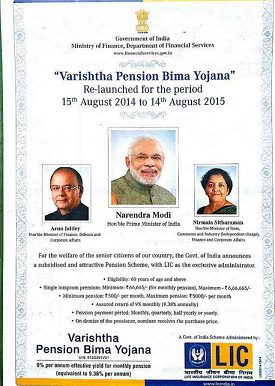

Government of India is about to launch a pension plan called Varishta Pension Bima Yojana on 15th August 2014. It is treated as best pension plan because returns quoted as more than 9%. However, let us look at its feasibility and to whom it will be suitable.

Features-

- Minimum age for entry is 60 Yrs.

- One time investment of minimum Rs.66, 665 and maximum investment of Rs.6, 66,665.

- Minimum pension will be Rs.500 and maximum Rs.5, 000 per month.

- It offers a guaranteed return of 9%.

- You have various options to choose pension like monthly, quarterly, half-yearly or yearly.

- On the death of a pensioner, the nominee receives the invested amount back.

- The maximum pension limit is not only for individuals, but also to the whole family. Family for this purpose constitutes pensioner, spouse, and dependents.

- The pension will directly credited to your bank account through ECS/NEFT. No cheque issue or you are going to the LIC office to collect a pension.

- One can surrender only after 15 years. Surrender value will be equal to purchase price.

- However, in case of surrender before 15 years for any medical emergencies of his or spouse, then such surrender value will be 98% of the purchase price.

- One can avail loan after 3 years. The maximum loan will be 75% of the purchase price.

- Loan interest will be adjusted to pension payment. However, one can settle principal at settlement time.

So is it good retirement product?

1) This plan is available only from 15h August 2014 to 14th August 2015 (as currently declared by Govt). Therefore, for those who already invested somewhere and unable to liquidate it may find it difficult to invest in this plan.

2) Good if one is expecting an interest rate downturn in the future. Because banks can’t pay your same consistent amount in the long run. However, here it is fixed irrespective of interest rate fluctuation.

3) Whatever you get from this plan as pension will be taxable income. Therefore, you need to consider a post tax return than simply opening your eyes at 9% interest.

4) This pension will not take care of inflation. So, irrespective of the raise in expenses, you receive a constant stream of income.

5) This good for those who look for safety (Govt’s sponsored and managed by LIC), constant stream of income or who not care about inflation at their retirement life.

7) Setting a maximum limit of Rs.5, 000 per family is somewhat difficult to manage at the current trend of inflation and if pensioners have some health complications.

8) The best option is of payment directly to one’s bank account.

9) Liquidity is not an issue after 15 years. However, before 15 years, it will be only for health emergencies. So it will be hard for pensioners until 75 years of their age if they have some other emergencies.

10) Even though loan is available, but it eats the interest part and as it is adjusted for pension again reduce the income stream.

What do to?

- Don’t invest in this product if you are concerned about inflation.

- Don’t invest in this product if you need cash before 75 years of age as you have option to liquidate it only in case of medical emergencies.

- Don’t invest in this product if you know how to manage your retirement corpus.

- Don’t invest in this product if you are unable to manage your expenses with Rs.5, 000.

- Don’t invest in this product if your family retirement corpus is more than Rs.6, 66,665.

81 Responses

Is the pension taxable income

Dear Govindaswamy,

YES.

I am a policy holder of varistha pension bima yojana since bagining and getting the assured amount in my account in due time. But on scrutinizing it observed incomplete in my address. Advise in this respect is accorded to rectify.

Prabir-You have to update this with insurer.

varshth pension yojna.is the investment comes under 80-c?

Manohar-It will not come under Sec.80C.

(1) My friend invested 6,66,666 + Service tax in February 2015.

After new budget the “service tax ” was withdrawn. This made investors before 1st April 2015 as “April Fool” and now the scheme is much cheaper.

