A few days back Moneylife Foundation approached the Supreme Court with regard to LIC Jeevan Saral Plan seeking a refund of premiums to the policyholders. Who is to blame for this? LIC, Agents or Policyholders?

I have written long back about this product “LIC’s Jeevan Saral-Why so much confusion?“.I want to reproduce the same for your benefit.

- In this plan, you can choose your premium amount which is not possible with other plans. Minimum monthly contribution in this plan is Rs.250.

- Sum Assured will be 250 times of your monthly premium payment. Hence suppose your monthly contribution is Rs.1,000 then sum assured will be Rs.2,50,000. You may call this benefit as “death benefit sum assured” as this benefit is only meant for deaths. Hence don’t misunderstand that Sum Assured is the amount you get after maturity (which is the case with other plans). Hence I will call it as Death Benefit SA or DBS. So this option is a bit advantage for age-old buyers as irrespective of your age this DBS is fixed on your premium payment but not on your age and term you selected. This is not the case with other plans of LIC. So two persons paying the same premium but age difference is around 30 yrs then they will get the same sum assured benefit under this plan.

- In this plan, if death occurs during the policy period then your nominee will receive this Death Benefit SA+Return of premiums paid (but excluding 1st-year premium)+LA till that period.

- Now the biggest confusion arises is, what you will receive after the maturity. Usually, in all LIC policies, you will receive Sum Assured+Accrued Bonus+Final Additional Bonus if any. But in this plan depending on your age and term of the policy your sum assured which is also called as Maturity Sum Assured will change. So during the period of taking this policy, you will come to know what is your Maturity Sum Assured you will receive at the end of the policy. This is fixed and will not change during the policy term. Will show you how to calculate it.

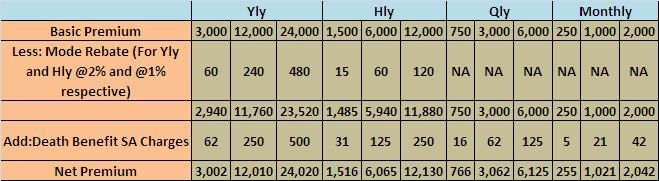

- In this plan, there are two types of premiums. One is called Basic Premium and another is called Net Premium. The basic premium is the base premium without adding any cost, but Net Premium is the premium which you actually pay to LIC and includes premium mode rebate (a rebate of 2% for yearly and 1% for half yearly payment)+charges for providing you the death benefit SA (@1% DBS). Below table will give you a clear picture of this.

Note-Death Benefit SA charges are arrived as below-

A yearly premium of Rs.3,000 is divided into 12 and then multiplied by 250 times this will be (3,000/12)*250=62,500. This is the DAB and charges for this will be @1 hence Rs.62.

Now notice from the above table that basic premium is nothing but base premium but the net premium will add rebate and costs of this plan (which includes mode rebate and DAB charges @1%).

If it is so confusing to you then the simple formula to come to net premium is multiply your basic premium by the factor 1.00083 this will result in net premium which you need to pay to LIC.

Now, what you will get after maturity?

In this plan, you will receive Maturity Sum Assured which is fixed and known to you in advance during the start of the policy once your age and term you chose. With this Maturity Sum Assured LIC will also provide you Loyalty Additions. This Loyalty Addition will be declared annually and currently, LIC declared Loyalty Addition (LA) for 10 yrs and 11 yrs of policies only and which are Rs.250 and Rs.300 respectively. Based on this declaration we may presume the returns from this policy which hover around 6-7%. But for 10 yrs policy, it is just around 3-4%.

How to calculate the Maturity Sum Assured yourself?

LIC provided Basic Maturity Sum Assured list for the premium of Rs.100 per month for all ages. So just you need to select your age and policy term then multiply that to your Basic Premium. I am working on this chart and soon will upload the whole Basic Maturity Sum Assured Chart.

- Surrender Value-There are three types of surrender values under this plan. To avail, these option policies need to complete at least 3 years.

a) Guaranteed Surrender Value-In this you will receive 30% of total premiums paid excluding 1st-year premium, all extra premiums and accident benefit/term rider premiums.

b) Special Surrender Value-It will be of 1+2 options given below.

1) 80% of MSA will be paid if less than 4 years premium paid, 90% of MSA if between 4 to less than 5 years of premium paid and 100% of MSA if premiums are paid for 5 years or more.

2) Loyalty Addition until that period.

c) Can be made anytime after completion of 3 years or more from the start of the policy provided full premiums are paid.

