LIC is launching new money back plan called LIC’s Bima Diamond Plan No.841 . This policy will be available from 19th September, 2016 to 31st August, 2017. Let us see it’s features, benefits and why you should skip this product.

Before proceeding further, let us first look into the product feature of LIC’s Bima Diamond Plan No.841.

This is a typical non-linked, with-profit, limited premium payment money back life insurance plan. Non-linked means it is not ULIP or your money will not be linked to equity market movements. With-profit means, it is like investment product where you get returns on your investment based on the product feature. Money back means at a different interval of the policy term, you will receive some money from this policy.

What are the highlights of LIC’s Bima Diamond Plan No.841?

LIC features this as a unique product with so many features included in a single product. Let us see each of them.

Auto Cover Period of LIC’s Bima Diamond Plan No.841

This policy claims that your life risk will continue even though you will not pay the premium. But there are certain conditions to it. Hence, first, let us understand what us Auto Cover Period for LIC’s Bima Diamond (Plan No.841). They specified the auto cover into two periods as below.

- If at least 3 full years’ but less than 5 full years’ premiums have been paid under a policy and any subsequent premium is not duly paid-Auto Cover Period of 6 months shall be available.

- If at least 5 full years’ premiums have been paid under a policy and any subsequent premium is not duly paid- Auto Cover Period of 2 years shall be available.

So if you fall under first auto cover definition, then your life cover will continue for another 6 months from the first unpaid premium. Same way, for the second option it is for 2 years from first unpaid the premium.

What is the benefit during Auto Cover Period of LIC’s Bima Diamond Plan No.841?

Here is the catch which many fail to notice. As per this plan the benefits are divided into two types.

# Death Benefit-Death Benefit will be payable to you after deducting the all unpaid premiums+interest thereon up to the date of death and the balance premium(s) for the base policy falling due from the date of death and before the next policy anniversary. If any survival benefit was due but not paid before the date of death, the same shall also be paid along with the above-mentioned death benefit.

What it indicates that the auto cover will be payable only after deducting all the premium dues from you along with interest thereon.

# Survival Benefits-The survival benefit will be paid only after the policy is revived.

Therefore, this auto cover feature of LIC’s Bima Diamond (Plan No.841) is just an eyewash. Nothing will be payable to you at free of cost. They will deduct all the dues and interest thereon and finally they pay you.

What is the benefit after the Auto Cover Period of LIC’s Bima Diamond Plan No.841?

# Death During Policy Period-Death Paid-up Sum Assured will be payable to you and this death paid up sum assured will be calculated as below.

Death Paid-up Sum Assured=[Sum Assured on Death * (Number of premiums paid / Total number of premiums payable)].

It is nothing but the reduced sum assured risk based on how long you paid the premium paid. This feature will be applicable to all LIC policies. So not a great thing.

On maturity-Maturity Paid-up Sum Assured which will be payable on Life Assured surviving to the end of the policy term. This is calculated as below.

Maturity Paid-up Sum Assured=[(Number of premiums paid/Total Number of premiums payable) x (Sum Assured on Maturity plus Total Survival Benefits payable under the policy)]-Total amount of Survival Benefits already paid under the policy.

Extended Cover feature of LIC’s Bima Diamond Plan No.841

During this extended period your life is protected up to 50% of Sum Assured. Therefore, if you have Rs.1 lakh policy, then after maturity period, you are eligible for Rs.50,000 free risk coverage.

What is the extended cover?

It is the period which is half of the term of the policy and begins immediately after maturity. Therefore, you may say as below.

Extended Cover-Policy Term/2

The extended cover feature will be applicable to those policies which are in force (not lapsed) up to the period of maturity.

Therefore, if you buy the LIC’s Bima Diamond (Plan No.841) for a Sum Assured of Rs.1 lakh with a term of 20 years. Then this extended cover will start immediately after 20th-year completion or beginning of the 21st year and it will end after 10th year from the date of maturity.

During this extended period, LIC offers you half of the sum assured in policy (Rs.50,000) up to the 10th year from the date of policy maturity period.

Premium Paying Term of LIC’s Bima Diamond Plan No.841

This policy offers you various term and premium paying options. This is nothing but limited premium payment feature of LIC policies. The feature is as below.

# For 16 years policy-The premium paying term is 10 years. So you pay the premium only for 10 years. From 11th year to 16th year, you no need to pay the premium.

# For 20 years policy-The premium paying term is 12 years. So you pay the premium only for 12 years. From 13th year to 20th year, you no need to pay the premium.

# For 24 years policy-The premium paying term is 15 years. So you pay the premium only for 15 years. From 16th year to 24th year, you no need to pay the premium.

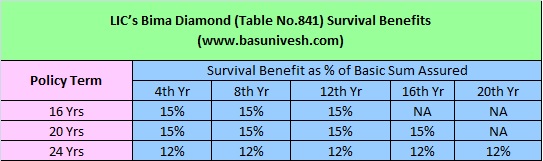

Money Back Feature of LIC’s Bima Diamond Plan No.841

During policy period, you will receive survival benefits under this plan. Let us see the feature of this.

# For 16 years policy

15% of Basic Sum Assured at the end of each of 4th, 8th and 12th policy year. Therefore, if you go for a Rs.1 lakh sum assured policy, then you will receive Rs.15,000 at the end of each of 4th, 8th and 12th policy year.

# For 20 years policy

15% of Basic Sum Assured at the end of each of 4th, 8th, 12th and 16th policy year. Therefore, if you go for a Rs.1 lakh sum assured policy, then you will receive Rs.15,000 at the end of each of 4th, 8th, 12th and 16th policy year

# For 24 years policy

12% of Basic Sum Assured at the end of each of 4th, 8th, 12th, 16th and 20th policy year. Therefore, if you go for a Rs.1 lakh sum assured policy, then you will receive Rs.12,000 at the end of each of 4th, 8th, 12th, 16th and 20th policy year.

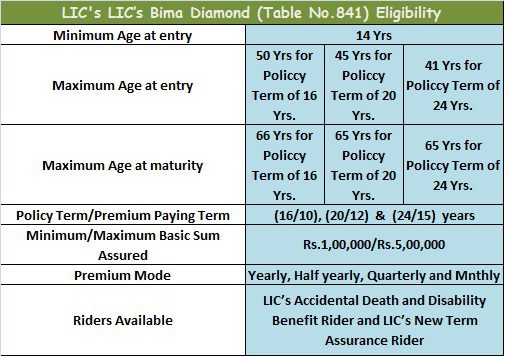

Eligibility for buying LIC’s Bima Diamond Plan No.841

Above said features are highlighted as unique one to LIC’s Bima Diamond (Plan No.841). Now let us look at some features of this plan and who are eligible for buying this plan.

You notice that the maximum sum assured is restricted to Rs.5 lakh. This I think the biggest hurdle to many.

Benefits of LIC’s Bima Diamond Plan No.841

There are three types of benefits one can receive while buying this plan. Let us discuss one by one. Before jumping into benefits, there two points you must understand.

Sum Assured at Maturity–

55% of Basic Sum Assured for policy term 16 years and 40% of Basic Sum Assured for policy terms 20 and 24 years.

