It is always believe to be a good option to take Interest free loan or concessional loan from employer. But before going for this facility check the taxability aspect too. Interest part of that loan is chargeable to tax as Perquisite. It is taxable on the following basis.

Step 1. Find out the “maximum outstanding monthly balance” (i.e., the aggregate outstanding balance for each loan as on the last day of the each month).

Step 2. Find out rate of interest charged by the State Bank of India (SBI) as on the first day of the relevant previous year in respect of loan for the same purpose advanced ( Housing Loan, Car Loan, Two Wheeler Loan, Educational Loan or Personal Loan) by it.

Step 3. Calculate interest for each month of the previous year on the outstanding amount mentioned in Step 1. at the rate of interest given in Step 2.

Step 4. From the total interest calculated for the entire previous year under step 3, deduct interest actually recovered, if any, from the employee during previous year.

Step 5. The balancing amount (i.e. Step 3 minus Step 4) is taxable value of the perquisite.

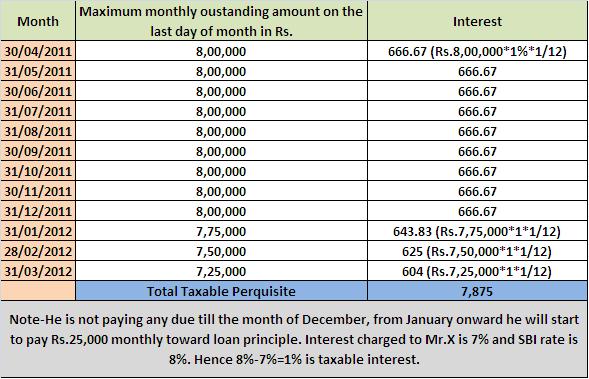

Will show you with one example which will make you clear on above steps. Suppose Mr.X took loan of Rs.8,00,000 from his employer in the beginning of the year and the rate of interest chargeable for the same loan from SBI is 8%. But Mr.X is going to pay 7% as interest to his employer. What will be his taxable perquisite? Below table will clarify the method.

Interest will be calculated according to the method given above. No other method is allowed.

But below are the two exceptions for not consider this facility as taxable, which are as below.

1) If a loan is made available for medical treatment in respect of diseases specified in rule 3A (the exemption is, however, not applicable to so much of the loan as has been reimbursed to the employee under any medical insurance scheme).

2) Where the amount of original loan (or loans) does not exceed in the aggregate Rs.20,000.

Hope above few lines made you clear about the taxation part of Interest free loan or Concessional Loan from employer. Now think and decide is it worth??