You may have watched on business news channels a pre-open session for NSE and BSE from 9.00 AM to 9.15 AM during market days. But you actually know how your placed orders are executed during this session? It is very interesting and must know factor for all who are interested to invest in stocks.

Before we proceed let us look for the types of orders you can place in market. Their are two types of order placing methods. 1) Market orders-These are the orders where you have not specified any price while buying or selling. Hence such orders execute as per the availing market rates. 2) Limit orders-These are the orders where you have specified the price and quantity for buying or selling. These get executed once find the matching orders.

Pre-open session as I told above starts from morning 9.00 AM to 9.15 AM during the market days. This 15 minutes consists of mainly 3 slots.

1) 9.00 AM to 9.08 AM-Order collection period-During this period you can place the orders, modify or cancel them.

2) 9.08 AM to 9.12 AM-Order matching period and trade confirmation period-During this period placed orders are confirmed based on the price identification method called “Equilibrium price determination” or “Call auction”. Will discuss about these methods below. During this period you are unable to modify or cancel the placed orders.

3) 9.12 AM to 9.15 AM-It is called buffer period and which facilitates transition from pre-open to normal market session.

How Equilibrium Price determination or Call-auction session actually works?

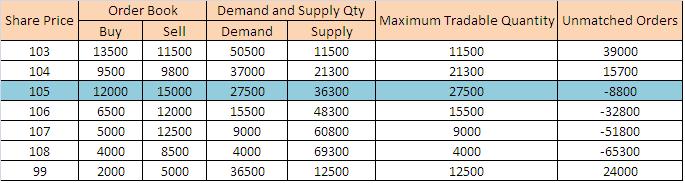

Let us say with example of XYZ stock and previous days closing price of the stock is Rs.100. Now during the market pre-open session types of price and quantity reflect may be as below.

1) Scenario I-We found only one share price with highest trading quantity.

In above case share price with 105 have highest trading quantity with 27,500. Hence it will get executed as equilibrium price or call-auction price.

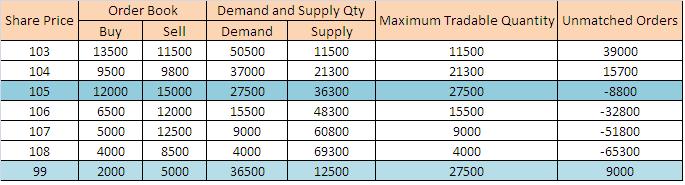

2) Scenario-II-We found two matching maximum tradable quantity for different share prices.

In above case we found two matching maximum tradable quantity for share price of 105 and 99. In that case minimum unmatched orders quantity is for 105 (8800) than 99 (9000). Hence in this scenario share price 105 is considered as equilibrium price or co-auction price.

3) Scenario-III-We found two matching maximum tradable quantity and same unmatched orders for them too.

From above table we found that for the share price of 105 and 99 we have matching maximum tradable quantity and same unmatched orders. In such scenario previous days close is come into picture. Here I told earlier that previous days close for XYZ is 100 which is nearer to 99 than the 105. Hence in above case 99 is considered as equilibrium price or call auction price.

4) Scenario IV-We found two matching maximum tradable orders with same unmatched orders and share price are equally distanced from previous closing price of share XYZ.

In above case we found that share price 101 and 99 have same maximum tradable quantity and same unmatched orders. Also share prices 101 and 99 are equally distanced from previous days close. In such case previous days close share price 100 is considered as equilibrium price or call-auction price.

Points to remember regarding Pre-open session.

1) After finding the equilibrium price or call-auction price all market orders are executed at the equilibrium price and all no executed limit orders are carry forwarded to open market as it is.

2) Price band of 20% shall be applicable on the securities during pre-open session.

Any comments or suggestions?????

https://www.nseindia.com/products-services/equity-market-pre-open — this link says ”Both limit and market orders are reckoned for computation of equilibrium price.”

From what I understand, the market orders are matched once the equilibrium price is computed based on the limit orders. Why does the NSE documentation says both limit and market orders are used in computing IEP?

Dear Sudheer,

I too surprised.

Sir

For selling stock which is in lower circuit we can use pre-market session. My question is what price should be given, market price or the lower circuit price. Which one is better chance to get executed?

Dear Bijan,

Hard to say.

This is vary helpful article to get to know how the market works from 9:00 to 9:15 AM that is pre market session.

Can you please tell how the indices works or what factors affect change in movement of indices like Nifty 50 or Sensex in pre market period?

Dear Swasthik,

The indices change based on the price movement of the underlying stocks.

Sir , can I buy a particular stock in pre open market for its previous closing price ? Say yes or no ? And reason is very important.

Dear Subahan,

Sadly NO.

Sir

I want to know whether matching of orders will take place during 9:00am to 9:08am or this period is only for placing orders?

Dear Bala,

At 9.08.

I am holding shares of a company which has gone out of NSE/ BSE. What is the disposal for them.

or

Can I wait for the re entering of the same company NSE/BSE in future.

Dear SK,

Wait or disposing depends on your capability. How can I say?

I want to understand the priority of order in the below condition.

During a pre-market value one places a buy order with price set to market value. But, unfortunately it’s not executed at 9.08 am due to high demand and low supply. also the share gets locked at upper circuit and there a many pending limit orders at pre-market (9.08am) session.

Now, at 9:15, I know that all market orders will be pushed as limit orders with opening price value. But, real question is which has the highest priority? The order that was places as market order during pre-market or the pending limit orders with buy price as upper circuit price ?

Dear Arun,

As per me, it should be Market order druing pre-market.

Sir my question is, in Pre market session(in ipo) share is fistly listed on issue price ? if yes then why this price not consider as Opening price ?

