Today I will show you how you can reduce your tax liability on Interest you earned by investing in NSC. Many investors may not know how to do it. As you all know, interest you receive on your investment in NSC is taxable when it matures. It is taxable income under the head of “Income from Other Sources”. But there is a way to reduce a bit by following your accrued interest on yearly base. Before we discuss further, first we will glance at the features of NSC.

Tenure-5 Yrs and 10 Yrs

Min Amount-Rs.100

Interest rate-8.4% for 5 yrs deposit and 8.7% for 10 yrs deposit (Compounding Half Yly)

Tax Benefit-Avail upto Rs.1,00,000 by investing in NSC under Sec 80C of Income Tax.

Maturity Taxation-Interest is taxable under the head of “Income from Other Source”

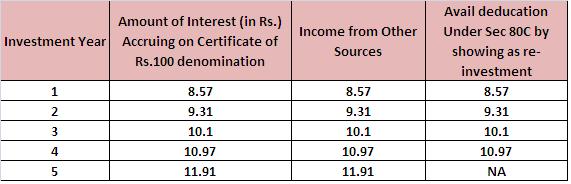

Suppose you invested Rs.100 in 5 Yrs maturity NSC then you will get the tax exemption under Sec 80C when you invest. Hence, after 5 year you earn Rs.50.89, which is taxable income under the head of “Income from Other Source”. But how to reduce tax liability on interest you earned? First you need to show each year’s accrued interest as income under the head of “Income from Other Source”. Afterwards for the same amount of interest you can avail deduction under Sec 80C as re-invested in NSC. But you can avail this facility till 4th year for 5 Yrs of NSC. If you look at below table then you will get the clarity of what I am saying.

So till the 4th year interest you can claim as re-investment and avail deduction. Suppose you didn’t claimed yearly interest, then the maturity accrued interest of 5th year will be calculated as “Income from Other Source” and it will be taxed as per your tax slabs. Hence it is better to claim on yearly base till 4th year to avail the exemption benefit (About NSC Tenure-10 Yrs, when I contacted local Post Office, even they don’t have clarity about that. Hence, I avoided to mention about 10 Yr NSC). Hope this posting may benefit a lot of people. Happy Saving!!!

i have invested Rs. …………..in several NSC’s at different time. this year AIS reflects interest amount of each NSC though they are yet to mature. since i am filing iTR under new tax regime . how can i defer the tax liability on the interest until the maturity of the NSC. plz guide at the earliest

Dear Jannat,

As I mentioned above, you can ignore the interest accrued on yearly basis and can show it during the maturity.

Excellent information, concerns are understood so easily.

Dear Mehul,

Thanks.

A Post office NSC matured in FY 2021-22.(NO TDS) I have been paying tax on accrued income every year for the last 4 years. However PO has reported the entire 5 year Interest on AIS for FY 21-22. 1. Can I use AIS feedback “Information related to other years” and assign the last 4 years interest to those years?

2. I see I can only assign to past 5 years or future 5 years. What to do for KVP which has maturity of more then 9 years. How to assign to 6 or 7 years in the past?

Dear Ganesh,

For NSC you can do so. For KVP, where does the tax saving will come into picture?

Sir I had bought NSC which has been matured..I have been showing the interest earned in it since 3 years in income from other sources by calculating it myself…but this year the whole maturity interest is been shown in the AIS …now can I file the itr this time too in the same way and make corrections in the AIS …for just the 5th year…and can be exempted from the tax on the income for the last 4 years….or I have to give tax as they have provided

Dear Nishant,

You have to show the total interest income of last year of NSC as an income. Yes, you can correct it as in your case you are showing the interest income on yearly basis while filing ITR.

Dear Sir,

I did not show my NSC income in ITR till maturity. Now it is showing in AIS on ITR website and whole interest of 5 years is being taxed in 2020-21. Can I claim relief under section 89 and show interest of 1st 4 years as arrear?

Dear Sanket,

Sadly you can’t.

I has FD in bank which is to mature in 21-22 financial year. Bank has shown the interest accrual and tax paid in for 16A of 20-21. I want to know weather I could skip this in my income tax return and show the earning in whole in 21-22 when it will be matured.

Dear Dibakar,

You can show both ways.

Dear sir,

I invested rs 3.5 lakh in July 2020 in NSC. If I want to claim yearly deduction of interest then in which f/y ITR return will i claim my 1st year interest deduction. F/y 20-21 or f/y 21-22 return? And shall I claim interest from July20 to june21 or I have to calculate interest from July 20 to March 21 and so on?

Dear Udit,

You can’t claim earlier interest now (if you not filed ITR). Regarding the ITR form, I don’t know what are your income sources. Hence, hard for me to suggest a particular form.

1) I have various investments on cumulative basis – On which TDS is not applicable ( Like Post office ) – Can i offer tax on maturity of investment instead of annual accrual ?

2) While cumulative investment on which TDS is applicable – i will pay tax on accrual basis as per my 26AS – is it correct to follow both above at the same time ?

It maybe noted that I donot use any of the interest accrual for 80 C benefit rather i invest 1.5L seperately in PPF for 80C.

3) Further , when do i need to pay tax in case of GOI (2018) cumulative bonds ( they will deduct TDS at one go after 7 years at the time of maturity )

Kindly advise on all or some of the query above. Thanks.

Dear Vishnu,

1) Opt the one which is comfortable or beneficial for you. There is no hard rule.

2) If you are showing on yearly basis as income, then even though they deduct the TDS on maturity amount, you can show the last year’s interest as income and calm the TDS amount back (if any refund).

3) At maturity.

Hello Sir,

Invested in NSC on 14-Feb-2016 and Maturity date was 14-Feb-2021. On maturity, I have planned to show first four year interest under 80C and total five year interest under “Income from other sources” in IT return of FY 2020-21 but due to corona, I could not visit the post office before 14-Apr-2021. I will redem after 14-Apr-2021.

I would like to know

> Now what will be the maturity date, will it is be changed?

> Which finanical year applicable.

Dear Ketang,

Your maturity date will not change.

Thank you for your reply.

In my case due (Maturity) on 14-Feb-2021 and receiving somewhere in 25-Apr-2021 . Two different financial year So I would like know that in which financial year of IT Return I will have to show first four year interest under 80C and total five year interest under “Income from other sources”.

Dear Ketang,

As you are realizing it in this FY, show in current FY.

Can we show Every year Accured interest of NSC at ITR OR we can only Show interest after maturity.

My 80C is already exhausted.

If I pay yearly tax that will be beneficial at my salary increases every 2 years.

Dear Ashish,

You can choose any one option as per your comfort.

