Each year July month is a peak time for taxpayers to file their IT Return. However many of us are unaware of the process of how to pay income tax online in India using Challan 280? Let me share this with you all today.

Many of are unaware of pay income tax online in India using Challan 280 because we are relying on CAs or tax consultant. However, it hardly takes you few minutes to pay your income tax online.

There are various cases when you have to pay the income tax and they are as below.

- When TDS deducted is less than your liability.

- When you received the notice from IT Department to pay the balance tax.

- When you have other sources of income and combined all together, your tax liability raises more than your employer deducted TDS.

What is the meaning of Challan 280?

Challan 280 is the form which is required to be filled when you want to pay Advance Tax, Self Assessment tax, Regular Assessment Tax, Surcharge, Tax on Distributed Profit or Tax on Distributed Income. You can pay such taxes either offline (at banks designated to collect income tax) or through online mode.

How to pay income tax offline in India using Challan 280?

As I said above, to pay income tax offline in India using Challan 280, first you have to download the Challan 280 at first. Fill in the details and submit the same at the banks designated to collect income tax.

You can pay the tax through Cash, Cheque or Demand Draft mode.

How to pay income tax online in India using Challan 280?

There is one mode through which you can pay income tax online in India using Challan 280. This is simple and fast. However, you must have internet banking facility to avail this facility. Also, now you can pay the income tax using your debt card also.

Let me share you the steps involved here in detail.

Step 1-

Visit the NSDL LINK and choose the Challan 280 from the list of challans available there.

Step 2-

The next step is to fill in the details in Challan 280.

Here, you have to fill the fields which are mandatory and they are as below.

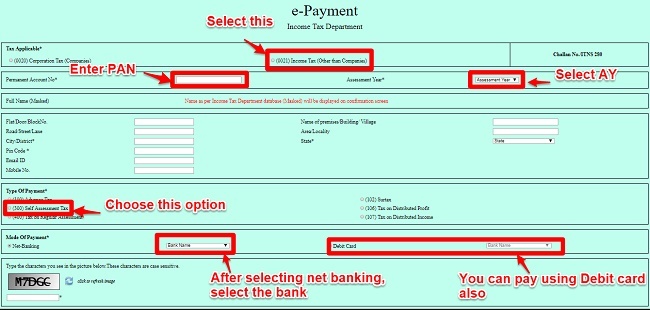

# As you are an individual, hence always choose the option “0021 Income Tax (Other than Companies)“.

# You have to enter your PAN number.

# Select the proper assessment year. You must have to take the highest care while selecting the AY. For FY 2017-18, the AY is 2018-19.

# Then select city, PIN Code and the state.

# Then under the “Type of Payment“, choose the option “(300) Self Assessment Tax“.

# Next is to choose the mode of payment. Here, you can either pay through internet banking or use a debit card. If you opted accordingly, then you have to choose the bank.

# Finally, click on the “Proceed” tab after entering the security code visible to you.

Step 3-

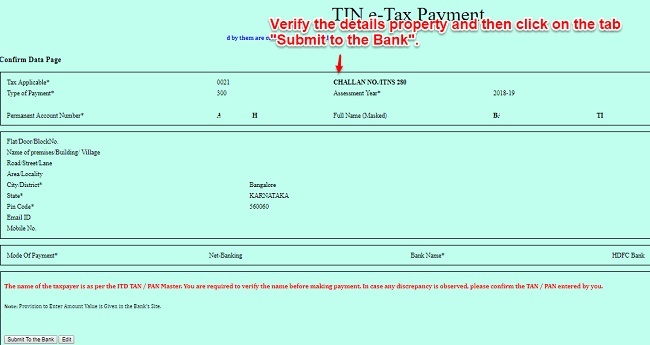

Once you click on “Proceed” tab, it will show you the below screen where you have to cross verify the details and then confirm on the tab “Submit to the bank”.

Step 4-

Once you click on Submit to the Bank” tab, it will redirect to your selected Bank’s internet banking login screen. You have to login and you may see the screen like below.

Here, you have to break up the tax payable into its components, i.e. “Basic Tax”, “Surcharge”, “Education Cess”, “Others”, “Penalty”, and “Interest) as shown in the picture below.

Step 5-

Once you make the payment, it will give you an option to download the challan receipt in the PDF format. Also, you will get the challan copy to your registered email. It will look like below.

You notice that this receipt also contains the Challan Identification Number (CIN). Challan counterfoil will contain CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made. You can verify the status of the challan in the Challan Status Inquiry at NSDL-TIN website using CIN after a week, after making payment.

To verify the status, click the “Challan Status Inquiry” link. Here, you will find the various ways to check the status. They are as below.

a) CIN based view.

b) TAN based view.

c) Collecting Bank Branch.

d) Nodal Bank Branch.

You have to select the CIN based view as you have CIN number available in challan counterfoil. Once you enter the CIN, then you can view the following details.

- BSR Code

- Date of Deposit

- Challan Serial Number

- Major Head Code with a description

- TAN/PAN

- Name of Tax Payer

- Received by TIN on (i.e. date of receipt by TIN)

- Confirmation that the amount entered is correct (if the amount is entered).

The status looks like below.

Along with this, you can also verify the tax paid details in “Part C of Form 26AS” also (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax, it will appear in this section. Verify that advance tax or self-assessment tax details are showing up in Form 26AS, If they don’t match with your details or status not showing, then you have to contact the Bank. It usually takes around 3 to 4 days to reflect once you paid the tax.

What to do once you pay income tax online in India using Challan 280?

Once you pay income tax online in India using Challan 280, you have to show it in your ITR. If you have paid Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is ZERO before submitting the return. Look at the image below for your reference.

Advantages of pay income tax online in India using Challan 280

- You can pay the tax by sitting anywhere on this earth.

- By instant payment acceptance, you can avoid the late penalty charges.

- It is purely secure and confidential.

- You can keep the receipt either in softcopy format or in hardcopy format by printing it.

- Even your bank statement also shows the proof of your tax paid.

Hope this much information is sufficient for you to understand the process of how to pay income tax online in India using Challan 280. Let me know if you have any questions.

I am an individual and I paid self assessment tax. Unfortunately, before I could print the RECEIPT my computer hanged. I need the payment receipt but do not know how to get it. Please help.

Dear Ashok,

Check by login to your IT portal.

I am a doctor working for a hospital and I get salary. I also admit my private patients to this hospital and the hospital pays me my consultation charges for my services after my duty hours for attending to my private patients. In my form 16 my employer has shown this under Professional Charges — Private Clinic. They have deducted tax on this as usual and it is appearing in form 26AS. Can you advise if I can show this Under Clinic Income for Presumptive tax purpose ie 50% of my total Clinic Income? Will it be disallowed as it is payed by the same employer?

Dear Rohit,

It is your professional income apart from salary income. Even though it is paid by the same employer. Hence, first check the presumptive income eligibility and then go ahead.

Sir

I am a salaried person and also having two house in my own name. In one house I am residing and other is given in rent. Which return should I have to filed ITR1 or ITR2 ?

Pl guide me.

Thank you

Dear Ashish,

Use ITR2.

Ok sir

Thanks.

Hi Basu,

Thanks for the informative article. One small doubt regards to ITR Filing. I am a salaried employee supposed to submit itr1. The deadline extension from July 31 to August 31 2018 applicable to me or not ? Please advise

Dear Shanmuga,

Yes, it is applicable to you also (If your Income Tax Return is not subject to any Tax Audit).

Thanks very much !