Lot of investors not aware about the fact that there are two mutual fund schemes from different companies which offers you the tax benefit of Sec. 80 C as well as treated as pension plans in India. So let us explore few details on these two.

These are the only two schemes notified by Govt as pension plans in mutual fund schemes. They are eligible for Sec. 80 C deduction and features as retirement product. Beauty of these two plans are tax efficiency and return (past performance).

1) Templeton India Pension Plan-This is a pension plan from Franklin Templeton India, a well known mutual fund company. This fund was started on 31st March 1997. So it is around 17 years old fund. This fund is actually a debt oriented balanced fund. Means maximum around 40% will be invested in Equity and rest in Debt products. Once you attain the age of 58 years then you have option to withdraw the accumulated amount in below manners.

- Pension Option-Your amount will be invested as it is. But you will receive pension in the form of dividend. But depends on declaration of dividend.

- Lump Sum Option-You are free to withdraw it all the accumulated amount without any penalty.

- Combination Option-Under this, you have facility to withdraw lump sum, rest amount will be continued as invested and receive the dividend on that.

- SWP (Systematic Withdrawal Plan)-Here you instruct mutual fund company to withdraw some fix amount or units at a specified frequency like monthly or quarterly.

For a detailed scheme information you can visit Templeton India Pension Plan link.

Load Structure-

Entry Load-Nil

Exit Load-3% if redeemed within 58 years of age.

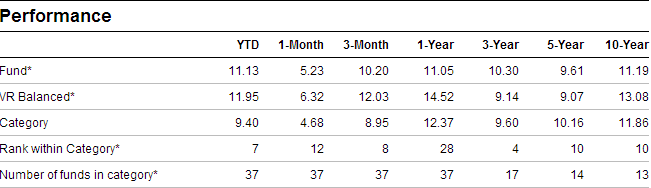

How fund performed?

(Source-Valueresearchonline, as on 31st May 2014)

2) UTI Retirement Benefit Pension Fund-This is a pension plan from UTI Mutual Fund, a well known and oldest fund house in India. It was launched in December 1994. So it is almost a 20 year old fund. This too is debt oriented balanced fund and the ratio of investment towards Equity: Debt is same as that of Templeton India Pension Plan. Here also retirement age is fixed as 58 years. But in this fund unlike few withdrawal options of Templeton India Pension plan, you have only option of SWP once you attain the age of 58 years. For a details scheme information you can visit “UTI Retirement Benefit Pension Fund link.

Load Structure-

Entry Load-Nil

Exit Load-Less than a year-5%, One year to three years-3%, more than three years but less than five years-1% and more than five years-Nil.

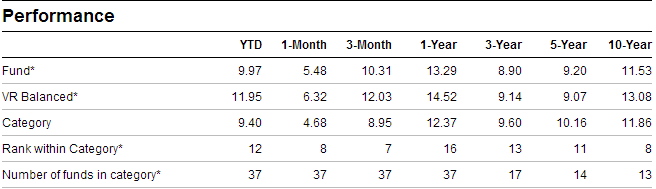

How fund performed?

(Source-Valueresearchonline, as on 31st May 2014)

So from above fund features, you notice that they have given around 11% return for 10 years period which is decent in it’s category. But how they are taxed??

Tax liability of investing in both the funds–

- While investing you will get the tax deduction under Sec 80 C of income tax limit. So a good option for higher tax bracket investors.

- While withdrawal-Both funds are treated as Debt Funds. So you need to pay STCG (Short Term Capital Gain), if withdrawal within a year. Or LTCG (Long Term Capital Gain) if withdrawal after one year from investments.

STCG-Taxed at normal tax rates based on your income tax slab.

LTCG-20% with Indexation and 10% without Indexation, whichever is less.

Who can Invest?

People who are looking for accumulation of retirement corpus with tax deduction can definitely look for these funds. Both funds are debt funds. So investors who are bit risk averse can go for such funds. Both are old funds (more than 15 years). Also when you compare withdrawal taxation of typical pension plans to these funds, then these funds holds upper hand. Because in typical pension plans, whatever you receive will be taxed according to tax slab of an individual. But in these funds it will be around 10%. So for higher tax bracket individual, these plans seems better tax efficient. Also apart from typical ELSS (Equity Linked Saving Schemes), these are the only two schemes which entertain such tax benefit under Sec 80 C.

