone of your choice.

Hello Sir,

Thanks for your detailed information. I have 2 questions,

1) I am comparing the 40 years Term policy with ICICI iProtect and HDFC Life option only. For my current age of 31, I see a premium difference of 1000 per premium. No riders, no Critical illness coverage opted. In your other comparsion for best online term policies, you have short listed ICICI as one amoung them. My question is, Is this new HDFC Life Only policy has any benefit when compared to ICICI Term policy (Even though HDFC is costlier) ?

2) I also though of checking the Return of Premium option, which is kind of combo of Life + Term insurance as you mention above. With advantage of getting back the premium as whole without nay additional interest rate or bonus. Also, return of premium , the premium is doubled compared to life only. My question here, in case of survival we atleast get back what we invested right. Why do you NOT suggest this? Any other disadvantage other than NO INTEREST for the premium n survival benefit ?

Balaji-1) Only insurers are differ and premium may differ. At the end you are looking for basic term plan.

2) You get something if you survive. But at what cost? Assume you paid the premium for non return of premium and invest the rest in any product (forget about equity mutual funds and all but consider PPF), then calculate and let me know which is viable.

Great, Sounds like a plan.

In that Case, instead of paying 25000 per year (premium repayable), I will pay 12000 per year in Life Only. The remaining 13000 even if I put an RD every year with Interest 5% PA (Just an Assumption), for the remaining 40 years I can get back the amount paid for Life Only, Provided that the RD I myself can enjoy in the benefits at a early stage compared to the premium return after 70 years Thank you for the prompt response, I really appreciate.

Sir, I bought a investment plan from bajaj allianz. Now I want to buy term plan 50lacs. But when i filled the proposal form in bajaj allianz they asked me ” do you ever used tobacco?” I tick ‘ no’. (Agent’s advice). But sometimes I use tobacco. Now I want to take a term plan online and I’ll go with smoker category. There are two difference data. What should I Do?

Priyatosh-Listen to your voice but not agent’s voice. Buy online by declaring all facts properly.

Dear Basu I’m already having private health insurance cover for 5 Lakhs for my family is it better to take another insurance which covers cancer and heart disease as given in newspaper like icici heart and cancer plan

Rahul-Yes, it is always best to have your own health cover. Instead of going for specific health cover, go for health insurance and also critical insurance.

Dear Sir,

I am 28 years old & married from last 1 year. Looking to buy term insurance plan (30 year term for 50 lac life cover).

I am comparing two options of different companies plans i. e. ICICI iProtect smart – life plus option & HDFC 3D plus life option. Pl tell major difference between this two options & suggest which one is the best.

Regards,

Sachin

Sachin-Don’t overdo your research. You go ahead with anyone with simple lump sum payout at death and without any rider benefits.

HI Basavraj,

Can u suggest me a good term insurance plan, i have applied for HDFC Click to protect plus for 1 Cr, but after medical test they have raised premium from 14 thousand to 24 thousand per annum saying my BMI and sugar level is more. Can you suggest if i have to cancell this plan and go for other one.

Shekhar-Refer my post “Top 5 Best Online Term Insurance Plans in India in 2017“.

Hi, I have an existing ‘HDFC Life Click 2 Protect’ term policy from 2013 which is due for renewal next month. Now I have been given a choice to upgrade to HDFC Life Click 2 Protect Plus and HDFC Life Click 2 Protect 3D.

Could you please suggest me if it is wise to upgrade now or continue with existing plan?

Thanks in advance!

Ashish-Better to continue the same.

Thank You BasavaRaj.

Any particular reason why you suggest it is better to renew the existing plan, rather than upgrading ?

Ashish-First thing, a plain term plan is best than these fancy features. Second thing, do this upgrade is at same premium and without any medical check up? In my view NO. Then why to be a scapegoat to a company selling tactics?

Hii Sir,

am in job since 5 yrs and just got married , i want to take term plan . Kindly suggest me which plans i should go forward between ICICI, HDFC, LIC, SBI.

personally am interested between LIC & SBI due to high claim ratio & they are govt. players

Also suggest me whether it is beneficial to take 2 terms plans of 50 lakhs each or 1 term plan of 1 cr.

Prakhar-If you already shortlisted, then go ahead with anyone of the two. There is no logic in splitting the insurance. Go ahead with the single policy.

Hello sir pl write on term insurance deceased claimed settlement process.i just read it,i find it difficult for my nominee

Sagar-What information you are looking at? Can you elaborate more?

Dear Basavaraj sir,

very nice article with very nice explanation. It seems like HDFC Life has introduced this product with the sole intention of earning profit. If you look at claim amount settled ratio of HDFC life, its worst in last 5 years.

regards

RAJESH PAI

Rajesh-Completely agree.

What prompted the IRDA to permit such a complicated product ?The institution is doing a disservice to the people.There should be somebody to question the IRDA for such a luxury.

Siva-It is hard to question 🙂 Hence, better to stay away from such products or use it wisely.