Dear Akshay,

Pre Opening is different than the already listed share for newly listed.

Hi sir hw r u…my question is can I buy share at 9am for intra day? and is there any advantage of gap up opening after buying share at 9am for intra day ?? Or I will able to buy at 9:15 only ?..plz leave comment

Dear Mahesh,

You can place the order during Pre-Open but confirmed at 9.15.

Sir,which host site are u using,to host your website

Dear Phani,

May I know why?

Hello Sir

What is the difference between “Buy and Sell” and “Demand and Supply”. I tend to think Buy = Demand and sell = Supply. How there are different. This may be a very basic question. Kindly explain

Regards

Dear Venkat,

Buyer demanding and selling is the supplier.

Hello Sir,

Very well explained!! Thank you for that.

Will you please don’t mind to answer my question.

How to make sure that order is executed first in the day?

Like by placing After Market Order or Pre-Market Order?

Which is given higher priority?

Thank you in advance!

Dear Keerthi,

It is a supply and demand based. Hard to say.

This is vague reply. You have two columns, one is for Order Book and Another is for Demand & Supply Schedule. In real time we get the info of Buy & Sell on NSE Website which is very confusing. Qty of Sell is shown on Lowest Price and Qty of Buy is shown in Higher Prices. At the end Total Buy & Sell Qty is shown. We have understood the mechanism but how the figure of Order Book and Demand & Supply Schedule is to be derived from the NSE Website is confusing. You are also not explaining it properly. It is observed that some Brokers are playing with this mechanism and forcing to declare the pre-open price as per their own wishes by last minutes orders. Pl. explain in detail asap.

Dear Dilipkumar,

If my answer seems to be vague for you, then it’s your wish. If you have concerns that few brokers playing with this mechanism, then you have all rights to complain against them in the SEBI’s SCRORES.

Sir, my question is: for ex: on 14-08-2020 Pre open market price declared as Nifty50 11.353.30 52.85 (0.47%) Advances:44 Declines: 4 Unchanged:2

Here Nifty50 open price is 11353.30 and the difference price from Yesterday’s Close Price is 52.85 here they mentioned in % as 0.47%,

i want to know this percentage calculation method/ pattern. If any knows about this please mail me [email protected] or on whatsapp 9481056949

Thanking you

Prakashrao

9481056949 karnataka

Dear Prakashrao,

Better you contact NSE.

Good morning sir, during 9 to 9.08 am only we can place orders in stock market during pee market session. After 4 min trade confirmation happens. Then why there is increase number of trade during first 8 min.

Dear Raghavendra,

If your question is post-Pre-Open, then it is value of buyers or sellers. Hard to say WHY.

At what basis order will executed.. i asking in terms of priority lets say 100 is uc and 10-15 order have been placed on previous day @market than

which order executed first?

Dear Vijay,

It is always based on demand and supply. If you refer above post, you will get clarity.

Sir,

Nice article.

Could you please explain below point.

2) Price band of 20% shall be applicable on the securities during pre-open session.

Another Query: After Market Order with Market Price (not AMO with LIMIT), How it is calculated in pre order session.

Which has highest priority?

Dear Smruti,

It means the bid and offer price must not be more/less than 20% of the previous day’s closing price. “Which has highest priority?”-The price discovery will continue as usual irrespective of the price you set the order.

Thanks for explaining things beautifully, it cleared lot of doubts. Here I have one more

Does FIFO applies on pre-market session and later on AMO orders or vice versa?

Dear Vinod,

Yes. FIFO applies for pre-market session.

Sir,

Your post is very informative.I have 3 query.

1.some shares allotments takes place place even in upper circuit.What is the logic for allotment is it FIFO basis or some other.

2 Is there any difference between ami orders and pre orders in allotment.

3 Is there any difference between limit orders and market orders while allotment in uc.

Dear Adarsh,

1) FIFO basis.

2) AMI means?

3) Yes.

Wonderful explanation ! Thanks a lot.

I have a query i actually placed a market order in between 9 to 9.05am and then cancelled and placed a limit order for it before 9.08am, but, even after that, my order got executed at the equilibrium price.

Is this also a scenario and can happen or should i contact my broker if its an issue ?

Dear Prince,

Check the exact punching times and then you can complain.

That’s the beautiful explanation. Many thans for that. Here I have one more query.

Does the pre market ordered prevails over the pending orders of last day. I mean what we bid after market

Dear Reena,

NO.

Hi, I have understood very clearly on the four scenarios. I have two questions.

1. Apart from these four any other scenarios are applicable for the calculation of Equilibrium price?

2. Is share price only only increase when buy happens or any other source that affect for raise?

Thank you for the Help.

Dear Srikanth,

1) NO.

2) It depends on DEMAND and SUPPLY.

Hi

Thank you so much for quick response. So Demand means Buy and Supply means Sell?. If not , can you please explain?

Dear Srikanth,

Yes.

Hi, firstly I sincerely thank the author for this post and easy explanation, I really appreciate your efforts, I will come back again and again to check for updates on this blog. But I have a small request will you please share the source of this information?

Dear Sushant,

It was available on NSE (I am not sure about now).

Sir, I didn’t understand the concept as the images you quoted are not visible. Please, if can check it once more.

Thanks in advance.

Dear Tarun,

I think it is resolved now. Please have a look and let me know if you still facing this issue.

Beautiful explanation.. Cleared my long pending query!! I think that I will be visiting more often!!

Keep enlightening the people.. A lot of us need it. 🙂

Can we place the order for option in premarket session?

Dear Gopinath,

NO.

You have explained it as simple as possible. Your effort is greatly appreciated. Thank you very much Sir.