Unlike typical pension product like NPS, here in this plan you are free of withdrawal all accumulated amount at the time of retirement. Which makes these funds bit liquidity option than NPS. But do remember to have your eye on exit loads of both funds.

I am still confused why only two mutual fund companies offering these plans, why not others?? Any idea… Please share.

77 Responses

HI Mr. Tongatti, I am 52 years old and wish to invest in building a corpus for retirement through SIPs in MFs. I already fully availing 80C benefits. I am looking for an option where at the end of 58 th/60th year, I can withdraw either lump sum or a mix of lump sum & monthly income- without any tax impact at the time of withdrawals. Frankling Templeton retirment plan is broadly looks good, but from my understanding, if i withdraw lump sum, it may attract long term capital gains tax. Please correct me whether my thought process is fine?? Is there any other funds you recommend to achieve my objective?? Thank you very much in advance for your advise.

Subramanyam-For a tenure of just around 6 years, I will not suggest any equity oriented funds. However, you can use short term or ultra short term debt funds. Your goal tenure is too short for equity investments. Stay away from this equity product.

I m 35. I have started monthly Sip of 5k ( 2k for Axis long term equity Growth, 1.5k each in MIRAE ASSET EMERGING BLUECHIP FUND – REGULAR PLAN GROWTH & SBI Blue Chip Fund Reg Plan-G ). I hv 5k investment in PPF MONTHLY. 12K IN NPS yearly. I hv small kid of 6 months. Pls suggest me better investment.

Digvijay-Try to invest more towards equity than PPF. Asset allocation must be around 30:70 between debt (PPF):equity.

Thank you for your quick response.

Can u please suggest some of the funds which would sort out 80C tax benefit + fund growth + Pension

Digvijay-Refer my earlier post “Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016“.

I will have approx.Rs.5 lacs ( by maturity of FDs) by end December 2016. I wish to invest this lumpsum in a Fund ( like a pension fund) which can give me a regular monthly income . This monthly income, I wish to re-invest as a SIP in some Mutual fund schemes.

Will this investment in Pension Fund will attract any income tax? How can I save on this Income Tx. Which is the best way?

I am a 74 year old pensioner. I am saving this for my daughter/grand daughter’s future.

Sathamoorthy-What is scaring you to not invest Rs.5 lakh lump sum in one go into mutual funds?

Dear Sir, Thanks a lot for your kind prompt response.

I have already availed 80C benefit to the extent of Rs.1,01,000 per year.So there is only another Rs.50,000 I can avail as tax benefit under 80C. Supposing I invest all the Rs.5 lacs with Templeton

India Pension Fund, will I get the 100% tax benefit for the full invested amount?

Also will the earnings which I withdraw once a year also enjoy tax-free status?

2)What is your view about investing this in Jeevan Akshay VI plan of LIC? I will get an annuity of Rs.30,000 approx. which of course is not tax free. Kindly advise which option is better sir. Thanks again

Sathyamoorthy-Whether your concern is tax saving or investing for your financial goals?

Surely financial goals Mr.Basavarj.

Sathyamoorthy-Then for a moment stop concentrating on tax saving. Think whether the asset class suites to your risk taking ability and how to minimize the risk.

I want to invest Rs 2000 per month via SIP in each of below categories

1. Large Cap – 7-8 years time frame

2. Diversified- 15 years time frame

3. ELSS 7-8 years time frame

I am 38 years of age.Please advice if the categories chosen are correct and if so suggest couple of mutual fund options for each of the categories

Gautham-First identify the goals. For each goal, you must include large cap, small and mid cap, multi cap and debt portion as per time frame. You are doing it wrong.

Dear Basu

After reading many of your blogs continuously from past several months I have made up my mind to invest in MF’s now.

I have few queries,

Is it the right time to enter as the market is down?

I have finalized the few funds kindly advise in selecting.

1. Franklin India Prima Plus/UTI MNC fund

2. ICICI Pru Dynamic/UTI Midcap/HDFC Mid cap

3.ICICI Pru Long Term Plan

Wants to invest 5000/month . The basis for selecting these funds by reading your answers to Queries from the readers and my own bit research.

Kindly advice,

Satish-If you have long term view, then invest NOW. Regarding funds, I don’t know how you selected. Because I never recommended UTI MNC, UTI Midcap or ICICI Long term.

