Recently Govt launched Varishtha Pension Bima Yojana with much fanfare. I already wrote the features about the same in my previous post. However, few started to compare this scheme with Post Office Senior Citizen Savings Scheme (SCSS).

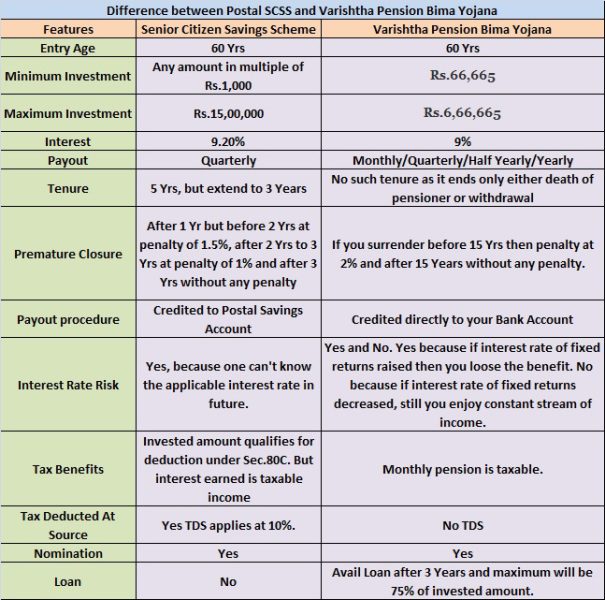

Therefore, in below image I am showing you the comparison of both products to make it clear how each product is different. In the plane, both products look similar. However, when looking at individual features then they are totally two different products meant for different purposes.

My concerns after comparison of two products are as below.

- You may face more interest rate risk to SCSS if in future interest rate goes down.

- Both products not meant if you consider inflation.

- Even though SCSS has some tax benefit, but the interest is taxable. Therefore, you may say not a big differentiator.

- TDS in SCSS makes a bit negative point. Because we have tendency to avoid tax than filing it and getting it right.

- Interest payout of SCSS is outdated as one need to open a savings account in the post. Whereas in case of Varishtha Pension Bima Yojana, you receive a pension in your account irrespective of the bank.

- In SCSS interest payout is quarterly but in case of Varishtha Pension Bima Yojana it is monthly. This makes attractive.

- SCSS is more liquid than Varishtha Pension Bima Yojana, with lesser penalty and period.

- One is a pension, which you expect from lifelong. Whereas SCSS need your monitoring like extending it before maturity or post maturity you need to think again which plan suites your need.

Hope above points makes you decide in choosing the right product between these two products.

54 Responses

Hi,

My Self 35 years old . I want to know the secure and good Policy for my child education. My child is now 4 years old. Could you please let me suggest so that I can make good amount of funds for his better education.

Regards,

Anil

Anil-Are you looking for INSURANCE or INVESTMENT?

Hi ,

Firstly I am sorry I have posted here but your comments were pretty clear so want to ask you. My purpose for child Education. Where I should get security if anything happens to me and also Once the maturity period is done then the lum-sum amount should be helpful for my Kid.

Kindly provide the best suggestion for me..

Regards,

Anil

Anil-Then buy Term Life Insurance to protect your life. Invest rest of the amount as per your risk taking ability.

Yes I do having now term insurance policy but now looking to opt something else which may helpful for his future education… So pls suggest if you can any ?

Anil-Why searching for POLICY rather than a product where you can invest? Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Dear sir Basavraj,

Thanks for sharing your excellent comparison between SCSS and VPBY.

The postal schemes are good but the staff of post office are more busy in their official work , no one explains…more over no agents involved in promoting such postal schemes…so your informative and unbiased comparison becomes useful.

.thankfull to you again on behalf of Sr. Citizens.

Anil-Pleasure 🙂

Sir

Congratulaions on your yeomans service to educate the public.

I am senior citizen of 65 years age and I have opened an SCSS WITH POST OFFICE for a deposit of Rs 15 lakhs.

