Do you feel your car as an asset? Think twice! Reason is, from the insurance point of view this not at all considered as an asset. Instead, insurance companies consider it as a liability, whose value starts to depreciate immediately when you buy a new car or bike 🙂

Usually to arrive at value of vehicle or two-wheeler, insurance companies need to calculate the valuation to judge the premium. Such valuation will be very much important in case of complete loss or theft of vehicle. So you may say that in case of complete loss or theft of vehicle this valuation amount will be payable to you. Such valuation called IDV or Insured Depreciation Value.

How IDV or Insured Depreciation Value calculated?

As I said above this is the actual value of your vehicle in today’s term. IDV calculated on manufacturer’s listed price adjusted for depreciation based on the age of the vehicle.

Manufacturers Listed Selling Price= (Cost Price+Local Duties+Taxes)

Note-Excludes Registration and Insurance cost of the vehicle.

Accessories, which are not part of the fittings, are not included to arrive at such listed price. So if one need insurance for such materials then it calculated separately.

So total IDV= (Manufactured Listed Selling Price-Depreciation) + (Cost of Accessories that not included in Manufacturer’s listed selling price-Depreciation).

However, I am unable to find how insurance companies arrive at the depreciation value of accessories which includes glass, rubber or of any kind of materials.

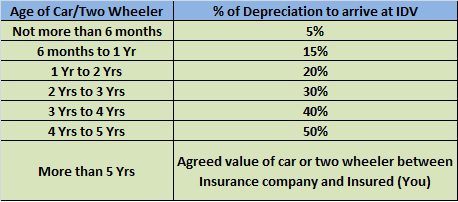

Below is the depreciation table, which helps you to understand each year how your vehicle valuation will go on decreasing based on insurers.

You notice that after 5th year the valuation will drastically go down to below 50%.

Points to remember-

- Your premium depends on the IDV of vehicle.

- Lower IDV leads to lower premium.

- However, after 5th year it is the agreed value between insurer and insured. So never be in a mood that to pay a lower premium by lowering your IDV. Because in case of loss or theft this is the actual value, you receive. So be careful while arriving at IDV.

- At the same time, do not overestimate IDV after the 5th year, as there is a possibility that such valuation may not be agreeable to your insurer.

- Finally, think twice whether your car is an asset or liability 🙂

23 Responses

Sar my car Idv is 525000 my car theft in cavrd insurance. Comny pay to mi only 20000 i ‘ll cleam in court plzz give mi law point

Rohit-Whether they pointed for what purpose they paid this much amount?

My two wheeler IDV was Rs.29,636 on 25/07/2015.My vehicle Purchase date is 28/05/2009.What will be my current IDV?

Prakash-It depends on insurer. Check with the insurance company.

Sharanu Sharnarth Basavraj Appa,

Need your guidance on the IDV part!! Does it include Basic cost + Local Taxes and Duties ( Apart from Registration, RTO) and What accesories would become part of IDV?

Please note that i have purchased a brand new activa 3g 58500 On Road Plus Accessories whereas after receiving the insurance copy, the IDV shown at Rs. 47000. When i inquired abt it with the Retailer, all he has to say that the amt is calculated on a basic cost i.e. Rs.49000 – 5% Depriciation and it does not include On road cost!

Please guide.

Shrikant-Basic cost arrived at a value of a vehicle which is before tax and any duties. Accessories list depends on a vehicle to vehicle. I can’t list down all of them here. Yes, your dealer is right.

Thanks!! You are doing an awesome job!!

(1)Public Sector Insurance Companies issue an Vehicle Insurance Policy and cover note as per Form 51 & 52 of MV Act which is stamped with an Insurance Stamp.

(2)The private Insurance companies issue a paper document called “Certificate cum Policy Schedule” in form of a singleXerox page, stating details but no stamp and not as per form 51& 52 of MV Act.

(3)Insurance Policy Document as per Motor Vehicle Act (as available over the website oh RTO,Maharashtra)the Policy and Cover note should only be as per Form 51 & 52.

(4)Unfortunately the policy I am having is not in above format. The title of document ( past three policies in my possession) is termed as “Certificate Cum Policy Schedule”

(5)In case of any litigation in future as regards claim will it not create problem as No Policy document was issued or not in my possession.

How Private Insurance companies disregard the written law ? I wrote to the concerned Insurance company twice with reminders but they did not answer my point ?

Avinash-How about the states where using stamp paper is totally banned?

Sir,

I am not talking about use of Stamp Paper ! It is an adhesive Insurance stamp pasted over simple paper where all details about terms & conditions are written and as per format stated above as per MV Act. In case company has paid the stamp fee to government in a lot,then they can state accordingly .

Why private Insurance company avoid to answer my simple question about following the rules stated in MV Act ?

This action leads to an doubt (may not be true) about some malpractice of issuing Vehicle Insurance policies without any record and settling the claims from the huge amount so received !!!

When we buy a new vehicle, the Car agency says that they have a good tie-up with this company and for hassle free settlement of accident claims they advise to go for the same. In case the customer chooses other company then they will not help at all !!!

Avinash-Insurance companies can’t issue the policies without any record. Also, they can’t manipulate their book as per their wish. There are so many regulators like IRDA and even companies act will also play a role.

Sir, I understand the explanation given by you but still not satisfied about companies issuing a single page that too xeroxed and without any signature ? When we pay in thousands for Insurance Cover of our car then why such a casual approach ? Does these lines of the Policy Document

Quote:

…………………. in Witness whereof this Policy has been signed at ………………. this ………..day of ……………………………. in lieu of cover Note No. …………….. Date ……………………………….. Receipt No. ……………………….Date ……………………….. Address of issuing office (Duly Constitute

UnQuote: are of no importance to the Car owner ?

Avinash-I don’t own car. So hard for me to check at my end 🙂 But I still firmly say that they can’t mishandle the money on their own.

That’s true, it is difficult to mishandle your money but then the definition/format of Auto Insurance Policy be changed to suit the whims of some private Insurance Companies !!!

Avinash-You can’t change, at the same time, they can’t cheat the buyers too.

does in any case two wheeler idv increases for 3 yrs.

my Honda active fore last 3 yrs IDV has increased from 17000–17500-18000-20000.my model is of 2003 and initial idv was 42000/-.pls guide

thanks

Kamlesh-How can IDV increases? Infact it defenitely decreases.

Sir,

IDV stands for Insured Declared Value.

In your article at one place u have inadvertently mentioned it as insured depreciation value.

Raj-Thanks for your point. But while declaring the value what you are quoting? The current value which is also called depreciated value of original vehicle value. That is the reason I mentioned so. Long form of IDV may be of what you said.

Hi Basu,

I think, the insurers cheat consumers by showing the reduced premium each year projecting it as a result of NCB (no claim bonus) when it is actually due to the reduced IDV. Is it true or just my assumption?

Thanks.

Teja-Yes both NCB and IDV reduces premium. Your understanding is correct.

Hello Basu,

Thanks for choosing this topic..

Good to know this.

Thanks again.

Thanks,

Chandra

Chandra-Pleasure 🙂