Thanks Basu,

As I mentioned its a bit of my research and your recommendations. After going through value research, money control, funds india etc., I zeroed on these two funds UTI MNC and ICICI long term,but UTI mid cap you did mention in your top list of 2016 funds along with SBI magnum, I do agree with one of your comment to reader about ranking in these web sites may change. I shall go ahead with your list, One large cap, mid cap and one Debt fund to balance 70:30 equity/debt ratio, but I didn’t see any debt fund you recommended but the equity oriented balanced funds. Will these balanced funds should be treated as Debt fund? bit confused!! so my request to you is, suggest me how shall I start my 15k /month SIP. My investment will be for 7+ years to 15 yrs.

Just by reading blogs we can not gain right knowledge, but certainly plan better. Thumps up to you for spreading the knowledge to thousands among readers.

Many Thanks

Satya

Satish-First decide which is your investment period. This is the BIGGEST Problem of many that they don’t know when they need money and how much. There is a huge gap of around 8 years between your 7-15 years of gap. I suggest balanced fund, because these funds invest around 35% to 40% in debt category, which automatically balance your portfolio and again this debt investment is treated tax free exactly like equity.

Thanks again Basu,

Wants to create some corpus for my daughter’s marriage, she is 13 now and wants to create around 8-10 lac by her age 20-22yrs(depends on her marriage)I have also a small plot which is 12 lac market price today in her name. I can invest 15 k/month and may step up in between depends on financial situation. As you suggested, Shall I go with balanced fund HDFC and ICICI pru 7.5k each.

Please sir Advice…..

Satish-More towards balanced fund. Because there you get debt exposure.

Dear Basu

Greetings,

These are Retirement plans but what about we need money say after 16 yrs, we can withdraw with applicable exit load?Or will have to wait until 58 yrs? Will this applies to both plans or they differ Pls.clarify

Satish-If you want to withdraw early, then there is a exit load. Yes, rules applies to both the funds.

I am retiring shortly. I want to invest some portion of my retirement proceeds in MF schemes. Please Suggest 2 or 3 good schemes.

Thanks

Vinay-What is your requirement from such an investment?

I am retiring shortly. Can I invest some portion in Franklin Pension Fund instead of Bank FDs

Vinay-These funds are meant for retirmeent corpus creation but not suitable for someone who is about to retire.

Hello Basu ,

Thank you very much for sharing your knowledge.

FY2015-2016 : In 80C limit 1,50,000 Here I have investment components like ELSS , FD , SBI ULIP , PF Contribution & PPF. Would like to know for 80CCD apart from NPS is we have any other components to invest ?

Regards

Manian

Manian-To certain extent it looks great to save tax. But if it matches your goal then it is horrible. So concentrate on planning along with tax, instead always looking forward to save few hundred rupees.

Thank you very much for the nice articles and website.

I am an NRI in Dubai, If I invest in retirement plan ofUTI/Franklin and after 7-8 years if not able to invest and stop contribution but do not want to withdraw.What will happen?will my 7-8 year investment grow further? If I invest 10k monthly now can I reduce to 3k later say after 5 years?Out of these two which one better?.I know UTI has its office in Dubai.

I will follow your advice,please help me.

Ravindra-If you stop in middle then the same existing investment will grow. No need to worry. Yes you can reduce or increase the monthly contribution in future. But before that check whether these two are eligible for NRIs or not. My suggestion is to opt a simple diversified fund over these two.

Thanks Basavaraj,

Kindly suggest me simple diversified fund which u mentioned.Can I invest being in Dubai and how?

Appreciate your guidance.

Ravindra-My choice will be ICICI Pru Focussed Bluechip and HDFC Midcap Opp. Regarding investing as an NRI, suggest you directly contact with mutual fund companies.

Thanks Basu Sir,

Hi Basu,

It seems that Reliance has introduced Reliance Retirement Fund-Wealth creation Plan.I hope other companies too in coming months will come with such funds.

Regards,

Ashish

Ashish-I too feel so especially if the product is tax saving instrument.

Basu-What I have known about the reliance one that it is investing in hybrid funds that too with 1% exit load if redeemed before 60 yrs so it would be not better directly to invest in hybrid funds….

