When it comes to investing, we always try to look for COMPLEXITY than SIMPLICITY. Because we are always in doubt that such a simple strategy works or not. We have a strong inclination that COMPLEXITY always works. Because it is designed by so-called experts. Let me share with you the idea of how to beat a Nobel Prize Portfolio easily 🙂

I love this book called “Risk Savvy” written by Gerd Gigerenzer. Because it is full of how we as humans understand the risk and behave when it comes to managing the risk. Hence, you might notice that I have quoted the contents of this book in the past also.

How to beat a Nobel Prize Portfolio?

As I pointed above, simplicity is the best form of investment strategy one can adopt. However, we look for complexity. Especially if we have to invest more, we don’t want simplicity but a complex strategy to manage our money. Investing in 2-3 funds may looks risky but not investing 20-30 funds. Because we fell more secure.

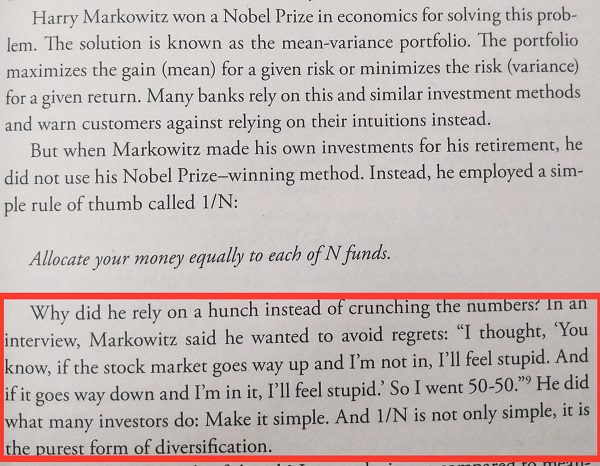

In this book, there a topic called “Mind Your Money”. Let me share the content.

Take for example of Covid, how many of these experts predicted the fall? How many of these experts predicted the raise of the market so instantly in few months? But we still believe experts know everything about the market. They are also humans but with complex approaches towards your money. The problem with many experts is that they can’t declare what they don’t know. They have opinions on everything (finance or non-finance).

I am not questioning Harry Markowitz’s knowledge. However, when it comes to prediction of the unknown, no matter what may be our expertize, we fail miserably. We may have solutions to our known risks but unknown risks are unknown to all of us. Hence, risk management is to prepare ourselves for unknown risks than known risks. Sadly all these theories work for known risks but not for unknown risks.

The best hedge against such unknown risk is diversification and the best hedge against such complexity is simplicity. When the experts are not sure of how accurate their research is, its dangerous for the common man to implement such complex strategies.

As per me, COMPLEXITY ITSELF IS THE BIGGEST PROBLEM TO OUR MONEY. Simplify it and make sure to concentrate on your profession and let your investment be in such a way that you required the least attention to it.

Finally, I end this post with this wonderful quote.

“Simplicity is hard to build, easy to use, and hard to charge for. Complexity is easy to build, hard to use, and easy to charge for.” – Chris Sacca

2 Responses

Thanks for sharing the Information. I totally agree with your stand. Yes, its tough to be simple without messing up.

Dear Anil,

Thanks for airing your views 🙂