Sum Assured on Death-You will receive highest of below three.

- 10 times of annualised premium;

- Sum Assured on Maturity

- Absolute amount assured to be paid on death, i.e. Basic Sum Assured.

The death benefit shall not be less than 105% of all the premiums paid as on date of death. Premiums referred above shall not include any taxes, extra amount chargeable under the policy due to underwriting decision and rider premiums, if any.

# Death Benefits under LIC’s Bima Diamond Plan No.841

- If death before 5 years of policy period-“Sum Assured on Death” will be payable.

- If death after 5 years but before policy maturity date-“Sum Assured on Death” and Loyalty Addition.

- If death is death during the Extended Cover Period-An amount equal to 50% of Basic Sum Assured shall be payable.

# Survival Benefit under LIC’s Bima Diamond Plan No.841

If you survive till policy maturity with paying premiums regularly, then you will receive the money back during policy period as below.

# Maturity Benefit under LIC’s Bima Diamond Plan No.841

- 55% of Basic Sum Assured+Loyalty Addition for policy term 16 years.

- 40% of Basic Sum Assured+Loyalty Addition for policy terms 20 and 24 years.

Other Features of LIC’s Bima Diamond Plan No.841

# You can avail the loan from this policy. For in-force policies it is up to 90% of surrender value and for paid up policies, it is 80% of surrender value. Any loan outstanding along with interest shall be recovered from the survival benefits or claim proceeds at the time of exit.

# If the policyholder commits suicide at any time within 12 months from the date of commencement of risk and the LIC will not entertain any claim except for 80% of the premiums paid, provided the policy is in force.

# Policy can be revived within the 2 years of the first unpaid premium.

# The policy will acquire paid up value if the premium has been paid for 3 full years.

# Policy can be surrender after the 3 years if at least 3 full year premium is paid.

LIC’s Bima Diamond Plan No.841-Why you should avoid?

Let us try to point one by one of why you must stay away from this plan.

# Maximum Sum Assured is Rs.5 lakh-I am not sure why LIC restricted the sum assured to LIC. What will be the value of Rs.5 lakh after 20 yrs or 24 years? It may be the monthly expense. How can one assume that this will create wealth in future??

# Auto Cover is highlighted as if the unique benefit. But look at the feature closely, they may be offering you the cover but while paying, they deduct all the premium dues exist along with interest. So basically the idea is to run the policy as much as possible instead of show in their books as LAPSED policies. Hence, it will not benefit to many or a flagship feature to go for this plan.

# Extended cover is showcased again as the unique benefit. However, more than this plan, LIC’s New Jeevan Anand seems to be better, which offers this extended cover forever and full to the value of sum assured. In this plan, it is up to half of policy term and half of sum assured ONLY.

# Premium Paying Term and Money Back features-This is like a typical limited premium paying endowment plan. Not a big deal again. Also, LIC already offering money back plans. Same feature here too. LIC wisely pay you some % of sum assured you opted. Rest of sum assured at maturity.

# Maturity Benefit-At maturity you are eligible for Maturity Sum Assured, which is 55% to 40% of Basic Sum Assured and Loyalty Addition. Hence, never be in a belief that maturity benefit will be full sum assured as is the case with other plans. It is a money back plan. Some % of sum assured they pay in the middle. Rest of sum assured will be payable at maturity. For this, LIC named as maturity sum assured for this plan. Just to confuse ME and YOU.

# Returns-This is a typical endowment plan. Hence, you can expect around 5% to 6% return. If you feel this is the BEST return expectation for 16 yrs , 20 yrs or 24 years, then definitely you must buy this product. Otherwise, simply ignore this.

I will not do any calculation as LA part is not known now. But if we compare the returns of other endowment or money back plans, we can easily presume the returns from this plan.

In my view, they bundled the features of Money Back plan and part of Jeevan Anand plan and produced a hybrid product calling it as LIC’s Bima Diamond Plan No.841. Also, this extended cover feature is not new in LIC. If I remember correctly LIC’s New Bima Gold had this feature.

Hence, it neither fulfill your insurance need nor the investment need. Simply avoid it. Always separate your insurance requirement with investment. For insurance, term insurance is best and simple. For investment, try to identify your financial goals. Based on goals select the asset and asset allocation. Finally, go for products within that asset class.

111 Responses

I Can’t find my Thread to reply back

But My Only answer is to watch the below video…and come up with comparison which can compete with this Product.(Except LIC)

Sandeep-You will find thread of your earlier comment at http://www.basunivesh.com/2016/09/18/lics-bima-diamond-plan-no-841-why-you-should-avoid/#comment-155972. Don’t try to promote your youtube here 🙂 Instead come up with valid facts and show me the returns IRR. Can you please?

I will tell one simple reason why this INSURANCE policy is not worth it. The max sum INSURED is Rs.5,00,000.

I stress INSURANCE here because that is what LIC is supposed to sell.

Is an adult human life worth just Rs.5,00,000?

Don’t tell me that one can take 10 of these policies. No one will want to pay Rs.3,00,000 every year for insurance.

You tell me is your life worth only Rs.5,00,000? Your company will pay you more in the form of gratuity if unfortunate death happens.

This one reason alone is good enough to ignore this insurance policy.

Pradeep-His intention is not to come up with valid points, but promoting his video (in which only features of product explained) 🙂

Basu, I think you explained this useless product in 300 words. Why would anyone watch and waste 30 mins video?

May be these LIC folks are harnessing technology to sell their products nowadays. They are not getting convincing agents these days, may be because customers have become smarter.

By the way he has no single valid point, so lets not compel him.

Pradeep-I completely agree with your views.

Hi Pradeep,

First : Please note am not the person who spoke in the video and not even directly or Indirectly related to him.

Second: am Ex. Development Officer of LIC and am no where concern to LIC now..am CFA by profession ..working in one reputed MNC.

Third : If am financial planner ..I will never suggest my client to buy single naked Insurance Plan..Instead I will ask them to buy combinations to have them enough protection and coverage.( This is in response to your question to SA : 500,000)

@ Basu : If you think If any my comments is promoting LIC ..Please delete my comments as soon as you read.

Sandeep=Great to know about your past and present profession. Now let us move on. Let me know in what way this product fulfill the long term returns and also one’s insurance need. I never delete the comments which always heading towards quality discussion. I never do that. Instead promote you to validate your points with facts.

Hi Sai,

The financial planners that I have heard from have all been saying to keep investment and insurance separate. Never combine the two. Spend as little as possible for a large insurance cover and invest the remaining large investible surplus in high return investments depending upon the goals and their tenures.

You seem to be having different ideas presumably because you come from LIC background.

In my humble opinion, Coverage and Protection denote the same idea in insurance context and Rs.5,00,000 is never a sufficient coverage/protection now let alone 15 or 20 years later.

I will consider this only as an insurance policy.

So anyone buying this plan now paying 30,000/year and dies 5 or 10 years later is planting a big disaster for his dependents.

I am sure you cannot say this policy is for a low income population. Because the premium of 30,000 a year is not a low amount by any stretch of imagination.

