What is the latest TDS Rate Chart FY 2019-20 after the recent Budget 2019? How it will impact your earnings. What are the changes done during Budget 2019? Let us discuss these in detail.

Let me first update you regarding the TDS changes proposed during Budget 2019.

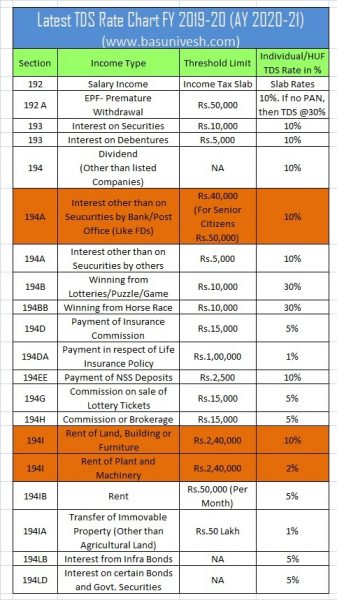

# TDS limit hiked from the existing Rs.10,000 to Rs.40,000 on the interest income of Post Office (Time Deposits), Post Office (Recurring Deposits), Post Office Monthly Income A/c, Kisan Vikas Patra, NSC VIII Issue, Indira Vikas Patra, Bank Deposits and Co-Operative Bank Deposits.

# TDS threshold for deduction on rent is increased from existing Rs.1,80,000 to Rs.2,40,000.

When we receive income through different ways like Salary, Dividend income from mutual funds or stocks, commission, rent, interest on Bank Fixed Deposits / Securities etc., the providers of these income like Bank or your employer deduct the tax before transferring you such income.

TDS or tax deducted at source is a process of collecting Income Tax at the source. It is a process of deducting the tax from the original source of income.

TDS is calculated and levied on the basis of a certain threshold limit, which is the maximum level of income after which TDS will be deducted from your future income/payments. It is deducted as per the Indian Income Tax Act, 1961.

As I told earlier, apart from salary income and Bank FD earning, there are many ways TDS is deducted like interest income from the post office, insurance commission, rent payment, early EPF withdrawals, the sale of immovable property, rent payments on property etc.,

Latest TDS Rate Chart FY 2019-20

I am preparing this Latest TDS Rate Chart FY 2019-20 based on the Finance Bill 2019.

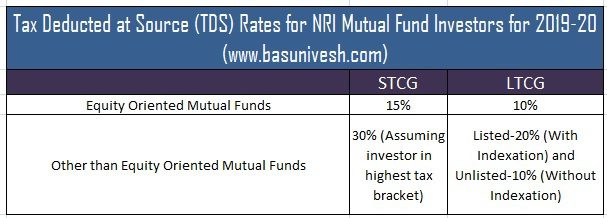

Latest TDS Rate Chart FY 2019-20 (AY 2020-21) for NRIs

When it comes to TDS, the rules changes to NRIs. Hence, let us discuss on this aspect separately.

# Interest earned on Non-Resident Ordinary Account (NRO) is taxable. TDS of 30% is applicable to it. But interest earned on Non-Resident External (NRE) accounts and Foreign Currency Non-Resident (FCNR) accounts is not taxed in India. Hence, there is no tax deducted at source on NRE and FCNR interest income.

# NRI Investments in Shares / Mutual Funds attract TDS and below are the TDS rate applicable on MF redemptions by NRIs for FY 2019-20.

Note:-STCG and LTCG along with applicable surcharge, and Health and Education Cess will be deducted at the time of redemption of units in case of NRIs

# Under Sec.195, when an NRI sells a property, the buyer is liable to deduct TDS @ 20% on Long Term Capital Gains. In case the property has been sold before 2 years (reduced from the date of purchase), a TDS of 30% shall be applicable (on Short Term Capital Gains).