(2) After much delay by LIC in issuing and receiving Policy and reading some clauses (within Free looking period of 15 days), He decided to ‘Cool Off’ . As per existing rules LIC shall refund the total money invested + service tax and deduct only the Registration Charge.

(3) Meanwhile my friend received the Annuity from LIC due to delay in issuing the Policy document.

Can LIC deduct the Annuity already paid ? If so under which rule ?

(4)Rule about refund is silent about Annuity already paid before receipt of Policy ?

Avinash-I think they deduct the annuity already paid to you. I know the rules may be silent. However, this may be the end result.

In case they deduct then my friend has a loss of keeping his investment idle for such a long time, just because LIC delayed the issuing of Policy document ? Had LIC issued the Policy document immediately or within a reasonable time ( week or so) then this loss could have been avoided. IRDA guidelines are also clear in this regard.

Avinash-I can understand your concern. However, usually free look in period starts only after you get the policy bond but not immediately after issuing the policy to you. Hence, the delay clause may tilt towards them.

so scss is better than bpby as it allow tax benifit u/s 80c. Am I right

Manab-When it comes to investment, yes SCSS have an edge. But returns from both are taxable.

“”Service Tax Exemption on VPBY Effective April 1, 2015″”

is this correct news ???

If it is correct, what about all those investors who have invested in this scheme till date?

i think who have invested after this declaration in budget .. they have done a big mistake.. as per my calculation they are loosing 0.25% interest on his investment for life..

Dharmendra-Yes the news is true. But losers will be those who already invested.

Senior citizen have no much income only they get Pension and Interest from their savings.

As per current law the limit is Rs.3 lac If any one to invest in this Scheme is they Fill 15 G or 15 H form for not deduction of T.D.S. if they are not taxable. As I read the scheme it says that Pension paid after deduction of T.D.S. then what is the rate? and it’s deducted by L.I.C during the payment of Pension?

Durgesh-Why you are more concerned about TDS? Even if there is no TDS then too it is taxable income. So you have to file return showing this as taxable income.

A senior citizen is exempt from filing return if income less than limit. If TDS is applicable then either for 15/16 to be submitted or unnecessary return to be filed for refund. If TDS amount is Rs.500 and cost of filing return is Rs.600 what is the use? It is unnecessary harassment for senior citizen to visit bank for this TDS issue as well as loss of income excluding if say auto rickshaw takes Rs.200 for visiting bank.

Guest-I understand your concern but not the policy makers 🙂

I believe that the investor in this scheme has to pay the service tax himself. I have a feeling that payment of service tax in itself would be quite complicated. Please elaborate.

PK-Why you feel paying service tax so complicated?

Is the principle amt invested by me refundable on completion of 15 years , kindly clarify .

Govind-It is already answered above. Yes after completion of 15 years you can come out of the plan and get whatever you invested.

it is observed that the amount needs to be invested in order to receive Rs. 5000 per month as interest in Varishta Pensin Bima Yogna is erronuously stated elsewhere as Rs 2,66,665. Please be noted that in order to getRs 5000 interest per month you need to invest Rs. 6,66,665 and NOT Rs.2,66,665. You also need to pay 3.09% as service tax on the same.

thanks

Ramachandran-Thanks for sharing info.

The investment attracts Service Tax & the Interest income earned is Taxable Hence the

Scheme seems not Attractive. Pls. advice.

sir is there any excemption under any of the income tax sections on the principal amount of varishta pension

Ampili-As of now NO.

SI THEIR ANY TAX EXCEMPTION UNDER 80C 80CCC 80CCD OR GTHER THAT AMOUNT INVEST IN VARISHTHA PENTION YOUJANA PLEASE CUIDE ME I AM EAGUARLY WATING

Abdul-No tax benefit by investing in above plan.

Dear Sir/ Madam

if we invest amount of Rs 100000/ only whats monthly Pension benefits will be & Yearly benefits

pls reply to this

Thankas & Regards

Praveen Chavan.N

Praveen-Simple…calculate it using above proportionate.