Sir,

I have invested Rs 150000 in NSC @8% interest in 03/2017. Total interest earned will be 70399. Pl let me know how much amt to show as income from other sources on yearly basis for 5 years and if I want to show it in 5th year, how much I show. Thanks

Dear Jeetendra,

Sadly I can’t do the calculation for each individual for each year. Take the pain and read the above post, please.

Dear Sir,

I need your help.

I purchased NSC in Dec-14 of worth Rs. 40000 and purchased Rs. 70000 NSC in Dec -15. I claimed only principal in those particular year ITR but did not show interest (In form of interest of other source & in deduction in 80C) from those in ITR of subsequent years.

Now in Dec -2019, NSC of Rs. 40K , Purchased in Dec -14, got matured , but i could not got them en-cashed them. SO please help me with your kind reply of following questions.

1). As encashment is not done so far,can i show interest of NSC in income from other sources , if yes then which 5th year interest or complete interest?

2). As i did not shown interest of Rs. 70000 NSC Purchased in Dec-15, so can i show fourth year income in ITR AY 2020-21?

3) As there is no details of NSCs in 26AS and declaration of interest of NSC will lead to notice from ITR? Then how to deal with this notice?

Thanks in advance…

Dear Alok,

1) Total interest.

2) The total interest you can now show at maturity as earlier you have not adopted yearly disclosure.

3) You have to declare it during filing of ITR.

If I purchase NSC in the middle of FY20-21, then in FY21-22 should me 80C claim on interest be Principal*Interest rate or should it be (Principal*Interest rate*Number of days in FY20-21) / 365 ?

Dear Sanchhit,

To avoid confusion, better you claim principal for FY where you invested.

Sir,

The way of showing Interest on NSC as income and then claiming deduction u/s 80C for first 4 years is correct. I want to ask whether only Interest of 5th year is taxable on maturity or Entire interest accrued on NSC will be taxable on maturity. Kindly clarify.

Dear Vishal,

It is 5th year interest.

Sir , Suppose I invest 100000 in nsc for 5 years the principal amount is deducted under section 80c in only first year or for all five years.

Dear Rishi,

It is only for the first year.

Dear sir,

Thanks for this excellent article. My query is:

Suppose if I invest 60 lakhs in nsc and I file my returns each year along with other income, which doesn’t exceed 6.5 lakhs as per present IT relief.

I will declare nsc interest each year under 80c. I am also investing 1.5 lakh in PPF.

On maturity of nsc in fifth year, since the amount is not reinvested, the 5th year interest is taxable.

Can we avoid this tax by showing my PPF of 1.5 lakh under 80c for the 5th year if I am with in the tax rebate.

Kindly advise.

Dear Roshan,

Sadly you can’t do so.

Dear sir,

Thanks for your prompt reply.

SIR SUPPOSE RS. TEN LAKH NCS VIII ISSUE IS INVESTED FOR 5 YEARS. YEARLY ACCURED INTEREST SUPPOSE 80000 THEN IF WE DON,T SHOW THIS INTEREST AS INCOME AND DEDUCTION IN 80C AS WE ALREADY HAVE 150000 DEDUCTION IN 80C SO AFTER 5 YEARS AT THE TIME OF MATURITY IF WE GET TEN LAKH + WHOLE 5 YEAR INTEREST SAY 5LAKH SO THE INTEREST WILL BE TAXABLE UNDER OTHER SOURCES AND NO DEDUCTION IN 80C WILL BE APPLICABLE. OR WE CAN SHOW 150000 80C DEDCUTION AT THE TIME OUT OF 5 LAKH INTEREST AND OTHER 450000 OF INTEREST WILL BE FULLY TAXABLE.. IS IT RIGHT PLEASE CLARIFY.. THANK YOU

Dear Nishant,

This will be correct “SO THE INTEREST WILL BE TAXABLE UNDER OTHER SOURCES AND NO DEDUCTION IN 80C WILL BE APPLICABLE.”

I HAD VARIOUS NSC DT 31/03/2014 MATURED ON 31/3/2019. I DID NOT ENCASHED THESE NSC’S IN THE FY 18-19 i.e. ON 31/03/2019 .I HAD CLAIMED THE ACCRUED UP TO 4 YEAR AS INVESTMENT IN MY RESPECTIVE ITR .CAN I CLAIM THE 5TH YEAR ACCRUED INTT BOTH ON INVESTMENT SIDE AS WELL AS ON INCOME SIDE IN THE ITR FOR THE FY 18-19. ALL THESE NSC’S BEEN EN CASHED IN APL 2019. PLEASE GUIDE .

Dear Yash,

You claimed the INVESTMENT, but you failed to show the interest income?? You have to show the income also.

If i show the accrued interest of each financial year in my it returns and claim deduction under 80c, now atlast , at the time of maturity, do i have to show my it returns soft copies of all the previous 4 years to the postmaster as proof .

Dear Kiran,

Why?

I bought NSC few years back .I have not show the accrued interest of each year or claimed deduction under 80c for this accrued amt in the tax returns of the previous years.My nsc is maturing this year ,can I file my return with just this years accrued interest under income under other source or should I show the the entire interest income and then claim 80 c for an amt totalling the interest amt for the previous 4 yrs ,since they had been reinvested every year.

Dear Rad,

You have to show the entire income as the income from other sources for this year. This entire interest again can’t be claimed for Sec.80C. Because the interest is again not investing in NSC.

Anyother way I can reduce my tax liability with regard to this interest amount

Dear Red,

NO.

Thanks for your help

Hi Basuji,

I am an nri (working) and my wife (not working) is in India. I thinking of investing 1 lakh (single payment!) in 5 yrs NSC. Is it necessary for my wife to file tax returns?

Dear Raju,

Mere investment will not be a reason to file a tax. It is income which matters to file IT Return.

You have shown in this post how you can claim accrued interest on NSC till 4th year as reinvestment under 80 c and avail deduction under 80 c for it. Can you do the same till 4th year for accrued interest from Tax saver FD (if bank has not deducted TDS as I had submitted form 15G)?

Dear AR,

Sure…let me write a post on this in detail.

Hello…indeed a greatly useful post….I have purchased NSC worth 80,000 on 16th Jan-2018. Now the quarterly rate for Jan-2018 to March-2018 was 7.6%. I calculated annual interest for 80000 for 365 days which came 6080/-. Now interest for 75 days (from 16th Jan to 31st March) come out 1250/-. So should I show 1250/- rs. as reinvestment for tax exemption while filing return for AY 2018-19. Is it the proper way of calculation?…Please guide….Thanks in advance.

Dear Dipti,

Yes, you can show it as I already explained the same. Regarding calculation, I can’t do the same for each individual.

