What if you are not satisfied with your existing health insurance premium, feature or service of an insurance company? The simple answer is to use the Health Insurance Portability option.

You can easily switch your health insurance from one insurance company to another insurance company or from one plan to another plan with the same insurance company. Let us see the benefits and the process of how you can use this feature.

What is the definition of Health Insurance Portability in India?

It is the right granted to an individual health insurance policyholder to transfer the credit gained for pre-existing conditions and time bound exclusions, from one insurer to another or from one plan to another plan within the same insurance company.

Here, the meaning credit gained is-General Waiting Period, Waiting periods for coverage pre-existing conditions and any time bound exclusions.

Health Insurance Portability is allowed to all individual, family floater and group health insurance products. However, in case of group health insurance portability, you can’t move from one insurance company to another. Instead, you can port it within the same insurance company.

When you can opt for Health Insurance Portability?

- When the existing health insurance company offering you poor service.

- When you feel the existing cover is not enough to cover specific diseases. However, the existing insurance company not providing such high cover.

- When you felt that your existing health insurance company settle the claim at very low pace or bad claim settlement history.

- When you feel there is a better product in the market with competitive price than the existing health insurance.

Points to know before opting for Health Insurance Portability

# Individual, Family Floater, and Group Insurance products are eligible

As I pointed above, health insurance products offered by general insurance companies like individual, family floater and GROUP HEALTH INSURANCE products are eligible for Health Insurance Portability.

Earlier I am of the opinion that only individual and family floater health insurance policies are allowed for portability. But one of the readers of my blog pointed that group health insurance products are also eligible for portability. However, the only condition is that you can’t port from one insurer to another. But you can port from group insurance to individual health insurance product within the same insurer.

In the case of individual and family floater health insurance products, you can port either within the same insurer or shift to another insurer also.

# 45 days prior notice is a MUST

You must apply for health insurance portability to the new insurer or existing insurer (in the case of porting a product), 45 days prior (but not more than 60 days) to the premium renewal date of an existing policy.

Insurance company may reject your portability application if they found that the application for portability is submitted for less than 45 days or more than 60 days for premium payment of an existing policy.

You must apply for portability only before 45 days (not more than 60 days). Hence, you are not allowed to use portability feature during any policy period.

# You can port from individual to family floater and vice versa

I was unable to find the specific guidelines on the same from IRDA. However, in Bajaj Allianz FAQs, I found that it is possible. This gives a big relief to many.

Let us say currently you are single and after few years if you get married, then the existing insurance product must be moved to the family floater. However, the features of existing insurance company’s product may not be suitable to you. In that case, you can opt for portability. But do remember that portability features of “credit gained for pre-existing conditions and time bound exclusions” applies to an individual only. The new member’s waiting period and time bound exclusions will start freshly.

When you move from family floater insurance to an individual insurance? When any member of a family suffering from diseases, which resulting into frequent claims. This leads to the major headache and risk to you. In that case, it is wise to remove that member from the family floater. Select an individual policy for that individual and rest of members can continue the family floater insurance.

# If there is a break in existing policy, then you are not eligible for porting

One of the basic conditions of eligibility for porting is that you must not skip the premium dues and there must be any break in existing policy. Definition of the break as per IRDA is “A break in policy occurs when the premium due on a given policy is not paid on or before the premium renewal date or within 30 days thereof.”

# What if Health Insurance Portability not processed on the premium due date?

Let us say you applied for health insurance portability well before 45 days. But it is still pending with the new insurance company. In such a situation you have below option.

You can extend the policy with the same insurer by requesting of extension. Such extension will not be more than a month. Also, the premium will be charged only for such extension period.

However, if any claim arises during this temporary extended period, the insurance company will accept the claim as per rules and conditions of existing policy. But note that, insured will have to pay the balance premium of the year. After this claim, he will not be allowed to port his policy. He will have to continue his policy for a year with existing insurance company.

The existing insurer can’t cancel the policy until a confirmed policy from the new insurer is issued or there is a specific written request by insured to cancel it.

# You have to pay for accumulated No-Claim Bonus

Let us say your existing policy is of Rs.2 lakh. You accumulated the no-claim bonus of Rs.50,000. When you opt for portability, the new insurer will add the total cover as Rs.2 lakh+Rs.50,000=Rs.2,50,000. But you have to pay the premium on Rs.2,50,000 but not on Rs.2 lakh. Hence, whatever the no-claim bonus you accumulated will turn to be NOT FREE.

# New Insurance company may reject your application

As I mentioned above, the health insurance portability is the right of an individual insured to opt. However, there is no such obligation from health insurance companies that they must accept. Hence, your application will be treated as the new proposal for the new insurance company. They process it as per their underwriting rules. If they found it risky to insure you, then they may reject it. Otherwise, in some cases, they may request for medication examination also.