Hope now you got clarity on this product. Let me shortlist all these as below.

- Unlike other products of LIC, in this plan, you have the flexibility to fix your own premium and sum assured at death. The ideal sum assured at death is 250 times of your monthly premium.

- The interesting part of this plan is that irrespective of age, your life risk will remain the same. Because your sum assured at death will depend on premium but not on age.

- LIC first time introduced the concept of Maturity Sum Assured through this plan, which is not the sum assured of the plan.

LIC Jeevan Saral – Is it really a scam?

Now let us come to the main issue of why Moneylife Foundation knocked the Supreme Court for compensation towards the policyholders.

As per the Moneylife Foundation’s claim, LIC sold around 50 million policies. The major points of what Moneylife Foundation claiming are WRONG from LIC are listed below.

- Maturity Sum Assured was not mentioned in the proposal form. How the LIC forgot to mention the Maturity Sum Assured when this product offers two types of sum assured?

- Goraknath Agarwal was the head of the actuarial department of LIC when Jeevan Saral was launched. Mr.Agarwal himself addressed the gathering of LIC Officials and claimed few things like one can surrender after 3 years, good returns, high returns, yield like 9% and not mentioned anything about the loss of the money.

- In Policy Bond issued by LIC to the policyholder mentioned the wrong Sum Assured or Maturity Sum Assured. Many policies issued during the years 2003-04, 2004-05 and 2005-06 did not show the maturity sum assured in the policy bond.

- Policyholders, especially the senior citizens receiving the lower returns than the actual claim by LIC staff or Agents.

My take on LIC’s Jeevan Saral Vs Monelylife Foundation issue

- I am not here either to defend LIC or Moneylife Foundation. Also, I am not a representative of LIC or Moneylife Foundation.

- This is a typical endowment plan of LIC. Hence, expecting a higher return from such an endowment plan is the BIGGEST mistake for the buyer.

- I am not saying that there are no misselling, as with other financial products, here too few representatives might exaggerate the returns and lured the buyers. Hence, there may be certain genuine misselling by agents.

- When we buy any product or invest somewhere, then it is we who has to do the RISK profiling on our own.

- The reason why older people purchased this product is mainly life risk coverage is higher or equal like any other young buyer. Because your life risk in this plan depends on the premium but not on age. Hence, this trick might be used by a few agents to sell this product specifically to older people.

- Claiming LIC not mentioned the Maturity Sum Assured on proposal form is not a mistake as per me. Because when it comes to Guaranteed Addition products like an older version of Jeevan Shree or Komal Jeevan, where the LIC used to give us the GA at a fixed rate, LIC never mentioned the benefit amount in the proposal form. Hence, claiming this as the BIGGEST fault is not digestible. Also, there is a standard format for all LIC plans rather than separate proposal form for each product.

- If whether LIC’s actuary, officials or representative of LIC given in writing about high returns, deviated from the policy feature in claiming, manipulated the benefits and showed to the buyer, then it is complete WRONG. However, as per the Moneylife Foundation, there are no such written or confirmed statements by LIC or it’s representatives that LIC will give us higher returns than the typical endowment plans. Hence, I don’t think this it is an issue to squarely blame LIC.

- As per Moneylife Foundation claim, LIC not mentioned or wrongly mentioned the Sum Assured or Maturity Sum Assured in the Policy Bond. If this is true, then definitely LIC has to pay the penalty for this. Because Policy Bond is an agreement between the Policyholder and the Life Insurance Company. If there are any such wrongdoing by LIC, then policyholder has every right to claim the compensation.

- Yes, I can understand the situation of the old people who for the sake of GUARANTEED income, higher returns and TRUSTWORTHY LIC, purchased this product and now ended up with lower returns ranging from 3% to 6%. But, it does not mean we have to blame LIC for this.

- Claiming LIC responsible for launching this product, claiming LIC responsible for lower returns NOW, or claiming LIC for the misguide happened by an agent (without valid proof) is completely wrong.

- However, as I said above, if there is valid proof where LIC did wrong in printing wrong Sum Assured and MSA in a policy bond, then it is a responsibility of LIC to compensate for the same.

- Moneylife did not understand the product properly. The reason is that in their one article they mentioned as “For example, a 58-year-old person, paying a half-yearly premium of Rs4,076 for 12 years, had paid a total of Rs97,824. The maturity sum assured, which was paid to him after 12 years, was a mere Rs24,575 plus bonus, amounting to Rs34,405. Even though the maturity amount was mentioned in the policy document, it was missing in the proposal, which only specified the death sum assured of Rs1.25 lakh.” The reason is that this policy not offer you the BONUS, but a LOYALTY Addition.