If investment made on 16th January-2018 is more than Rs 2 lakhs, then you have exceeded 80C limit of Rs150000 for AY 2018-2019, hence the interest on Rs2lakhs for the period 16-01-2018 to 31-03-2018 would be treated as income from other sources. Sir,Please correct me if I am wrong

Dear Anand,

Yes.

Dear Mr Basu, I intend to invest 50 lacs in NSC. I will not claim yearly accrued interest. Also I will be investing 1.5 lacs in PPF seperately. In that case, is the maturity amount ( net gains) of NSC taxable? Or only the 5th year interest taxable?

Please advise…

Manjunath-The whole interest is taxable.

Sir, very informative article

One query ,

Can you explain how to show accrued int of nsc

If nsc is purchased on 13.7.17 for rs 20000.- and it will mature on 13.7.22

So accrued int for

Fy 17-18

Fy 18-19

Fy19-20

Fy20-21

Fy21-22

Fy23-23 , as nsc is maturing on 13.7.22

It will be very helpful to me ,if you give me exact interest amt for above example for corresponding fy year

Thanks in advance

Minal-It is hard for me to calculate each individual and explain. Please refer above post.

Dear Basavaraj – I have purchased NSC of 5 years tenure. It’s currently in 4th year. I did not claim yearly interest for first 3 years as re-investment, while filing IT returns. At the end of 4th year’s IT returns filing, is it ok to claim the accrued interest for all 4 years together, in order to reduce tax liability upon maturity?

Raj-Yes, you can do so by referring above post.

Hi Basavaraj,

I made two Joint NSCs of 1.50 lakhs each, in the name of myself (first name) and my mother (second name). Can I show one of them under 80C for my ITD and one in my mother’s name?

Basically, first name and the second name have equal importance or not in a NSC certificate?

Thank you

Pratik-As the first holder is YOU, you can claim the tax benefit if the investment source is from your income.

And if the investment source is from my mom’s income, I can show it under her tax declaration?

Pratik-Not possible.

Sir my expired in Jan 2018. There many certificate of NSC on her name. I am the nominee of the said. Whether the amount payable to me as a nominee is taxable or not. Please reply.

Jitendra-Yes, it is taxable to the deceased head but not for you.

Thanks. On death of my mother NSC amount payable to me as a nominee whether I have to describe the income from other sources In ITR .the amount is taxable for me or not.

Jitendra-It is not taxable income for you. Hence, you have to show it under the exempt income.

Hi Sir ,

I purchased NSC VIII last year for 50000.

Now during ITR I need to show the accrued interest. When I asked in post-office they said they cannot give those statements showing the current accrued interest.

I only have the passbook that shows the amount deposited and maturity amount.

Now my Qs is I need to calculate the accrued interest on my own and put that value during ITR is it?

How can I give the proof?

Subash-Yes, you have to calculate and put it. Your proof is your NSC certificate.

Hi,

Sir i want invest in FD post office ,, for 5 years plan please advise to me which plan good .

Nagu-It is hard for me to guide you with mere two lines of your sharing.

Hi,

I have FD’s done at bank whose over all interest is exceeding taxable limit,Hence i am eligible for TDS deduction from bank.

But my question is how these TDS computation will take place because some of my FD’s are maturing in FEB’18, Some in March/April’18 and rest in March/April 19.

Fd’s Maturing in Feb’18 and March’18 has interest less than taxable limit.will i have to pay TDS ?

Thanks,

Rajan

Rajan-Don’t bother about TDS. Bother how much you earned in total for that FY and based on that compute the taxation.

Thats the Issue..How will i come to know how much i had earned from Bank interest, As i am not sure of my income in the current FY.

My FD are for 2-3 years duration.How these calculation are done ?.

Even bank people are not ready to say.They say they too don’t know. 🙁

Rajan-You can ask the bank for the same. They will provide the interest earned for that current FY.

I am Pensioner, having pension amount of approx 25,000 P.A(EPS pension), I earn interest on my saving which is crossing taxable limit.In order to get tax benefit, can i claim House rent Allowance under section 80GG.

Sharma-But you are not employed then how can you claim?

Sir, I purchased a NSC on 1st June 2017.

So, For F.Y 2017-18 accrued interest will be calculated up till 31st March 2018?

Am I correct?

Also there would be problem in computing tax if NSC is purchased in between a F.Y.

This way interest will be treated in 6 Financial years for a 5 yr NSC

Yash-Your understanding is correct.

Hi,

Earlier I was working as Software Professional and used to file ITR. Since 3 years I am unemployed. I have invested 4,00,000 /- in NSC, which got matured in 2016 and have re-invested the entire amount again. This I never showed in ITR, but now can I show the interest under other income? If I show then, in ITR form it asks for TAN number. what should I give?

Pallavi-Yes, you can show it yearly like I explained above. I think you are not showing this as INCOME FROM OTHER SOURCES.

Yes, I did not show that under Income from other sources. But I wanted to show that now. But did not know how to. Since I am unemployed now, I don’t get any salary. But the interest on NSC and other bank FDs are my earnings. Since Bank interests can be seen in 26AS form. But interest from NSC cannot be seen anywhere. It is so confusing to show it in the ITR. My question is should an unemployed person also submit ITR?

Pallavi-Is there any law that unemployed person must not have any asset and must not have any income from such asset? There is no such law. You can show the income and file the IT Return.

Thanks you so much.

Hi Basavaraj sir,

I am a regular reader. You are doing a great service to all with your advice. Thank you very much.

I informed my Uncle in Salem of the procedure to get money after maturity. But things turned different for him, which I would like to share with you and all.

There is no application to fill for getting the amount, just hand over the signed NSC and they give you a cheque. But some questions did arise, which he asked me, for which I had no answers.

1. When he gave the NSC, he was asked to give a copy of PAN card with signature on it. He did it. Later when waiting for the cheque, another person came, who was asked Aadhar Copy. Why the difference? He has not asked the clerk.

Is it for taxing purpose? But I had read you say there is no TDS. For him too he got full cheque. But still why the difference in asking documents (photocopy)?

2. He went after 15 days of maturity, they didn’t give any amount as interest for 15 days, they said its for more than a month only. Is it so? Isn’t it daily interest like in banks?

Could you please reply.

Thanks a lot once again sir.

Senthil-1) Now PAN is mandatory whether there is TDS or not.

2) They really need some heat treatment by using and making customers suffer like this. Who will the hell give the interest for those 15 days? I don’t think you did right by waiting for 15 days. They must give the cheque on the same day of the presence of documents.

To be frank, they are still living in the era of 1947 and think they are the BOSS and we are the servants.

Thanks for the reply sir.