Dear Subhash,

Pleasure 🙂

https://www.nseindia.com/live_market/dynaContent/live_analysis/pre_open/preOpenOrderBook.jsp?param=MANPASANDEQN&symbol=MANPASAND

In the above scenario of pre-markets order session dated 12July 2019 for MANAPASAND BEVERAGES the buy price of Rs. 35.50 @ 1750 quantity will be executed at what price?

Dear Akshay,

I can’t track individual price.

In general what happens to BUY orders that are placed above equilibrium price

Dear Akshay,

It is already explained above.

Sir from where we can see this table on our broker,s platform ???

Dear Utkarsh,

These tables may not be possible to see. However, I explained to you how it works.

1. In scenario 2 quantity of demand and supply at 99 is the same as in scenario 1. This could be an error which has been corrected in scenario 2. I understand during pre-open only market orders can be placed. Then how do you match demand and supply at different price levels?

Dear Ratan,

Please read once again the scenarios properly.

I don’t understand how you get 36500 as demand and 12500 as supply in last row 4th and 5th column of 1st example.

Dear Nilesh,

They are just examples to show.

Dear sir if i place a limit order of a stock at price 500 but seller puts limit order at 480. Then at what price trade would execute?

500 or 480?

Dear Learning,

If there are matching seller order for Rs.480, then it will get executed but not at Rs.500.

Can you explain more on order book and demand/supply

Dear Gowrishankar,

What is your doubt? Because ORDER BOOK and Demand/Supply is the simple concept.

sir any chart or broker who provides pre market price and candle too?

Dear Vansh,

Sorry, I don’t know.

Dear Basavaj,

Could you explain the difference in buy and sell quantity versus demand and supply quantity?? Also, What is the importance of buy and sell quantity in determining equalibirium price? Also, What is a “At the open (ATO) orders and how they help in driving the market in active trading session??

Thanking you in anticipation.

Sir , Please suggest on the below scenario :

I wanted to buy 500 stocks of cummins ind on 1st aug.

I had placed buy at market order at 9.05 am and the stocks were not bought.

Instead stocks were carry forwarded to open market with limit of 680 ( which was the decided equilibrium price at pre open market ). Do you think this happened due to low volume ?

Thanking in advance for your help.

Dear Vishal,

It may be.

Thanks for explanation, please let me clear how can we can anticipate the price in pre-market session, or its simple luck by chance if order get executed. if there is any good or bad news of stock so how one can decide as to which price stock will open.

Dear Anil,

Yes, you can anticipate but alloting the stocks during pre-market is completely on demand and supply.

What is unmatched order here?

Shreekant-Orders which are not matched.

Is there any way to get the total number of unmatched orders during that period ?

Shreekant-It is hard to find through broker. You can knock NSE or BSE to fetch that data.

Is there a pre and post market session for Futures too ??

Omkar-NO.

Sir can any individual or retail investor as small as 100 shares can be placed order in pre open market ?

Arjun-YES.

Dear sir

By the time 3.30PM to GNFC closed at rs414/-. But 3.31PM it changed to 401.95. Why that sudden change. Normally to get Rs3.00 change thousand of share to be traded.

Reddy-Check with your broker.

this happened because in post market order i.e from 3.30pm to 4pm there were buyer and seller who traded at the price of 401.95

1. Is demand & supply is based on buy & sell market Order?

2. What is the difference between buy, sell order & cumulative buy sell order in pre-market?

3. Why bids is greater than offer in pre market?

Vishwesh-1) Not market orders but during Pre-Open Session.

2) I am not sure of cumulative. May I know the details of the same.

3) Because there are someone to buy and sellers look for higher bidders.

Buy, Sell Order & Demand, Supply Order what are the difference?

Vishwesh-Demand and Supply orders are not there at all. It is only buy and sell orders which fluctuate based on demand and supply.

Why volume & limit quantity is high after 9.08 in pre-market

Vishwesh – It’s not high but shows all pending orders.

Ok ok got it. Sir I’m a intraday trader I always follow pre market strategy. I have little more doubts can give u share Ur no.

My number :- 8850609088

Vishwesh- But sadly I’m not an expert in intra day trading.

If Market Orders quantity is greater than unmatched tradable qty …

How remaining market orders will get execute which are placed in pre-open session.

Ankit-As per me, they will be turned regular orders after the pre-open session closure.

Nicely explained thanks

Can you please tell me about minimum amount required to buy nifty future in intraday trade.

Saurav-Check with your broker.

Dear Sir,

I would like to view the past Pre-Open Market data by date wise. Any possibilities to get this.

Please help me in this regard.

Sripathi-Contact the NSE or BSE.

Thank You Sir…..

HELLO BASU SIR !!!

Can you pls help me with this !

At what price i should bid in pre open market.?

Can i bid at any price in the upper &

Lower circuit range?

And why do previous close price & next day’s opening price is different?

Does it is only due to the equilibrium price calculation or there are some other reasons?

Sumit-At what price I BID-It is purely your call. Price difference is due to equilibrium price calculation.

Hello sir I would like to know where can I get this premarket data does anyone provides this because I need the quantity of shares traded in the premarket session which is responsible for a gap up or gap down.By knowing that one can predict if it’s a real or just an anxiety move since some stocks might be oversold or overbought because of certain news but the performance of stock might not reflect the move and there may be a chance of gap filling. It would be really helpful if you could tell me where I can get this since I trade on zerodha they don’t provide this. Even Amibroker with its feeder doesn’t provide that or if there is any setting which I could change on amibroker such that I get the volume on the premarket data please do tell me thank you.

Dwijesh-You can knock the NSE or BSE for the same.

Hello,

As explained by you in above cases for example case 1 where 105 is the equilibrium price of the share,then when the market opens at 9.15 is 105 going to be the opening price?In short is the pre-opening equilibrium point also the opening point at 9.15?