Hence, considering all these aspects, we just can’t brand LIC Jeevan Saral is a TOXIC just because this product was not delivered the returns I EXPECTED (rather than the actual claim by LIC), just because LIC did not mention the MSA (Maturity Sum Assured) on the proposal form, just because few representatives misguided the buyers (without valid proof) or just because Moneylife received many complaints about Jeevan Saral, we can’t brand LIC Jeevan Saral plan as a WRONG.

However, if the Moneylife Foundation has valid proof where certain LIC representatives manipulated the product feature, misguided the buyers with higher returns, LIC defaulted it’s a payment to the policyholders as per the policy wordings, wrongly mentioned the sum assured and maturity sum assured in policy bond, then definitely LIC has to take responsibility and compensate to those where such things happened.

But we can’t squarely blame LIC for all our mistakes. It is we the buyers or investors first have to OPEN our eyes before BLINDLY judging or investing in any product.

I am recommending to read the few of Moneylife Foundations article for your better understanding on their claim about LIC’s Jeevan Saral.

- LIC Jeevan Saral: Moneylife Foundation Files Petition in Supreme Court Seeking Refund of Premiums for Policyholders

- Will LIC Be Made To Pay for the Horrible Mis-selling of Jeevan Saral?

- Life Insurance: LIC Jeevan Saral: A Toxic Product

108 Responses

Hello Sir,

I had taken this policy on 1 September 2011 my quarterly premium is 3062 rupees. Maturity period is 1 November 2026 My question is do I haave to continue with this policy or do I have to surrender now?

Dear Santosh,

Better to close now.

Namaste Sir,

I purchased LIC Jeevan Saral (Plan No. 165) in Oct. 2008 (at my age 28) for a period of 30 years. Policy is in active stage and I pay premium regularly. My sum assured is 5.50 Lacs and yearly premium is 25872. My maturity amount after 30 years is around 30 Lacs as per chart given to me by LIC agent.

My question is, should I stay invested in this policy or opt for surrender and use this fund to lower my home loan liability.

Kindly advise me.

Thanks & Regards,

Nitin S. Navare

Dear Nitin,

If you feel around 4% to 5% returns are great by holding this policy for 30 years, then please continue. Otherwise, better to surrender NOW.

Dear Natrajan

I had taken this policy in 2013

My premium is 6125 monthly

Please suggest what shall i do shall I continue till maturity or surrender the policy

Dear Rakesh,

Better to surrender once it completes 10 years.

Sir my father lic did on 13/04/2010 for Half yearly premium 2376. He never missed a single premium.

Policy maturity date: 13/04/2021.

Policy Lic jeevan saral 165.

Now lic offering him only 40000. But he deposited more than 47000. What to do now.

Sir please suggest

Dear Subhankar,

This is the reality of this product.

Please note that your yearly premium is (Policy premium + Rider Premium) . Your LIC agent must have paid back 1st year premium like most agent does.

Also, you did not mentioned the Loyalty addition part. which will be (12000) calculated at the surrender.

Also, it would have covered 1L of life insurance.

Also, all the paid premiums will be tax deductible.

I also thought that I made a huge mistake when I got this policy in 2004 @25000 p/month (3L p/year) premium. but now I am very satisfied that I made this choice. Because

1. it gave me big tax deductible of 3L every year at 30% of top bracket income, which is ~1L p/year

2. covered me with 62.5L of life insurance, which is ~5000 p/year

3. now on my 17th year in policy, loyalty addition is almost at 790 per 1000, so if I surrender, I get a lumpsum of ~1c, that too TAX FREE, how cool is that.

This was an awesome product to diversify your investment. Only bad part is the Agents, who mis-sold this policy for their commission.

Dear Bharat,

I feel pity for your ignorance.

1) Don’t surround each of your investments behind Rs.1.5 lakh tax saving. One can fill this gap easily now than buying such junk products.

2) Do you feel Rs.62.5 lakh life coverage sufficient for your nominees in case of your sudden demise? There are lot of cheap term life insurance to cover life risk (in fact LIC itself offers), why to consider this for life risk?