1. If PAN is mandatory, why another person was asked just for Aadhar?

2. Is this info of withdrawal sent to IT or just procedure to have all transactions under PAN?

3. Actually he got cheque on same day. He couldn’t go immediately after maturity. Yes sir, they should have given interest for 15 days like banks.

4. Why no more “NSC maturity form” filling? All forms done away sir?

Thanks for reply once again sir.

Senthil-1) How you know that he submitted only Aadhaar? He might have already submitted the PAN, which your uncle might have not noticed.

2) There are certain limits to report to IT Dept based on the financial transactions. For that purpose, they need the PAN.

3) Agree.

4) It is the process of Post Office.

Thanks for the reply sir.

Hi Sir,

Could you please give the link of your older blogs where you have given info on Post Office SB account. Thanks.

Or if not, can you please give some advice regarding the following doubts:

1. Do we need introduction from an existing A/C holder to open an account?

2. Minimum balance is Rs. 50 but what is the maximum balance, we can keep?

3. Should we compulsorily take Debit card (RuPay) or can we decline? Online Banking is optional I think.

4. Do they give cheque book or just withdrawal slips?

General Question:

1. Is it ok to open a SB account or is there any unseen restrictions, that it is better not to open an account?

Restrictions like regarding closure, interest, TDS, other procedures etc….

Thank You sir.

Senthil-1) It is usually asked to identify the person.

2) There no such maximum limit.

3) It is up to you.

4) You can open. But many of the Post Office rules are customer unfriendly.They are very rigid and not service oriented.

Thank you very much sir.

Dear Basu,

Thanks for this informative post. I have a query and would be grateful if you can resolve it.

I purchased NSC six years back and have not declared the accrues interest in any IT returns. Now they have matured but I have not encashed them. So the entire tax liability of the total accrued interest (of six years) would be taxable in the year of maturity or encashment.

My problem is I cannot get it encashed before 31 march this year, as I am in other city and the NSC are at my home town. Instead, can I declare the entire accrued interest income in this year only in my IT returns under Sec 80CC to save taxes. Or can I declare this only next year after I get it encashed.

Please note that currently I am studying and don’t have any income in current fiscal year.

Ka2047-Without liquidating the NSC how can you show in ITR?

So encashing them before march 31 beneficial as I don’t have any taxable income this year.. Right ?

ka2047-Yes, if NSC maturing.

I intend to purchase NSC jointly (myself & wife). Intend to get 80C benefit in my itr and not in my wife itr. Now question is interest accrued from NSC can be shown in my wife’s itr as other income or not. Her total income does not come as taxable income after showing the aforesaid interest. Simple question is purchasing joint NSC and earning interest on it will be property of second holder or who is taking benefit u/s 80c, or the interest earned can be shared.

Harsh-IT Dept more intelligent to your SIMPLE logic. Before taxation, they will check the source of investment. It is from you. So definitely the tax liability will be on your head.

I have invested Rs. 50000/- in 5 Years NSC VIII issue on 3rd Feb. 2017. What will be the accrued interest in 2016-17, 27-18, 18-19, 19-20, 20-21, 21-22?

Mukund-You can easily check based on the interest rate applicable to you.

I have Purchased NSC for Rs.1,00000/- for 5 Years VIII issue on 19.01.2017. what will be the accrued interest for the A.Y. 2017-18

Vidya-The interest rate is already mentioned on your certificate. Based on that you can calculate and show in ITR.

please provide information about show nsc for icome tax declaration. i already purchase nsc on date 10 feb 2017 . postoffice not give me hard copy of certificate. they give me passbook so how show nsc for declaration. passbook statement accept or stamp of post office compalsary on statement or only passbook xerox sufficient to sho

Pritam-Photocopy of passbook is suffice.

Hi,

I have invested 1,30,000 in NSC VIII (5yrs) during last year (2015-16). I have shown this under 80C as well. But did not claim the interest under 80c & “Income from other Source”. So, my query are two folds:

(a) What if, I don’t claim the interest for the rest of the period till maturity. How much amount will I be getting on the maturity.

(b) If I can claim the interest for this year (Based on calculated interest of 1,30,000 i.e. 11,284.)

Also, I buy NSC every year as an investment and show it under 80C with full principal amount.

Please help..

Kumar-It is total interest less of tax.

Sir earlier my father purchased NSC VIII issued and due to his illness they put my name jointly. After 1 years they had expired. Now how I shown the interest income in my IT returns. Actually this amount was my fathers and there have no tax liability on him if they had include this income in his returns. Still my mother has lived and I want to give this amount to him. What option I had for tax point of views. I want all transaction within permissible rules of IT. Total interest amount is approx. 50000/-. That time I am paying tax on my all investment and if I will included this interest I needs to pay highest slab of IT i.e 30%. Please advised me within framed rule how I keep my tax liability minimize.

Thanks

Sharma-Being join holder, after your father’s death whatever the interest you earn, will be in you head.

Hi,

To get the Investment deduction of 80 C from my Salary, every year I purchase NSCs for 5yrs and 10yrs worth Rs 2,00,000. So, I show 1,50,000 in 80C deduction out of those 2,00,000.

I’ve never utilized the benefit of ‘Interest earned on NSC’ for 80C deduction as I always buy more NSCs then required.

Kindly confirm,

1. Is it better to go with taking the benefit of ‘Interest earned on NSC’ for 80C deduction, considering, in both the cases I’ll invest atleast 2,00,000 in NSCs every financial year ? Or is it fine the way I am showing 1,50,000 out of 2,00,00.

2. Also, please confirm the tax liability / calculation that I would need to do once these NSCs would get matured ? can there be any exemption to it ?

Anuj-1) Better you disclose and take benefit on yearly basis.

2) Interest earned on NSC is taxable.

Hi Basavraj,

It’s good to see your prompt reply on my query.

Thank you, for your kind help..!

I still have couple of doubts in my mind, please clarify :

1. Don’t you think, that calculating the interest amount every year for NSCs, that I am buying year on year, would be cumbersome process; as in any case the total amount of deduction that I would be getting is 1,50,000 only and that is some thing which I get by buying new NSCs as well..?!?

2. Will it reduce my tax liability somehow on maturity if I disclose the interest on NSCs year on year ?

Anuj-1) It is not cumbersome process. I agree the limit is that much only.

2) Yes. Because you don’t know in which tax slab you be after 5 years right?

One last question,,,

In this financial year, there would be some previous NSCs (some of 5 yrs and some of 10 yrs) are getting matured worth Rs more than 7-8 Lakhs.

So, in my case at the time of filling return do I have to pay tax on only the last year’s interest of those respective NSCs or on the total interest that I would get?

Anuj-If you not claimed earlier interest, then the whole interest will be taxable to you.

Ohhhh..!!!

