Should you invest in 7.6% G-Sec or Government of India Securities 2019 Auction? RBI came up with the Government of India Securities or G-Sec bidding for 2019. The coupon offered is around 7.6%.

On 23rd Nov. 2017, RBI opened the G-sec market to retail investors by allowing them to participate in “non-competitive bidding” in government securities and T-bills.

Currently, you can invest in G-Sec using platforms like Zerodha Coin, BSE Direct or Nse goBID platforms. The minimum investment is Rs.10,000 and in multiples thereof up to Rs.2 Crore.

Features of 7.6% G-Sec or Government of India Securities 2019

# Individuals, Firms, Companies, Corporate Bodies, Institutions, and Provident Funds/Trusts are eligible for buying.

# However, individual investors are not eligible for bidding. They have to buy through the Non-Competitive Bidding process.

# Minimum investment is Rs.10,000 and in multiples of Rs.10,000. The maximum amount is Rs.2 Cr.

# Allotment rate will be as per the weighted average price of all allotments.

# Demat Account is mandatory.

# Investors receive a half-yearly interest rate till maturity. At maturity, you will get back the amount you invested.

# The transfer of securities to the clients should be completed within five working days from the date of the auction.

# There is no TDS on the interest you earn on these securities.

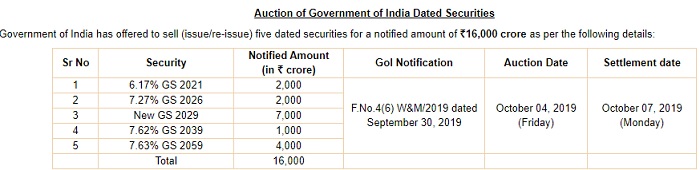

The current bidding details are as below.

For further details, refer to the RBI Notification in this regard. You can refer to the current listing even in NSE also.

YOU NOTICE THAT THE MATURITY DATES OF BONDS VARIES FROM 2 YEARS TO 40 YEARS.

What is non-competitive bidding on G-secs?

When RBI announces G-secs, the price is determined in an auction by banks and institutional investors (big players). While retail investors can now participate in this auction, they cannot bid for these bonds. The price allotted will be decided by the bids of the big players.

To encourage retail investors in Government Securities (G-Secs), the facility of non-competitive bidding (NCB) has been introduced. Under the scheme, eligible retail investors apply for a certain amount of securities in an auction without mentioning price/yield. Such bidders are allotted securities at the weighted average price/yield of the auction.

The non-competitive bidding facility will encourage wider participation and retail holding of government securities. It will enable individuals, firms and other mid segment investors who do not have the expertise to participate in the auctions. Such investors will have a fair chance of assured allotments at the rate which emerges in the auction.

Taxation of Government of India Securities or G-Sec

# Half-yearly interest received on such securities will be considered as “Income From Other Sources” and taxed as per your tax slab.

# However, if you sell a G-sec before 3 years in the secondary market then the capital gain (if any) is considered short-term and taxed as per slab. If sold after 3 years, the capital gain will be long-term and taxed at either 10% or 20% with indexation of the purchase price.

7.6% G-Sec or Government of India Securities 2019 – Should you buy?

# These bonds are issued by the Government of India. Hence, there is no question of DEFAULT risk.

# Hence, these securities are safer than your Bank FDs and also the Debt Mutual Funds.

# The biggest issue with these securities is LIQUIDITY. They hardly trade in the secondary market. Hence, you may face a huge liquidity issue if you wish to sell them in the secondary market before the maturity date. However, if you are holding these securities till maturity, then you no need to bother about liquidity.

# I prefer to buy it from the secondary market by looking at the number of volumes traded rather than this IPO kind of buying.

# However, retirees who accumulated the corpus and looking for safe heaven of parking their retirement fund with a constant stream of fixed income, can definitely look for such an offer.

# Do remember that this constant half-yearly income till the maturity of the security will remain the same. However, inflation will shoot up on a yearly basis. Hence, down the line after a few years, this decent interest income may turn to be peanut for you.

# The biggest risk with such securities which mature for more than 10 years, 20 years or 40 years is that they are more volatile to interest rate movement. Even though there is no default risk, even though there is no doubt on the half-yearly coupon payment by Government, if if you try to sell it before maturity in the secondary market, then you have to bear the BIG INTEREST RATE RISK.

# TAX- Do remember the Post-Tax Returns. Even though there is no TDS, but the interest income is taxable exactly like Bank FDs. Also, if you sell the bonds in the secondary market, then you have to pay capital gain tax.

Dear Sir, A quick question. What are the major factors of international macroeconomy which move our gsec yield and where do we look to track it.

On 6th July 2022 our gsec fell to 7.3% when dollar was appreciating and crude price was falling. Maybe i am missing something. Need your guidance

Dear KB,

To a certain extent dollar appreciation to the rupee and the rest all related to the Indian economy.

Is 10% tax allowed without indexation on LTCG ie if you sell after 3 yrs? or it is only 20% with indexation??

Dear Dipak,

It is either of one which you can choose.

what is the maturity period of g secs

Dear Jaikumar,

I have already mentioned in the above post. Please refer the years mentioned in above image.