3) Whether you did the return % calculation? If you feel 5% to 6% returns for 17 years of investment is a wonderful achievement, then for god sake, don’t discontinue. Please continue the policy 🙂

Dear Basavaraj,

I am already utilizing and maximizing all sorts of retirement and investment options. I have;

60% in mutual funds

17% in shares

13% in Jeevan Saral

10% in cash

At present Saral covers risk of 62.5L which is not enough but it also covers 1.25Cr for accidental death + all but first paid premiums + loyalty addition. My job also covers the risk of +2Cr

I know 5% to 6% annual return seems way below average, but if I consider the tax benefits on premiums that’s 30% immediate return on the investment (I pay 3L in premium, I save 1L in tax). Also, on maturity or upon surrender loyalty additions are tax free, which is again 30% savings in my case. So, if you add all up, returns are much larger in long run.

This was not my first investment choice, it was my last, after I invested in all other options.

I feel that agents were not honest and they are the one who conn the investors by selling them their lies . They sold policy to people nearing the retirement age and people who are not on the higher side of tax slab.

Which other product provides risk free options, with all benefits Saral offers? Please do not take it as offensive, I could be totally ignorant.

I would love to get your recommendations and consultations on comparable products.

Even I am open with the new investments () for next 5 years, my target is to get at-least 1L per month with this the new investment.

I am open to get 2Cr term life insurance for my wife and I, we both are in 50+ (please recommend) so we get coverage after I retire from my primary job.

Dear Bharat,

As I said, if you are comfortable with 5% to 6% returns, then please go ahead.

Thanks!!

But would really appreciate if you throw some light on comparable investing options, for the individuals who falls in >30% tax bracket?

You have my email address looking forward to hear from you.

Dear Bharat,

There are various options. Hard to give private email communication.

Dear Bharat, How you calculated immediate benefit of 30% over premium paid. I believe you pay LIC premium after getting your salary from employer and before your salary credit all the taxes (10%,20% or 30% bracket) is collected by employer. So you get salary after tax deduction and then paid the premium. Now you can submit premium paid under 80C (max limit is 1.5 lacs). So overall you will get 45k tax saving if you consider only LIC premium under 80C. But you EPF and other investment are also under same 1.5 lacs. So please clarify how you consider 1lacs tax benefit under 80c, being as salary employee.

Sir, my father is of 70 years, he paid the premium for all 11 years under Jeevan saral policy and now ended up not receiving atleast the paid amount.please advise. Thank you

Dear Subhankar,

May I know the details like Term of the policy he selected, premium he paid and what LIC is is claiming to be the surrender value?

Sir Jeevan saral 165 (with profits)

Date of opening 13/04/2010

Date of Maturity 13/04/2021

Yearly premium 4752 for

Now LIc offering only 40000/=

Dear Subhankar,

This is the sad reality of this product. Including agents and LIC officials missold this and now you have to bear the heat.

SIR I PURCHASE LIC JEEVAN SARAL IN DECEMBER 2013 WITH MONTHLY PRIMIUM AROUND 2042 I PAID PRIMIUM TILL AUGUST 2019 & FURTHER I STOP PAYMENT IS IT WORTH TO CONTINUE POLICY OR BETTER TO SURRENDER PLZ HELP ME

Dear Sachin,

Better to discontinue after the completion of 10 years.

Sir

I bought the policy in 2010 with quarterly premium 15312

Completed 10 year in 2020. The maturity value as shown to me as per advertisement named LIC JEEVAN SARAL ATM PLAN T NO 165 after 10 years was Rupees 1064520 . However as enquiry from lic office , the surrender value I am getting is only 7,45,000

Can I file a complaint against this? Or should I simply surrender my policy now

Dear Vipen,

ATM Plan is a creation of your agent but not LIC. Hence, it is your fault that you believed on your agent. Better to surrender.

Hi,

I took a Jeevan Saral policy in 2010 monthly premium Rs.3064. Policy term is 35 years. In this policy any facilities available for to stop my premium and I will take money after the Maturity. If I take the Maturity should I get the bonus and loyalty or not.

Thanks

Dear Pravin,

As your policy completed 10 years, either you can surrender it or convert to paid up.

I purchased the policy in 2009 with yearly premium of 57648 and my age was 33.the term of policy is 35 yrs is it good to surrender now pls advise .

Dear Prasanna,

Better to surrender as it completed 10 years.

sorry for distrub you sir but my quest is lic declare loyaity addition for 2020-2021

Dear Bharat,

As of now, NO.

Hello sir,

I have started my policy in sep-2010 with a monthly premium of 4083. Maturity sum assured is mentioned as RS.1182880 and the policy term mentioned is 21 yrs. When I purchased this policy , I have completed my 23 years of age. I would like to surrender this policy by Oct-2020. This would be the 10 th yr completion of my policy. What would be my surrender value ?. Kindle guide me as this would benefit me in clearing some of my debts. Thanks in advance.