I am not a CFA or Financial planner, but I would rather advise someone to get an insurance cover of Rs.75,00,000 paying only 7,000 for 25 years. Invest the remaining 23,000 in a mutual fund to get 10-12 percent returns. Mind you all of the 30,000 is still eligible for tax benefit (ELSS MF).

I hope you do justice to people (with little financial knowledge) who come to you for growing their money as well as asking ideas for insurance coverage.

@Pradeep…

It doesn’t matter If am CFA or from LIC profession …

Crux of the discussions is where should some one’s hard earned money should go..Right?

Before that .I would like to bring some more points

1. No Product is Good or Bad.Its upon end Consumer how he plans it and what are his targets.

2. Its Our Duty ( Bloggers, Finance Enthusiastic )to educate the pro’s and cons of it.

3. No One can say It is BAD product. It may not be fulfilling your target so it may not suit to you .. so you can avoid it ( Like Basu has mentioned in his Blog Post)

4.I agree with the point which you have mentioned above( Term Insurance+Mutual fund)…which is suitable for the few set of people and not for Every body

5.Bima Diamond is not for the people who are first timers to the personal finance world who Just started the carrier and even LIC clearly says in the promotion

6.You can add Term Rider concept if your SA is not Sufficient ( Please note Premium is Very low in this case and SA will be multiplied)–This is in response to SA for above comment.

7. My Hunch here is please recommend the product based on the Target of your Client.

Thank You..

Have a great day ahead.

Sandeep-So according to you to whom this product BEST suites?

I agree no product is a BAD product as long as it is beneficial to somebody and that somebody in this case is LIC agents with the commissions.

We are into 5 or 6 comments in this discussion and you have not given one ‘pro’ for this product.

When someone comes to you for financial planning, you are supposed to give the best SOLUTION for him. It is like a patient going to a doctor when he is ill. Patient goes with no idea on how to treat his illness and its the doctor who should prescribe the treatment in the patient’s best interests. If doctor only thinks about his fees, then the patient is doomed.

Its exactly what LIC agents are doing all these years. They don’t tell any of the cons of this product. They don’t tell the customers all other best options available in the market.

As a CFA, you must have the best knowledge of what is available in the market.

And for point #5, so the first timers should buy this product and get themselves locked for 12 or 15 years of paying premium? Are you joking? By the time this policy payment term completes, he would have completed half his career.

Just count the number of people who want to surrender these kinds of policies after 2 or 3 years. They are so anguished to hear that they wont get anything back before 3 years completion. And after that only 30% excluding the 1st premium. Where did the remaining money go?

For point #6, the premium is LOW? 30k to 45k is LOW premium for a 5 Lakh insurance cover? Seriously?

As a CFA, are you not supposed to explain what are the expenses of this product? Have you explained this to you customers? Can you tell us in this forum about the expenses of this product? Why not LIC publish the details?

When you go to a doctor, don’t you ask for a bill with various details? You ask for a bill when you go to a restaurant.

Your comments lack any substance.

Basu,

This product suits the LIC agents selling it. 🙂 They get nearly 10% of the premiums as commissions.

Pradeep-That is why once I said, if you really need GOOD return by investing in LIC only, then be agent and then invest.

Basu..where are my comments?

Sandeep-Check the link which I provided or take time to search the page with your name as “Sai Sandeep”.

I Can Bet with any of the above guys who challenged that 841 policy is better than any other policy!!

Being Development Officer of LIC..This is only blog which showed negative reviews

Sai-Come up with facts 🙂

Hi Basu,

Nice post!!!

Had a small confusion.

Loyalty addition is like Final Additional Bonus, right? i.e. it is announced only in the year of surrender, maturity or death.

It is not like simple reversionary bonus.

sir i have taken online term plan of 60 laks in this month but i forgot to disclouse family history i.e my fathar death due to heart disese

its consider a froud or misrepresentation?? plz reply i m very confusing..

Bhushan-It may and hence better to disclose it now immediately.

sir they accept it after issuying the policy….

Dear basu,

you should write, it is your prime duty to spread knowledge .

But be clear,

This mr. pradip is

Against insurance?

against LIC?

against endowment policy?

against agents?

OR

against agents income?

Punit-I completely endorse of what Pradip told.

Dear Basu,

I am sick of discussing with this guy who doesn’t answer any of our valid questions but keep jumping from one point to another.

Let me chuck this.

I have a sincere request to you to consider writing a blog on agent commissions for various LIC plans with detailed illustration. Then attach it to every LIC plan you review, it should be the first information for each of your review blogs of LIC plans.

Public need to understand how much of their money is looted by the agents before they read a review of the plan. You may also add what service these agents offer to a customer that commands such high commissions.

You can do huge service if you can writ such a blog.

Thanks..

Pradeep-I already wrote it long back (Do you know your life insurance agents commission?). But, yes from now onward I have to publish it whenever I write about LIC plans.

dear pradip

pls. update your knowledge or stop arguingFirst of all *

*There is no policy having term of 10 years

secondly

*your money paid

*the bonus declared and

*the SA all are 100%guarantee by govt. of india, just like one rupee note (currency) pls. read the words written on it, if u have

Insurance is a financial tool accepted worldwide, in India company like LIC is giving guarantee which very few countries have

In insurance sector worldwide, LIC is amongst highest rewarding and claim sattleing company

you should be proud of it being an Indian.

Punit-“the SA all are 100%guarantee by govt. of India, just like one rupee note (currency) pls. read the words written on it, if u have”-Who said Sum Assured is not guaranteed?

“Insurance is a financial tool accepted worldwide, in India company like LIC is giving guarantee which very few countries have”-Insurance is a financial tool or risk mitigating tool? I am now confused 🙂

“In insurance sector worldwide, LIC is amongst highest rewarding and claim settling company”-What about the size of the each claim, I mean average Sum Assured of all it’s claim LIC settles?

did you know pradip, what is your problem?

you dont have proper exposure at insurance industry. see all the companies are recruiting more and more agents, so they publish each and everything in public.

now, you said that where LIC is investing?

you will get the details in IRDA website, just check LIC annual accounts and LIC profile as well

It is not mendetory to disclose with each and every client because LIC is giving guarantee (sec. 37 of indian constitution) of the money policy holder paid, the SA LIC has assure and the BONUS LIC declared

Is any other instrument of your type gives such guarantee?

so, they need to declare where they invest people’s money.

Is it clear?

each and every financial instrument has its own stand dont compare haphazard and bluff….

Have a nice day

Punit,

I wanted you to give details on charges, investment and insurance amount of LIC policies, you refuse to divulge any of it. Why?

LIC guarantees SA, agreed. Please go ahead and calculate the Sum Assured, it will be less than the total premium paid.

Its like you give me 10,000 Rs every year for 10 years and I will return you 100,000 after 10 years. I can do that as well. Why do you drag constitution in this simple calculation?

Go read LIC brochure, none of bonus, FAB, Loyalty bonus are guaranteed. Its totally at their discretion. So dont hide behind the word ‘guarantee’

Investments are of two types.