Is there facility to change nominee in the middle. Though Banks and LIC give interest at the same rate, we could get the principal after expiry of 3 or specified years from the Bank, whereas we can get fromLIC only in emergency.

Venkataramani-But do you feel interest will be same in case of Bank FDs? I think you can change nominee details as is case with any other LIC plans.

Thanks. Banks (specified) give at this ratefor senior citizen

when i take vpby policy ,can i get tax 80c benefits or not

Killi-No it will not come under Sec.80C of income tax.

can I join the new scheme though I am enjoying the benefits under old scheme

how much is surcharge thanks for educating seniors god bless u

Srinivasan-If you are not member of this plan then you can go ahead.

Will this pension be taxable under the IT Laws?

Satish-Yes any pension is taxable income as per current tax law.

I am 70 yrs old and already holding Varista Bhima scheme offered earlier through LIC and getting Rs 2000 as pension per month. This will be redeemable in Aug 2018. Is the maximum pension limit of Rs 500 0 pm applicable in my case also if I opt for the new schme?

Gopalan-They have not mentioned anywhere that the limit specified in this plan also includes the earlier plan. So they are treating the earlier and this plan separately.

Thank you very much for the clarification Mr Basu.

B G

what is the last day when this scheme closes ?

usha

Usha-It is already mentioned above. It is valid for one year only. I am not aware whether they will continue or not in future.

if as of today, i am able to invest only a minimum amount as per the scheme, and over a period of time, say a year or two, i am able to accumulate Rs.6 L (i.e. the maximum limit), is this possible ?? or once invested, you cannot change the figure …???

Usha-You can do so. But the maximum pension under the family must be within Rs.5,000 per month. So no need to worry of one time investment.

thank you for your reply… wish this scheme could be linked to units…. in which case it will be really very very attractive for all investors… can someone suggest this to theFM/ PM ?? who will bell the cat !!

Usha-This scheme is for those who unable to manage their retirement corpus. If they are very much happy with 9% of return (not adjusted to tax and inflation) then they can go ahead. As far as suggesting this to our policy maker, it is your turn when they come to your doorstep asking for vote 🙂

is there a table of investment for this Varishta Bima yojaja ? : i.e.

lowest investment is Rs.66,665…

next…. ??

next…..??

next…..?

last maximum for investment 6,66,665 ??

then one can decide on the amount to be invested..

and i presume the other rules like maturity value, loan available, pre-mature withdrawal in case of sickness will be the same for all brackets of investments ??

look foward to your reply…

usha k iyer

Usha-No need to have such table. You can easily do yourself. Like for investment of Rs.66,665 pension is Rs.500 and what if for Rs.X? So simple. Yes, rest of the rules will remain same.

THANK YOU FOR YOUR KIND REPLIES TO BOTH MY QUERIES… AND I REALLY APPRECIATE YOUR PATIENCE IN HANDLING STUPID QUESTIONERS LIKE ME !!!

WITH BEST REGARDS..usha

Usha-Thanks for your kind words 🙂

Hi Basu,

You had previously commented that to get 5000 pension per month we need to invest Rs 2,66,665. How is it possible if max investment amount is Rs. 6,66,665. Is there something that I am missing?

I am a 61year retired individual wanting to explore this & want to get max. pension of 5000 from this scheme. Can you please let me know how much amount I should invest?

Also will I be getting pension amount as interest from the money invested or will my capital investment also get eroded?

Shankar-To get Rs.5,000 as monthly pension then you need to invest Rs.6,66,665 but not Rs.2,66,665.

Thanks Basu. Could you please also let me know is this 5000 being paid as Interest or also from capital. i.e incase of death of the policy holder will the entire invested amount be returned to nominee?

Shankar-This Rs.5,000 is as if interest on your investment. So once the policy holder dies then initial invested amount will be paid back to nominee fully.

sir, i am shwetha ,my father age is 65 so i want to invest behalf of them ,my wish is he supposed to get 5000 rupees per month as commission,what amount i have to invest,? i am waiting your reply sir & tel me the benefits also plz

Shwetha-If you wish to receive pension of Rs.5,000 monthly then investment amount should be Rs. 2,66,665.