Regards,

ashish

In that case Franklin one is also not so better but UTI is overcoming with that demerit as after 5 yrs there is no exit load after 5 yrs…

PERIOD

BEST PERFORMER

SCHEME NAME

RETURN(%)

1Wk

ICICI Prudential Advisor -Cautious Plan Regular Direct- Dividend

1.56%

1Mo

ICICI Prudential Advisor-Moderate Plan Direct – Dividend

5.22%

3Mo

Birla Sun Life Asset Allocation Moderate Plan Direct-Dividend

11.54%

6Mo

UTI CRTS 81-Dividend

22.18%

1Yr

Franklin India Pension Direct Plan-Dividend

40.91%

2Yrs

Franklin India Pension Direct Plan-Dividend

19.84%

3Yrs

Franklin India Pension Plan-Dividend

18.10%

* Returns less then 1 year are absolute and above 1 year are annualised

ET

Ashish-Please give me sometime to review this new product.

I have changed job from 1st September and the previous employer’s PF balance including my contribution for the last 16 months has been credited to my account. Will this be counted as income in this financial year?

Thanks in advance.

Best regards,

Bhaswati-Please check my earlier post on this by visiting “Old Articles” tab of top.

Hello, I have surplus money every month and presently invest max limit in ppf (1.5 lac) and have 3 sips in hdfc top 200 and icici focused blue chip and cananara obecco balanced but only 2 thousand rupees each in each sip. Also have Nps account since in govt job. Can u please guide me to improve my investment. This is long term plan. I think I should increase my sip amount. What about funds- are they alright? Do u suggest to add a new pension fund like franklin for my wife who has no Nps-contractual job? Both of us are in 40’s age so our horizon is long around 10-15 yrs. Also have 2 growing children 15 and 12. please guide? Not very risk taking person, Scared of real estate. Plus for short term goals of children who already have ppf should I try kisan vikas patra or post office RD? Truly appreciate your reply.

thanks and regards.

Sunil-Retain either HDFC or ICICI. In my view if your time horizon is more than 10-15 years then easily you can invest in same funds. Short term goal in the sense how many years away?

Hi Sir,

Can you please let me know if it is good to invest lumpsum amount say 30,000 at a time in a good running ELSS fund?

I already have SIP on ELSS fund, as the 80c has increased I am looking into this option.

Thanks,

Ram.

Ram-Yes you can do so. But don’t be in wrong belief that you will come out of this investment once lock-in is over. Your time horizon must be at least 5-7 years or more.

Hello,

I am trying to build a retirement corpus of around 2 Crore INR in the next 20 years. I am currently 37 years old, married and have a 5 year old daughter. I am currently invested in LIC for 65000 INR per annum and in PPF for 35000 per annum.

What would be the ideal way to invest so that I get a 2 Crore INR Corpus by 2034? Please suggest.

Regards,

Sagar Pradhan

Sagar-First understand whether Rs.2 Cr suffice for your retirement life. Second whether current investments make you richer to achieve that goal easily? I think both the current investments are not worth (especially LIC). So first come out of LIC and start investing in well diversified mutual funds immediately. At the same time don’t forget to have term insurance.

Sir,

Thanks for the wonderful article. I went through many of ur articles and all are very informative and helpful. I am planning to invest in Mutual Funds through SIP for a longer term(Min 5 yrs). Can you please suggest me two good mutuals funds in below 3 categories, which would give me apprx 9-10% return atleast for a longer term. Thanks in advance.

1. Large cap

2. Small & Mid Cap

3. Diversified Equity

Sudarsan-If your time horizon is around 5 years then stay way. Invest only in case of more than 5+ yrs.

Sir,

I am looking for long term investment only, as a part of my retirement plan. So can u pls suggest few good mutual funds for those 3 categories.

Sudarshan-Go with ICICI Focussed Bluechip, and IDFC Premier equity. What do you mean by Diversified Fund?

Sir,

Thanks. I took this ‘Diversified Equity’ from fund category in moneycontrol.com. Below are few of mutual funds under ‘Diversified Equity’

1. Birla Sun Life Equity Fund (G)

2. Reliance Equity Oppor – RP (G)

3. HDFC Equity Fund (G)

Sudarshan-Birla is large and mid cap, Reliance is small and mid cap and HDFC is large and mid cap fund. Now decide whether they overlap or not.

Sir,

Thanks a lot for the response.

Hi,

How is HDFC Life Pension Super plus as a pension plan? does the premium paid here qualify for an 80C deduction??