1) One type gives you fixed returns like FDs, Post office deposits, NSC bonds, etc. You dont care where they invest your money but they pay you fixed return of 8 or 9% when you invest and you get it

2) second type, does not guarantee returns, but they are very transparent about the charges they deduct, show where your money is invested and you get variable returns. The returns as history shows us can even be 20-30% on good years like 2014-15 and 2016. MFs are prime example of this

Insurance is only one type.

You pay a small fixed amount for large sum insured for fixed number of years and they will pay your nominee if you die within those years.

LIC plans don’t fall into any of the above categories, its all fraud plans. You are one unfaithful agent to many of your customers with little finance knowledge and you are earning a lot due to many poor people ignorance.

We can talk further only if you give details on LIC policy individual charges, insurance and investment details.

A Rs.10 coffee packet sold at shops gives you the ingredients with %, calorie details etc but not your 1,00,000 Rs LIC policy.

Punit-“It is not mandatory to disclose with each and every client because LIC is giving guarantee (sec. 37 of Indian constitution) of the money policy holder paid, the SA LIC has assure and the BONUS LIC declared”-What is guaranteed here can you explain in detail (compared to private players)?

Whole India know how respective central governments using LIC as scapegoat everytime they need money and sell off holdings in public sector companies. It is open secret of LIC’s style of investment.

As per my knowledge secured product or guaranteed product is RBI’s bonds (that too if you hold it till maturity), rest of all products have risk. So how can you explain it towards LIC’s returns are guaranteed?

Dear Pradip

clients of LIC knows very well what the agent get as commission. Lots of literature in print published regarding agent commission.

Infact from 1st of oct. people will start surprising when they know how much you get as TRAIL commission on SIP and particularly Hybrid product

Punit,

You are assuming that the LIC customers know what the agents are paid. Even worse, they don’t know that the commissions are actually some percentage of their premium paid. So higher the premium, higher the commission.

So its clear that you don’t tell your client about this.

Now lets talk about the charges. Can you give a list of all charges for LIC policies.

Take New Jeevan Anand. As an agent, you must be knowing what are the various charges, what part goes towards insurance and how much is getting invested. Where does LIC invest the money, what percentage in stocks and what % in bond? What do LIC do with the bonus accrued every year until paid out after 20 years? Can you throw some light on it?

You take an example of a 30 year old for 20 years, give all above details with source of information and then justify you commissions.

Mutual Funds are way more transparent. They advise people to invest only your long term money.

1) They publish expense ratio in % (both direct plans and regular plans) and most regular plans charge a max of 2,5% only. Direct plans charge around 1.5% only

2) They publish where the money is invested (including individual stocks and % of investment)

3) As you said, they will even publish absolute commissions paid going forward

4) The exit load applies only for 1 year for most equity funds and that too only 1%

5) You can redeem you fund any time, and you clearly know what you will get as returns

6) Any day you can calculate whats you returns you investment has given

7) You can rank the performance of your fund as per benchmark and other funds in same category

What more do you need from MFs?

See I give you so many answers, you don’t give any answers for our questions much like your organisation LIC. Very opaque and does not want to go into details for any plan.

Punit-Commission structure of LIC is also going to disclosed in LIC Bonds? If so, then I welcome the daring step of toothless regulator called IRDA.

Mr. pradip Now I got your confusion

you are doing a very common but typical mistake

Let me clear

you derive at 4% or 4.5% return on lic policy

how it comes

it come that if SA is 1000 and bonus is 45 than it is 4.5%

BUT

BUT

BUT

dear Pradip here you makes a mistake,

on what amount intrest should be calculated?

on amount invested amount.

agreed

you are calculating on SA

let me clear it also

Sum assured is the figure which is guaranteed by the company to the payer (life assured) that on happenning of certain event the sum will be payable in lue of premium (a small amount in instalment)

SA has nothing to do with return

your way of calculating is just like mesuring cloth in litter….

anyway thanks to you many of the blog readers confusion also got vanished regarding calculation of insurance returns

good night

Punit,

No blog reader here is confused, they are all very clear about the returns of LIC policies. Its no more than 5 to 6%

Again, I will ask you this.

Do you tell your clients that 10% of their investment comes to you as commission?

Punit-There is something called compounding effect when we calculate return on investment. If someone claiming 4.5% returns, then it does not mean that yearly bonus is Rs.45. But it is that LIC bonus may be Rs.50 or Rs.60, but such idle amount will remain with LIC up to the period of death claim or maturity without adding a single rupee to it. Hence, the effective return will come down drastically. Hope you got my point.

Dear Pradip

LIC s bonus is declared every year and is known to all as its publise in the newspaper also, excel sheet is used by MF agents

Wisdom is to speak only what much we know,

What do you know about LIC FUND MANAGER?

company is making profit for last 60 years

show me any of your script showing conttinious growth for last 60 years

persuasion is the nature of instrument like insurance. it is of same nature all over the world. even you or your child would haven’t gone to school first on his own, they might be persuaded by parents!. for their wellbeing…

Punit,

My first question, whats your answer? I have put it below here again.

Do you tell your clients that 10% of their investment comes to you as commission?

LIC bonus is declared in a clever way. They say 40 or 45 Rs per 1000 Rs of sum assured. They can easily say 4%, they wont because when policy holders see in terms of % and its so low that they wont pay any further premiums. We are talking about people who flock to FDs which give 8% returns. Bank savings account pay 4% and every quarter the money comes to you. With LIC bonus, you have to wait for 15 or 20 years by which time the value of the bonus will be lost.

I know LIC is making profits for 60 years, just that they don’t pay their customers a good share of it which is one of the reasons why they make profit in every year. How come every year LIC bonus remains the same for many years? Are they not getting higher profit like in the year 20014-15?

You may persuade a customer, but it should be done in a morally correct way. You must sell term insurance to every customer. You must tell them that long term investment money should flow into either PPF or Mutual funds for higher returns. Thats the correct way to ensure their wellbeing.

Not by giving them half cooked information and selling traditional policies. And well earning a lot of commission by that.

You cannot win arguing for LIC with us, don’t prolong the losing battle. But as long as there are people who don’t understand investment and insurance, you will get your clients and your bonus.

Punit-At what cost this so-called growth?

Dear Ritesh

I dont know with what profession you are aline at, but

don’t be impatient and loose tamper

this is an open forum and I just shared my knowledge and non of it was wrong

if return is measured in” terms of percentage ” only, you can say LIC is giving only 7 %

and the way you are arguing….. I think you should write letter to Mr. jetly(honourable finance minister of India) to grab his attention to this” mal practice”of giving lower return is doing by LIC OF INDIA he can atleast find some way

the rest is public and policy holders of India they know what they want and how they are getting. I met nomber of clients who bought another policy one maturing one, even they are educated and investing in SIP too

better you ask them why they are putting their hard earn money with LIC they will give better answer than me.

knowledge is never lies in criticizing one abruptly

so keep cool and be patient I am not going to sue you, I have many other works to do

I have given all the logical answers with facts and figures but somehow you don’t want to look at it…

May God help you.

Punit,

Do you tell your clients that 10% of their investment comes to you as commission?