# Enhanced cover while portability will be considered as new insurance

Let us say you have existing insurance coverage of Rs.2 lakh. You accumulated no-claim bonus of Rs.1 lakh. However, the minimum sum insured in new insurance company starts with Rs.5 lakh. In such a situation if you enhanced your coverage to Rs.5 lakh, then the waiting period and exclusions you gained from existing policy will not apply for the new enhanced cover of Rs.2 lakh (Rs.5 lakh enhanced cover-Rs.2 lakh insurance+Rs.1 lakh no claim bonus=Rs.2 lakh).

# Understand the waiting period while porting

Let us say there is a clause of 4 years waiting period for a disease X. You completed 3 years with existing insurer and moving to port with the new insurance company. In such a situation, if you move to the new insurance company, then the waiting period for disease X will be only 1 year (because you already completed 3 years of waiting period with the old insurer).

Let us say you have health insurance coverage of Rs.5 lakh and a waiting period for a disease X is 4 years. You applied for health insurance portability with the enhanced cover of Rs.10 lakh. In such a situation 1 year waiting period for disease X will be applicable to the old ported sum insured of Rs.5 lakh. The enhanced Rs.5 lakh will have the feature of waiting the period of another 4 years for disease X.

# New Insurance company must inform you within 15 days of applying

If you submitted all the necessary documents along with the prescribed application form for portability, then new insurance company must inform you about their decision within 15 days. Otherwise, they will not have rights to reject it after 15 days.

Therefore, if they can’t reject your application within 15 days, then they MUST accept it.

What are the documents required for health insurance portability?

- Existing health insurance policy document

- Self-declaration by insured about no-claims made in last year (if there are no claims).

- If there is a claim in existing policy, then discharge summary, investigation and follow-up report copies.

- If there is a past medical history, then consultation papers, prescription, investigation, treatment and report copies.

- Portability Application Form.

- Other basic documents which may vary from insurer to insurer.

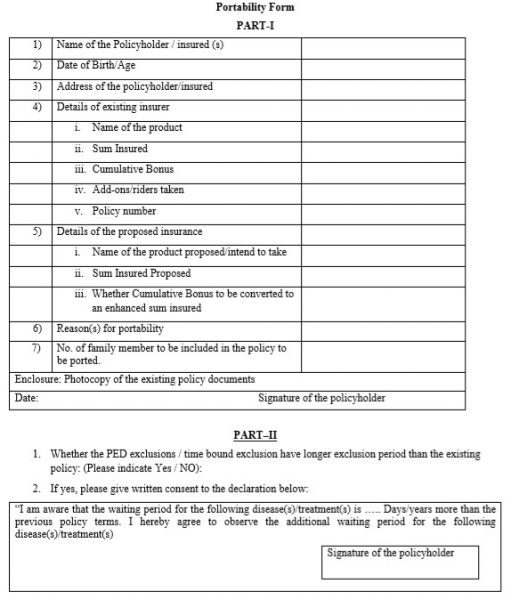

The application form of Health Insurance Portability looks like below.

What is the process of Health Insurance Portability?

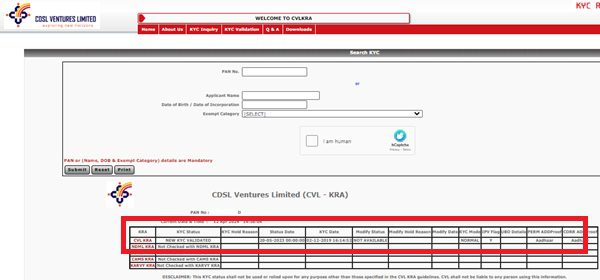

Once you submit the form along with necessary documents, the new insurance company will seek the necessary details of medical history and claim history of the concerned policyholder from the existing old insurance company. This will be done through the web portal of the IRDA.

On receiving such request from the new insurance company, the existing insurance company will submit the required data with IRDA within 7 days. If they did not furnish such data within 7 days, then it is the violation of IRDA rules.

Once the new insurance company receives the data from the existing insurance company, it will start the process of underwriting. The new insurance company will inform the insurer about it’s decision within 15 days of time from the application submitted by the insurer.

There will be no loading or any special charges related portability service. It is purely FREE. Also, do remember that according to new IRDA Health Insurance Regulations 2016, agents will not get any commission immediately by offering portability. However, they are eligible for renewal commission at later years.

Advantages of opting Health Insurance Portability

- Better service expectation from the new insurance company.

- You will get the competitive price.

- You will get the better-featured product.