Hi !, I’ve my Jeevan Saral policy running since 24/09/2013 (6.5 years), monthly premium is Rs. 4,083 and policy term is 27 years. Please advise whether to :

(a) stop the premium payment and hold the policy for 10 years before surrender, or

(b) surrender the policy immediately, or

(c) continue the premium paymeny till 10 years and then surrender

Dear Amit,

Surrender the policy once it completes 10 years.

Thanks for your answer. As you have adviced, I should surrender the policy once it completes 10 years.

Now my question is whether :

(a) I should continue to deposite premium till it completes 10 years and then surrender, or

(b) I should immediately stop paying premium and continue it till it reaches 10 years and then surrender.

Which option should I opt for, (a) or (b) ?

Dear Amit,

Better pay the premium.

Dear Sir, First of all- many many thanks for enlightening the readers regarding the features of this policy.

I have also bought this policy, the details of which are shared below:

Age at entry: 27

Policy Term : 35

Death Sum Assured: 2.5 lakh

Yearly premium : Rs.12010

I bought this policy during February 2012. So far i have paid 9 premiums.

1) My problem is that the MSA field in the original policy document is appearing blank. However, LIC officials have updated this figure in the online docs of this policy as Rs.5,16,550. I am unable to find out how this figure was arrived at. LIC Officials also not responding properly.Please provide the calculation steps for arriving at this MSA figure. Also please indicate the amount that i would get, if i surrender this policy next year (after paying 10th premium).

2) How the Loyalty addition amount is arrived at? In the Benefit illustration for this policy (available online), it was indicated that the amount that would be payable as loyalty addition during 10th year is Rs.7000/- (assuming 6% Rate of Returns) and Rs.18000/- (assuming 10% Rate of Returns) for a policy with annual premium of Rs.4704/- (Age:35 with Term : 25 years). Please explain how these figures of Rs.7000/- and Rs.18000/0 arrived at?

Thanks in advance.

Dear Natarajan,

1) MSA is an internal calculation based on your policy details. Hence, please check with the branch for the same.

2) LA is again declared by LIC based on it’s profit. Hence, we can’t question this also.

Wonderful article, thanks for writing.

My query is – I bought Jeeval saral (table number – 165) with yearly premium of INR 42,800/-, I have completed 8 years now. I want to know which year I will get better return if I surrender today or on completion of 10 years.

Is it true LA will be paid only after completion of 10 years ?

Thanks in advance.

Dear Vipin,

Better you surrender after the completion of 10 years.

Hello sir I gave jeevan saral policy which I took in March 2010 and the premium I am paying is 24500 every year I have completed 10 years of paying but when checked the surrender value it was 40 thousand less what to do please guide

Dear Deepak,

Suggest you to get the values at first by approaching the branch.

I bought jeevan saral in 2013 with monthly premium of 3062rs . I paid this premium for 6 year 6 months . So basically i paid 2,38,836rs in last 6 and half year. Today i went to LIC office to surrender the policy,they told me i will get only 1,95,000rs. It means i will loose more than 40,000 rs. What should i do?

Dear Deepak,

Better to continue for 10 years completion and then close it.

I have a LIC Jeevan Saral policy with a premium of Rs1531 and I have completed 10 yrs. should I surrender the policy and put my money in Mutual Funds

Dear Ganesh,

Better to surrender.

I bought Jeevan Saral policy in 2009 while I was 32 years, with Death Sum Assured Rs. 5 Lakh (MSA 3.80 Lakh) for 15 years, premium 2000 per month. Now it is about to 11 years, I want to know that if I surrender this policy 4 years before the maturity.

As per my calculation in 11 years I would get 2000(premium) X132 (month)= 2,64,000 – 26,400 (less 1%) = 2,37,400 + LA (237X300=71,100)

which should be 2,37,400+71,100 = Rs. 3,08,500.

Please correct me or guide if it is not so

Dear Manish,

In Jeevan Saral your maturity amount is MSA+LA but not as you assumed 1% less or so.

Hello sir,

Thanks for that wonderful article. It clarified most of the confusions I had about this policy.

I hold LIC Jeevan saral policy bought in 2012, I have regularly been paying a quarterly premium of 9187 (amounts to 36748 annually). I was 24 years old at the time of purchase. I am 32 now. Should I hold the policy for another two years and then sell? Or better sell at the current loss (Loss: approx 50k).