How many of them go ahead and buy policy after knowing this info?

To be frank most of us have had a session with LIC agents. They carry an excel sheet which shows 8% or 10% returns after this many years. They cant explain how those numbers are arrived at, if you probe more they will give up and start talking India and all sorts of nonsense.

LIC is just a govt agent to collect money at low interest rates and help govt fund their owned companies and to pay fat salaries for their employees who are not accountable to anybody.

Do you know what LIC does with its money?

You tell people that MFs invest in risky stock markets and scare them off, but all LIC does is invest in risky stocks in the same stock markets because govt wants it to. And they earn lower returns as such.

May god give you good thoughts and make you truthful to your clients

don’t ask

join LIC

Help people to save, give security to their family and get a lots blessings…

Punit,

Just check how many people thank Basu for his blogs. It will be much higher than many LIC agents. This alone proves that you don’t need to join LIC to get people blessings.

From my side, I point my friends to blogs like these to make them understand finance and investments, that brings me enough of goodwill.

Pradeep-Thanks a lot for your kind words 🙂

Wow.

It seems a lot of development took place over a weekend!!!

Sir,

I raised some genuine queries towards Mr. Punit’s tall (and baseless ) claims about LIC policies giving better returns. However, he kept on giving irrelevant answers and the worrying thing is that his response got more and more irrelevant without giving any logical answers to those queries.

Sir, I started reading your blogs since last one and half year and learnt a bit about financial planning. So as a better informed investor, I can raise some questions about traditional plans and no one should feel offended by it. This is a public forum and we are here to share our experience so that we can rectify our past mistakes and move ahead in life towards financial well-being and freedom.

Have I committed any crime by raising following issues?

1. Is it not our right as customers to ask relevant questions about the financial product before committing our funds for 20 – 25 years?

2. Is it not true that traditional plans (from any life insurer) results in policyholder perennially remaining under-insured?

3. Is it not true that traditional plans are generating sub-standard ( 5% – 7%)returns?

4. Is is not true that there are better products available in the market? (compared to traditional plans)

5. Is it not true that LIC never promoted Term Plan until recently (years after private insurers)?

6. Is it not true that traditional plans are non transparent?

7. Is it not true that LIC has worst Child Plans in the market? ( forget about returns. More worrying fact is person to be insured is Child!!!)

8. Is it not true that LIC agents never tell investor about exit clause? ( I have personally gone through this bitter experience)

9. Is it not true that not a single plan from LIC is giving inflation beating returns?

If answers to above-mentioned questions is affirmative, why should one bother to buy traditional plans, paying premium for major part of his working life, remaining seriously under-insured and couldn’t reach any specific goals?

I am raising these questions against traditional plans of all life insurance companies including LIC. The only thing is LIC should be blamed more since it commands around 70% of life insurance business and major chunk of it is traditional plans.

I know Mr. Punit will keep defending LIC since he is an LIC employee and hence I don’t expect any logical answers from his side. Now it is up to individual investors to decide.

Thanks.

Ritesh-Don’t worry, he stopped to reply for all our questions.

Punit-Don’t showcase yourself the tag of SOCIAL ACTIVIST. What about the commission? Will you share it back to the customer or handover to IRDA? You can help them more by donating your commission also.

Punit,

Next time you sell a policy to your client, please tell him truthfully what is your commission out of the client’s premiums throughout the policy period. When you find a client whose premium is 30,000 yearly for a policy tell him that 11,000 of that 1st year premium goes to your pocket. Lets see whether he blesses you or curses you.

The points why LIC is selling policy through agents:

1. In 1956 when LIC is started, lots of fraud private companies were there, and it has been merged and for the benefits of people government has started.

2. It is avoiding overheads like salary (basic, DA, medical allowance, retirement benefits etc has to be paid). The agents who procures business only gets commission.

3. It is avoiding overheads like Rent (if everybody appointed all branches should requires bib premises) which in turn avoids electricity, water, etc.

4. It will some amount of unemployment problem has been solved.

5. They wont be getting annual increment like us where we work. There is no increment for agents. Do business and get commission.

Even where you telling share markets and any other financial products they are also not doing free of charge. Fund Managers are getting lakhs of ruppees from your fund only. During 2008 crisis many had losses even me. Nobody is guarantee you.

Also now I am seeing the most of the infrastructure of India is because of LIC only (See All Five Years Plans).

After life we dont take anything. Insurance is nothing but sharing of losses. So some part of our amount will go for lighting the unfortunate family whose main bread winner might have short life.

So LIC is not only for profit. It is for welfare of the people and country.

So definitely who loves our people, loves our country, loves our family will not betray LIC.

Srikanth-1) So LIC NONFRADULANT company? Then what about the illegal commission sharing activity by almost all agents? Why can’t LIC MUM on this issue?

2) Then you mean to say LIC products only have agents commission and rest of expenses will be bear by LIC itself?

3) So who pay such expenses? LIC or Govt Of India?

4) For the sake of resolving unemployment problem of country, I must invest in LIC products??

5) So for that purpose why I have to invest my hard earned money?

If LIC is so smart in managing the money, then why can’t it preaches the same lesson to LIC Mutual Fund??

Mr Srikanth,

Are you saying that all individuals in this country should pour their hard earned money in to LIC because

1) They give employment to many

2) They help build infrastructure, etc

3) They are taking care of welfare of this country

Basically you are saying we should invest our money in LIC’s charity. And a big chunk of this charity money goes to agents who are very unfaithful to the very customers from whom they get the commission.

No middle class and poor individual in this country want to do charity of such large scale. We pay enough in terms of direct and indirect taxes.

I repeat, if you are an agent and you go tell your customer how much of his money comes to your pocket then your customer will talk some filth and be gone forever.

You keep saying 2008 crisis brought about huge losses for investors. LIC is bringing huge losses to every policy holder every year. 5-6% returns and the fact that the investor is trapped once he buys a policy is the worst combination one can buy.

Talk about fund managers, they are not like LIC employees who will have a long career until 60 irrespective of what performance they show in office. A private Fund manager has to perform for his high salary or perish if he cant.

Do you think those fund managers get their job through govt reservation? Check their qualifications and then talk about their salaries. A number of them deserve their high pay given the fact their funds have performed exceedingly well for many years.

Tell me why do the LIC agents deserve such high commissions. Can you justify the same?

Basu,

Do you know the real reason why LIC offers money-back policy?

Many of their customers may stop paying premium after 3-4 years. So to make them continue they will pay you something after 3-4 years which you will pay as premium at least 1 more year. And also assume you will get 15% of the money after 8 years, then you won’t stop paying premium after 6 years because you will get some more after 2 more years of payment. This way people will continue the policy and agents will keep get their commission.

LIC people are quite clever and they know the mentality of our people

Pradeep-You no need to say all those 🙂 Because my journey with LIC started when I was 8th Std. So I know more and more.

Sir

do you know the difference between

flat 35% discount and

upto 35% discount

samaj lo

and ya 2 nd and third year the figure you mentioned

someone sue you

Punit-May I know the how much will be the commission rate for endowment plans?? Is it 35% (including bonus) or less than that?? Flat or UP to we discuss later. Let them sue me, if I said anything wrong.