Now, I understood, why you were saying, that it is Better you disclose the interest received by NSC in ‘income from other sources’ and take benefit on yearly basis as deduction..!!

As I believe, in that scenario only, I will have to pay tax on the last year’s interest. But, as I was not doing so, hence, now the complete interest will become taxable..! Right…!?!

Hi Basunivesh,

Could you please tell me how much would be the maturity amount for Rs 50000 under NSC VIII for 5 years at 8.1,%?

My passbook is showing 73807…

Please clarify

Regards

Sunny Joshi

8238140053

Sunny-When you bought this?

3rd Sep 2016

r/sir

i am middle class PSU Employee with anuual salry Rs 650000 and i have been taxed and deducted by my employer Rs 28540 during FY 2015-2016. i got my form 16.

sir i got my NSC of Rs 20000 matured in that FY 2015-16 and got Rs 32000 ( means 12000 as interest) . Is this interest Rs 12000 to be shown in my income during return file ?? i heard there is no tax on interest up to 10000. then how much interest to be shown in my income during return filling ( Rs 12000 or Rs 2000) . i keep my all records neat. plz suggest me.

Sanjeev-Yes, it is taxable income and you have to show.

sir

thanks for reply . but i did not understand whether income to show is whole interest Rs 12000 or only Rs 2000 as i heard there is no tax on interest up to Rs 10000

Sanjeev-That interest exemption is only for savings account interest but not all products.

Sir

I have requirement for guranteed return after 5 years for my daughters wedding. Are there any investment options available where I can get tax benefit of 80C for invested amount for the invested year and 10 10 D tax free maturity benefit?

Thank you.

Anil-You can try for tax saving FDs, but interest earned will be taxable.

Hi Basu,

Last time you have directed me to this page which is very informative and accurate to my concern. Thanks a lot.

Now my concern is..suppose My investment in NSC as follows:

IN Year Investment ExitYear Interest (8.5 compounded Half yearly)

2 85000.00 6 128878.23

3 85000.00 7 128878.23

4 85000.00 8 128878.23

5 85000.00 9 128878.23

6 85000.00 10 128878.23

7 128878.23 11 195407.04

8 128878.23 12 195407.04

9 128878.23 13 195407.04

10 128878.23 14 195407.04

11 128878.23 15 195407.04

12 195407.04 16 296278.98

13 195407.04 17 296278.98

14 195407.04 18 296278.98

15 195407.04 19 296278.98

16 195407.04 20 296278.98

17 296278.98 21 449222.47

18 296278.98 22 449222.47

19 296278.98 23 449222.47

20 296278.98 24 449222.47

21 296278.98 25 449222.47

22 228310.71 26 346168.01

23 248863.96 27 377331.14

24 273766.74 28 415089.10

25 298405.27 29 452446.39

26 317869.82 30 481958.82

27 346168.01 31 524864.94

28 377331.14 32 572114.94

29 415089.10 33 629364.09

30 452446.39 34 686005.77

31 481958.82 35 730752.94

32 524864.94 36 795807.82

33 572114.94 37 867448.94

34 629364.09 38 954250.95

35 686005.77 39 1040131.87

36 730752.94 40 1107978.17

and reinvest all matured amount after each completed NSC till next. As per my knowledge govt have provided to reduce tax liability up to 1.5 lacs so Suppose during any year after 11th(bcoz it will cross 1.5 lacs)..accured bonus and income from other sources will work bcoz we have 1.5 lac limit only. Or there is any alternate solution for this.

Vimal-No, there is no such alternative solution.

If a housewife invest 10 lakh rs in nsc,then does she have to pay tax on interest earn from it?

Lucky-Yes, she can invest. Taxability is same for her too.

Hi,

If I don’t show NSC for tax exemption, then also interest earned on NSC is taxable? kindly reply.

Thanks,

Shilpa

Shilpa-YES.

Dear Sir,

1. Suppose I have purchased 2,0000 NSC (10 years) in FY 2013-14 and 2,00000 NSC (10 years) in FY 2014-15 but still I have not shown as reinvestment of interest gained, If I will not show any reinvestment of interest gained, then on maturity what amount will be taxable ? if I am right, except my principal amount all are taxable, is it ?

2. whether the tax will be deducted as per my tax slab of that time or the tax slab of the NSC purchase year ?

Kindly reply

Lambodar-1) Yes, your understanding is correct.

2) It will be taxed as per the tax slab at the time of maturity.

which one of the following is better for tax saving:

NSC, PPF, Bank FD (Tax saving scheme).

Please clarify.

Thanks,

SHilpa

Shilpa-Which one will match your financial goals?

Hi,

Is interest earned on NSC taxable? If yes, how much and when tax will be deducted?

Thanks,

Shilpa

Shilpa-It is explained above.

If I purchase NSC worth 10,00,000 today (Feb. 2016) will following tax treatment apply for following years?

FY 2015-16 – upto 1.5 Lacs Deduction u/s 80c

FY 2016-17 – 86800 Deduction u/s 80c as the same will be re-invested (considering that we show this as income from other sources)

FY 2017-18 – 94340 Deduction u/s 80c as the same will be re-invested (considering that we show this as income from other sources)

FY 2018-19 – 102530 Deduction u/s 80c as the same will be re-invested (considering that we show this as income from other sources)

FY 2019-20 – 111430 Deduction u/s 80c as the same will be re-invested (considering that we show this as income from other sources)

FY 2020-21 – 121100 – No deduction – one has to pay tax on this amount as per the income slab

Your inputs are highly appreciated!!

Shah-Perfect.

I have bought a B type NSC issue worth Rs. 100000 in Dec-15, from my money only , the second name on the NSC is of my mother. Can I claim full amount rebate for Income Tax for this year?

Param-Yes, you being the primary holder can claim the tax benefit.

HI,

I would like to invest in NSC Rs.20k every month for 5 years starting from Apr 2016. Could you please show me how and when i should declare the tax for the principal as well interest from NSC for each year though i receive the full interest only after 5 yrs. O would appreciate if you can make in a table form like

FY 2016-17, Income from other sources(which is interest from NSC), 80c declariotn etc….

Ashalatha-It is already explained in detail in above post. You have to declare this while filing your IT return every year.

I have made NSC of Rs. 50000 in Feb 14 and RS. 55000 in Feb 15, I forget to claim the accrued interest for the first year of NSC made in feb14 in tax filing of ay 2014-15, can I make the claim from second year onwards and pay tax on interest of first year on maturity of NSC and can I show the accrued interest of NSC made in Feb 2015 in this year. Thanks in advance

Piyush-You can start showing from this year. But you can’t show the earlier income into this financial year.