And the policy term is 25 years

Dear Veera,

Better to surrender.

Okay, thanks for the response. Wish you a happy new year!!

Dear Veera,

Pleasure and wishing you the same.

i have paid premium from 2009 in Jeevan Saral Policy and get loan of Rs. 30000/- in 2013

now i want to surrender it

Policy term is 15

how much amt is cutting ???

Dear Priya,

Please contact the branch for the same.

Hi Basavaraj Tonagatti,

Thanks for the Article. The details were clear enough to understand.

I have bought Jeevan Saral policy in March 2010 and paying premium yearly of 16814. This is 30 year policy. Now, I have paid for 10 year (Mar 2010 – Mar 2019). shall i close it on March where 10 years is completed?. Any idea If i close what will be my return amount along with Loyalty addition?

Regards,

S. Ramesh Kumar

Dear Ramesh,

Better to close once it completes 10 years. Regarding values, be in touch with LIC Branch.

Thank You

Hi, I have bought Jeevan Saral policy and paying premium yearly of 60000. This is 25 year policy. Now, I have paid for 8 years. I have checked with LIC branch to surrender the policy and the surrender value was less than the premium paid. It is advisable to wait till 10 years completion and close it? I do not expect gain but at the same time, don’t want the loss too.

Dear Sainath,

Better to wait for another two years and then surrender.

Hi Sir,

I am paying premium for Jeevan Saral (Plan 165) from 2012 at my age 24.

Yearly 26944 as premium. Death Sum Assured mentioned as 550000. Maturity Sum Assured mentioned as 650584. How much I will get at the end of 21 years (in 2033) if paid fully?

How much I will get if I withdraw now? Which is the best way?

Kindly advise sir…

Dear Chandru,

The return will not be more than 5%. Hence, it is better to close now.

Thank you sir.. can u suggest me for an any good investment idea?

Dear Chandru,

It is hard to suggest BLINDLY.

Sir, I am about to complete 10 years. Now I want to surrender it. But license agent suggest me to continue for atleast 5-7years.I ask him how much amount I will get if surrender after 10 years and that after 15 years but he telling that we can not conclude now. Pls advice. Also let me know why license agent always ask customer to continue? Is they are getting benifits for that?

Dear Vishoo,

They never allow you to close as if you close, then their commission will also cease.

Hi Sir

In Jeevan Saral policy I want to confirm that if a person pay complete premium on time till tenure of policy then LIC paid any 2-3% bonus more or not. Someone says that if you paid complete premium on time then during mature provide 2-3 lakh as a bonus

Is it right

Regards

Rahul Gupta

Dear Rahul,

2% to 3% bonus is not here. Please read the product details. This plan offers LA but not BONUS.

Hi Sir,

I am paying premium for Jeevan Saral (Plan 165) from 2011.

Yearly 36,748 as premium. Death Sum Assured mentioned as 7,50,000. Maturity Sum Assured mentioned as 8,36,280. How much i will get at the end of 20 years (on 2032) if paid fully ? It will end in loss?

How much i will get if i withdraw now ? Which is best ?Kindly advise

Thanks for all your information

Dear Siva,

Regarding values, approach the branch. Regarding continuing or close, if you are OK with 4% to 5% returns, then go ahead and continue.

Dear sir

I have been paying premiums since I was 27 and have paid them for 10 yeas now.

I don’t expect a single rupee in addition to what I have invested. I just want to get in return the amount invested. My agent whats me to complete the tenure of 20 years. Pls suggest.

Dear Abhijeet,

Better to surrender now.

Hi Sir. Maturity sum assured is not available in my policy document. Only death sum assured is mentioned. How to find my MSA. I paid premium for 7 years. Should I continue or surrender it. Pls guide me. Thanks.

Dear Suresh,

It is surprising that MSA not available. Better to surrender.

Thank you for a classy writing and clearly mentioning the idea behind jeevan saral. It was a term plan with less endowment portion,many customers who bought it in higher age hoping for 6 7 8 percentage of return lost the money. It was somewhat missold but i prrsonally know many customers who at that time comed to agents and ask for only this policy. As a seller agent can guide his buyers but if a buyer is redisting to buy anything but jeevan saral its not agents fault. We dont have much awareness about financial services.

Finally thank you again for a great writting.

Dear Deep,

If customer asking this particular product, then BLIND SELLING to them is also a CRIME what agents did towards their customers.