Why not you answer all my questions?? Just eager to hear your direct answers 🙂

mr. pradeep

if you are trying to publish your intelligence over a public domena you must at least check the fact 10 times

the figures you shown of agents commission are wrong

Punit-Do an agent not receive 35% commission from endowment plans in first year (including bonus commission)??

Alright Punit,

Let me ask you this, you tell us the agent commission paid for endowment plans. As an investor, I have the right to know how much of my money is paid as expenses including agent commissions.

You give the details first and then let’s discuss about suing and other stuff.

Pradeep-He replied the commission by emailing me but not replied to my comment here 🙂

Basu,

The fact that he protested only the 2nd and 3rd year commission at least proves that my stats for 1st and from 4th year onwards is correct.

So if it’s not 12,000, it will be 11,000 for a 100,000 investment.

So I am still paying 11% as agent commission of my investment. I am not even talking about the charges LIC deduct from my investment.

Damn I pay only 1% as expenses on my equity mutual funds which gives me far greater returns and the freedom to withdraw my money anytime.

Even FDs charge me only 1% for a premature withdrawal.

Why do people pour their hard earned money on the agents for 25 years? Baffles me.

Pradeep-First thing is lack of knowledge and second thing is the so called PUSH to buy by friends, relatives or neighbors.

Basu,

I think if people fix the knowledge part, the PUSH factor will be taken care automatically.

BTW, do you realize from the queries you get about LIC policies, people worry only about returns. They don’t care about the miniscule insurance part of their policies. So the argument that people go to LIC to get insurance with investment is a farce.

This is where the agents are not turning people away and in the name of service, they sell high commission products.

Pradeep-I know and that is why I strongly recommend the final solution in terms of money is DO IT YOURSELF. Learn and educate yourself is the final solution.

Yes, social cause in the name of BUSINESS. That is why I asked whether that agent donate his commission to the so-called social cause or not 🙂

Absolutely Basu, you are the sole owner of your money and you care about it more than anyone else. So learn and do it yourself.

And only the LIC pays 11% commission for filling documents, no one in this country earns easy money than these agents. Even thieves have to risk so much to make their kill.

Next time an agent argues in your blog, raise the issue of commissions and ask justification for that. They will keep themselves shut.

Pradeep-Thanks for sharing your views 🙂

Now you got the point sir!

IRDA never made it mandatory to give 4 or 6% of return

one can give more and LIC is giving but as you said can indicate only as per IRDA guidelines

now, Mr. ritesh is wrongly taking it as real return so, he should update himself accodingly.

Punit-Now I not got it really 🙂 Do you know what Mr.Ritesh pointing about the so-called REAL RETURN?? May I know the meaning (according to you) of REAL RETURN?

Why you tilt your position when I point something towards Mr.Ritesh?? Why not answer to my questions properly?? 🙂

Dear sir, Its not me

Its mister Ritesh who is quoting the indirect return as actual return

please look at his post a day before he made

you must made this clear to him. I am very much aware that LIC IS DECLARING FAR MORE RETURN ON HIS PRODUCT THAN IT IS MADE MANDATORY BY IRDA

Punit-But you referred that due to private players LIC suffered a lot and hence gave an example of 4% or 6%. MANDATORY?? What is mandatory? Mandatory or Indicative returns are made ONLY to show the plan features. But IRDA never made it MANDATORY that insurance companies MUST GENERATE THIS MUCH RETURNS ONLY. Please understand of what you are speaking.

dear author

I think you are not following my post properly or you don’t want to follow with hidden intention. I repet,

the 4% and 6% return is mandatory norms by IRDA for all the insurance companies by 2014 before that it was 6% and 8% (I think as afinancer planner you must be knowing this, at least you should know)

but before entry of pvt. players it was not there

and LIC is alredy paying far better returns than this norms,

So, to whome it is applicable to..?

I think you smart enough.

Punit-The complete misunderstanding of what is INDICATIVE RETURN to ACTUAL RETURN 🙂 Indicative returns are mandated by IRDA to show plan features but it does not mean that product MUST deliver that much return only. Otherwise, the product which is delivering more than indicative return is SUPERIOR product. There is no such definition by IRDA. It is you who interpreting as per your wish to defend LIC. Please refer my post on the same “Life Insurance-Difference between Indicative Returns to Actual Returns“.

What is harm in mandating indicative returns? whether it is due to entry of private players or whatever the reason. LIC is delivering more than indicative returns means a great product offering company to invest??

Dear author,

the 4% and 6% also came from 2014 only

only due to bad practice done by pvt. players

I am not saying this as an LICAN

go to the IRDA site or visit any ambudsment office you will find the same fact

and tera rate and BITA has no connection with LIC but Mr. Ritesh has made it connected by claiming that all MF are giving good returns for years…

so I needed to mention the fact

Punit-Due to bad practice of private players how can LIC’s returns got reduced?? May I know which facts you are pointing. You are revealing some interesting facts, which I am eager to learn. Please provide the link which claims that due to private players LIC policies returns dropped to 4% and 6%. Ritesh never said ALL MFs doing good. Even if he said so, is only BETA and TERA are two indicators to judge MF?

I hope my comment gets published

my dear Ritesh

I think India is the only contry where an organization is giving more return for last 60years, still he should show it between 4 to6% only because other private players can not do as well.

check it at your own level

If you are very much keen and MF

please share some light on BETA and Tera Ratio…

Punit-For your information, private players entered into insurance sector post 2000. May I know the logic of MF Beta and Tera to LIC returns??

dear, Ritesh you rightly said that I am with LIC. YES, IM LIC EMPLOYEE.

but I bought many policies before I joined LIC. anulyways, ” you said you have a typical mindset” yes I am, I am having the mindset of 90%of Indians.

Financial planning taught me that one one should put all the eggs in one basket.

people like you always tends to advise everything in mutual fund, it is wrong advise. I do invest in MF, BONDS, STOCKS but at the same time I also invest in LIC traditional plan as well.

you said that I havent given proper evidence of my example

I sent it to this blog admin as I dont know how to post it on blog.

you said in 1991 you were not born.

but LIC was there and the figures were actual.

you advice me to do Google

can you say me HOW MANY MUTUAL FUNDS are there, HOW MENY OF THEM are performing at expected level? you show cliets the performing funds only (after they performed) what abt. the other funds where you and other advisors have suggested to the clients and they didnt perform, and Ya, NON PERFORMER FUNDS ARE MORE THEN PERFORMING…

so please, dont put people ‘s money at risk, divided them properly between risk and growth.

It is advisors ROLE too…

Punit-“Financial planning taught me that one one should put all the eggs in one basket” GOD CAN PROTECT 🙂 You sent me half truth, you not replied to my last email where I specifically asked details. May I know what is your EXPECTED LEVEL from MF? I am eager to know your EXPECTED RETURN from your equity portfolio.

Is LIC product only a debt product which DIVERSIFY our investment? There are no other DEBT products on this earth??

Mr. Punit

You are again giving irrelevant answer to my query. But then, that is what one expects from LIC agent / employee.