Also, is after hours trading don in india?

Raj-This is what I already explained in above post.

You only explained the defination of pre-open session here, I beleive. Could you please tell us how should this be taken for the entire day intra-day. I mean if the pre-open session was mostly selling, will only selling happen throughout the day for intraday or viceversa?? What’s the importance of pre-open session for intraday?? Please share your valuable honest opinion per your intraday/stock market experience! thanks

John-Pre-Open session will never ever be the indicator of market day. It may or may not be. Hence, do investment or trading as per your plan but not relying too much on pre-open session.

What is the difference between order book and demand & supply qty.

Rajasekhar-Order book is a book where the orders are entered. Demand and Supply is based on the type of orders booked.

thank you sir

Is there a way to know the actual demand and supply at a given point of time?

Prakash-During Pre-Open Session?

Any time – including pre-open.

Prakash-It can seen live. Check with your broker application.

A very nice blog which clear lots of doubts. Few questions to ask you if you please clear the doubt

1) Suppose a HNI trader with 50 crores capital wants to trade a script which is has closed at 200 previous day.Obviously his volumes will be more. So what will be his ideal strategy to fill the orders quickly AMO or Pre opening session?

Feelthemarket-Hard to say as it depends on that day’s demand and supply.

Is there any data available where ALL ( not only my account) pending orders for a specific stock are given ?

Davidroy-Check with your broker.

Great article!

Few questions.

1. Let’s say I place an order in premarket, when do I find out if it gets matched?

2. If it does get matched, will I know the price?

3. What other info do I get? (for example, is it possible to glance at the book before market open?)

4. And most importantly, if it doesn’t get matched, does it roll over to market open? Do any orders rollover to market open?

Thanks!

– Raghu

Raghu-If it matched, then your order get executed. You can’t see that back end process.

Hi Basu,

I have few doubt about circuit limit

Recently i observed that Indiabulls share price raised by 50% in a day, Adani enterprises raised 27%, Divi’s lab dropped by 24%, how can this happen as they fall into the 20% price band.

thanks

Gani

Gangadhar-Do research on these stocks which either goes up or down drastically, you noticed that circuit limit acted. Just search some news items related to these.

Circuit limits are not applicable on stocks in Futures & Options.

PaagalTrader-Not applicable to stocks??

Correct, circuit filters are not applicable to stocks which have derivatives e.g. futures and options. Remember SATYAM ? 80% fall in a matter of minutes, so be careful. Happy trading.

for F&O stocks circuit limit is different

what does 3 min of buffer do?

Does it perform specific task other then facilitates transition from pre-open to normal market session?

what exactly happens in this 3 min of buffer period in pre open?

Deep-It is price adjustment at internally and getting ready for market opening.

what does price adjustment means?

i mean in what manner the adjustment is done?

Deep-It is at server end.

Basu i have new doubt,

per my understanding whenever a script breaches the circuit limit within bse prescribed hours trading will be halt for 15 min(2pm), 30 min(1pm) and 45 min(11am). after each halt the equilibrium price determination process repeats

pls ref bse website and circuit limit field, pl confirm my understanding is correct or not

Gangadhar-I am not sure about circuit breaker rules during market timing. But what I am explaining here is about Pre-Open.

Basu,

1.GTDC stands for good till date, this option is available for some scripts in BSE and we can put order validity upto 1 month for both sell and buy, but am not sure whether unexecuted order will be taken for pre-open session next morning or not, but it will be taken for regular market b/w 9.15-3.30pm daily upto 1month

2.if i have demat a/c with 1 broker can i trade with different broker and transfer shares to my 1st broker demat a/c, because some firms provide less brokerage but not sure about long term guarantee

Gangadhar-1) I am not aware of that.

2) Yes, if the ownership is same then within different demat, you can transfer stocks.

Hi Basavaraju,

1.May i know when will be the circuit limit for each script fixed

2.As the circuit limit for all scripta is 20% during pre open sesson, if i place the order at +20% and if the circuit limit for that script is fixed to 5% how it will be transferred to regular market

3.If i place the GTDC order after market hours will unexecuted order be considered for pre open session

4.If i place the order before 9.00am will that be taken for pre open session

thank you very much for your time,

Best regards

Gangadhar

9686570238

Gangadhar-1) It is fixed by NSE based on the script considering many aspects like liquidity and volatility.

2) It is script specific.

3) GTDC stands for?

4) You are not allowed to place before 9 AM.

Hii, I’ve got a question sir,

1. Their r two types of orders, after market order n pre open session order; whats the advantage of them over each other?

2. If i want my order to get executed at highest odds, what precautions shall i take? (ex. Place order at most probable price point or place order as early as possible, as soon as pre market session starts?)

Arjun-1) Is it during Pre-Open session?

2) Probability is not known to anyone. Then how can you judge?

1. If two people have placed buying order at same price, Which order will get priority to be matched if supply is less than demand?

2. Which order get priority to be matched, limit or market order if at limit price order, supply is less than demand?

3. Which order have high probability of execution?

Thank you for sharing excellent article.

Hansmukh-1) Both if punched to be exactly at same time then for market it is considered as ONE order but not two orders.

2) There is no such differentiation, if market order and limit order at same price then they treated equally but based on timing the priority will be given.

sir one small doubt. often my stop loss order is executed much above the feeded price as input during intraday trade. for example , for SBI as scrip I have ordered Stop Loss at Rs. 235.00 but the Stop Loss order gets activated at price say Rs. 238.00, many a times it has happen to me. Please help.

Ranjit-Check with your broker.

Could you please put opening sessions of BSE and NSE differently, also elucidate the closing sessions. Thank you so Much!!!

Naeem-Pre-Open session works same way for both NSE and BSE.