I had bought a Jeevan saral policy bearing the No.577617396 with sum assured value is 1,25,000. Premium value was Rs. 6005.00(yearly ). Policy period is 10 years.But after maturity I have got only Rs. 59337.00 only. This amount is less than the total paid amount . This is totally a fraud case .I had complained against this . But the LIC team could not satisfied me.

Dear Parimal,

It is the classic case of not understanding or how the possibility of lesser returns than what you paid. If you are not satisfied, then I am not supporting here anyone. Hence, you better file a case against LIC.

Why dont you enlighten us if you bought this policy for the 250 times monthly premium as insurance it offers or the returns which your agent dog would have calculated as some 4% or 8% bonus?

I personally feel nobody buys this for the insurance.

Dear Pradeep,

In this classic example, the catch is the initial MSA is as per the initial term of the plan. However, when you go for surrender after 5 years of the policy period, then the MSA will be adjusted as per the age of the policy at the time of surrender. I know it is the biggest mistake of LIC if someone after investing for more than 10 years, receiving less than what they paid.

Dear Mr. Basavaraj,

Either knowingly or unknowingly, you too have misled the readers. Kindly be aware of the following:

1. LIC aggressively published their ads and pamphlets for Jeevan Saral. These clearly mentioned “Monthly Premium X 250 times” as the ONLY sum assured (no distinction was given whether it is on death or maturity). Is this not fraudulent advertising?

2. You are describing the maturity refund figure as “low return in the range of 3-4%”. You make it sound as though at least a savings bank rate of interest is being earned. In reality this scheme is generating a NEGATIVE earning, a financial loss to the investor, while it was advertised as a “with profit” scheme. People are getting back amounts lesser than even the total premiums they paid, in some cases only 30-40% of the sum paid to LIC. Forget even the bank rate of interest. Did LIC advertise this while marketing the policy?

3. Will you invest in an instrument to have your hard-earned money halved, where even the principal amount paid is not being returned after an investment period of 10-12 years?

Dear Sharad,

1) If buyer unaware that sum assured is the death amount in Life Insurance than the maturity, then who has to blame?

2) In Traditional Plans, this is the case of negative return if one tries to surrender, Whether it is JEEVAN SARAL or any other JEEVAN tagged policies. Those who are getting less than what they paid are surrendering their policies but that is not the maturity amount which they will get at maturity of the policy period. Please check and let me know the facts.

3) Who said that I am going to invest in such JUNK? I am saying that BLAMING LIC just for everything is BAD. Rather, we the buyers have to be aware rather than SIMPLY BELIEVING FEW AGENTS TRAP.

Basu,

I will not absolve LIC in this case. If the maturity returns is expected to be in the negative zone for a section of people (50+ years), then why sell this to them?

Why not fix the max age to enter is 45 or so?

Agent dogs will only care about their commissions, so it is imperative that LIC protects the older people by ensuring they are prevented from buying this policy.

They have not, if it happened in a developed country, they would have paid huge penalties.

Dear Pradeep,

The maturity amount turned negative in many cases (irrespective of the age), the maturity sum assured at the policy issue was with respect to the term of the policy. However, when one try to close the policy after 5 years (in this particular product they said so), then the MSA will be adjusted to 5 year policy term and accordingly LIC paying it. I know that it hurts many of us irrespective of who right or wrong. I also know that the complete design of this product is an error, which LIC is facing it now.

Dear Mr. Basavaraj,

1. I was not giving you hypothetical situations. I have several cases where amount refunded on MATURITY is less than total premium paid. I am not talking about mid-way surrender of policy, but full maturity.

2. In the LIC advertisements, the LIC proposal form, as well as the LIC policy bond documents (those issued before 2011-12), the ONLY sum assured mentioned is the so-called death sum. No description is provided about maturity sum, so it misleads the investor. When LIC realized this, they silently started adding a column about maturity sum on new policies issued after 2012.

3. Yes we are planning a mass litigation against LIC, and all evidences will be produced in court. We don’t invest in LIC to get our money halved after maturity.

Regards

Dear Sharad,

1) I am not saying it MIGHT not happen. However, if the LIC paid as per the policy feature, then whom to BLAME?

2) As far as I know, LIC publishing MSA in the bonds itself since the start (I saw personally few initially when the product was launched).

3) Let us hope for the best and best of luck.

Dear Mr. Basu

Why aren’t you answering the question about the Negative returns?

Answer is simple words.

Don’t try to trick customers.

It’s not about 5-10 customers.

Thousands of us fell into this trap

You think we all are fools?

