We all know that to create the wealth we have certain simple rules like SAVE as much as you possible and INVEST. We all wish to save and invest. However, we fail miserably to stick to such simple rules of wealth creation. What are the reasons for this?

Let us go back to our epic Mahabharata and especially the Bhagavad Gita part. We all know that Krishna preached the knowledge to Arjuna during the Kurukshetra war. Have we ever thought why not Krishna preached the same knowledge to Duryodhana? If Krishna preached all his knowledge to Duryodhana then there is no question of Kurukshetra war right?

However, if we precisely go by the Mahabharata story, you noticed that Krishna tried to convince and share his knowledge with Duryodhana. But Duryodhana’s reply was similar to all of our replies. It does not mean we are all Duryodhanas. However, the reply of Duryodhana to Krishna is what we all believe and practice.

Duryodhana said to Arjuna “I Know that I should do, and what I should not – yet I cannot put it into practice!”. This is exactly what is our state when it comes to investment. We all know what we should do and what we should not do. However, we FAIL to follow.

We all know the basic principles of wealth creation as below:-

- Be within the limit.

- Follow the frugil lifestyle.

- Invest before spending.

- Understand your NEEDS and WANTS.

However, we fail to practice. then what is the solution for this?

We all wish to SAVE and INVEST – But why we FAIL?

Let us say you have given a choice of having an APPLE or ICECREAM after a month. Then psychologists found that many of us will obviously choose APPLE. However, if the choice of having an APPLE or CHOCOLATE today and in fact NOW means, many have opted for CHOCOLATE than the APPLE.

The reason behind this is the Marshmallow study conducted by greatest Psychologist by Walter Mischel.

Let us discuss the Marshmallow Study. The Stanford marshmallow experiment was a study on delayed gratification in 1960 led by psychologist Walter Mischel, a professor at Stanford University. In this study, a child was offered a choice between one small but immediate reward, or two small rewards if they waited for a period of time. During this time, the researcher left the room for about 15 minutes and then returned.

The reward was either a marshmallow or pretzel stick, depending on the child’s preference. In follow-up studies, the researchers found that children who were able to wait longer for the preferred rewards tended to have better life outcomes, as measured by SAT scores, educational attainment, body mass index (BMI), and other life measures. A replication attempt with a sample from a more diverse population, over 10 times larger than the original study, showed only half the effect of the original study. The replication suggested that economic background, rather than willpower, explained the other half.

It is not only about marshmallow or choice between Apple or Icecream. This rule applies to INVESTMENT also. We know that saving, investing, sticking to our decisions are very much important in wealth creation. However, we fail miserably to stick to it.

When you commit yourself to save and invest more, obviously you left with less money to spend. This is painful for many of us.

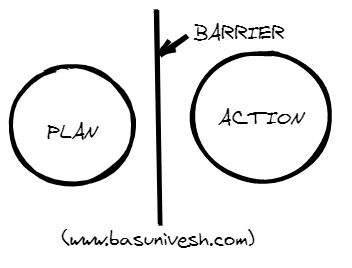

We all do financial planning, define our financial goals and we strongly decided to stick to it. However, many of us fail to stick to it. Hence, there is a huge gap between what we actually PLAN to what we actually ACT.

The answer is SELF CONTROL, DELAYED GRATIFICATION, or WILL POWER, which is explained in Bhagavad Gita Chapter 3 Verse 34 – “Indriyasya indriyasya arthe raga – dvesa vyavasthitau”.

Refer this wonderful lengthy (worth to watch) video of Shri Swami Sarvapriyananda of Ramakrishna Mission Ashram. It is a lecture given in IIT Kanpur. The whole idea of writing this post is because of this wonderful video.

The GAP between PLANNING and ACTION is CONSCIOUS SELF CONTROL, DELAYED GRATIFICATION or WILL POWER, which we can easily control and make it to act.

Hence, building SELF CONTROL, DELAYED GRATIFICATION, or WILL POWER is of utmost importance to save or invest more for your future wealth creation.

How to do this? The simplest answer is to make your savings or investment actions into AUTO MODE until and unless they turned to be your HABITS. Another way to create is following the strategy INVEST before you SPEND.

This is what mentioned by James Clear in his book “Atomic Habits” as below.

A more reliable approach is to cut bad habits off at the source. One of the most practical ways to eliminate a bad habit is to reduce the exposure to the cue that causes it.

- If you can’t seem to get any work done, leave your phone in another room for a few hours.

- if you are continually feeling like you are not enough, stop following the social media account that trigger jealousy and envy.

- If you are wasting too much time watching television, move the TV out of the bedroom.

- If you are spending too much money on electronics, quit reading reviews of the latest tech gear.

- If you are playing too many video games, unplug the console and put it in a closet after each use.

Conclusion:-Setting the goals, having the BEST plan is not at all useful until and unless you ACT on this. To act, one must have great SELF CONTROL and practice of DELAYED GRATIFICATION. Nothing can be achieved without the WILL POWER. I am ending this post by sharing the quote of Swami Vivekananda.

Anything that makes weak – physically, intellectually and spiritually, reject it as poison. – Swami Vivekananda

Refer our latest posts:-

- NPS Tier 2 Vs Mutual Funds – Which is better to invest?

- How to start investing in Index Funds in India?

- Should you continue Sukanya Samriddhi Yojana after becoming NRI?

- What happens to unclaimed Bank Savings Accounts and Deposits?

- SIP Vs SWP Mutual Funds – Which is better in India?

- Post Office Small Savings Scheme Interest Rate Oct – Dec 2024

I happen to watch the same video two weeks ago and when I started reading the post, I felt like this is going in the same direction. Truly applicable to many aspects of our life. Thanks for relating it to our investment planning as well. You are doing a fantastic work, I have recommended your blog to so many of my colleagues and all of them are benefiting from it.

Dear Nikhil,

Pleasure 🙂

Dear Basu,

You have written article full of wisdom. Hope we can cease to be Duryodhana. Do you think destiny has a role to play in these efforts.

Regards.