Which are the best investment plans for 2021 in India? How to choose them? Let us discuss whether such plans which are universal for all of us exist or not.

We have around 34 Public Sector and Private Sector Banks who offer us different rates of FDs and RDs. In the same way, we have around 24 Life Insurance Companies that are offering different variants of Life Insurance Products like Term Life Insurance, Traditional Plans or ULIPs. We have around 34 Non-Life Insurance Companies who are offering us different types of Health Insurance, Accidental Insurance or Critical Illness Insurance Products.

Also, we have 44 Mutual Fund Companies that offer us various categories of Mutual Funds. If we assume each of those companies offering us around 25 products (the real number is much bigger), then in total there are around 1,100+ Mutual Fund products.

Along with all these financial products, we have various offerings by PMS, Stock Brokers and some other financial institutes.

They all bombard on us with their product features and they want to showcase that they are the BEST in the market and their products are best suitable for our requirements.

In such a huge JUNGLE of financial world, how to find the product which is the BEST suitable to me?

Best Investment Plans for 2021 in India

Now let us come to the topic of choosing the best investment plans for 2021 in India.

Yesterday I was reading a popular book “The Paradox of Choice,” where the author and psychologist Dr. Barry Schwartz broadly describes two kinds of people: maximizers and satisficers.

Maximizer is someone who spends lot of time in evaluating options before they make the BEST DECISION. Usually such people in financial world are called as FINANCIAL ANALYST OR RESEARCHER. But I usually call them the NUMEROLOGISTS.

Satisficers on the other hand, tend to settle for the first thing that meets their requirements: like investing in Index Funds with the simplistic approach and stick to it.

At the end who is happiest? The purpose of earning the money and investing wisely to generate the highest return is to be happy forever right? But research shows that satisficers tend to be happier. Let me share a few quotes from Barry Schwartz from the book “The paradox of Choice”.

“So to make the task of lowering expectations easier: Reduce the number of options you consider. Be a satisficer rather than a maximizer. Allow for serendipity.”

? Barry Schwartz, The Paradox of Choice: Why More Is Less

“people with high maximization scores experienced less satisfaction with life, were less happy, were less optimistic, and were more depressed than people with low maximization scores.”

? Barry Schwartz, The Paradox of Choice: Why More Is Less

Let me share my recent tweet where I mentioned how this whole financial world complicating us with MORE options.

If you look around how financial products designed to complicate YOU, then the simple and the best example is TERM LIFE INSURANCE. 95% of their features are useless. But they offer, regulator approve and buyers turn scapegoat.

— BasuNivesh (@BasuNivesh) January 5, 2021

So what I am trying to say in this post about “Best Investment Plans for 2021 in India”?

The answer is there is no such UNIVERSAL BEST INVESTMENT PLANS FOR 2021 in India.

The reason is we have various products available in the market. Each of those products or assets have their own positive or negatives. Hence, generalizing them and making the complete list of best suitable to ALL is impossible. However, someone can give you a hint about the suitability. In the end, it is YOU who have to take a call as YOU ARE THE BEST RISK ANALYZER OF YOUR MONEY.

Take, for example, for me LONG TERM means maybe around 10+ years. However, there are few whose definition of long term is 3-5 years. If I blindly suggest investing in a product with a long term view, then a person whose definition of long term is different than mine may take it as an investment call for 3-5 years.

Steps in shortlisting the BEST INVESTMENT PLANS for YOU

It is disheartening for those who visited this post in view of looking at my best readymade options. Instead of giving my options, I wish to do some homework for you to select your OWN BEST.

- Buy a Term Life Insurance to cover your life risk for at least 15-20 times of your yearly income.

- When it comes to which is the best term life insurance, go with the one who is in the market for 10-15 years or more.

- Select pure and simple term life insurance without any riders.

- Don’t buy the term life insurance for 75 years or 100 years.

- Buy family floater health insurance of at least around Rs.5 lakh and Rs.25 lakh Super Top Up Plan.

- Buy accidental insurance of around 15-20 times of your monthly salary.

- Create an emergency fund of at least 6-24 months of your expenses.

- Categorize your goals like less than 5 years goals, 5-10 years goals and 10+ years goals.

- If your goals are less than 3 years, then stick to Bank FDs or RDs.

- If your goals are more than 3 years and less than 5 years, use debt funds (Like Liquid Funds or Money Market Funds).

- If your goals are more than 5 years, then do the asset allocation between debt and equity-like 60:40. Choose the debt funds mentioned above. For equity, you can choose one Large Cap Index Fund, one Mid Cap Index Fund or one Multi-Cap Fund (if possible). You can refer my list of funds at “Top 10 Best SIP Mutual Funds to invest in India in 2021“.

- If your goals are more than 10 years, then for debt, you can use EPF, VPF, PPF or SSY along with Liquid or Money Market Funds. For equity, you can follow the same funds which I recommended in the above point.

- Invest CONSISTENTLY and rebalance yearly once (Basic 10th standard Mathematics is enough).

THAT’S IT!!! Life is simple, calm, and enjoyable if you follow the minimalistic approach. Don’t complicate your life with complicated advice. In the end, 90% of Financial Advice is USELESS!!

Conclusion:- I hope I have not disheartened you by sharing my points. Don’t look for the readymade product. Make it personalized as per your requirement. The whole financial world is looking for a FOOL and his money desperately. If I close the eyes, then I may be a biggest fool for them. Be a informed investor. Best of luck 🙂

Refer our latest posts:-

- Is it safe to invest in Small Finance Bank Fixed Deposits?