Sir,

After the selection of “Equilibrium Price” which orders are given the priority

(i) The Market Orders OR

(ii)The Limit Orders – Here the Limit Orders I am talking about are the one which ultimately decided the Equilibrium Price i.e the ones with maximum tradable quantity. Here as the limit price of these orders equals the new market price

which type of orders are completed first?…. (i) or (ii).

Sahil-Once the equilibrium price identified, then there is no difference between market order or limit order. The orders get executed based on FIFO format.

Hey… Whether can we short-sale any stock in pre open market? Pls reply me

Abhishek-Yes, you can.

Hi

I asked same question on fb page you replied NO! I am confused!

Abhishek-I updated the same reply in FB. Check.

Hi,

Today I tried to Short sale State bank of Mysore, but it doesn’t happened! Why?

Abhishek-I am not sure of why it not happened. Also, it depends again on equilibrium price.

But, the thing is it has rejected the transaction! so no question of equilibrium price!

Anyways thanks for the reply man!

Abhishek-But as per rules, it must. Check with broker !!!

Sir, i have a question. If i place an order in pre-market session then can i get the shares at market price or do i have to use limits?

Debayan-If they executed as per the market price, then it will be at market rate otherwise at limit price.

is it good to invest in penny stocks using delivery mode through zerodha because zerdoha not charge on delivery as compare to other brokers?

Rahul-Zerodha may be offering NO CHARGE on delivery. But are they guaranteeing you on profit or safety of your money? Act as per your risk.

Hi, i think no broker gives guarantee on profit.. and regarding safety of Money… our money in our account or in form of stocks.. where does it go? Pl clarify

Aksuvarna-Where does it goes means?

can i buy shares on 9 Am and sell at 9:30 Am ???

.

.

should i get share on yesterday closing price ??.

.

.

thank you

Rajesh-Yes, you can place the order. Once it matches the opening price, then it get executed based the priority. Then you can sell the same at 9.30. No, you will not get the share at yesterday’s closing price.

thanks sir. i have one more query regarding to this.

i will get stock at open price. And suppose it comes down than open price at the end of the day but its more than the previous day closing price. then whose profit is this. is it my profit or company profit. i m asking about intraday shares.

.

.

thank u .

regards- rajesh

Rajesh-If you bought the stocks (whether it is at market price, open price or the price you bought at), the profit and loss are purely YOUR’s

I am little bit confused. I have following quaries

i) Am i eligible to place an oreder with market price (instead of Limit)?

ii) If so, once the equilibrium price will be set as per your algorithm, the orders will be executed?

iii) How the traded quantity calculated whether it is based on the pending orders or previous day’s traded quantity?

Thanks in advance.

Chandan-1) NO. 2) You don’t know the market price for the day, hence how can it get executed? 3) At what point?

Sir, Thanks for helping investors. Can I place After Market orders in Futures?

Panduranga-Not allowed.

Futures and cash segments are allowed in After market orders.

Only in pre-open sessions cash segment alone is accepted.

Surendar-YES.

So what happens if my quote is below or higher than the equilibrium price.

Rajnish-It will not execute.

hi buddy,

So i want to ask you a question here, this means it is a very rare possibility that my order will be executed. i mean what are the chances here that i quote exactly the equilibrium price.. am i getting it right?

Karan-YES, you may say so.

In that case, why do investors/traders even bid or place orders in a pre market session, i mean, what is the point , its like winning a lottery – right? if i am wrong please correct me and explain me sir.. confused on this.

Karan-Trading is winning the same right?

Sir news channels shows nifty movements around 6.30 to 9am, that shows nifty is up or down. How can we see them on any other website or applocations before pre open .how news channel knows all this before 9am.

Rohit-Only GOD knows of how they show the movement. All it matters is TRP to them but not your moeny.

They check SGX Nifty….God doesn’t tell them…

Please upgrade yourself b4 acting as a subject matter expert

a-Please let me know which knowledge I have to upgrade 🙂

Hi sir i have a question from this article.

In case-4 what would happens to the orders placed at 101 and 99 when previous days closing price 100 is considered as equilibrium price or call-auction price? Will they be going to the open market?

Rajsekhar-Previous day’s close is exactly in same distance from 101 and 99. In such situation previous day’s closing price is the equilibrium price or call-auction price.

Nice article. Let me ask a question. Some sites advocate the application of the Chandelier exit by setting your stop upon entry at a multiple of, generally, 3 times the Average True Range (ATR). The ATR at entry for this trade is sitting at 0.0122. So they have calculated ATR as 3X122 pips=366 pips and have the initial stop at 366 pips lower. Now let me know how to calculate for the Indian stock market? What should be the equivalent of pips in the Indian stock market? I hope you would kindly help me.

Naren-I am not aware of this.

Does market orders get executed during pre-open session.

Prashanth-Yes, if the market order is the pre-opening price.

Very nice article looking forward to know more very many thanks sir

Excellent explanation Sir,Today i understand concept of Pre-opening .

Thanks a lot

Hi!! Thanks for the information. I am very new to the technical terms in the market. So, my question may be naive. My question is I want to buy a stock xzy. The closing price yesterday was 100. Just imagine the lower and upper circuit for the stock is 20%. I strongly believe the stock will move to 115-120 range after few minutes market opens. Now, i want to buy the stock at better price anywhere between 100-110. If I want to place order during pre market session (i.e between 9-9.08 am), how I can choose the price? any random price between 100 and 110 or the better price (for example 105) will be shown any where in the broker site (in my case ICICIdirect)?

Thanks

Alagu-Random price.

Thanks

So, the Equilibrium Price could be higher/lower than the pre-open price(which we get at 9:08 am) of a stock. Please correct me if i am wrong …

Pankaj-YES.

Sir thank you for the great article!