Misconceptions about TDS (Tax Deducted at Source)

# Avoiding TDS does not mean avoiding Tax. You just avoid the deduction of tax. However, you have to pay the tax as per the applicable rules and tax rate even if you avoided TDS. For example, in case of FDs, one can give Form 15G or Form 15H and avoid TDS. But it does not mean that such FD interest income is tax free. You have to pay the tax on such interest as per applicable tax rates.

Hence, never rush to submit Form15G/H or any method just to avoid TDs.

# If you paid the TDS, then your tax liability not ends there itself. You have to file IT return and if anything more than TDS is payable, then you have to pay it.

# All are not eligible to submit the Form 15G or Form 15H. Because only those individuals are eligible to submit the Form 15G or Form 15H whose total taxable income is NIL and also and the total of the aggregate of your income for which form 15 G can be submitted should not exceed the basic exemption limit. But sadly neither individual care about such rules nor the Banks who accept the forms.

Hope this much information is enough for you to understand the Latest TDS Rate Chart FY 2019-20 (AY 2020-21).

Refer our other posts related to Budget 2019:-

- Mutual Fund Taxation FY 2019-20

- Revised Tax Rebate under Sec.87A after Budget 2019

- Latest Income Tax Slab Rates FY 2019-20 (AY 2020-21)

- Budget 2019 Highlights – 7 changes you must know

28 Responses

dear sir,

please tell me which is tds nature payment head.

195-other sums payable to a non-resident

Dear Surinder,

There are many and one such is MF redemption.

Hi Sir

TDS exemption for cental&state government bills like CSIR National Aerospace Laboratoris it will be deduct or exempt

Thanks

Santhana Vijay

Hosur-Tamilnadu

Dear Santhana,

I am not sure about this. Check with your employer.

Form 15G should be allowed to be submitted for new exemption limit upto 5 lakhs. Many banks are not clear on it yet. Is there any catch

Dear Krishna,

Let the new government make it a law, then think about it. However, if we consider the budget proposal should be implemented, then you can submit Form 15G or Form 15H if your tax liability is zero, which is possible with 5 lakh limit. Hence, you can use it and submit it.

TEMPA RENT LIABLE TO T.D.S

Dear Umesh,

I am unable to understand your doubt. Can you elaborate more?

Sir, Persons eligible for submitting form 15G/H having total TAX on income should be nil instead of Total income should be nil. Article very informative.

Dear Vinayak,

Oh..Sorry for typo.

Wonderful article.

Dear Sir,

I observed that above mentioned TDS chart missing regular 2 section is missing

194 C contractor

194J Profession fess.

Regards,

Ajit Shinde

Dear Ajit,

It is not an exhaustive list. But the list of where TDS is applicable in many cases.

Dear Basavaraj

Will you update the tds rate list with threshold limit of missing tds sections of 194C & 194J.

Your list is incomplete because these two sections are the most used section in any tds return.

Dear Sumit,

Surely I will update.

Dear sir,

Kindly let us know proposed changes in Income under the head house property from my 2019-20.

Thanks

Dear Ashish,

Do you have two properties or only one?

Yes sir, I have two residential house.

Sir what is difference between 194I & 194IB

Dear Ashish,

They are two different IT Sections. Under Section 194I, renting like land, building, machinery, plant, furniture are covered. However, in case of 194B, it is only land and building.

Sir still confusing, in case of land & building, how we distinguish between them?

Dear Ashish,

Land means without property constructed.

Dear Basu, there is no TDS on NSC VIII issue & Kisan Vikas Patra, right?

Dear Kapil Sir,

Yes, earlier there was TDS on NSC and KVP. But currently, there is no TDS on both.

Sir what is the TDS limit under 194C for jobwork AY 2020-21

Dear Vishwanath,

It is 1% if the payment should be made to Individual, HUF and to sub-contractor and 2% in other cases.

Thanks sir for this info.

for salary people in fy 18-19 max limit was 2,50,000 P.A.

i want to max linking for fy 19-20.

Dear Kapil,

Don’t be in a rush of avoiding TDS.