Hi,

I am currently in US and my NSC got matured, however as of now neither I am not able to withdraw my money nor I have re-invested, NSC was for 6 yrs. and now its more than 7 yrs. Please guide what to do?? what will happen if I haven’t withdraw money from NSC nor re-invest that amount. Please guide,

Namit-If you not withdraw the NSC after maturity, then after maturity the post office gives you the savings account interest rate for another 2 years as per that period applicable rate. After 2 years of maturity, if you still not withdraw then they stop paying the savings account interest also. It will be idle as long as you not withdraw.

Thanks basu for ur kind replies.

What i wanted to ask is — If i invest an amount more than 1.5 lakhs in Nsc in a fy, then what i want to ask is that i shall show the full interest of Rs 4 laks as income from other sources, then can i adjust this interest of Rs 4 laks under sec 80c or not so that the net tax on interest is zero.

Ajay-The interest on Rs.4 lakh is not an investment for you but an earning. So how can you show that as an investment under Sec.80C?

Thanks basu for ur prompt reply, Yes the Nsc interest is taxable, but what i wanted to know is —

e.g. in fy 15 – 16 i have invested in Nsc for Rs 4 lakhs, Now while filing IT return in AY 16 – 17, I can Claim deduction of Max Rs 150000 under Sec 80C, Now in Next AY 17-18, The full intrest is to be shown under Income from other sources, Now i wanted to Confirm — Can the Accrued interest on Rs 4 lakhs bought in fy 15-16, be shown under Sec 80c deduction or not.

Ajay-“Can the Accrued interest on Rs 4 lakhs bought in fy 15-16, be shown under Sec 80c deduction or not.”-How the accrued interest be eligible for deduction? It is interest income for you and you have to show it under the income head of “Income from Other Sources”.

Thanks basu for ur prompt reply, Nsc interest is taxable, but its accrued interest till 9 years can be tax free under Sec 80c till max limit of Rs 1,50,000.

what I wanted to know is e.g. I buy Nsc for Rs 1,50000 in a fy 15-16, Now this fy I can claim max ded of Rs 150000. Now if I want to invest more e.g. Rs 250000, although I cannot get deduction under 80c more than Rs 150000, but in coming years shall the interest of Rs 250000 invested in same fy, be claimed under 80c deduction or not, I.e. interest of Rs 150000 can be claimed as deduction in coming years, but shall it apply to balance 2.5 lakhs invested in same fy or not.

kindly clarify. Thanks.

I want to invest 4 lahs in NSC as interest is better than bank fD, So i can take max Rs 1.5 lakhs deduction under Sec 80c, but if i invest Rs 4 lakhs, then should interest on balance 2.5 lakhs be added to income from other sources, now can i claim deduction of accrued interest in coming years on balance int of 2.5 laks or not or interest can be claimed on Rs 150000 only in coming years.

Ajay-All Rs.4 lakh interest earned is taxable and that is what I pointed above.

Lets say I earn close to 30000 a month and I want to use NSC for my tax exemption. Can you please suggest me with how much amount I have to buy NSC and the tenure also? How much tax will be exempted? Please suggest me.

Manoj-You can invest of whatever amount you want to invest. NSC tenure is fixed. It is 5 years or 10 years. You can claim tax deduction to full amount of what you invested. But read the post-investment taxability.

If a person purchased NSC ( five years ) say for Rs.1,00,000/- on April 01 , s/he can claim deduction u/s 80 C. What about the interest accrued on NSC purchased on April 01. will it get the deduction u/s 8o C again ie. in same financial year. In other words, Rs. 1,00,000/- invested on April 01, qualifies for deduction u/s 80 C and also the interest accrued on Rs. 1,00,000/- invested on April 01, also qualifies for deduction. kindly clarify. On single investment , twice deduction in same financial year

Vipin-When interest get accrued? Not on the day of investment right? It is yearly once which you can get benefit as I explained above.

Hi Basavaraj,

I have a doubt regarding NSC tax treatment.

I have bought NSC in the year 2008 and they got matured in 2014. I have not shown any interest or claimed any deduction in between 2008 – 2014. This was my mistake but now can you please help how the tax treatment will be in this financial year.

Thanks in advance.

Regards,

Mohit

Mohit-All interest so accumulated will be taxable income for you.

Thanks Basavaraj.

Hi

What does ‘interest compounding half yearly’ means? Does it mean that interest are calculated on June and January of given FY or after six months from the date of purchase of NSC?

Janme-From the date of purchase.

Sir this year I’ll be getting an LIC Money back of Rs 1,05,000/-II’m looking forward to invest this amount by way of NSC/KVP(as myself an employee of Railway Mail Services of Deptt of Posts)Now I need to show my Premium Paid Statement of LIC to claim 80CC benefit.But how do I show the LIC Money back to my employer? Also is this money back be counted under the head ‘income from other sources’? My employer only asses my IT return liability & we don’t need to file IT return ourselves.

Prabir-Please read the tax liability of an amount you receive from LIFE INSURANCE by going through my earlier post “Tax Benefits of Life Insurance“.

Question: If I want to get benefit under section 80C for NSC purchased last year. I mean accrued interest. Than what all actual documents to be submitted to my accounts department.

Surprisingly, I am buying NSC every year without reaping the good discussed benefits.

THanks in advance.

Anmol-Nothing to show them but mention that you received interest from NSC which is again re-invested under Sec.80C. If at all they need proof then you can show the earlier NSC certificate.

Hello,

I have invested 40,000 in NSC in the year 2012. 70,000 in 2013 and 1,00,000 in 2014. While investment declaration I only declared the actual amt in declaration and not the interest accrued on it.

Questions

1. Will I need to pay interest when it is matured as income from other sources?

2. What if I declare the interest accrued from now onward. Like 40,000 for 3 years completed 70,000 for 2 years completed and 1,00,000 for 1 year completed.

How will it benefit me in income tax when it is matured.

Sneha- 1) You need to pay tax (not interest) when it mature.

2) If you declare the interest on yearly base and show the re-investment under Sec.80C then it will reduce your liability and that is what I pointed.

Hi,

I have small query.

As mentioned table you had showed calculation for 5 years NSC. Let assume, if I take NSC for 10 Yrs then I have to show income from other source upto 9 yrs. Kindly confirm on this.

Regards

Rakesh Gupta

Rakesh-Yes your understanding is correct.

Hi Basu,

I have an NSC VIII which matures in Sept 2015. I haven’t paid tax on the accrued interest so far. I believe I will have to pay tax on the complete interest earned on the NSC in the next financial year 2015-16. Now my tax slab has changed from 30% to 20% since financial year 2013-14. Given that, how will my tax be computed. Also will there be an additional interest that I need to pay on the tax for the preceding years? Kindly advice. Thanks

VN-Your taxation is based on your current tax slab. No interest need to be payable from your side. Don’t worry.