The amount of investment required for 5000 pm pension is Rs 666665/- + Service tax @ 3.09 @ = 20600. So, total 687265/-.

Rajnish-Thanks for sharing your info 🙂

Dear sir,

I am 73 years old.I am eligible to withdraw a sum of Rs 2,66,665.00 from my ppf account and invest in varisth yojna of lic so that I can get an additional pension of Rs 2000.oo per month. I come in the taxable range of 10%e. My remaining deposits in ppf otherwise also go in the kitty of my children after my demise. So will it not be advisable to draw some money from ppf, invest in the varisth yojna and I am more comfortable while I am in existence. Can I go for this scheme when I am already having a similar scheme since 2004 and getting 2000.00 per month in my account. Is there a limit on investment on individual in Varisth yojna.

Kindly advise me on my move.

Jagan-Sir you can do so. The maximum limit from this scheme is Rs.5,000 per month pension. You are very much eligible.

Dear Basavaraj Tonagatti ,

As a senior citizen aged 78 I want to invest in two LIC VarishthaPension Bheema Yojan policies, one on my name and another on my wife aged 73. We are having rental income of Rs.25,000 pm. Is it suitable for us? Still, have to pay any Taxes? Please inform me in details. Thanks

Mathi-Sir suitability depends on your requirement. Do remember that over all limit in this plan is Rs.5,000 per month per family. So first ask yourself whether you can sustain with this income flow or not. Yes if you include this income too (Rs.3,00,000 rental+Rs.60,000 Pension), because your income crosses Rs.3,00,000 limit. So need to pay whatever is over to this limit.

My question is not related to finance. I have started a blog . I want to have a comment/reply box like you. I have tried a lot by myself/googling and can not find a solution. Can you please help me out.please

my blog is itoocaninvest.blogspot.in

Mani-It is default wordpress comment system. I am not using any plugin for this purpose. May be you are not getting the same look of mine, because of theme. So you can check it out with Genesis platform which I am currently using (which is paid one but not free).

sir i have ?500000.plz suggest me pension plan which is batter than varishta pension yojna.

Praksh-If you are unable to manage your own fund then you can opt for 50% into this fund and 50% into SCSS.

The planis having following additional features

Loan Available to the extent of 70% of deposit amount.

Full maturity value can be availed after 15 years.

Policy can be surrendered in case of medical emergency for annuitant or spouse.

surrender value will be 98% of invested amount.

maximum investment cap is for investment made Husband & wife together & and not per individual.

There will be service tax on premium paid

Nitin-Thanks for sharing these inputs. May I know the source of this info so that I can add it to above post?

From LIC circular. The service tax reduces the effective yield

Nitin-Yes you are correct but not at big numbers.

For the investment amount, whether they will collect the service tax of 3.09%

Anantharaman-Forget about service tax, but understand whether if you are currently at 60 Yrs of age then will you invest in it?

@ishan, LIC will never deduct any Tax like banks do when the interest in a year crossess Rs.10,000.

9.38% for Yearly Pension will be given to u in full without TDS.

Saju-For your information this not LIC product. But LIC is just managing this product. Also do you feel if TDS is not there then one can stay away from paying tax? It is just misconception that if TDS (Tax Deducted at Source) is not applicable to any product then it is free from tax. Whether they deduct TDS or not any taxable income is always attract tax.

The scheme sounds pretty interesting, especially because it seems sustainable (for LIC and govt.). However, the only reason I won’t go with it is because the interest is not tax free.

Isham-Yes it is taxable. But senior citizen is not under highest tax bracket then he can avail this with some marginal tax on this income.

Whether the principal amount can get any tax benefit like Section 80-C/80-CCC, etc.

Anil-As of now there is no such tax benefits.