- You can customize the policy based on your future requirement by opting portability.

Disadvantages of opting for Health Insurance Portability

- Portability is allowed only during the renewal time.

- As I mentioned above, you may end the accumulated no-claim bonus as free. It will be added to your sum insured and you have to pay the premium.

- New insurer will again analyze the risk involved in offering you the health insurance. Hence, they may load the premium based on their own underwriting process.

Few other posts related health insurance are as below-

- Health Insurance Regulations 2016 – 5 changes you must know

- Multiple health insurance policies -How to claim from all?

- Best Health Insurance Company in India-Based on IRDA 2014-15 Incurred Ratio

- Top Up Health Insurance Plan & Super Top Health Insurance Plan-What are they?

- Best Senior Citizen Health Insurance in India-Product Comparison

18 Responses

My wife is holding health insurance policy from star health.The policy continues from 2009,but recently I noticed that DOB in Policy is wrong .Instead of 1/1/1952 the date in policy is 1/4/1956.Whether claim if any in future can be rejected in this ground.

Dear Vishwa,

It is better to correct it immediately.

Hi,

My father has a basic family floater health policy in New India for 5 lacs covering me, my father and my mother. As my age is crossing 25 this year I am thinking to take a individual basic health policy for 5 lacs with royal Sundaram and thinking to take a super top up for my parents. Now whether the port option works for my parents that is they are moving from a family floater plan to a super top up plan. I guess in my case it is not a problem as I am going from family floater to a individual plan.

Manoj-Portability from family floater to super top up is not possible. But you can come out of family floater and can buy an individual plan.

Dear Sir,

I am your subcriber user…

I want to know that can I do portability in my existing Union bank health insurance plan as Union Health Care?

If yes, what process for the same?

Please give your answer soon…

-brijesh

Brijesh-As Insurance company is same, portability is possible from group insurance of Bank to health insurance company (I think Union Bank offering you group health insurance). Please contact the insurance company for the same.

Hi Mr Basavaraj,

May I have your contact no for seeking advise .

Sanjay-Please drop an email to [email protected]

I AM CURRENTLY WITH THE NEW INDIA ASSURANCE CO. FOR MEDICLAIM.

I AM HAVING THE MEDICLAIM POLICY SINCE 2001 WITH NO CLAIMS AS ON TODAY.

BUT THIS YEAR I.E 2017 CO. HAS INCREASED THE PREMIUM UPTO 200 % I.E ONLY THE NEW INDIA ASSURANCE CO.

CAN I OPT FOR OTHER GOVT. CO I.E THE NATIONAL INSURANCE CO. WHERE I HAVE LEARNT THAT THERE IS NO SUCH INCREASE IN PREMIUM RATES.

PLS ADVICE.

Paras-First check the reasons for such steep hike, then take the decision.

which is the best mediclaim policy for age 53 yrs,47 yrs for 2 adults + 3 kids( age 22,21,14) in terms of

1)low premium

2) good claim reimburse record

Bharat-Refer my post “Best Health Insurance Company in India-Based on IRDA 2014-15 Incurred Ratio“.

IRDA states “All policyholders are hereby vested with the right of portability, i.e., policyholders have the right to purchase a Health Insurance Policy from another insurer from amongst the products such insurer is marketing” so Individual to Floating is possible as the policy holder can chose any policy being marketed.

Further, IRDA states “Individual members, including the family members covered under any group health insurance policy of a non-life insurance company shall have the right to migrate from such a group policy to an individual health insurance policy or a family floater policy with the same insurer.”. So, if porting is allowed from to Individual or Family Floater for Group insurance then I believe it is applicable for individual policies too.

Sreekanth-Individual policies to??

The IRDA guideline to non-life insurance companies about porting states one can chose any policy being marketed. So, I interpret so. I’ll try to get more details with the help of RTI. I’ll update my comment if I’m successful in getting info through RTI. Usually it takes 20-30 days to get reply.

Sreekanth-Sure..Let us wait for that.

Dear Basa

I am having a health insurance policy (icici pru health saver) under which i am insured along with my wife and 2 kind. I am paying 22000 every month as premium. this policy is having a unique feature that from the premium some amount is invested in market to generate a fund which can be use to other medical expenses not cover in the policy. In my case this fund reached to more than 1L.

Because in my city (meerut) network hospitals are not of my choice, therefore i want to port this policy.

My question is that what will happen of this fund (1L) if i am port the policy to any other company.

Nitin-It is not a health insurance product usually offered by general insurance company. But a product which is offered by life insurance companies. A combination of insurance and investment. Such products are worst to buy and hard to get claims. It is a ULIP with high expenses. I suggest you to try to come out of this plan at the earliest.