Thanks Basu for your quick response. I have another query related to taxation but couldn’t not find a relevant article in your archive. You can tag it accordingly.

This is related to tax on FD interest. I had booked a couple of FDs from HDFC deposit under the no TDS scheme for 33 months. These FDs mature in a couple of weeks from now. I will be paying tax on the lumpsum interest earned in the current financial year. Again, will the taxation be on the current slab? and will there be an additional interest that I would have to pay? Somewhere I recollect having read, that if tax on the accrued interest is not paid yearly then there is an additional interest of 1% per month needs to be paid.

VN-I am not aware about the 1% additional interest on FDs. But yes, it is must to show the interest as and when it is accrued on yearly base than at the time of maturity. It is best to pay it yearly because, suppose while this year you may be at 20% and if you not pay the tax this year then while maturity if you moved to 30% tax bracket then whole interest will be taxed at 30% tax. In such situations you may loose some money.

Hi Basavaraj,

I have bought NSC in 2006 for 40,000. I did not withdraw it after got mature in 2013. Can I now re-invest this year ?

How much tax will be deducted if I withdraw now?

Thanks a lot in advance .

Nair-There is no TDS on NSC. So you can withdraw it easily. But the interest income is taxable as I said above. Yes you can now withdraw it and re-invest.

my NSC is mature on 13.11.2014, which was taken Deepshika Post Office Dist- Angul, State orissa. That time i was posted there due to Central Govt Job in CISF. Now i am posted at Durgapur .Maturity date is over and i have not in position to go there. How i get this amount in Durgapur Local post office , Pl guide me.

Arun-You can visit the nearest post office and submit for withdrawal.

Is there any way can i reinvest both (princibal+interest)under 80C after 6th year? if yes can i show it as it is reinvested in Insurance premium rather in investing in NSC?

Hi Basu,

Thanks for the detailed blog.

I have a doubt, whether the interest paid for the first year is flat even if invested in middle of a FY.

For the example table, if the NSC is bought for INR 100 on 16-Aug of a FY, still the interest of INR 8.57 (considering rate of interest 8.4 ) paid for the first year as?

Thanks,

Prabu Manoharan

Prabhu-It is half yearly compounding. So if you invested Rs.100 then after one year interest earned will be Rs.8.57. Also do remember that NSC investment is not related to taxing year. Hence your one year will be completed from your investment date but not either March 31st or April 1st.

HI,

I want to know about CFP Course? I am Inter C.A. nd gave many trials of Final C.A. so now i need some help in finding other valuable short term courses in finance or taxation field coz due to agebar i can not pursue any fulltime course of 2 yrs or more. presently i m doing job in c.a.firm so can u pl. guide me about other courses which i can pursue as working professional and which will b helpful in my carrier.

Thank u.

Keya-Regarding CFP, it is huge scope especially if you have CA with you. Let me know your city so that I can guide you in better way.

Hi Basu,

Read all the info and discussions in the blog. I too have few doubts, it’d great if I get a reply at earliest.

Here are the doubts.

1) How much tax is levied on the maturity amount?

For example if I invest Rs.65000/- then how much is the tax levied on the maturity amount?

2) Do we need to show only the accrued interest of the previous year or we can show the accrued interest of date of commencement of NSC + current year’s interest. Hope you got my point.

Sorry, adding one more to the above doubts..

3) What do you mean by “till the 4th year interest you can claim as re-investment and avail deduction.”? Pls elaborate.

Thanks in advance.

Ganesh

Ganesh-

1) Tax is not levied on maturity amount. But on the accrued interest amount and that is according to your tax slab.

2) You only need to show the accrued interest of previous year.

3) That means up to 4th year the accrued interest can be shown as income from other source and at the same time you can opt as re-invested in NSC and avail benefit of Sec 80C. But after maturity how can you show that??

Dear Basu,

Thanks for the quick and valuable reply.

Just one more doubt.. I have brought 3 NSCs Year after Year from Jan 2012, Jan 2013, and Jan 2014, now how do I show the accrued interest in the investment declaration form.

If my understanding is correct, I can show the total accrued interest of all the three NSCs.

Pls confirm.

Many Thanks in advance.

Ganesh K

Ganesh-Yes you are right.

Many Thanks Basu.

Hi.. I read in most of the articles that it is advisable to declare interest as accrued while taking nsc. Could you please tell me which form should be filled to declare interest as yearly basis? And will they give any document for the reinvested amount?

name-There is no particular form to show it. You can show this income in the same form which you use for ITR filing. Usually at the time of investment only you receive the document as a proof of investment from post office. This document is like what you get when you invest in FD.

Hi can you please tell me what is the meaning of term “first investment year”. I have invested Rs 10000 in NSC’s on 10 January 2014. Now while declaring my Income Declaration for period April 2013 to March 2014, I know I should include Rs 10000 as NSC Investment for deduction under section 80C.

But do I need to include interest accrued on my NSC from 10 January (the date of applying for NSC) to 31 March (end of financial year) under the head “Income from other sources” and “accrued NSC interest reinvested under 80C”?

Rhijul-In NSC interest will not be accrued on financial year base, instead on the investment done that. So You need to mention at once a year completes.

Hi Basu,

I have a question for you.

Will there be TDS when NSC matures? If yes, will the deduction be for the interest earned over the entire period or just the 5th year?

My understanding is that the entire interest earned ( for 5yrs) is taxed at Source, however since we have the option of showing interest earned every year as an investment, this tax liability gets reduced( very nominal though).

Angel-There is no TDS on NSC.

I am little confused now. Above u hav mentioned, ‘ Maturity Taxation-Interest is taxable under the head of Income from Other Source’, how is this different from TDS?

Angel-TDS (Tax Deducted at Source) is like your employer is deducting the tax you owe to pay Governement in advance. “Income from Other Source” is type of income you generated. So both are different.

Hi, I have one question.

i took NSC certificates in 2009 and forgot to show the accured interest in each year returns. So after maturity, if i reinvested the total amount in again buying the NSC, do i need to pay the tax for the matured amount.

Srini-Tax will be payable on accrued interest only but not on whole matured amount, even if you reinvest the amount.

Hi,

I forgot to declare the accrued interest for the first 4 years. Can i declare the total amount in fifth year and claim it as tax exempted.

Srini-No you can’t do so.

Hi,

Just to clarify, in your above table, the total taxable interest (under ‘other income’) would be Rs. 50.86 or Rs. 11.91?

Also, At the end of the 5th year if i re-invest the full 100+50.86 into a new NSC, will i still be taxed on Rs. 50.86 or 11.91?