Thanx

Aruna-IT is ULIP plan but expenses are high than a typical diversified mutual funds. So better to differentiate your insurance need and investment need. You can avail tax benefit of this yearly investment under Sec.80CCC but not under Sec.80C. Again do remember that overall limit of Sec.80C+Sec80CCC+Sec.80CCD is currently for FY 2012-13 is Rs.1,00,000. So accordingly you need to plan.

Hi Basu,

My son completed 1 year recently and my grandfather wants to give a gift of five lakhs for his education (long term investment).

The overall approach I have is to invest the amount first into a few liquid funds and then move small amounts (Rs.10000/month) into large cap and mid cap funds at regular intervals. Is this approach correct?

I am planning to invest only in Direct funds with dividend reinvestment option. Do you have any suggestions on what funds I can consider?

Thanks for all your help,

Shankarram

Shankarram-Your plan is correct and go ahead. Fund selection will be like one large cap fund (Franklin India Bluechip), one large and mid cap (ICICI Pru Dynamic) and one small and mid cap (IDFC Premier Equity).

Hi, Basu

thanks for suggesting the two mutual funds. if i want to invest in Franklin how can i approach and I have 10 years of horizon period to invest for around 2k/month. which one of the above is benefecial for me to get good corpus amount. pls revert back or your suggestion is very appreciable. Thanks.

Regards,

Upin

Upin-If you are looking for some tax benefit with investing in mutual funds then go with above said funds. But if you tax saving is not your one of requirement then I don’t think to invest. Instead there are so many equity funds than balanced funds which may give good return than this.

I am holding HDFC Unit Linked Endowment Plus II (Growth) from July 2009, paying monthly premium of 2K. SA is 1,20,000 and period is 25 years. Is it worth to continue this or close this and switch to Franklin Pension fund with same 2K as SIP mode ? Kindly advice

I don’t see any benefit with HDFC Unit Linked Endowment Plus II (Growth).

Raja-Expenses are at higher end than the above said plans. So better to come out.

Hi Basu

I want to invest in small and mid cap mutual funds. Am looking at a one year investment.

What would be the best options for me?

Jagrut-One year investment in equity?? No stay away please.

Dear Basu,

Thank you very much for sharing information. I have been reguraly visiting your website.

I have been investing in ICICI PRU Lifetime Pension II plan for last 7 years (Approximately 30 k/annum).

Should I continue to invest?If not, what should be the exist strategy considering tax implications?

Thank you.

Regards,

Anmol-It contains huge expenses compare to the plans which I discussed above. Like for example initial 3 years of premium allocation. So as you already completed more than 4 years, you can easily come out of this plan without any charges. But the only positive about this plan is, you may increase your equity exposure which is not possible in above two funds, as both are balanced funds. But when you look at expenses, return and typical plan product then definitely above two funds are good than the ULIP you invested.

Thank you Basu 🙂

Inorder to buy this do we have to approach the mutual fund company? No Demat is needed for this right?

Hello Basu,

Thanks for all the wonderful articles.

Iam bit confused, whether to invest in NPS or Franklin pension plan. I was almost convinced to invest in NPS but recently read your article about 2 pension plans (franklin, and UTI) and the benefit of lumpsum withdrawl and also the option to withdraw before the tenure (though with penalty). Can you please elaborate on anything I should watch out before investing ? At first look Franklin retirement plan looks better. Is there a catch in here? NPS do offer very low charges, so in longer term higher charges of Franklin gonna affect more ?

Ankit-For me Franklin seems better with lot of withdrawal options. NPS is Govt regulated and not a tax efficient (as of now. Instead of all these issues, why can’t you opt plain well diversified mutual fund?

Thanks for your reply.

By diversified funds you mean any large cap fund (as per your rating) I can choose ?

Ankit-Yes go ahead.

Well… thanks. Will go for Recurring Deposit.

Cheers!

Hi Boss,

I am Rajat. 25 Yrs. Delhi. I am a complete novice when it comes to investing. Now I am planning to invest about 2000 Rs per month in SIP in some mutual fund. Do not know much about technicalities of mutual funds and their language like debt, equity etc. Just name me that ONE fund you consider to be best where I can Invest and how long the SIP should be? Will follow your advice blindly.

Regards

Rajat

Rajat-What is your time frame of investing?

Say 24 months roughly… 2 years.

Say 24 months roughly… 2 years. You suggest?

Rajan-Then don’t enter into any mutual funds. Better to go for RDs or any other such safe avenues.