Can I open another account with my spouse aged 58 years for another 15 lakhs ? Kindly clarify. Thanks

S N

Nagarajan-Yes sir you can open another SCSS account in your wife name.

Dear Sir,

Glad to see ur efforts explaining all the details in detail. Appreciate ur good work. Keep it up.

I have a query : my parents will retire this year. Pls suggest the best investment options available.

Nick-Without knowing much about their finance, how can I guide randomly?

Hello Sir ,

First of all , I’d like to thank you for making a fairer , unbiased comparison sheet . Please keep up the great work .

My mother retired on 31st May 2014 from central government , with total compensation of around 44.5 Lakh . Her monthly pension would be around 34’000 . We are in the process of buying a flat however we would not touch the compensation amount . She may live in a rented apartment ( since she doesn’t want to go out of our hometown ) till we buy a flat for her . She doesn’t have any liabilities . And I can take care of the medical expenses via investing in my corporate medical policy .

Is there any other plan like Varishtha Pension Bima Yojana where she can invest ? I’m thinking out investing in Post Office Senior Citizen Savings Scheme (SCSS) close to 15 lakh .

SBI annuity 665000 and rest under short term Fixed Deposits . While leave around 4 -5 lakh in her account .

I’d want her to have at-least 50K ( including pension ) in her hand at the start/end of every month(I’m dividing SCSS /12 although it’ll be released quarterly ) .

Please Guide ,

Regards

Yogesh

Yogesh-Instead of Varishta Pension Bima Yojana, you can opt for Post Office SCSS or LIC’s Jeevan Akshay VI.

I am a senior citizen and today only I saw your blog. First of all, I appreciate your work on this and you have done an awesome job by spreading awareness in filling up 15H & 15G. In the details of income received can we include SCSS interest income and has this to be shown in a separate form 15H over and above the form for FD interest income. The total income means the gross income before deducting 80C and donation or the net income. Can u clarify.

Raman-Yes, you have to show SCSS interest income in Form 15H. Net income post tax deduction income.

Is govt announce rate of interest for this scheme everyear?

Jay-You no need to worry about interest rate and they not declare. Pension is fixed based on the term (age) and the amount you pay.

Hi want to take up the Senior Citizen Savings Scheme but i have a confusion regarding TDS. the TDS is charged @10% in interest rate is above 10,000. I am retired senior citizen and i do not have any other income source so if i fill form 15H then will TDS still be deducted? Or not? I am planning to put 6lakhs. So how much will the TDS be cut and how can i save it?

Paps-If you submit Form15H then they not deduct TDS. You can view my earlier post “Video Tutor Guide-How to fill Form 15G and Form 15H?“.

What is the tax benefit for LIC’s single premium policies?, Can we avail entire amount u/s 80 (C)

Sounder-Whether your question is about this particular scheme?

Really good job. Appreciate your great service.

Please keep it up.

Thanks.

Jeevan-Thanks 🙂

Hi sir,

I am a public sector employee coming under NPS . Is this sufficient for my retirement planning or I have to opt for any other retirement plan also. Pl advise.

Regards

Tara

Tara-NPS have it’s own demerits. If you are capable of investing more than why can’t add more to your retirement planning?

Hi Basavaraj,

First of all… you are doing awesome job by spreading awareness of schemes. Much appreciated. Do you happen to know any investment which is aligned to inflation?

Sandy-As of now there is no such retirement plan. But in LIC’s Jeevan Akshay VI, they have option to inflate it every year. You can check it out.

But sir in jeevan akshay the interest rate is very low like 6-6.5% in plan that increase 3% interest every year

Raaz-In Jeevan Akshay there are other options too apart from what you said. Please check it.

Sir,

Congratulations on the great work you are doing. I was also considering this for my Family. The payment of 66,665 is a one time premium only if I am not mistaken? With this premium I get 500 Rs per month as Pension till the policy is surrendered or death of the insured. In Either case the initial premium will be refunded.

Please let me know if this is correct and correct me If I am wrong. I asked LIC office in my area but they did not have the details.

