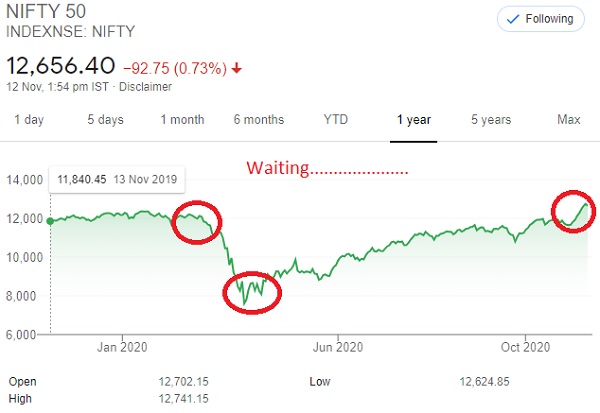

Many of us now scaring to invest as the market is at an all-time high. Many are eagerly waiting for the so-called second wave of market fall due to Covid. Is it the right strategy? Or what if you invest ONLY when the market is all-time high?

Yesterday I was reading the book “A Wealth of Common Sense” by Ben Carlson. Here, I found one interesting story of a person whom the author described as the world’s worst market timer. Let me share that story for your understanding.

His name is Mr.Bob. His investment journey is full of the worst market timing. He invested whenever the market touched its all-time high.

He began his career in 1970 at the age of 22 years. He was a great saver and planner. His simple plan was to save $2,000 a year during the 1970s and increase that amount up by $2,000 each decade until he retires at the age of 65 years (2013). So the simple strategy is $2,000 a year during the 70s, $4,000 a year during the 80s, $6,000 a year during the 90s, $8,000 a year until he retired.

So according to his saving plan, he started saving $2,000 a year in his bank account. What he did was once he accumulated $6,000 in 1972, he invested the whole $6,000 in the stock market. He is so unlucky that the market crashed around 50% during 1973-74.

However, his only commitment was that once he invests the money he will not withdraw it (no matter whatever the ups and downs) or the loss % he can see in his portfolio.

After this crash, he felt uncomfortable investing and accumulated his yearly savings for around $46,000 and invested in S&P 500 index fund in 1987. Here too he entered the market exactly when the market is at a high level.

After 1987 peak, market crashed to almost around 35%.

After 1987, Bob not felt the right time to invest in the stock market up to 1999. He had another $68,000 of savings to invest. This time he invested at the end of December in 1999. It is just before a 50% downturn that lasted until 2002.

This 50% crash made him to stay away from the stock market from fresh investing (DO REMEMBER THAT HE NOT WITHDREW WHAT HE INVESTED).

His final investment was made in October of 2007 when he invested $64,000 which he had been saving since 2000. He rounded out his string of horrific market timing calls by buying right before another 50% crash in 2008.

After the financial crisis of 2008, he decided to continue to save his money in the bank (another $40,000) but kept his stock investments in the market until he retired at the end of 2013.

Therefore he invested just before 1973-74 crash, 1987 crash, 2000 and 2008 crash. His invested dates are as below.

- In December 1972 he invetsted $6,000 and after that he faced -48% downfall.

- In August 1987 he invested $46,000 and after that he faced the -34% downfall.

- In December 1999 he invested $68,000 and after that he faced -49% downfall.

- In October 2007 he invested $64,000 and after that he faced -52% downfall.

But during all these four falls he might stay away from fresh investing. However, he not withdrew the invested amount. HE NEVER SOLD A SINGLE SHARE of what he invested.

FINALLY….Even though he only bought at the very top of the market, Bob still ended up a millionaire with $1.1 million.

What if you invest ONLY when the Market is all-time high?

So what we can learn from this story?

# He planned his investment well in advance and infact he increased his savings drastically as he planned.

# He gave around 40 years of compounding effect on his investment (Refer my post “Power Of Compound Interest – NOT the 8th Wonder of the world!).

# He stood strongly when his portfolio looked around 50% downfall and especially after his investment.

# No matter whatever the portfolio value, he simply saved as per his plan.

# He adopted the simple low cost Index investing.

Even though it is a story for illustrative purposes, if someone really invested during those periods and stayed invested like how Mr.Bob did, then obviously the valuation is of what I mentioned above.

Conclusion:- Define the goals….Set the asset allocation….Notional losses are part of the investment game but how you react to these notional losses will convert your portfolio into either a profitable or loss-making portfolio. Save more, invest for the long term with proper asset allocation. Today’s all-time high may be low if you look back after 10 years or so.

I will end this post by sharing a quote of Peter Lynch.

“I can’t recall ever once having seen the name of a market timer on Forbes‘ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.” – Peter Lynch

Refer our latest posts:-

- Budget 2024 – NPS Vatsalya Scheme – Should you invest?

- Budget 2024 – Mutual Fund Taxation FY 2024-25 / AY 2025-26

- Budget 2024 – Changes In Taxation Of Gold in India

- Budget 2024 – New Capital Gain Tax Rules And Rates

- Budget 2024 – 10 BIG changes impacting personal finance

- July 2024 Budget – New Income Tax Slab Rates FY 2024-25

Very true …. Simpler the strategy is better is the probability of good returns. I believe one should continue its sip irrespective of market conditions till the goal. If have enough money then put at the time of crash. If not then keep patience.

Dear Anchit,

Yes, but with proper asset allocation.

WoW!! What an explanation with example. an eye opener lesson.

Thank you Basunivesh.

Dear Raj,

Pleasure 🙂