Can I place after market order at market price so that it can get executed at equilibrium price. For example, Infosis results are out and it was excellent, last closing price was around 1162, I anticipate it to increase on Monday. To avoid gap when placing limit price, can I place a AMO at market price and by placing market order will I get best price around the equilibrium price.

Lohit-How you know the market price of the day’s start during pre-open session?

Sir,

Can we place Buy/Sell orders in FNO segment too during the Premarket session?

Jatin-NO.

Minor typo – Scenario 2 supply Qty for share price is incorrect in figure. Should be 27500 instead of 12500. Great article otherwise. I have 2 questions as well. Do prices move in the same fashion in regular session as well? 2nd – Where can the order book details be found?

Vikas-Thanks for finding error 🙂 1) Yes, the prices move in same way. 2) You will not get that information during trading time.

Dear sir,

Please tell me Pre market orders are possible for all stocks or only index stocks.

George-For all stocks.

In the pre market orders what will be the mode of Product Type–margin, delivery, mif or ptst.

Priyabrata-It may be anything. You can buy it either delivery or margin.

IS there any way to carry forward my last day selling order to next day in NSE?

Also what strategy should i adopt to exit from a stock which is going in lower circuit from past 4 days?(Every days some 3000 sell oders is bring the stock to LC)

I want to place a request in a such a way that it get executed first in NSE as NSE will place first come/first serve basis

At what time/what method should i adopt so that NSE will take my orders first?

Sam-No, you can’t carry forward your selling order. The order expires after the market closure. It is hard to guide as to what you have to do with the stock which is trading at lower circuit. It is purely your call of buying. Hence, can’t guide the strategy to SELL from my end. It is everyone’s dream that their orders MUST execute at any cost. But it will not happen like that. Because it is market driven by many of like you and me.

Also just want to know whether any benefit is there for placing selll limit offline order one day in advance instead of giving in pre open session on the same day?

Sam-NO.

Can you please guide me the link wherein I can see pending sell orders/Buy orders for a stock which is in UC/LC?

Sam-Check with your broker.

Good morning sir, if a stock closes at 55 rs and in pre opening session it is at 56 or 57 (9:06 am) and I want to buy 500 stocks at the same time, so can I purchase it?

Shariq-Please elaborate more about the situation.

Sir like we purchase stocks after stock market gets open is there any way like that to buy stocks in pre open session

Shariq-Yes, and it is based on price mechanism I explained above.

Sir, can you tell me name of some broker’s from where I can do trading in pre open session

Shariq-All brokers provide this facility. Do remember that trading means you have to buy or sell orders. Based on price mechanism your order may get executed. Please read above post about how the orders executed during pre-open session.

Please let me have your help here.

I understood the process Pre Open Session as you have explained. However, one question that I have is whenever I place an order to buy or sell any stock at market price instead of limit order during Order Collection Period then I suppose my order will be considered in or as equilibrium price. Is that correct?

Aditya-I am unable to get you.

Sir i m having same doubt. Whether we can place buy order at market price instead of limit price in pre-open trading time I.e 9:00 to 9: 08 , so that my order will be executed with opening of market.

Thank u

Akhilesh-Can you elaborate more?

Sir

What are sell & buy in order book column in excel. IT IS NO. OF ORDERS OR QUANTITY?

Sunny-Number of orders.

Dear Sir, I have identified one scrip. My observation is that it definitely goes HIGH from it’s that current days OPEN price. Suppose I want buy that share in the morning with stop loss order but no higher selling price target, what time I should place order? If I have to place buy order what price should write in buying price place in tradetiger to get confirm order? If I put yesterday’s closing price will I get order? If it gap opening at higher price then I can not decide price. I am confused. But I am sure it goes definitely higher from open price except for few days. Please guide me.

Manus-If I know that then I may be called as GOD.

No sir it is not like that. If u give me ur e-mail address I can send u excel file with my observations. U have to tell me my thinking right or wrong. U have to guide me. That is all.

Manus-You can send mail to [email protected]

Hi sir,

I have done MBA after BSc , currently working for an Investments firm(2.5 years of experience into BPO finance operations). I am planning to do Certified Financial Planner course. Is it a right move. if so what would be the career as CFP and also can u suggest some good Institutions in Bangalore. Please let me know the course duration and expected fees for it. Thanks in Advance.

Sreni-It is good to know that you are interested in pursuing CFP. There is a huge scope for it. As far as institutes, I did my CFP under my mentor Mrs.Padmalochini who not associated with any institutes, but handles the classes individually. Institutes only care for you up to the time of your fee payment. Later on they not bother whether you completed or not. Hence, I suggest to follow her. If you need her contact details then mail me at [email protected].

Hi Sir,

I bought nitin spinners at 1408@ 73 and due to upper cicuit it went till 103 and now its on lower circuit and has fell to 81.90. im placing a sell order everyday and my order is being pending as there are some 3 lakh pending orders, today my sharekhanbroker has told me i should place order at 11pm in the night i.e premarket session, i dont knw if this is true or not…is he fooling me?? I need to sell my stock at any cost before it crosses my buy price. so tomorrow is the day and i need to place an order….plz help me! do i need to place an order at 11pm tonyt or 9am tomrw morning….i have calculated the price fall since the last three days…its 4.75 fall one day,next 4.5 and today it fell 4.2….so by this trend im assuming it will fall 4rs tmrw, i need your suggestion at which price shall i place the order and at wat time i should place…[email protected] is my email id, plz kindly help me with an advice as early as possible

THanks a lot in advance

Manoj Chandra

Manoj-I am not an expert of direct equity.

Dear sir, Nice to see you replying all the queries. I have a question. I am using investing.com for nifty and banknifty Future chart. In that i’m seeing candles from 6:30 am to 9:15 am and then normal market hours candle. how is it possible in Future sir?. Kindly see the investing.com streaming chart, you will see the above info. please let me know your thoughts.