Nelson-Yes you are right.

Dear Basavaraj,

1) In SCSS,the quarterly interest credits can be received in the individual’s Bank A/c-not necessary to have a P.O.SB A/c.

2) Just a suggestion-such informative articles could be shared in our Group AIFW- it would have a wider reach and more people may benefit.

Good Work.

Regards,

Sundaram

Sundaram-Sir thanks for your information. But still in post office website I found such lines “Interest @ 9.20% per annum from the date of deposit on quarterly basis. Interest can be automatically credited to savings account provided both the accounts stand in the same post office.”. This prompted me to arrive at that decision. I hope you too agree with this. They never mentioned any other accounts than post office savings account.

Thanks for your suggestion about sharing with AIFW. But I felt it little bit uncomfort to share. Because others may think that I am promoting my blog. Instead I use AIFW for knowledge sharing and learning. Thanks once again for your comment 🙂

Dear Basavaraj,

1) P.O. is actively seeking to increase the number of SB A/cs as a prelude to a banking license.But SCSS interest can be credited to any Bank A/c and maybe even convenient for the investor to do so.

2) As regards AIFW,IMO any informative article is welcome,irrespective of the source.In the process,if a blog gets attention,it is to be welcomed.

Regards,

Sundaram

Sundaram-Sir thanks for your sharing. I know Ashal, Pattu, you or some other active members of group always welcome such initiative. But for other it may sounds different. Hence I restricted my sharing.

Hi Basa,

I am regular user of this Blog, thought to write today something. I feel VPBY is much better if we take into account the eligible age for the plan. This plan gives a peace of mind to a person of age 60/above 60. Also the capital to invest starts from 66K to 6.66L. Hence is targeted towards lower and upper middle class ppl. A life time financial security for the ppl 60 & above.

I think we should not compare such plans with other plans unless we are sure that other plans gives a guaranteed returns that can be more than VPBY.

Can we just put it this way, VPY is the best plan available as on date for the ppl aged 60 and above?

Regards,

Deepak

Deepak-Thanks for your views. But as I said above this plan lacks few things like it will not take care of inflation (constant stream of return) and return is taxable.

Great job sir….You have a knack for explaining complex details very simply…You make things truly “Saral”…!

Thanks and God bless you.

Amit-Thanks for your inspirational words 🙂

The information is educative. I appreciate ur attitude to disseminate information on financial issues.

Wishing u the best.

Satyanarayana Rao-Pleasure 🙂

Shri Basavaraj sir,

I am a Chairman’s Club Member and work for LIC for last 20 years (based at Miraj, Maharashtra).

Just now I came across your informative personal finance blog. Was very much glad to know your clear-cut comments on LIC’s latest Varishtha Pension Bima Yojana (VPBY) and particularly the comparison between SCSS and VPBY.

I want to know whether they charge service tax in SCSS.

With regards,

Vinayak-Thanks for your encouraging words. I don’t think SCSS have any service tax attached with it.

As per plan circular, service tax applicable like all other plans including immediate annuity plan.

Rajnish-Thanks for sharing your information 🙂

Hi Basu,

I appreciate your hardwork which you put in 🙂

I have doubt

1. when we say taxable …every penny will be taxable or is there limit?

Chandu-Whatever you receive will be added to your taxable income. This taxable income will be taxed according to tax slab you fall into.

Hello Basavaraj..

I have been following your articles since a long time. Must say you have been excellent in sharing your knowledge on a platform like this..

Please keep the good work going..

Ashit-Thanks for your kind words 🙂

Excellent article Basa. Perfect timing.

Sreekanth.

(www.onlinefinancialplanner.in)

Sreekanth-Thanks 🙂

Hi Basu,

I want to know any pure investment other than insurance for investing under 80c and which also provides liquidity for a retired person who can invest up to 30,000 per year.

Please suggest one or two such plans.

Thanks,Vinit

Vinit-Tax Saving options are listed in my earlier post “Best Tax Saving investment plans and ideas in India“