We are living in 2016 and not 1991 (endowment plan about which you are bragging.) We have many independent websites like Value Research, Morning Star where one can see performance of mutual fund over last 10 – 15 years. There are many schemes of widely tracked mutual funds like Franklin Templeton, Birla Sun MF, Kotak, SBI, HDFC etc. which have given consistent returns over last 10 – 15 years.

A prospective investor can invest in any of those schemes according to his / her risk appetite via SIP route to get benefit of rupee cost averaging and build wealth over a long period of time. He can cover his life risk by purchasing online term plan from any Life insurance company (BTW, LIC’s term plan is costliest in the market. This is also evidence that LIC does not promote insurance per se.)

It is adviser’s role to impart financial education to his customers and help him reach his financial goals in the best possible manner and traditional plans are of no use in reaching either one’s insurance needs nor wealth generation objective.

Since you were bragging about endowment plan returns from LIC, I would advise you to check LIC’s website first and comment. I have checked Benefit Illustration Statement of LIC’s New Endowment Plan (UNI – 512N277V01). I am stating extract of that statement for the benefit of all blog readers so that they can decide on their own. This illustration is available on LIC’s website.

Age at entry 30 years

Policy Term 35 years

Mode of premium Yearly

Sum Assured Rs. 1,00,000/-

Annualized premium Rs. 2,881/- (Excluding Service Tax)

Amount payable on death / Maturity

Guaranteed Variable Total

@ 4% @ 8% @4% @8%

Year 35 1,00,000/- 40,250/- 1,49,000/- 1,40,250/- 2,49,000/-

So at the end of 35 years LIC’s new endowment policy gives Rs. 1,40,250/- as maturity value @ 4% expected growth rate and Rs. 2,49,000/- maturity value @ 8% expected growth.

If you have the ability to calculate IRR, you would observe it works out to be pathetic at 1.76% @4% expected growth rate and 4.57% @ 8% expected growth rate.

Would you like to give your expert comments on it?

I absolutely support Mr Ritesh’s statistical proof here.

Let’s also calculate the agent commission for the above illustration.

First year 35% of premium paid to agent, 2 and 3rd 15% and then 5% afterwards till 35 years.

That works out to be nearly 12000. So out of 100,000 paid as premium, 12% goes to the pocket of the agent which is totally unfair and shameful for no service offered by the agent.

For higher premiums, the commission amount is substantially higher.

Why would I waste my money on such useless stuff.

Pradeep-You may shock if you hear the actual expenses of such endowment plans. We know only the agent’s commission, but there are other expenses too which insurance companies never disclose. Refer my earlier post “Why Endowment or Money Back Life Insurance Policies give less returns?“.

Dear Sir,

I have some FD in banks and society . It is bit difficult to keep track of all because each FD is less than 50K.

I would like to know whether there is any mobile app to track these all in one place and it gives report like maturity date/ amt /interest amt.

Thanks in advance

Divya

Divya-As of now NO. But there are some personal finance tools available online to track your investment (which are not automatic, but you have to feed the data) like perfios. But as I pointed data will be updated by you manually. Because banks will not share your data with others. That is the problem.

Dear Basuji I don’t understand why a person of financial world can expect that LIC can give something FREE has LIC claimed it ? it is no point to criticize the product.

leave it.

the point of return in percentage. as I mentioned,

the bonus rate for last 25 year goes to 1587 means 1587 into 500, so it comes to 7,93,000

the SA is 5,00,000

the FAB 5,50,000 the maturity value is 18,43,000

paid premiun : as itis endorsement plan it will be something around SA (i. e. 500000)

now just calculate IRR

I hope you will be surprised

though

return in percentage is not the MOTTO of LIC, as an organization. still when we discussed only about returns. it is just like,

we you go to some good restaurants and get into calculating the cost of food the are serving

“this dish hardly cost them 12 rupees, they charges 60…”

sir,

dont compare AC with TV,

they both are for different purpose.

Hope you will understand.

Punit-Can you elaborate the bonus rate you assumed in the lines “the bonus rate for last 25 year goes to 1587 means 1587 into 500, so it comes to 7,93,000”? May I know the premium amount (I don’t want SOMETHING AMOUNTS). I will surprise if you provide me the details properly and I calculate the IRR 🙂

If RETURN PERCENTAGE IS NOT THE MOTTO OF LIC, then why they launching the products which also be INVESTMENT product. When someone invest, then the investors have rights to expect the good return. If LIC’s motto is only to provide insurance coverage, then better let them offer pure insurance product. At the end, buyers money is not so cheap, it comes from the hard earnings.

Now a different turn 🙂 So “this dish hardly cost them 12 rupees, they charges 60…” then we must BLINDLY not to question how much returns we get from LIC? Bravo…..I am not comparing AC with TV. But LIC combined AC and TV and selling it as a SINGLE product. Hence, one must look for each feature 🙂

Dear Ritesh,

I think you were worried about future return of LIC. I don’t understand you people, when you invest in propert, in MF you looks at its past when it comes to LIC you start talking about future? when you

you have mentioned LIC is giving 5to 6 % return how it is so?

if you have taken a simple endowment plan for 25 year in 1991 you would have got maturity in 2016 and the IRR would be around 8%

the average of ppf for these years is 8.77

have a look at….

Dear sir basuji

you have given too many things about 841 BIMA DIAMOND

sir, in a day of launching, we people of LIC even can not judge the plan? how can you? have you studied the feature SSV DURING EXTENDED COVER.? pls. go through

Punit-Can you elaborate the 8% IRR claim of Endowment Plan? If possible with exact data. When you choose any asset class or product then how you judge your return expectation? Property investment? When I recommended property as an INVESTMENT? If I am wrong about 5% to 6% return expectation from this product, then please enlighten me and other readers about return expectation from this product. Otherwise, on what basis we can invest without expecting anything? I am eager to hear your return expectation from this product. Please 🙂

Mr. Punit or whoever you are. You are either an LIC agent (or employee) and showing mindset of a typical agent who thinks only his products are best. However, I am not surprised. You said you are pursuing CFP. However, it is of no use if you are only going to sell pathetic LIC traditional plans to your customers. You are clearly suffering from conflict of interest. Otherwise, you would have promoted Term Plan.

Yes I am worried about future returns from LIC since there is no improvement since a decade. To substantiate your point, you gave me a loose example of taking 25 years endowment plan in 1991 and somehow arriving at IRR of 8% in 2016!!!!!

However, you haven’t proved your point in a detail manner. I would like to know how it is arrived at. In fact, you gave an example which is totally irrelevant today. In 1991, I was in school and hence not earning anything. I started earning from 2003. So I would only consider bonus declared by LIC since 2002-03. You should go through table of year wise bonus declared by LIC since 2003 and you will notice that bonus rate has consistently dropped to 5%

You are referring to example of 1991 when interest rates tend to be on higher side. But situation today is quite opposite. Interest rates are moving southwards and are expected to drop further in coming years as India gradually shifts from developing economy to developed economy.

On the other hand, stock markets have given better returns than LIC products. Google it and you would find it.