The LIC and the agents fooled us with fake numbers.

If LIC or the agents had made it clear that we’d get less returns(not even half of what we invested)

Then do you think we’d have bought that policy in the first place?

It means they clearly tricked us but providing false info.

Please don’t try to act oversmart.

Thank you.

Dear Remo,

I am not trick the comments. But asking you the simple question. Do remember that, I am not here to defend neither you the policyholders nor the LIC. But whether you purcahsed the policy because of agent, LIC, your need matching the policy, you looked for INSURANCE or INVESTMENT? Just answer me which prompted you to buy this plan.

Hi Sir,

I paid lic for 10 years

Qtrly premium 1,531 but I got maturity amount only 75,800.

Maturity amount was 55,000 and SA was accidental benefit 1,25,000.

agent told me in 2010 I will get 1,25,000

I am now 32 years old

Dear Amit,

Never rely on agent’s claim.

Even though author claims that it’s not supporting LIC, the write-up clearly shows that he has is supporting LIC deeds on the name of mis-selling. Marketing too should have some ethics, it should not be mistaken with fooling people.

Dear Vivek,

I gave my opinion. It is up to you to take which side I am 🙂

Hello Sir, I have paid Jeevan Saral premiums for 6 years now.

Should I surrender the policy. I am paying 36000 per annum.

How much I will get if I surrender now.

Dear Guest,

Better to do that.

I think this policy was miss-sold by agents and these were hidden in the proposal document and policy that was issued by LIC. Policy holders have every right to question them. Moneylife has taken the initiative to safeguard policy holders which should be appreciated

Dear Suresh,

The proposal form is the form which has to be filled by the proposer (buyer) by mentioning the details. Insurance companies can’t share product features in the proposal form. Policyholders have every right if LIC deviated from what it PROMISED but whatever the AGENTS PROMISED 🙂

Hi Basu

Considering your article above, can you please help with a clear illustration of what monetary return a policy holder can expect after 10,15 or 20 years if maturity period is 20 years.

Dear Kaushik,

In all cases, the returns will not be more than 6%.

If returns is 3 to 4%, all should get the amount they paid plus 3%. So why are they getting less?

Dear Amanullah,

It is because the product is designed so and expecting higher returns from such products is wrong.

Basu,

This policy sold to people over 50 years is similar to the mis-selling of ULIPs to people of such age a decade ago.

I cant find any difference between the two policies and we have people who went to court for ULIPs issue.

The 50+ year olds didn’t really buy this policy to insure their life for a high amount, they were mostly made to believe they will get 250 times the premium which in fact is grossly wrong because only their family would receive such an amount in the event of death.

If anyone told them the maturity sum assured, they will never buy it.

Dear Pradeep,

Yes, the confusion here is unable to understand the SA and MSA for many (Including those who sold) and the result is such a big issue popped up.

The real truth is that if lic mention the maturity sum assured in the policy they may not have sold even one policy to any senior citizen who have taken 10 year policy .no one is fool to accept 30 percent of their 10 premium paid amount on maturity. It is clear cut misleading.

most of the loosers are senior citizen .

Dear Emorse,

How many of those senior citizens read and understood the meaning of sum assured and maturity sum assured? It is a BLIND belief that costing them NOW.

The though that trust in LIC agent is a fault of the policy buyer is very dangerous thought. Similar to this is the case of flat buyers who have been left in lurch by the bulders. Why, then, has the Govt created new regulations (RERA?)

In this case the govt will not do anything because it is a case against a Govt Body

My Proposal document shows only one Sum Assured. Am I wrong if I did not read AGAIN the policy document?

LIC Policy document is a BOND? Bond has 2 signatures – one of the proposer and the other of the receiver. I have not signed any bond of such type

The fact that the policies were sold with improper as well as wrong information by LIC agents does not absolve LIC of wrongdoing.

What the agents have promised is indeed seen in the Proposal form against or under column Sum Assured

Regards

N T Patel

Dear Navatar,

LIC proposal will never show you the future benefits.

Benefit illustration form of 4% & 8% is being given along with policy bond.. Also jeevan saral maturity amount is printed on policy bonds along with DSA.

Dear Avinash,

Benefit illustration is just an ILLUSTRATION to make sure that how the policy works. But how many buyers understand this?

Sir

I have taken this policy in 2010 now its completed 10 years, policy monthly premium is 1500 but policy term is 20years, its better go 20 years or surrender now which is best…??

& what amount I get after 10 surrender this policy??

Dear Vaibhav,

Better to surrender.