- Gold price touched Rs.74,000 – Should you invest?

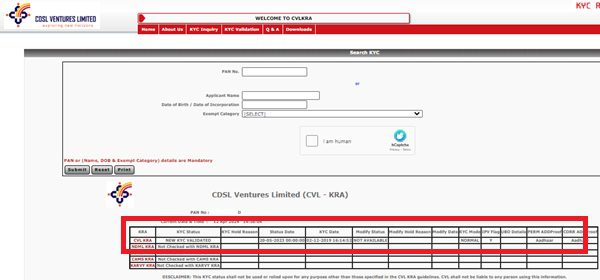

- Mutual Fund KYC Status Validation – How to check and continue investment?

- Latest changes in Health Insurance from 1st April 2024

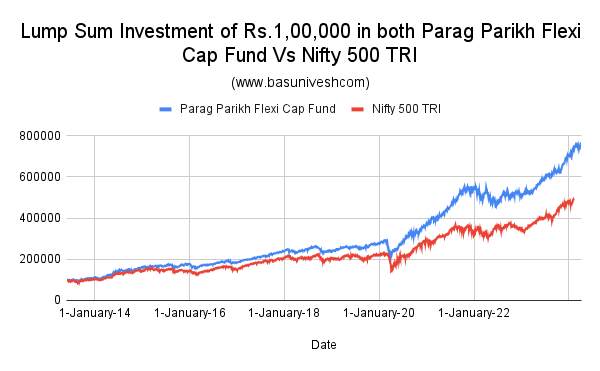

- Parag Parikh Flexi Cap Fund Review 2024 – Should you invest?

- Investing Rs.1.5 Lakh in PPF and SSY before 5th April – When you must NOT invest?

28 Responses

I have just received my service completion money.

I Intend to invest this in a safe assets with liquidity in case of emergency medical care for my parent in future

My husband is working and salaried .

Could you suggest ,how do I park these money so that I fetch returns as well as can withdraw when needed.

Dear Sachin,

Use Bank FDs.

Kindly elaborate more on NPS as good investment option ( not as tax saver ) in comparison to mutual fund , particularly with recent development on Tier 2 investment guidelines.

Dear Santanu,

I personally stay away from NPS.

Dear Basu,

I have started following your blog since last month and during this short span I’ve covered most of the articles. Needless to say they are very insightful and provide very good guidance towards financial planning.

This article has summarized the investment plans. Looking forward to fill the gaps in my portfolio based on your suggestions.

Thanks,

Yash

Dear Yash,

Pleasure 🙂

An amazing article, gives a clear step by step plan for the financial planning process.

Would greatly appreciate your advice how a retiree like me could deploy my retirement corpus for the long term ( >7 year) expenses in the suggested debt (60): equity(40) MF asset allocation. How could we invest in the Equity MF? Thru an STP mode? What should be a advisable duration for the STPs?

Dear Kamath,

It is hard to say blindly invest without knowing the actual financial life.

Sir

Pleasure connecting with once again, as I used to follow your advice on Best Liquid Funds2019 and 2020 as my horizon is more than 5 years Pl suggest best Liquid funds for 2021

Thanks and regards

Dear Raghavan,

You can use ICICI, Quantum or Parag Parikh Liquid Funds.

Dear Basu.. I am following your blog for more than 2 years and most of your articles guided me in planning my financial goals starting from term insurance, heath insurance and accidental insurance which is the basic and priority investment towrds life.. Thanks you for all your insightful articles.. Happy new year..

Dear Aravind,

Thanks for your kind words and wishing you Happy New Year to you and your family!!

I’m following this website over a year, your posts give great clarity and zero fuss.

Dear Pavan,

Pleasure 🙂

Hello Sir,

Also do not forget the post on banks – which are safe and which are not.

Regards,

Soumya

Dear Soumya,

Surely 🙂

Very informative post.

If our goal is more than 10 years, whether the returns from debt funds will beat inflation?

Such as investing in FD or RD , post tax returns might be similar to inflation adjusted value?

Dear Kishan,

You are not investing in debt to beat inflation. But you are investing for diversification purposes. Debt Funds are better tax efficient than FDs or RDS if your holding period is more than 3 years.

I have read your articles on Best Mediclaim/supertop up/term insurance selection and short list. Do you have any article like that Accident Insurance? Pl do forward a link or request give some insight on subject.

Dear Dipak,

Last year I wrote about this. However, wait for few days, I will write on this for the current year.

Sir,

Please cover also accidental insurance provided on debit card, credit card and on savings account by banks.

Thanks.

Dear Gajanan,

Sure.

what if I decide to retire now & have a Termlife plan. Should I still continue it as an investment for my son, after I die? thanks Naresh

Dear Naresh,

If you are retiring today means you are financially independent and also none is financially dependent on you. In such a situation, Life Insurance is WASTE.

amazing clarity in your thinking! thanks

Dear Naresh,

Pleasure 🙂

Good One…. On regular basis following your advise…

Can you make post on the Private Bank Fixed Deposit and associated risks.. As some of them are offering very good Fixed and Saving Accounts Interest Rate compared to Public Banks

Dear Basavanagowda,

Thanks for your kind words. Sure, let me write a post on this.