Hence, you should keep yourself updated about world economy, interest rate scenario, LIC’s heavy commission structure and establishment expenses and then make sensible comment.

Ritesh-Even he failed to reply to my email (he sent me a mail personally to defend his 8% IRR return).

Sir,

Thanks for sharing article. Your observation on auto cover is absolutely brilliant that it will enable LIC to show these policies as running / in force policies instead of lapsed policies.

We know that none of LIC’s plans give return more than 5% to 6%.

However, I wonder what will happen in future. Yield on 10 year government security used to be around 8.50% to 9% for last many years. Now it has reduced and is hovering around 7%. In such a scenario, how life insurance companies are going to provide even present 5-6% return in coming 20 years period is a big question mark!!!

Since, LIC has to invest significant portion of investible funds in government securities and other debt products (around 85%) and interest rates are poised to go down further in future. Even if it makes trading gains, will it improve overall rate of return?

I really don’t understand. Can you explain?

Thanks

Ritesh-Their majority exposure is in equity. They may get impacted from fixed instruments return. However, overall return be same or lower than this. Reason is high hidden costs like agents, officials and fund management charges.

In India People are not interested in buying Insurance Product. In India Insurance is not compulsory. Are yaar isme to benefit nahi hei mat le ye Indian people ke samaz ke bahar hei. Indian are interested in getting money it may be small or big amount. They don’t think about LIC Office, Officers, its location it is PSU or Commercial Institution. When Agent go to the common people and request him so many times then only people by Insurance. If we say I am Certified Financial Planner and I will guide you for your financial planning. He OR She / people will always say Dimakh Mat kha na yaar. You may be CFP or any other degree holder from India or Abroad. Dekh Muze kaoi lena dena nahi tu Agent hei itna paise mil raha kya to mai policy Nikalta. This is ground level talking and it is practical. Ye badi bate people ke samaz ke bahar. Jab election hota hei to Andhe Bankar Angutha lagate hei ye to India ki Kahani hei. In most of the Government Offices OR PSU people who attended age of 50 years and above not interested in working Mera salary milta hei mei to khush hu baki Jaye Bhad mey. This is the tendency of our Leaders when leaders getting crores of rupees, leaders always thinking mera jeb to bhara hei baki ye murkh janta jeye bhad me. This is the reality.

Dilip-So the whole India is as per you, HENCE we must buy such products??

dear sir

just go through censu statastics. it is already proved

and ya,

LIC is a commercial financial institutions which runs to spread insurance to larger and deeper in the country.

As the OLD AGE HOME is not ou concept TERM PLAN is also not of Indian origine, people still like to have insurance with savings and Its nothing wrong in it, provided they took sufficient insurance.

Punit-Bravo to your knowledge. Can you tell me the cost of a cup of tea 10 years back to now in your area? LIC is insurance company, let it spread awareness about INSURANCE ONLY. I too support 🙂

So any new concept of outsiders even if it is good is not acceptable for us?

Dear sir

I am also doing CFP, and very well known to the jargon ‘present value of money’ and ‘future value of money’

Dear sir,

Threr are 50 %of of family who can survive for 10 years in just 2.5 lakh! ya, I am marketer and I know it(still micro insu. is there)

The other thing is that buying insurance is a ritual in India. when salary increses, when new plan introduces, when a member add to family.. people buy insurance. and such they increase their cover.

so, LIC rightly say

“we know India better”

Punit-Great to know that your doing CFP and you understood the jargon called “Present Value of Money” and “Future Value of Money”. But I will tell you the reality of rural area as I belong to one of what backward area of Karnataka. The person who used to live happily with the expenses of less than Rs.10,000 a month is now finding it hard to survive in towns.

May I know any facts which can prove that there around 50% of family who can survive at the monthly expenses of Rs.2,500 a month for next 10 years (without considering the so-called jargon of “Present Value of Money” and “Future Value of Money”)?

So there is a ritual in India to buy the insurance as investment, hence we all must continue that??

Yes, LIC RIGHTLY SAY “WE KNOW INDIA BETTER”.

Basu ji, I am sorry to say that your analysis of this plan is not palpable.

It shows that you haven’t studied LIC ‘S old plans of same kind.

In every auto covered plans LIC deduced unpaid premium so there is no bafflement.

Why it is restricted 5 lakh SA, because LIC has introduced this plan as “Stand Alone”which will enable to to many people to buy this product.

Loyalty offered by LIC is far better than other private companies.

Shashikant-I read the plan feature and then only I wrote. Auto cover is highlighted as if the flagship feature of this product. But in reality nothing is FREE. LIC deduct the premium dues+interest and then only they pay the claim.

But the standalone plans which LIC usually launches during January month of every year will not have such restriction on sum assured. Forget about the future values, but in today’s term, for how many years a family can survive with a claim amount of Rs.5 lakh? May be few years. Then just think about the same claim amount after few years, it may be few months.

LIC offered it as STAND ALONE product, it is it’s own business. For that why I (all buyers) have to BUY?? May I know LA rates of this plan? Because I don’t know and hence not commenting. But you claimed that LA of this plan is better than private companies.

basu ji you allways give negative reports to all LIC product . plzz you suggest wich company’s plan better

Mukesh-Who said I am against all LIC products? I am strongly recommending LIC’s Term Plans.

Term plans are not bread and butter of marketing field force. LIC is having life fund of more than 20,00,000 is not due to selling of term plans or ULIP products.

Shashikant-So for “marketing field force” purpose we buyers must scarify our insurance need and buy endowment or ULIPs??

one more thing

you found nothing attractive in the product? i m surprised!

if on guy is 41. he will need to payfor 15 years only and his insurance cover will continue till 77 !!!

Regarding AUTO COVER many a times people with not good stable job (like diamond workers in our city surat) lost the job for particular period of time (it longs to 3 months and sometimes a year and more) this product will protect his family during the period. And LIC truly mentioned it as AUTO COVER and not aFREE COVER

Punit-So you feel this as a great product that after 24 years of completion also maximum Rs.2,50,000 coverage for your up to your age of 77 years. But have you ever thought the value of Rs.2,50,000 or Rs.5,00,000 when you are at the age of 65 years old? It may be your few days expenses. Hence, in what way we can say this peanut amount as a great reliever?

dear baduji,

I follow your blog frequently.

Regarding 841 of LIC I must bring to your notice that It is allowed only upto 5 lakh(you mentioned for 10 lakh many a times) which please get correct.

Punit-My error and rightly pointed 🙂 Yes, I rectified it.

Good . U r great sir . To spread bulk knowledge of all believe people. So hats up sir

Vijaya-Pleasure 🙂

Auto Cover is just an benefit to policyholders in case if they are unable to pay premium for 2 Years, Insurance Cover is On. There are many instances where Policies are in lapsed condition just for 1 Year & Insurers deny claim since it’s lapsed Policy. Hopefully this is much better than that even if they recover Premiums. It’s Insurance Business to recover Premiums due. It’s most helpful for people with seasonal income in agricultural field.

Vinaygudipati-For people of seasonal income it may, but at what cost? Nothing is FREE, that is what I am pointing.