Thanks

Raj s

Raj-I am not sure how they are showing price movement of a chart after market closure. As per me, the new movement starts from 9.15. Raise the same with your broker.

dear sir please tell me from where I can get all the entered orders in any particular script like when we checking on nse pre market page it only shows buy qty and sell qty ato and total if I want to check all enterd orders with al the rates in pre market. I mean want to get all the pre market order detailed summary

Lalit-Contact your broker.

Hi sir ,

I have one doubt. if previous close of x share is 100rs. So i have placed an order of 10 shares at 100,and it goes down(say 98) in pre open session. So i wanted to cancel it before 9.08(end of pre open session). is it possible to cancel or as soon as it reached 100 it is excecuted. please explain briefly

Sreenivasulu-You can not modify orders after 9.08.

Thanks for your reply. Actually I am not modifying. I placed an order at 9.01 or earlier but in pre open session Stock price is going down and i could notice it at 9.05 (still 3 minutes to end pre open session) so can i cancle it before 9.08(say at 9.06 or 9.07) or it would have been excecuted already

Sreenivasulu-You can cancel or modify the orders before 9.08.

Thanks

Hi,

I have a question. In the BSEIndia website when I checked Bharati Airtel price in todays trade it dispalyed as follows

Previous Close : 413.70 Open : 427.00

Why there is difference in Previous close and open price ?

Any information on this would be appreciated

Thanks

Amit-When trade start today and there are huge buyers then automatically the first trade get executed at higher price (in your case it is Rs.427). So it shows the difference. At the same time, when there is a huge sellers then the price will automatically goes down (like 310) also.

I have one small doubt, consider a company xyz

SYMBOL qty EP Prev.CLose

XYZ 5000 100 90

I am a little confused with the qty here, does it state 5000 shares have been traded for this stock at EP?

Thank You

Nikhil-Please provide the exact stock name and format of which you have confusion.

Like say for today 5th of Aug 2015 Preopen market of TATASTEEL is like

EP: 260 %Chng:1.44 Prevclose: 256.30 Qty :13,516

Does this mean 13,516 shares have been traded for the Ep price. *EP being equilibrium price*

Can yo please let me know the role of QTY in Premarket sessions

Thank You

Its very nice article, i m novice in the stock market, your article made me understand the pre market session, but i have a doubt. i have a sell order in the day market at the closing price at under price(friday), due to less demand it could not get executed. but i could see the price after 3.30 has appreciated beyond expectation. my question is that can i place pre market order to sell on monday market for the same stock?

Thanks basavaraj in advance.

Adarsh

Adarsh-Yes, you can place it.

sir, what is your view on hero motocorp after today’s fall. is it increasing in this month ?

Harsh-I am not a trader.

I learning share market last 6 month I want to know how can I know premarket buy n sell price. So I can buy or sell stocks.

Dhaval-It is already explained above.

Hi Basavaraj ,

I have placed the Buy order of 500 shares at 59.75 . the market was about to close . so my order was partially executed and executed quantity was 100 . But the strange thing is the share closed at 59.65 . I mean how can it be possible ? Will my remaining quantity go to pre market session next day ? Kindly clarify .

Vishal-Punching at server of NSE or BSE makes this difference in execution. No, it will not carry forward the order. It is considered as lapsed order.

Thanks a lot for replying . But still its difficult to understand that my order is already partially executed at 59.75 which means my order should be considered first as a buy at this price on the first come first serve basis .

So , now the question is if my order was already there at 59.75 , how can the stock reached the 59.65 level without fully executing the partially executed order at 59.75 .

This is total strange and my money is blocked for 500 shares instead of 100 shares. I am not understanding it .

The concerned Stock here is Kopran. You can check at what price it is closed at NSE .

Vishal-If the money blocked for 500 stocks then it is purely wrong. I think you check the DP statement. If the money blocked then in my view orders executed.

Hi,

I checked Pre-Open Order Collection for NSE at http://www.nseindia.com/live_market/dynaContent/live_watch/pre_open_market/pre_open_market.htm. When I click on any scrip it tells me me buy QTY, Price and Sell QTY. and finally it shows Pre-Order Collection summary. I am unable to follow your instructions above in those examples and IEP is something different. Can you please explain how the aggregation works in buy and sell qty? I think that is one of the parameters for deciding the price.

Thanks

J

Jvain-Check while market is in pre-open session and you come to know the applicability of above theory.

How this will work if there is no quantity on any equal buy and sell price.

Sanket-If there is no selling or buying order then the order will not execute. To say in a different format, we must have buyers or sellers for trade to take place.

i think there is mistake in scenario 2

Madhur-Please let me know why you felt so?

Is this the reason…if the stock is up 5% in pre-open…as soon as the market opens…the stock goes down….

Rohit-It happens…watch the movement of few stocks.

Hi Tonagatti,

Very Nice Article and helpful for Traders…..

One question confusing me that…. if Order will excecute after 9:08 AM, then why NIFTY and SENSEX Keep Changing from 9:00 AM to 9:15 AM Continue in Up/Down Pattern with huge Difference.

What is the Reason for that…. ?

Milan-Please notice. After 9.08 it will not change.

Nice article..feeling great..

but neeed some more clarification,..

1.how pre open market is helpful?

2.how to decide the trend upside/downside based upon preopen market?

Mohammed-1) I am investor and for me it does not matter. But for traders it make sense to judge the future course of rate. 2) You can’t predict.

very good article, thanks for updating my knowledge

Great writeup. What a way to shaft innocent derivatives holders. The pre-open session has been the biggest fraud heaped on unsuspecting traders of NSE/BSE. I don’t understand why dalal st. crooks are allowed to benefit from gap openings and retailers/small investors always lose. SEBI is very much a party to this institutional fraud. We have the same round robin trades throughout the day. Indian markets are no longer Indian.