Hanoz-If you not showed on yearly base then it is Rs.50.86 but if are showing on yearly base then it is Rs.11.91. You can re-invest the whole Rs.150.86 or Rs.111.91 and avail the deduction under Sec 80C as it is considered as new investment for that period.

nice and thanx

Ramesh-Pleasure 🙂

@BasuNIvesh : Could you please let me know whether NSC can be premature withdrawal ?

I have a NSC done on 10th April 2012 and it is getting matured on 10th April 2017. But currently I am in urgent need of money, can I withdraw the same right now ? I mean somewhere after 10th April 2013.

Please advise ASAP.

Sunny-No you can’t withdraw it. But if you want then you can keep as collateral security to get the loan.

Actually one my distant relative did not file tax ..so for his balance sheet preparation he has go the doubt posted about–>

Moreover, I have heard that 80C was 80L previously.

so in those years of 80L, please answer the same scenario as asked above.

say his income is X

Bank Interest/ KVP–Y

Gross income from all sources–> X+Y

Deduction under 80L/ something that was prevalent that time= Z

Net taxable income= X+Y-Z

if this net taxable is less than basic tax slab of that year i.e., NIL tax zone; in this case do anybody need to file the income tax return

Please note X+Y is taxable but X+Y-Z is not taxable or zero tax.

Please advice from 2000-2001 financial year..

Pritam-Your understanding is correct. No need to file the return.

One more doubt..

If in one finacial year my income is equal

say my income is X

Bank Interest/ NSC–Y

Gross income from all sources–> X+Y

Deduction under 80C= Z

Net taxable income= X+Y-Z

if this net taxable is less than basic tax slab i.e., NIL tax zone; in this case do i need to file the income tax return

Please note X+Y is taxable but X+Y-Z is not taxable or zero tax.

Pritam-Refer my comment.

If I am investing in NSC on 1 April 2012, in that case for which A.Y. I have show it’s interest of the first year in my ROI.(e.g.A.Y.2013-14 or A.Y.2014-15)

If you are investing on 1st April 2012 means you will complete 1 year on 31st March 2013. So interest will be for this period. Period of 1st April 2012 to 31st March 2013 will come under AY of 2013-14 and as financial year for 2013-14 is 2012-13.

if I am investing on 1 August 2012, how and when will the interest to be shown in accrual basis?

1. in first year financial year how much interest should i show?

2. similarly in my 5th year how much interest should i show?

3. is it okay if i show zero interest in the first year and balance first year interest if i show in the last year?

4. can somebody show a flat interest rate of 8% for 4 years and balance interest in the final year.

In other case, if somebody is investing on 1 november 2012 how will his accrual would be calculated.

Pritam-Please go through above table, you will get all answers to your doubts.

Mr. Basu my Income in the Year 1 to 5 ( In case of 6th year NSC) is below the maximum exemption limit and I do not file the return of Income in that year. But what if in 6th year I have to tax entire interest in 6th year or only that belonging to 6th Year only ?? Kindly help

Vinod-It is entire interest accumulated till 6th year will be taxed under the head of “Income from Other Source”.

But Sir I have made Computations in the respective Year and I added the Interest of IST Year in my computation and allowed deduction of the same in IST year , is it mandatory to file the return to show the taxability and deduction of NSC Interest ??

Vinod-If you are interested in showing the interest re-investment then it is mandatory to file return showing the same.

Hey Basu, I went to the post office today and invested in NSC. Just want to mention the procedure for the benefit of others. Its quite simple, we need to fill an application form in which we need to mention the investor details, the details of the nominee and a witness signature is also needed. Documents to be attached- Photocopy of Pan card, Address proof and a passport size photograph. Pay the amount (Cash is also accepted), get the certificates 🙂

Angel-Thanks for sharing. Hope this will be useful for others too.

Hi Basu, I need to submit my investment proofs in a week. After lot of research I decided to invest in NSC. I went to a post office but it was closed. There was an NSC agent who started troubling me, he wanted me to go through him, which i was not ok with. He gave some info which was quite discouraging, he told me that post office will not accept cash payment and secondly, the proof of investment will only be given to me after 15days, which is no good. I confirmed with my colleagues and they all paid through cash in the past nd the receipt was given to them within 15-20mins. Please confirm what is the mode of payment that is accepted and how many days will it take for the NSC Certificate/receipt to be given to me. There isn’t any issue with opting for any other mode of payment, but I don’t have so much time to apply for a cheque neither can I wait for 15days to receive the POI. Please help!!!

Angel-Exactly I dont know the procedure of investment in NSC. What your agent saying may be right, as post office may made it mandatory for agents to bring non cash investment for safety purpose. But getting certificate after 15 days seems too bad service. Anyway I suggest you to directly contact post office and atleast ask them any proof of amount paid towards this investment. Also if you invest directly then post office may accept cash too. Hope your all problems will get resolved once your reach your nearest post office 🙂

Hmm..hope so! Will try once again…thnx!! 🙂

Angel-You are welcome 🙂

Hi,

Your article was very helpful in clearing some of my doubts about NSC interest, and to write an article about the same, at:

http://the-analytical-mind.blogspot.in/2013/01/how-to-file-nsc-interest-for-income-tax.html

I would appreciate it a lot if you could review the content and provide your valuable feedback.

Thanks

Param

Param-For your information currently NSC is available only for 5yrs and 6 yrs. For details you may visit India Post. Hence I dont know it is worth to mention the NSC feature as 6 yrs, previously NSC was available only with 6yrs. This is my finding. I hope you want that clarity from end, or something else??

hey.. can you tell me how does your tax liability reduce. If say Rs. X is the accrued interest in year 1 and i am showing that amount as ‘income from other source’ and then include the same amount in the section 80c savings. But, don’t you think your taxable income will also go up by amount X the moment you show it as income from other source. So, If initially your taxable income was say Rs. 5 Lakhs , now it’s going to be Rs. 5 Lakhs + X .

So how does it save any amount on the tax payable ?

Pease clarify.

Rohit-Each year’s accrued interest will be treated as the fresh investment. Hence you can avail the benefit of it under Sec.80C. Accrued interest is taxable income for that year. To avail the exemption to the extent of that earnings, only option is to show it under sec 80c. Hope I cleared your doubt.

Hi,

Suppose if invest on NSC and forgot to mention the accrued interest as income and also didn’t mention it as deduction under 80C till maturity period. On the 5th year tax-filing, can I show all 5 years interest as “income from other source” and claim last 4 years interest to be deducted under 80C. I know that will reduce the amount I can invest on other avenues under 80C for the 5th year. But is it possible?

Bala-You can’t do like that. On maturity the whole interest is taxable under the head of “Income from other source”. But the previous years interest re-investment can’t be possible to show after maturity. Gone is gone.