Boka-Thanks for your views 🙂

Hi Bavaraj,

Is this applicable to FnO also? One more query…where does this demand and and supply came from?

Vijay-It is applicable to equity but not to F&O. Demand and supply will come from the sellers and buyers who place the orders.

I saw many days that NIFTY price changes at 9AM itself (you can see that on CNBC TV 18 too). How can this be? The market has to discover price from 9:08 to 9:12 right? How come price changes at 9AM and further changes at 9:15 AM?

Investor-Don’t check CNBC or any news channel. Instead either check your trading terminal or NSE site itself.

Thanks for a very nice article. One question to you Sir. For an equilibrium price , where demand is more than supply, few people will not get shares. How it is decided who will get shares and who will not..? Who decides this.? Thanks,

Sachikant-It is again who placed the order at first and decided by exchange as it will have data with timing.

Hi Basavaraj,

Do you know any link where we can get archive data for opening pre session qty. I feel this is the

deciding factor how share is going to react whole day.

Regards

Nisar

Nisar-I am not aware of such data. But if possible you can try with NSE or BSE.

Really Good Article..

Really good article..

How is it beneficial to know about the Pre Market as by the time trades get confirmation so do the price too may get changed (i believe,may be i am wrong) of an xyz company?

what is After Hours Trading Session?

Are stocks gets manupulated by big investors? As they buy in huge quantity and sell them off as soon as posible

i am a rookie..please can u suggest somthings more things to gain knowledge that will be really helpfull

looking forward for your answer

thanks

Dominic-Pre-Open Session will give indication. Regarding After Hours Trading Session, you find wonderful explanation HERE. Yes sometimes they get manipulated. But there is something called circuit breaker to stop such huge manipulation.

Sir, If I place a order in pre-open Market for buy xyz share in Rs. 100 and the equilibirum price comes Rs. 95 than on which price my order get executed. If my order get executed on Rs. 95 for which i had bided for Rs. 100. please tell Rs. 95 shall be debited or rs. 100 shall be debited from my account.

Vimal-Amount will be always debited based on executed price.

With due respect to you Sir,

Since last one week I am putting my buy order for Aimco Pesticide at 5% Upper Circuit Limit , but My order NOT GETTING EXECUTED . What is the mechanism , why my order is not getting execution ? I am entering at shaft 8.45am on BSE terminal . Can you please guide me how can I PUT my order atFirst , , so that I can atleast get 100 shares ?

With regards

Vakharia Mahesh

Mahesh-The process is already explained above. For further clarification you can contact your broker.

Hi Basu ,

Superb Article!!!!!

Could you please elaborate on Advantages and Disadvantages of Day Trading..?

Thanks in Advance.

Rahul

Rahul-Day trading is more of disadvantages than advantages. It need a full fledged post to discuss about it. But this is my opinion.

When I can place an order in pre=market session? Should I use AMO or can I place the order like normal (market open time) time I do?

Atanu-AMO stands for?

After Market Order

Atanu-You can place orders normally either at market price or at trigger price.

Hello

I really appreciate for the contents of article, but there are some doubts may be because stock market is new for me. I will be glad If you clarify the following doubts.

Scenario I – Order book – buy and Sell – are these quantity for a period say 9.00 to 9.12 or at a start of session.

Demand and supply quantity and Maximum trad able quantity – not clear to me, how you derived these quantity numbers.

Unmatched orders – is the difference between demand and supply? Why it can not be difference between buy and sell.

Thanks

Vishwas-Quantity numbers are based on placed orders during that period. Unable to understand your second doubt. Please elaborate more.

I m mechanical engineer but want to learn day trading, is there any job about trading

Mimvs-Do you know the risks involved in day trading??

Excellent Article!!

Can you please elaborate on “Price band of 20% shall be applicable on the securities during pre-open session.”

Varun-I don’t think it will be applicable during pre-open.

Hi,

Very nice article. Is there any partial execution happens in pre-open market? If yes, Premarket partial executed market orders, what rate it will be executed in the regular market?

Ananth-Whatever partial orders will be converted to market regular orders and once price tick at that level then they too get executed.

Then what about market orders. How it ll get execute?

Prasanth-Market orders are nothing but the orders executed at market price.

Nice article

San-Pleasure 🙂

but why there is always a significant move in pre market as compared to normal trading sessions? and also if our limit order does not get executed in pre market , then later do we have a option to modify or cancel it?

Krishna-It is the speculation that leads to high volatility during this period. Later part the non executed orders are considered as limit orders hence you have option to modify or cancel them.

Hi, please clarify one point during pre market trading.

Suppose i place a buy order at market price @9 AM (which shows last day traded value), does it automatically pick the market price after call auction price and execute the buy order or it waits till 9.15 am to pick the stock open price and then execute the buy order.

Dear Biplab,

It waits up to 9.15.

Hii Basu

A very nice article

I want to know about how price band works ?

and what do you mean by buffer period ?

Sumeet Gupta-Are you asking about IPO Price Band? Then it is the decision of Issuer who decides price band for that particular issue consulting with underwriter of that issue. Basically it is based on the company valuation and expected demand. Regarding buffer period, I wrote in above post. It is the transition period from pre-open to normal market period. Hope I answered your queries.

Thank you so much. I was longing for this . I have one question , all market orders will be executed , n what about the limit orders which are matched with decided pre open price?

Sarvana-They will converted into normal limit orders (I mentioned the same in last lines of this blog).

Can you tell me what are the risks involved in day trading. I am novice in this field